Energy Complex: what to expect in 2025

Energy Complex: what to expect in 2025

- Global crude oil exports declined by 2% in 2024 due to weak demand growth and geopolitical tensions.

- OPEC’s oil output fell by 50,000 barrels per day in December 2024.

- Severe cold front in North America expected to boost heating fuel demand.

- Proposed tariffs by the Trump administration may disrupt energy markets.

- Geopolitical tensions in the Middle East and Ukraine pose risks to supply stability over the next six months.

Market Analysis

In the next three to six months, the oil and gas market is expected to be shaped by key short-term developments in both supply and demand dynamics. Global crude oil exports, which fell by 2% in 2024, are unlikely to recover in the immediate term due to ongoing weak demand and shifting trade routes. The geopolitical instability in Ukraine and the Middle East continues to disrupt supply chains, compelling countries like India and China to secure alternative sources of crude oil, notably from Russia. Similarly, Europe is increasingly reliant on imports from the U.S. and South America, reflecting a broader realignment of energy trade.

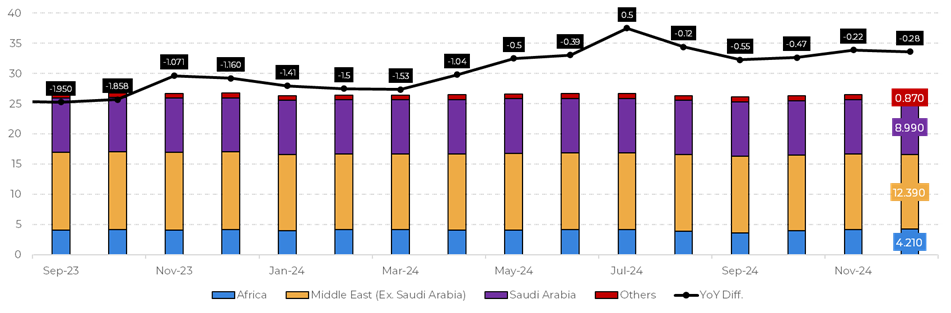

OPEC production cuts are expected to persist in the short term as the group aims to stabilize prices. December’s decline of 50,000 barrels per day, largely driven by maintenance in the United Arab Emirates and reduced output from Iran, is not expected to see notable reversal in the coming months. However, slight increases in production from Nigeria and Libya may provide some balance to the supply side.

Image 1: US - OPEC – Crude Oil Production (M bpd)

Source: Refinitiv

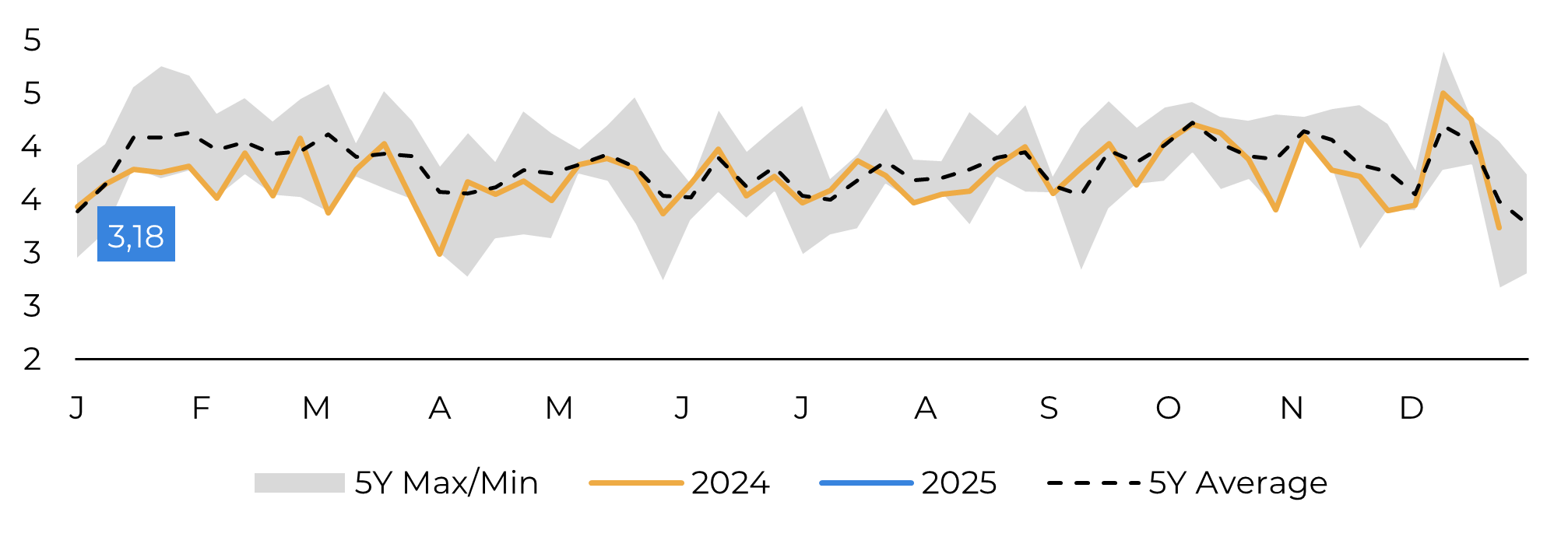

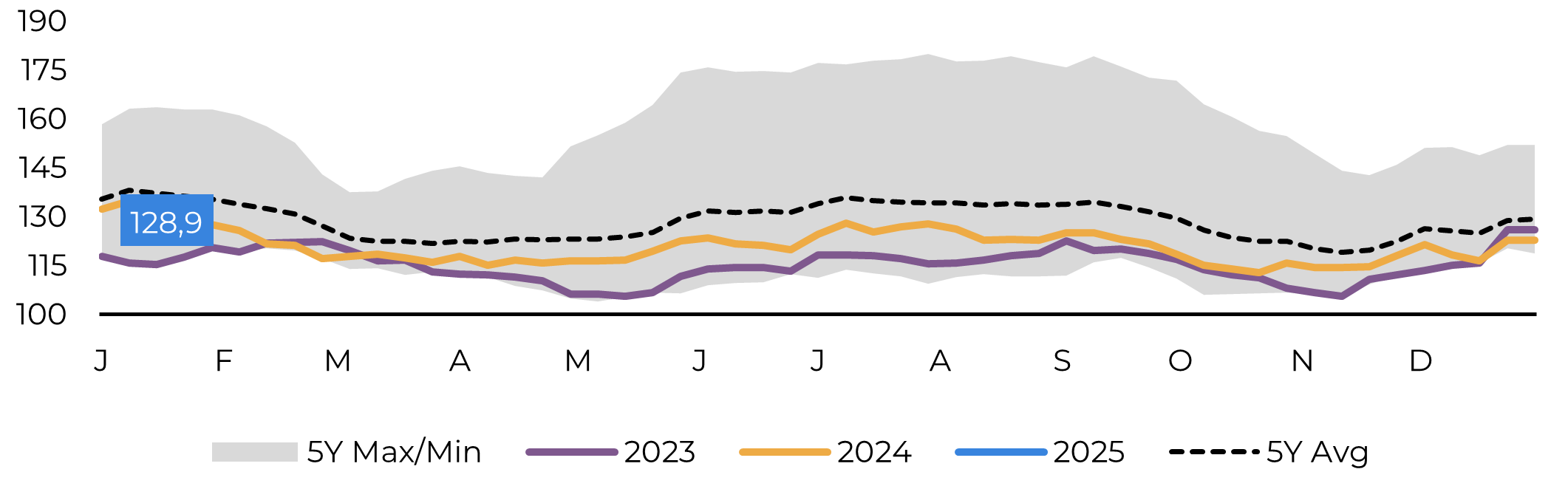

While the market in 2024 anticipated a significant supply disruption in the U.S. Gulf Coast due to a potentially active hurricane season, these disruptions never materialized as expected. However, the market is now facing weather-related disruptions in the form of a severe Arctic blast forecasted to hit North America in January. This extreme weather is expected to sharply increase demand for heating fuels, including natural gas and heating oil, potentially straining supplies and driving up prices. Natural gas pipelines and production facilities may face operational challenges as freezing temperatures set in, further tightening short-term supply.

Image 2: US - Weekly Destilate Demand (Mbpd)

Source: EIA, Refinitiv, Hedgepoint

Image 3: Distillate Stocks (M bbl)

Source: Refinitiv, Hedgepoint

In terms of policy, the anticipated trade measures by the incoming Trump administration could have immediate and profound implications for the oil and gas industry. The proposed 25% tariff on Canadian and Mexican imports, along with a 10% tariff on Chinese goods, may disrupt cross-border energy flows, especially given Canada’s role as a major crude oil supplier to the U.S. These tariffs could lead to higher fuel costs domestically, adding pressure to already volatile markets.

Geopolitical risks remain front and center. Escalating conflicts in the Middle East, particularly involving Iran, could lead to supply disruptions in one of the world’s most critical oil-producing regions. Similarly, the ongoing war in Ukraine presents a continued threat to European energy security, with potential for further shifts in global supply routes as the conflict evolves.

Looking beyond weather and policy-driven demand, global economic conditions will also play a pivotal role. While China’s recent economic slowdown has curbed its oil consumption, any signs of recovery could boost demand significantly. Meanwhile, India’s growing energy needs are set to support regional demand, driven primarily by transportation and industrial growth.

Summary

Weekly Report — Energy

daniel.osorio@hedgepointglobal.com

livea.coda@hedgepointglobal.com