Energy Weekly Report - 2023 08 11

Refined Products Get Attention Amid Low Inventories and Risks of Outages

- Inflation data brought relief to the market and boosted oil benchmarks heading towards a 7-week high.

- American refiners expect a 2H23 with strong gains given the low inventories and high cracks, mainly after the positive data on country’s inflation climbed 0.2% last month.

- China monthly oil imports dropped from June’s near-record highs to their lowest level since the beginning of the year.

- OPEC+ supply restriction keeps providing fundamentals for oil prices to rise further this year, but oil demand for 2024 remains challenging under perspective of a recession in the U.S.

Introduction

Despite

being exposed to some level of volatility by weak crude imports from China in

July, the main oil benchmarks showed a recovery during the week, mainly after

the U.S. inflation data gave positive signals that Fed could not need to raise

borrowing costs in the rest of 2023.

Risks

from weather events are growing as high temperatures in the Atlantic Ocean

provide a breeding ground for hurricanes, which may potentially damage refining

facilities on the U.S. Gulf Coast. Given this scenario, hedge funds are

positioning themselves as bullish for RBOB.

Meanwhile, the decrease in inventories reaches other refined products such as distillates, which registered a drop of approximately 1.71 million barrels in the week ended August 4th. In the case that economic activity expands further than expected, diesel will be highly demanded.

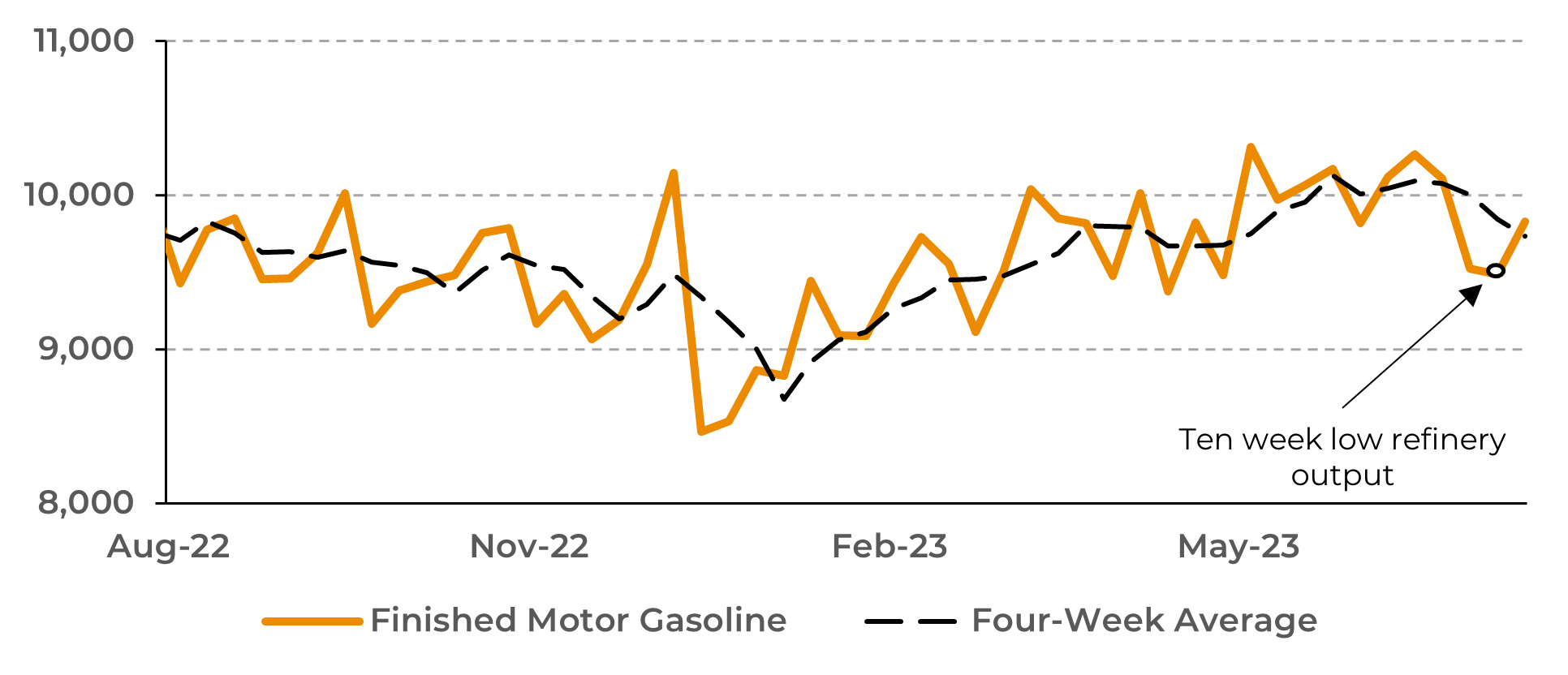

Image 1: Finished Motor Gasoline Production (M bpd)

Source: Refinitiv

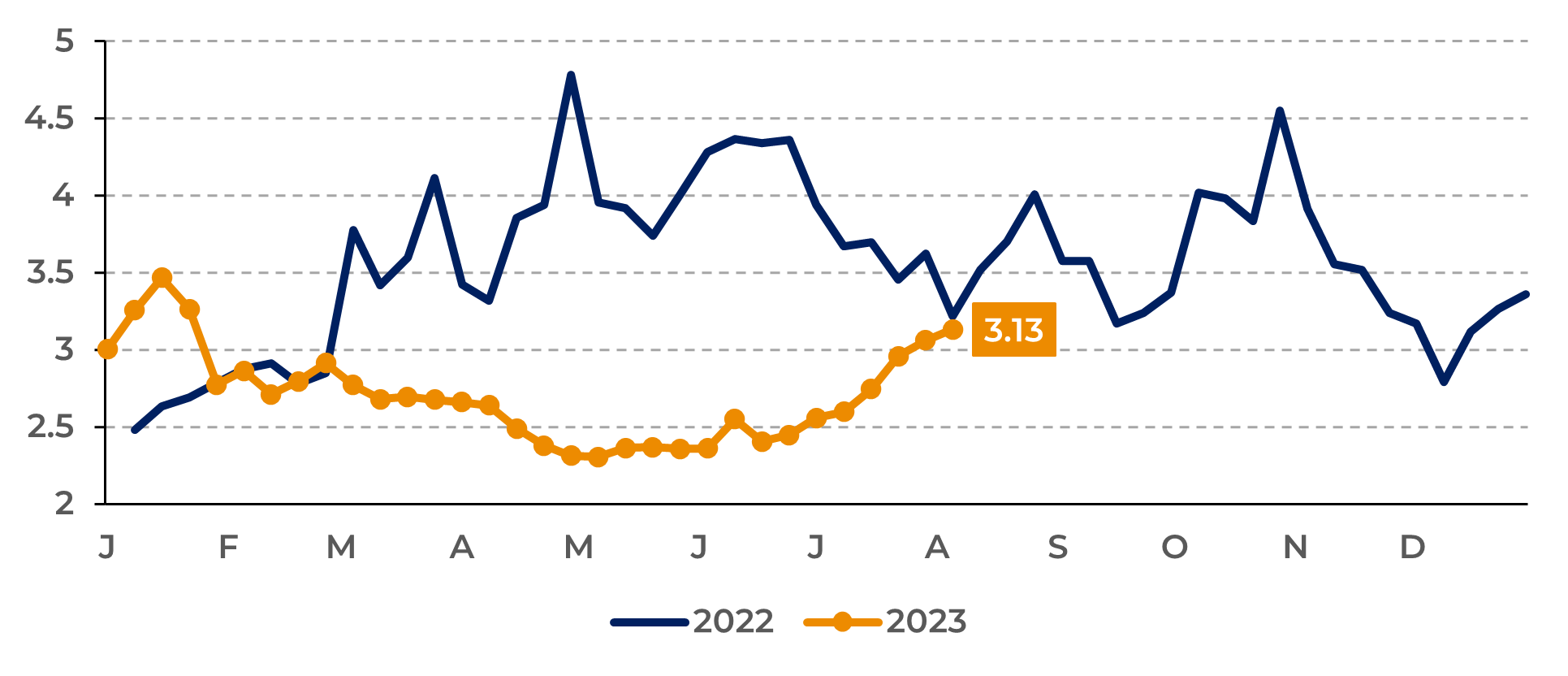

Image 2: Heating Oil (Dólares per Gallon)

Source: Refinitiv

Fundamentals Support Oil

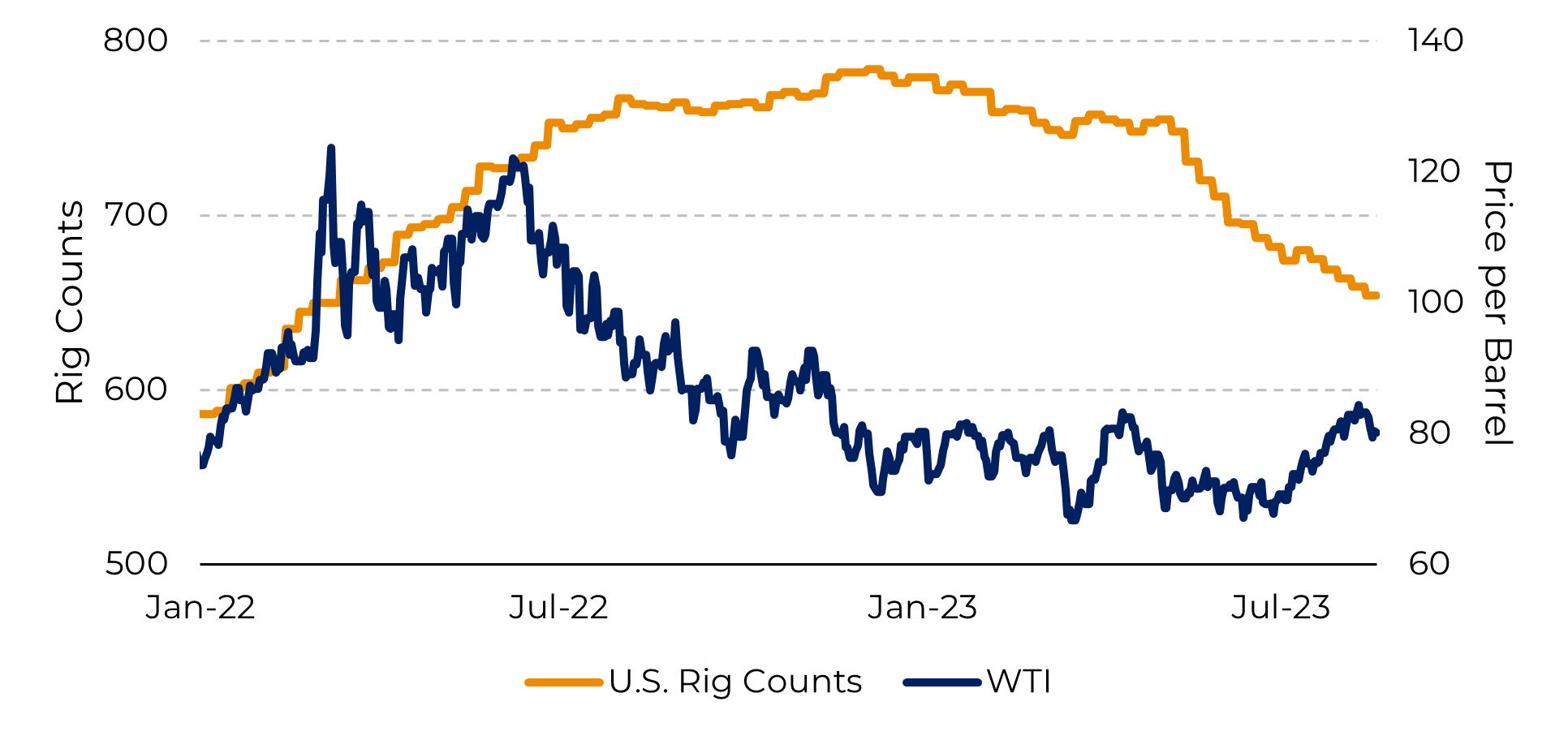

Image 3: Bloomberg Commodity vs DXY

Source: Bloomberg

Image 4: Net Position RBOB Money Managers

Source: EIA, Refinitiv

Better Perspective for Distillates in the 2H23

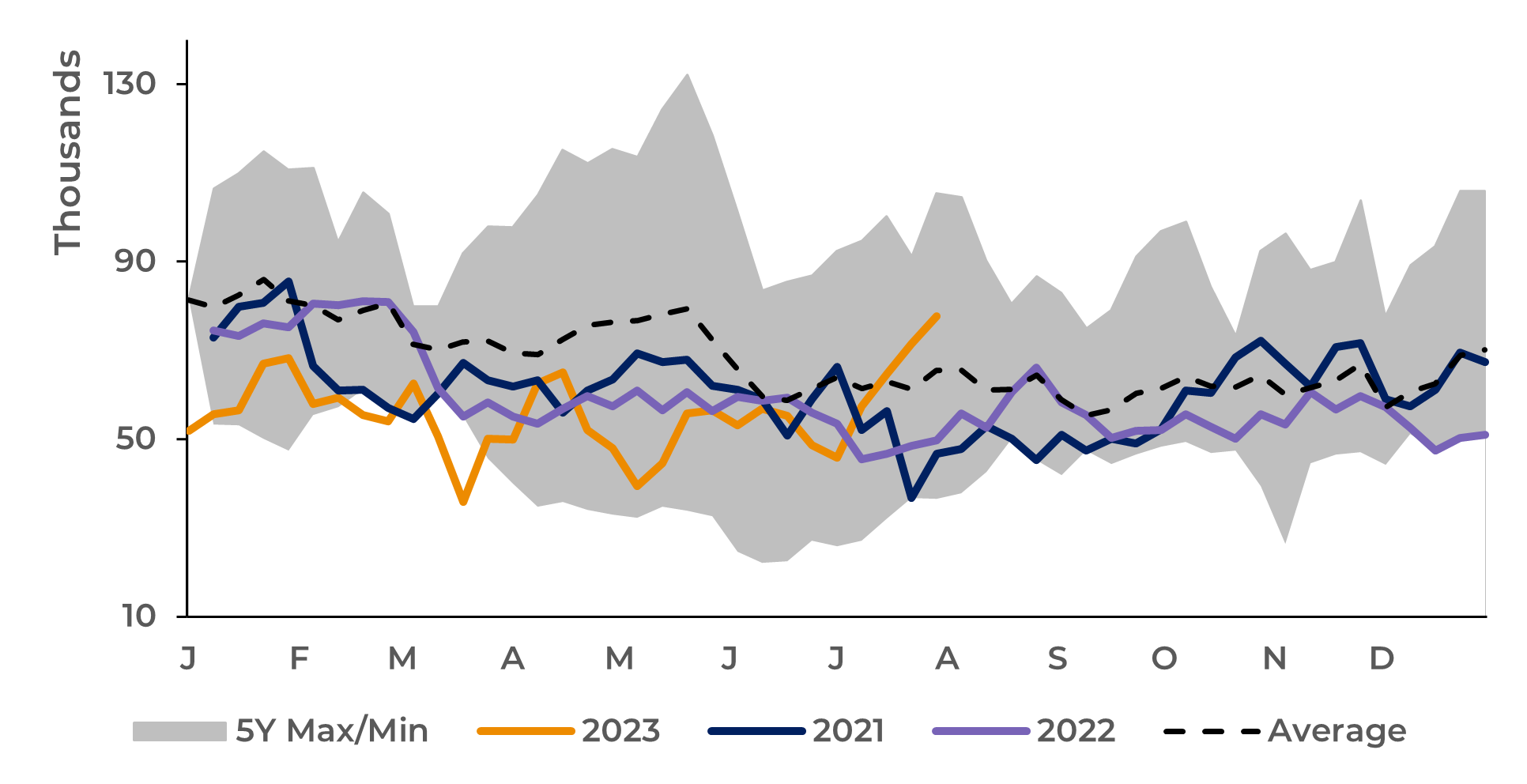

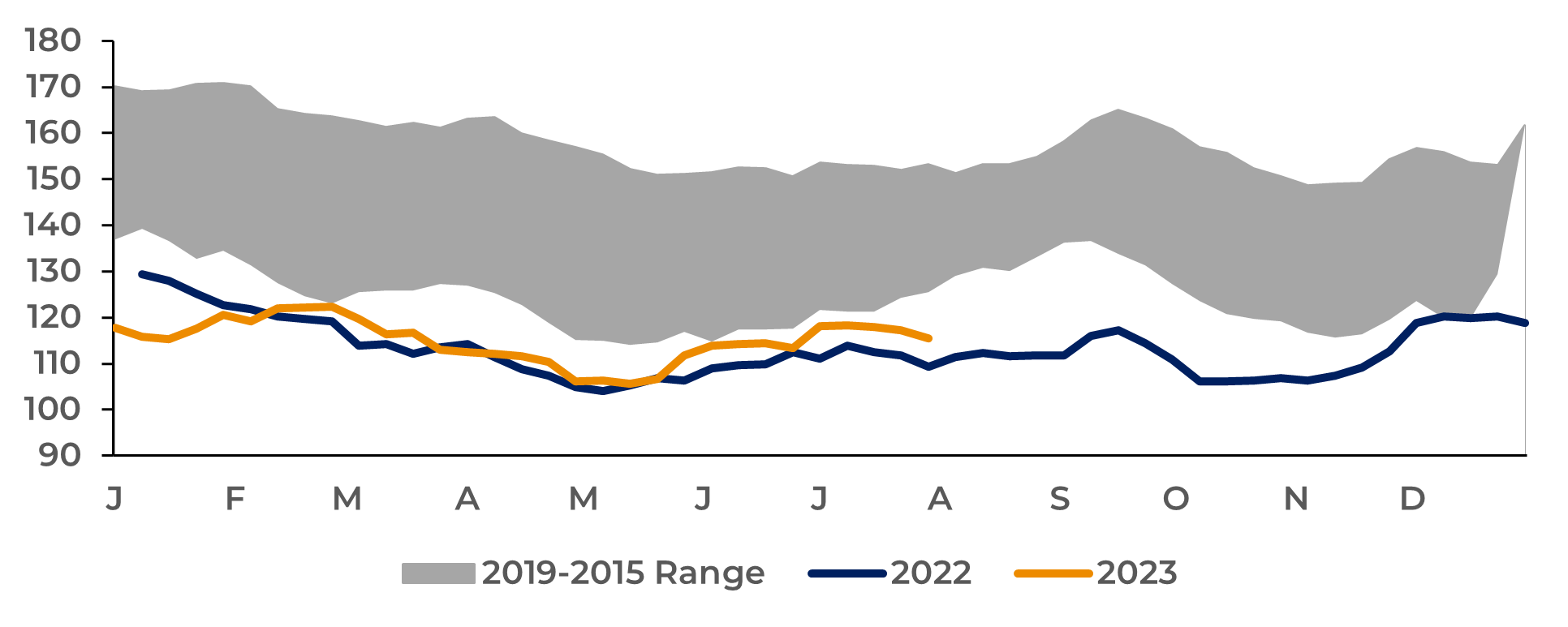

Image 5: Distillate Stock (M bbl)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.