Jan 22

/

Tim Vince

Russian Sanctions and Impacts of a New Trump Administration

Back to main blog page

Global price volatility, shifting trade flows, increasing shipping cost, and disruption in US refinery operations.

Russian Sanctions

The latest US sanctions, administered by the Biden Administration on Russian oil producers, along with vessels that have been shipping Russian crude, are profoundly impacting buyers such as India and China which have been buying up cheap Russian oil since the beginning of the war and initial sanctions efforts. The US Treasury announced sanctions on two Russian oil producers, along with 183 vessels which are primarily oil tankers that have been shipping Russian crude.

Though sanctions will also affect China, India imports a larger percentage. Nearly 88% of India’s oil is imported, with around 40% coming from Russia. Prices from alternative suppliers will not be cheap and relief may take several months to materialize. India is expected to look towards the Middle East to address this supply gap, but Brent oil prices have soared to a five-month high of around $80/BBL on sanctions news. As a result, prices in the Middle East have also surged. Therefore, US sanctions might take a toll on global trade flows, and major Russian oil importers are at greater risk regarding price volatility.

Impact of US Tariffs on Canada

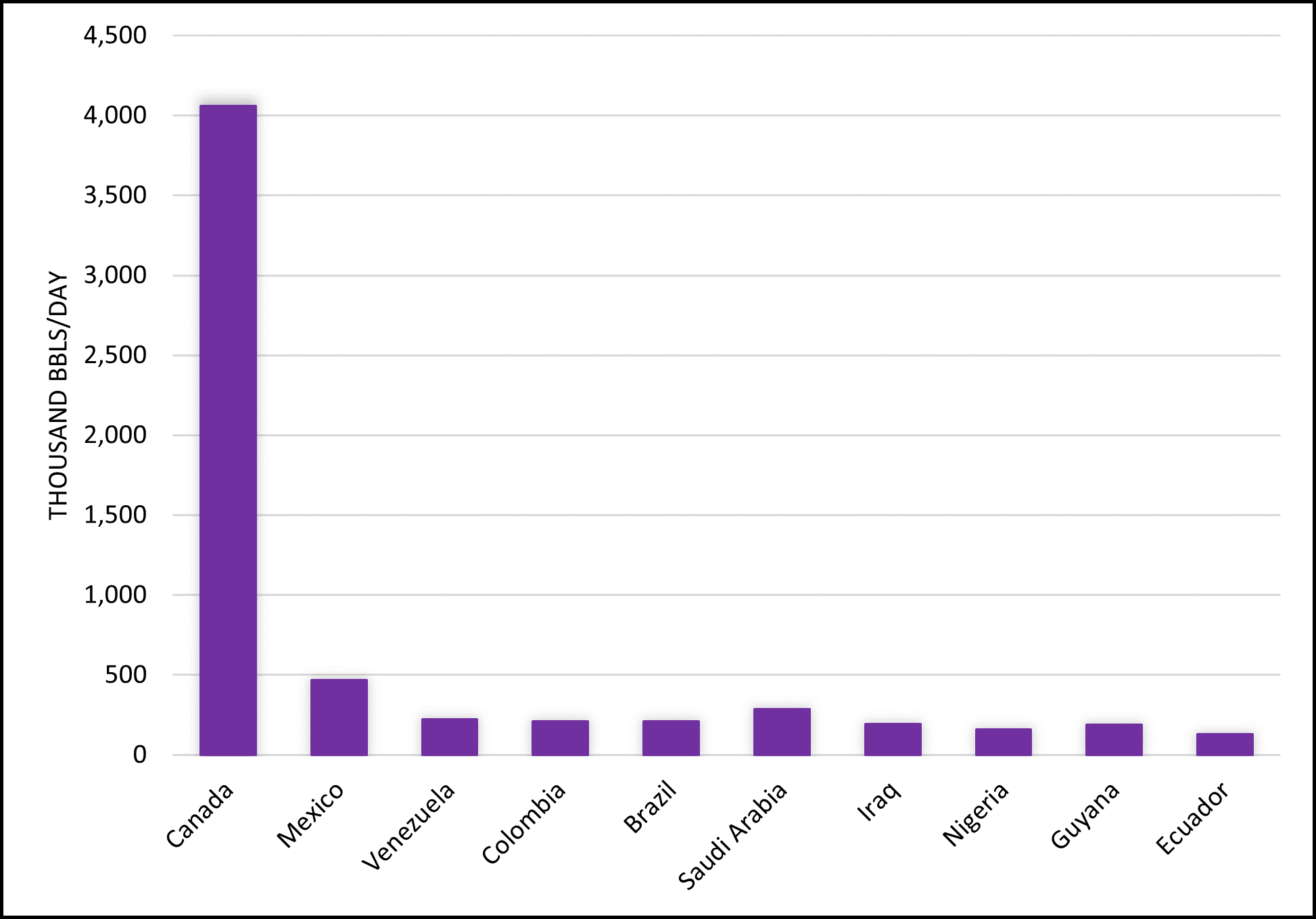

Trump has stated his intention is to invoke a 25% tariff on all imports from Canada and Mexico unless they take measures to control illegal drugs and migrants from crossing their borders. There is uncertainty whether these are threats or policy that will be followed through on. The Trump administration’s stated demands should not be difficult for Canada to meet but it remains to be seen if this is a negotiation tactic to achieve other economic policy. As of October 2024, the US imported 66% of its oil from Canada and 8% from Mexico per data from the EIA.

Image 1: Year to Date 2024 Top 10 US Oil Import Origins

Source: EIA

Many US refineries rely on the heavy crude produced by Canada, specifically in the Midwest US where they can buy Heavy Canadian crude at a discount to other indexes, a price advantage they would lose with the tariffs. The refiners will not be able to secure alternative sources of heavy crude quickly, nor will they be able to rapidly reconfigure their processing units to lighter oil and achieve the same yields. Therefore, imposing tariffs on Canada could raise US domestic energy prices, in particular gasoline prices.

The Trump Energy Policy

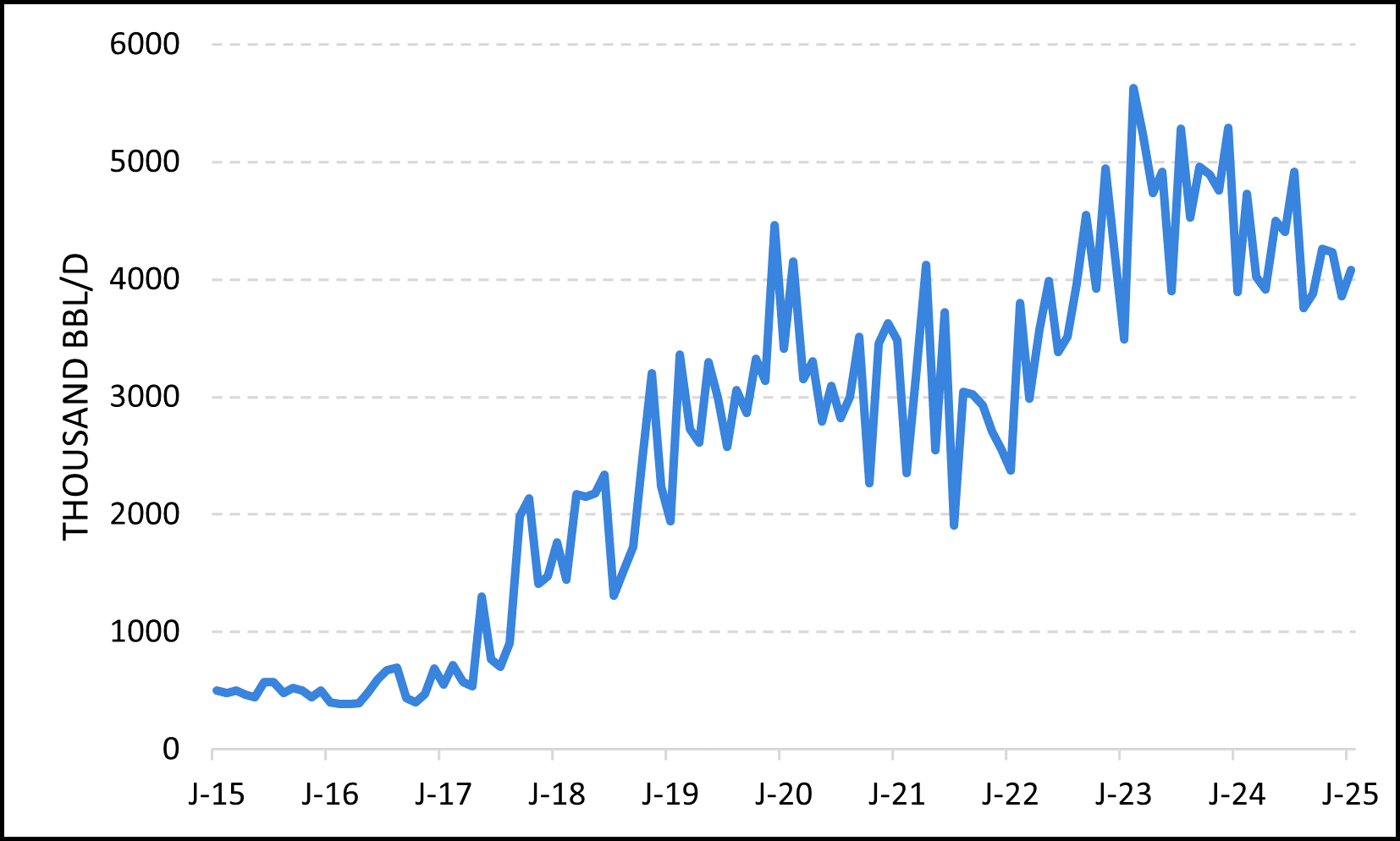

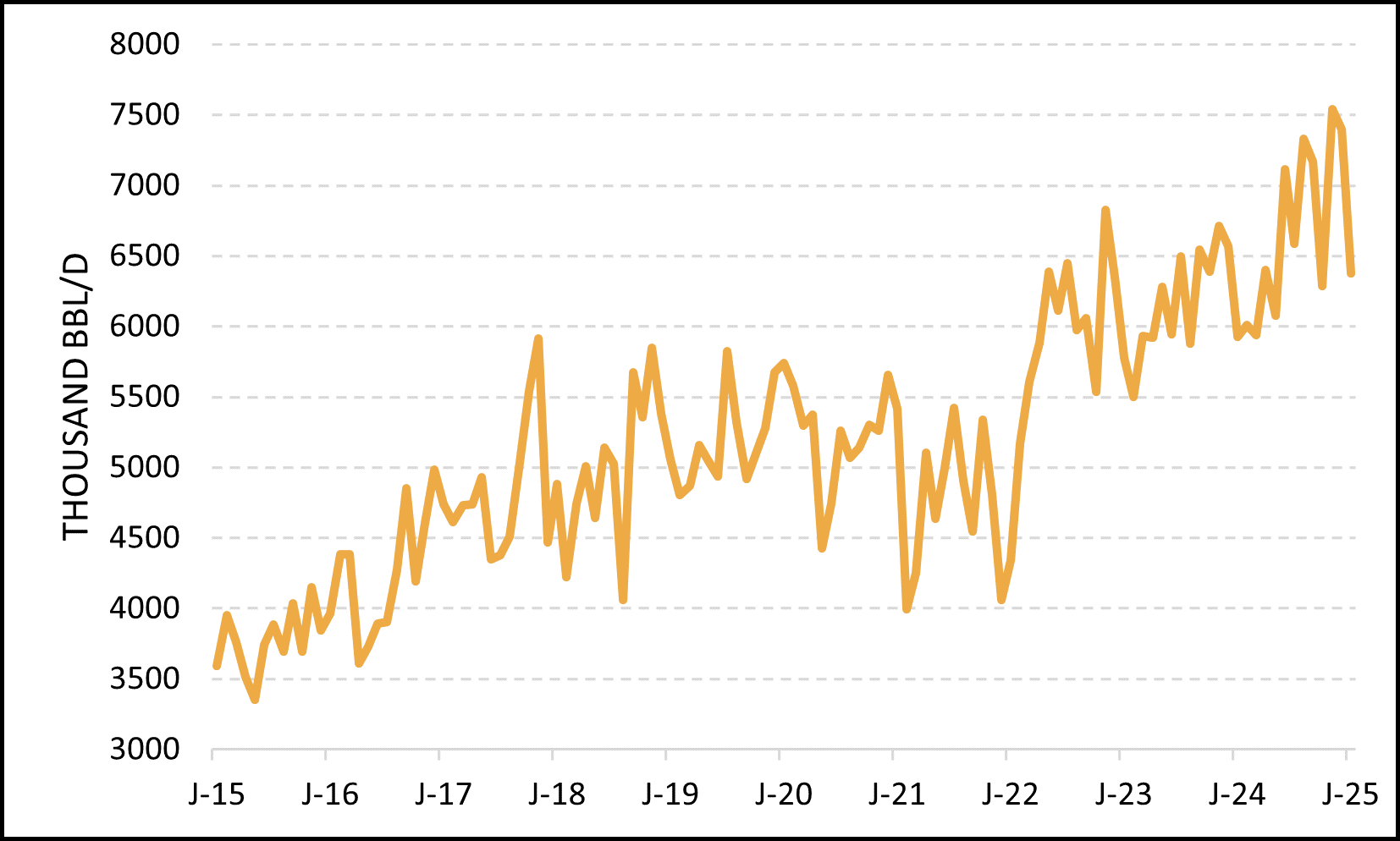

The first Trump administration made a major impact on the international trade of U.S. oil and gas, by streamlining export permitting and promoting U.S. product exports. U.S. crude oil exports also shot higher under the first Trump spell.

Image 2: US Oil Exports

Source: EIA, Refinitiv, Hedgepoint

Image 3: US Refined Product Exports

Source: EIA, Refinitiv, Hedgepoint

With another Trump presidency underway, it seems likely that the current output and export trends will continue. However, the intensity of these trends will probably be influenced as much by the economics of extraction and shipment as by any policy changes Trump might implement.

On his first day in office, Trump signed executive orders, aimed at promoting oil and gas development in Alaska, reversing Biden's efforts to protect Arctic lands and U.S. coastal waters from drilling, revoking Biden's target for EV adoption, suspending offshore wind lease sales, and lifting a freeze on LNG export permitting. These executive orders and his prior rhetoric regarding the fossil fuel industry seem to be aimed at reducing environmental restrictions on energy infrastructure and easing permitting for new transmission and pipeline infrastructure.

Though the promotion of oil drilling in the Artic and U.S. Coast is an important development for crude production, these are expensive operations for drillers to undertake. Most of the US’s production is concentrated in the Permian Basin of Texas and New Mexico, about 40% according to the Railroad Commission of Texas. Because of this, it is important to watch US production growth but pay closer attention to changes in flow of oil and products through midstream and exporting infrastructure.

Though the promotion of oil drilling in the Artic and U.S. Coast is an important development for crude production, these are expensive operations for drillers to undertake. Most of the US’s production is concentrated in the Permian Basin of Texas and New Mexico, about 40% according to the Railroad Commission of Texas. Because of this, it is important to watch US production growth but pay closer attention to changes in flow of oil and products through midstream and exporting infrastructure.

Summary

Global Price Volatility: The sanctions on Russian oil producers and tankers are expected to increase global oil price volatility. With India and China forced to source oil from alternative suppliers, the upward pressure on Brent and Middle Eastern oil prices could persist, straining energy budgets for oil-importing nations.

Increased Shipping Costs: The increase of VLCC tanker rates will further inflate the cost of oil imports for Asian countries, particularly China and India, exacerbating inflationary pressures in those economies.

Energy Security Risks: For India, which imports 88% of its oil, reduced access to discounted Russian crude may strain its energy security and budget. The country may explore new trading relationships to mitigate its dependence on Russian oil.

Disruption in US Refinery Operations: US refiners, especially those dependent on heavy Canadian crude, will face increased costs and logistical challenges. The Midwest refining sector, reliant on discounted Canadian crude, may suffer significant margin erosion, potentially reducing profitability and raising gasoline prices domestically.

Higher Energy Prices for US Consumers: Tariffs on Canadian and Mexican oil will directly lead to higher input costs for refiners, translating into elevated gasoline and diesel prices for consumers.

Shift in Trade Flows: India may rely more heavily on Middle Eastern suppliers, which could tighten supply in that region, further elevating prices. This shift could also alter global trade flows, increasing competition for Middle Eastern crude. It will be crucial to monitor OPEC+ for any adjustments to production quotas in response to this demand.

Increased Shipping Costs: The increase of VLCC tanker rates will further inflate the cost of oil imports for Asian countries, particularly China and India, exacerbating inflationary pressures in those economies.

Energy Security Risks: For India, which imports 88% of its oil, reduced access to discounted Russian crude may strain its energy security and budget. The country may explore new trading relationships to mitigate its dependence on Russian oil.

Disruption in US Refinery Operations: US refiners, especially those dependent on heavy Canadian crude, will face increased costs and logistical challenges. The Midwest refining sector, reliant on discounted Canadian crude, may suffer significant margin erosion, potentially reducing profitability and raising gasoline prices domestically.

Higher Energy Prices for US Consumers: Tariffs on Canadian and Mexican oil will directly lead to higher input costs for refiners, translating into elevated gasoline and diesel prices for consumers.

Broader Outlook

Inflationary Pressures Across Economies: Rising oil prices due to sanctions, tariffs, and restricted access to certain suppliers will likely contribute to global inflation, particularly in oil-importing nations.

Opportunities for Non-Sanctioned Producers: Middle Eastern and other oil-producing regions may capitalize on the reduced supply from Russia and Iran, potentially solidifying their positions as critical suppliers to major importers like India and China. However, this could also increase their geopolitical leverage.

Weekly Report — Energy

Written by Tim Vince

timothy.vince@hedgepointglobal.com

timothy.vince@hedgepointglobal.com

Reviewed by Lívea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without intending to create obligations or commitments to third parties. It is not intended to promote or solicit an offer for the sale or purchase of any securities, commodities interests, or investment products.

Hedgepoint and its associates expressly disclaim any liability for the use of the information contained herein that directly or indirectly results in any kind of damages. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information.

The trading of commodities interests, such as futures, options, and swaps, involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgment and/or consult advisors before entering into any transactions.

Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.

Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).

Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.

“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint.

Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

To access this report, you need to be a subscriber.

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.