Aug 18

/

Victor Arduin

Energy Weekly Report - 2023 08 18

Back to main blog page

"Since July, oil prices have risen more than 10%, reflecting coordinated action by OPEC+ members who have restricted the supply of the commodity to the world. With higher prices and strong demand, non-cartel producers were given incentives to increase their oil production. "

Drilling Productivity Boosting Oil Production in the U.S.

- U.S. energy firms reduced the number of oil and gas rigs operating in 2023, but higher-than-expected well productivity is boosting production to a record this year.

- Shale oil output falling in September after peaking in the highest record in July, raising risks of a tighter market for the rest of the year.

- While there has been a recent increase in average oil prices, low natural gas prices are discouraging companies from expanding their operations.

- A more restricted scenario for energy supply has also benefited Brazil, which should record an increase in oil exports in 2023.

Introduction

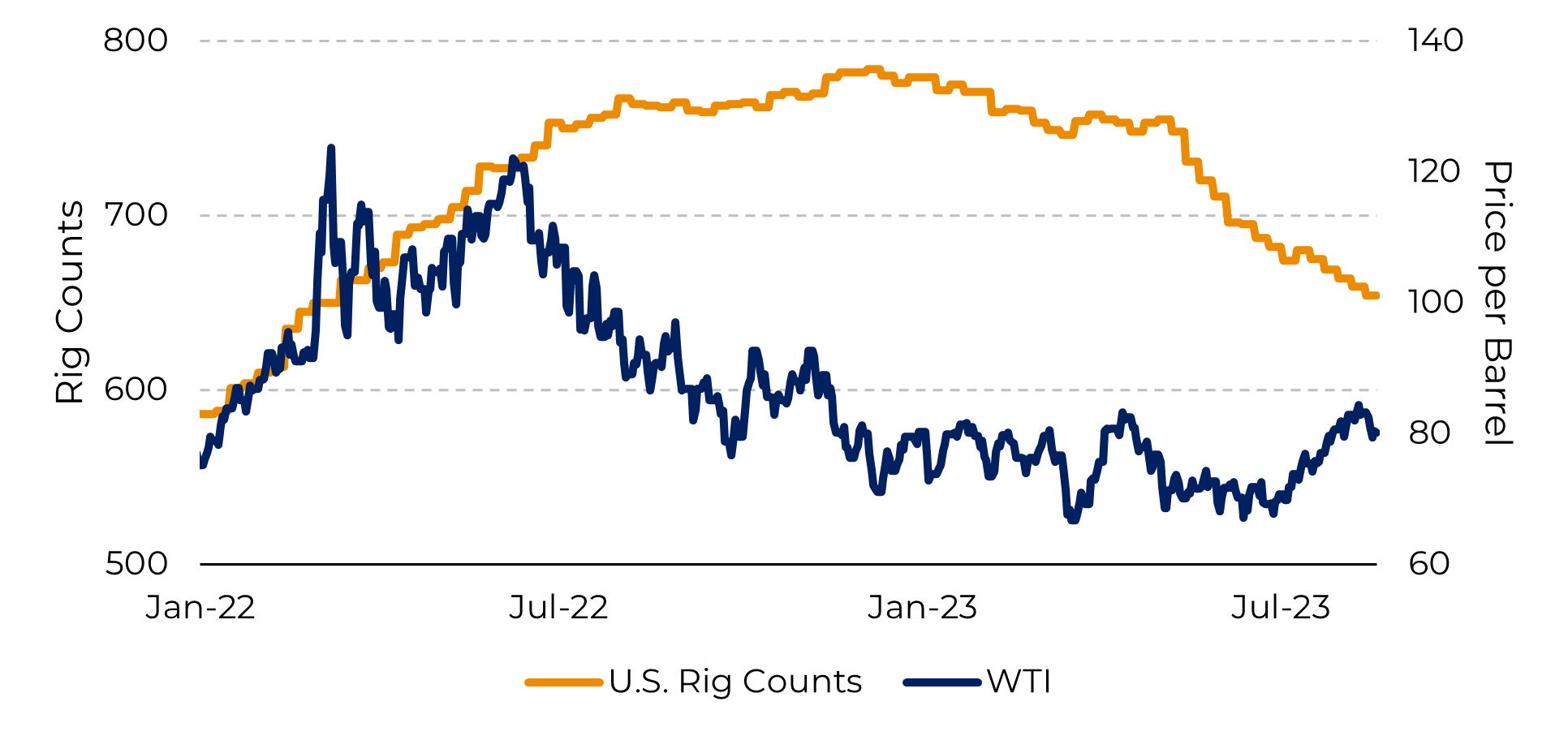

The oil and gas rig count, an early indicator of future oil and gas production, fell by five to 654 in the week tending on August 13. The first half of the year was marked by a sharp drop in oil prices, making the sustainability of some oil and gas operations more expensive and less profitable.

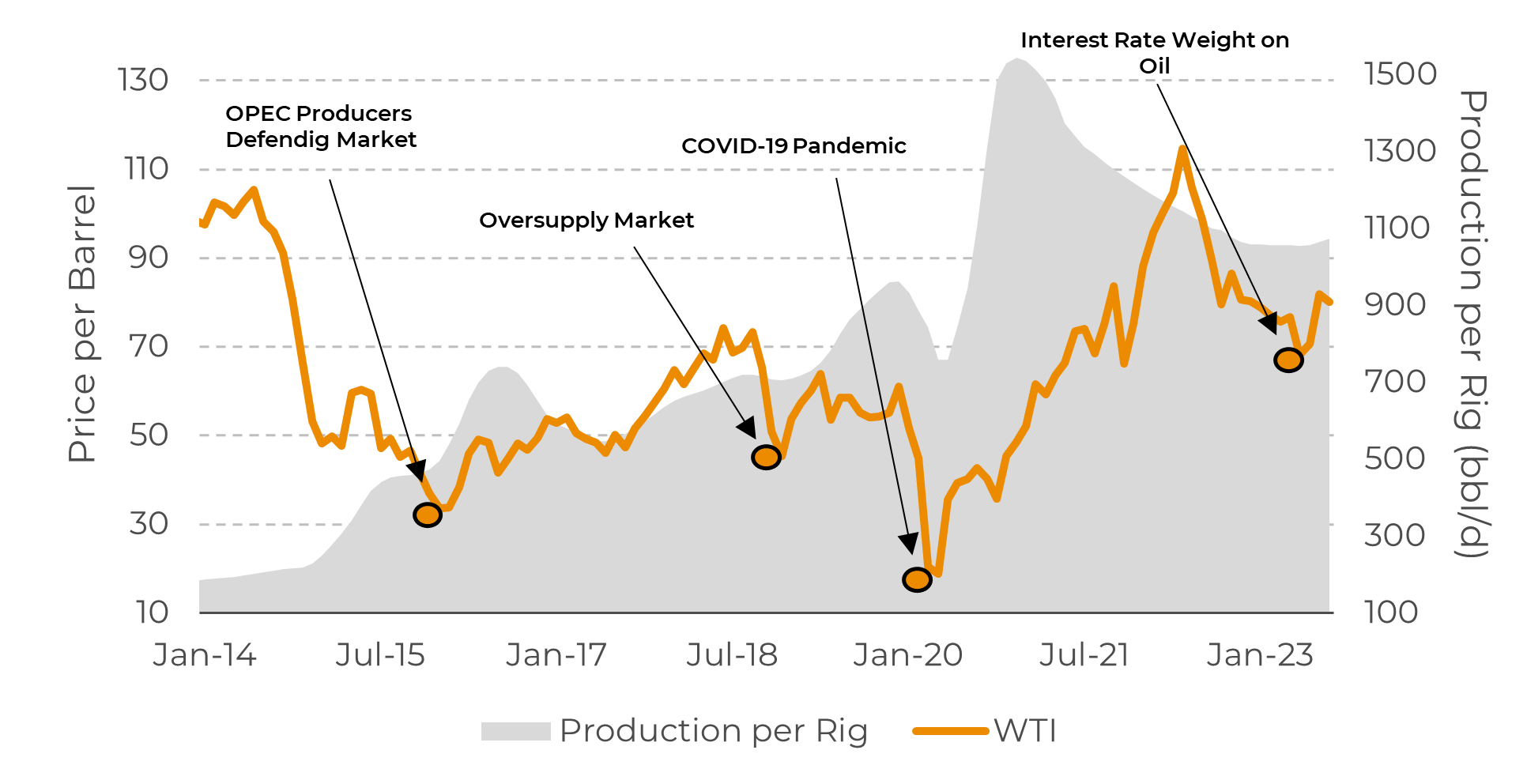

While most of the decline in 2023 has occurred because smaller players need higher oil and gas prices to sustain their operations, active producers are still increasing their market share through productivity. U.S. drillers are increasing the output from existing wells using new drilling efficiencies and innovations such as shale well refracturing.

Meanwhile, the new configuration of the oil supply in the world is benefiting Brazil, which it is expected to record its highest oil export volume in 2023.

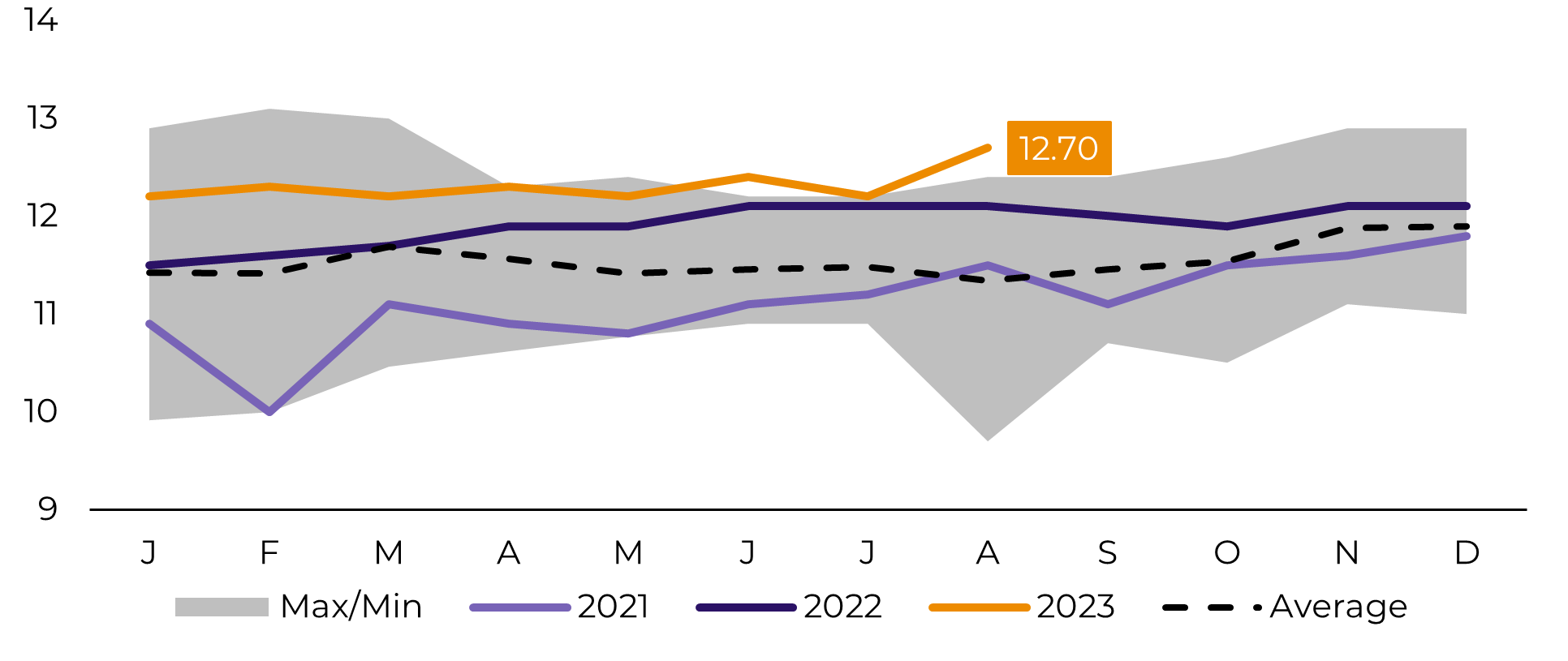

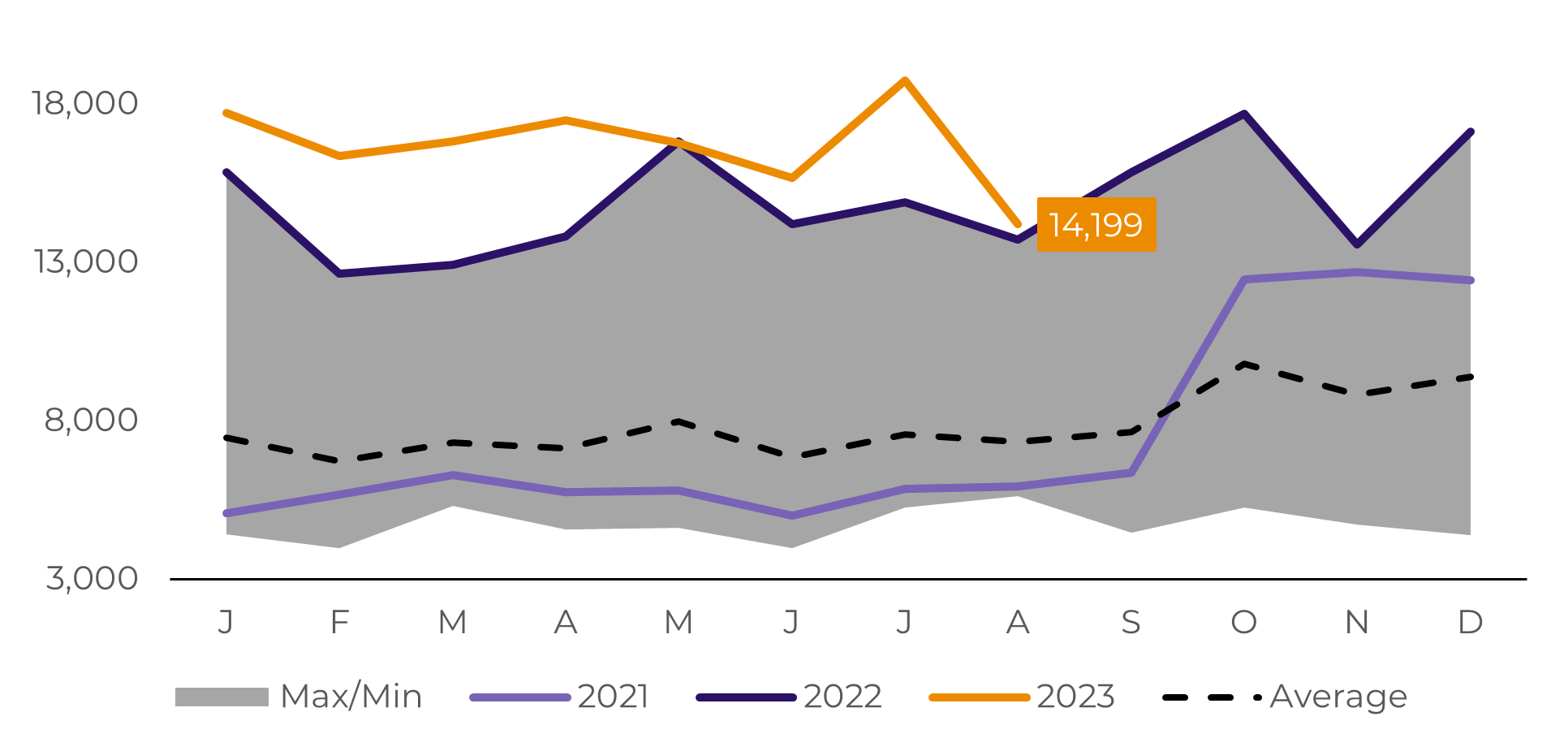

Image 1: Oil Output in the U.S. (M bpd)

Source: EIA

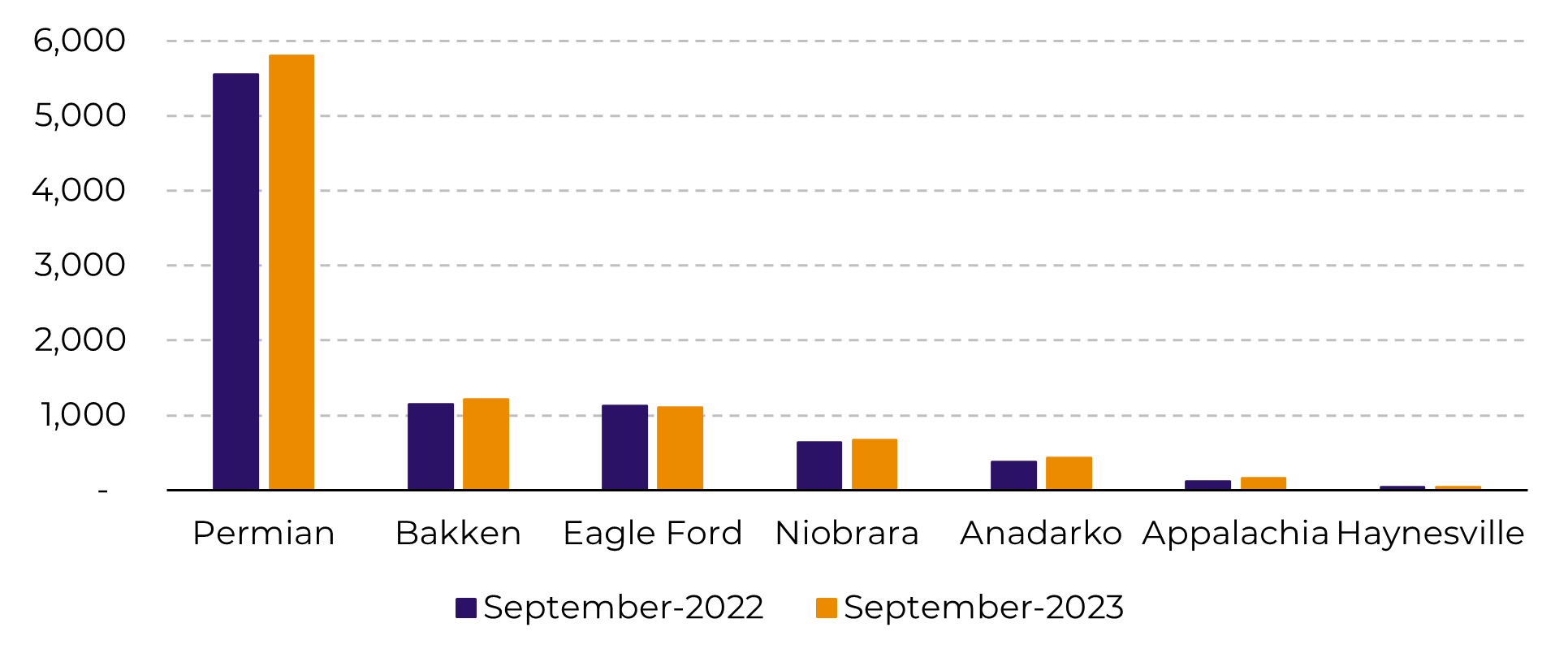

Image 2: Production per Region U.S. (Thousand bpd)

Source: EIA

U.S. Oil Production Increase Based on More Productivity

Since July, oil prices have risen more than 10%, reflecting coordinated action by OPEC+ members who have restricted the supply of the commodity to the world. With higher prices and strong demand, non-cartel producers were given incentives to increase their oil production. That has been the case in the USA, which is able to increase its production by 850,000 bpd to a record 12.76 million bpd in 2023 according to Energy Information Agency (EIA).

However, the number of drilling rigs, an indicator associated with future oil production, has been falling rapidly this year in the US, which may soon result in lower oil output. After peaking in July, signs of lower production are emerging from the shale basin. The Permian basin, which accounts for nearly 40% of all oil production in U.S., fall production for a third month to 5.8 million.

Image 3: Rig Count vs WTI (U$ bbl)

Source: Baker Hugs, Refinitiv

Meanwhile, the decrease in rig counts has caused an important phenomenon in recent years in the US, the increase in productivity in oil and gas extraction. Abrupt drops in prices have removed less efficient competitors from the market, which need to interrupt their activities to avoid the risk of operational losses. This ends up benefiting companies with better economies of scale that increase their production to match oil demand.

Even though the average oil price has improved in recent weeks, low natural gas prices are likely to deter companies from returning in the short term and provide incentives for operating companies to manage their reserves sparingly. Therefore, the expansion of oil production in the U.S. should slow down in the months ahead.

Image 4: Permian Basis Production per Rig Vs WTI (U$ bbl)

Source: EIA, Refinitiv

Strong Forecast Oil Exports Include Brazil

Brazil is another country that has also consolidating its position in the international oil trade. Last year, data showed a 4% increase in its offshore production operations and 68.3% in crude oil exports. This year, oil exports have already grown by over 15% compared to the same period last year and are expected to record the highest volume of exports in the country’s history, surpassing even 2022, which held the previous record.

The current situation of change in the global energy supply chain has opened up opportunities for new players, and Brazil has taken advantage of this scenario to increase its presence in the international market. The country has been making strong investments in floating production, storage, and offloading vessels.

Image 5: Brazilian Crude Oil Exports (Kt bbl)

Source: Refinitiv

In Summary

The record volume in US oil production has been made possible by the higher productivity of current drillers in the country. Although the market is debating a possible cut in interest rates at the beginning of next year in the country, more hawkish speeches by U.S. monetary authorities and inflationary risks which could trigger more interest rates hikes should keep oil prices at current levels.

The restrictions on the supply of crude oil after the invasion of Ukraine by Russia and the recent production cuts in OPEC countries have created a positive scenario for producers in other countries. Brazil is among the countries that have benefited from re-configuration of the supply chain and increasing its crude oil exports. The country had record oil exports in 2022, and this year should be even better, increasing its importance in the world’s energy supply.

Weekly Report — Energy

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.