Aug 25

/

Victor Arduin

Energy Weekly Report - 2023 08 25

Back to main blog page

"Furthermore, the coordinated joint efforts by OPEC+ have yielded significant results in limiting global oil supply, and with Saudi Arabia's influence, this restriction may be further intensified before the year's end."

Deficit Outlook in the Oil Market

- The OPEC+ has been making efforts to provide support to oil prices, particularly considering the significant losses in the market during the first half of the year.

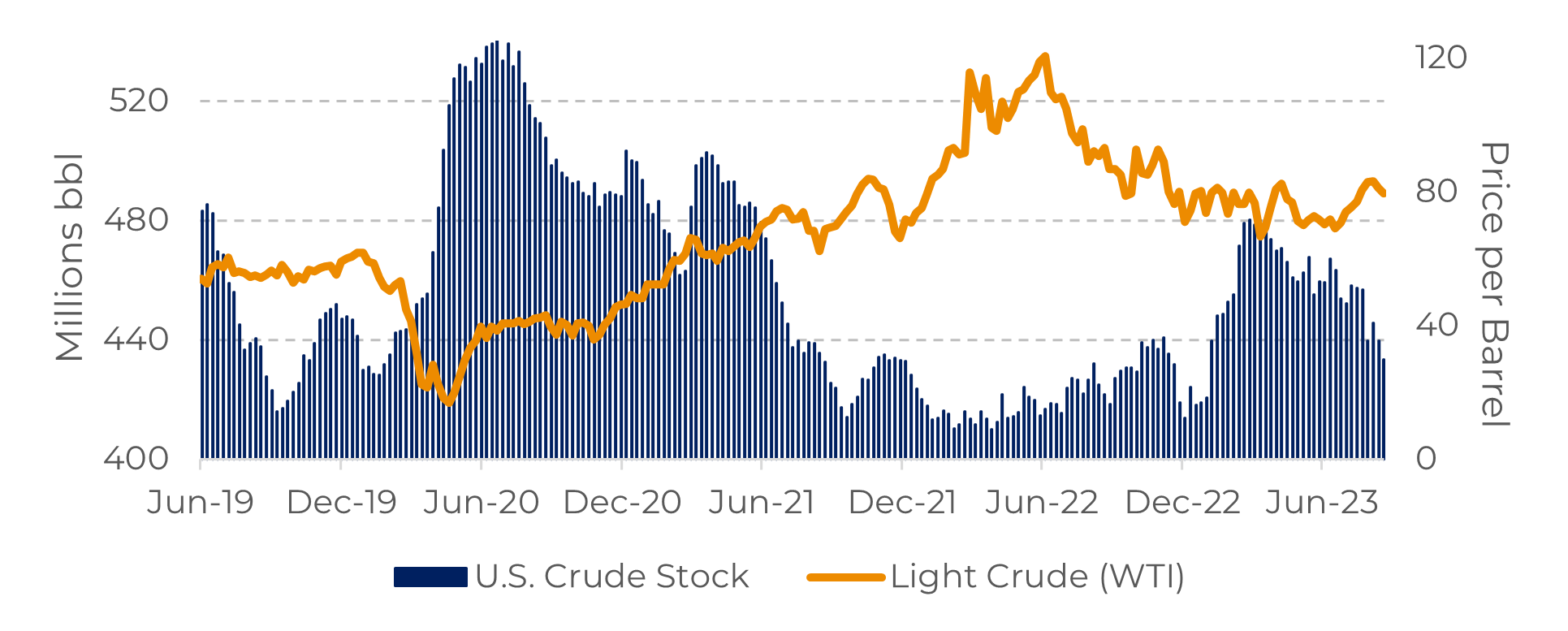

- Global oil supplies are steadily declining, with a focus on U.S. inventories that have dropped in the last week by 6.1 million barrels.

- Risks of a sharp drop in oil prices are diminishing due to the notable supply deficits emerging in the market.

- The major oil benchmarks continue to display a backwardation price curve, providing advantages for companies to sell their output in the short term.

Introduction

in October, for the third consecutive month, it is expected that Saudi Arabia will limit its oil production to 1 million barrels per day. Currently, the country is operating at a level of around 9 million bpd, the lowest since 2021.

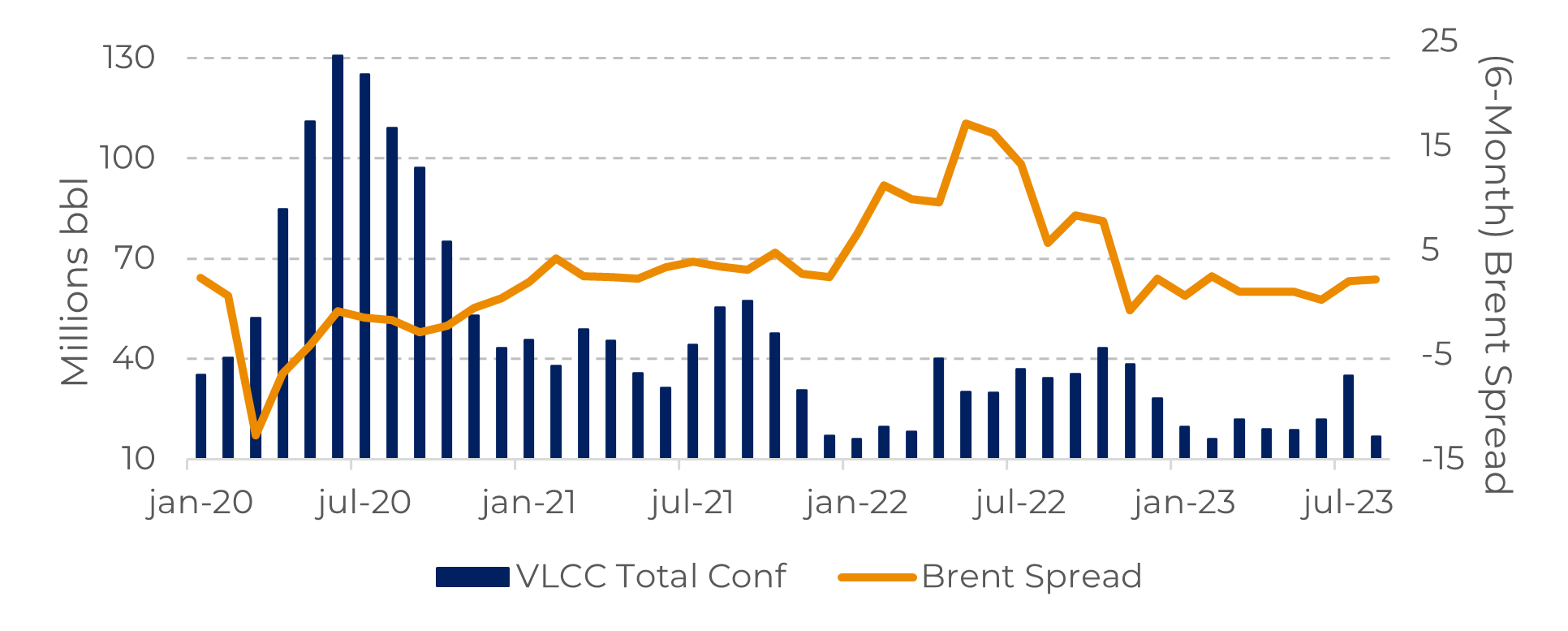

Oil fundamentals are showing signs of scarcity, demonstrated by a new reduction of 6.1 million barrels in the United States and by floating storage in VLCC ships, which has reached its lowest levels in 2023.

With the price curve exhibiting backwardation, oil producers remain motivated to trade their production in the short term, capitalizing on the advantages of higher prices compared to what they would receive in future sales.

Image 1: VLCC Floating Storage Vs. Brent Futures Spread

Source: EIA

Image 2: U.S. Commercial Crude Oil Vs. WTI (US$/bbl)

Source: EIA

Impact of OPEC+ on Oil Prices

Global oil supplies are progressively decreasing. While the market remains highly attentive to U.S. inventories, which once again recorded a decline of 6.1 million barrels to reach a total of 433.5 million barrels, other indicators point to further fundamentals of energy scarcity. By August, slightly over 16 million barrels were confirmed to be stored in Very Large Crude Carriers (VLCCs), the lowest volume in 2023.

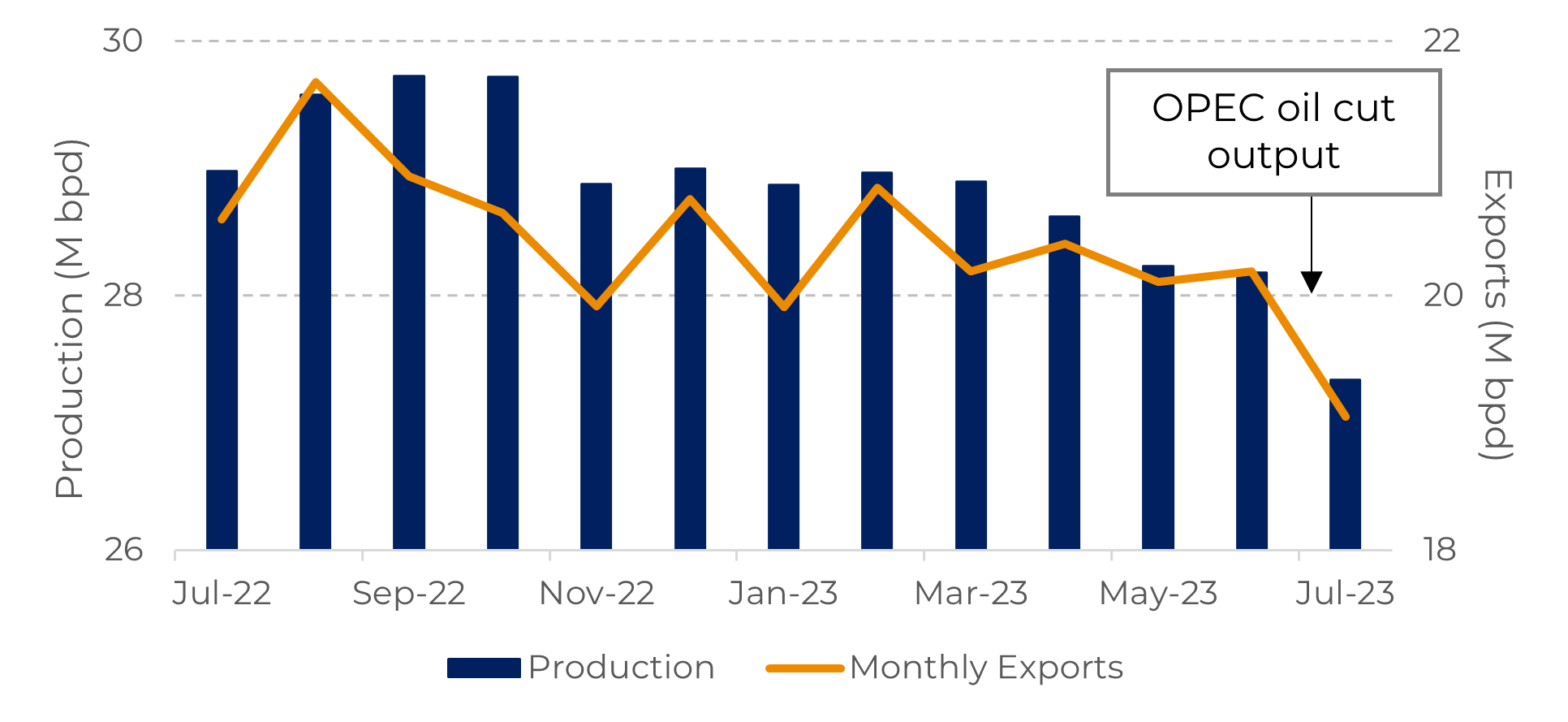

Furthermore, the coordinated joint efforts by OPEC+ have yielded significant results in limiting global oil supply, and with Saudi Arabia's influence, this restriction may be further intensified before the year's end. Holding approximately 40% of global supply, the group wields considerable influence over future energy markets.

Image 3: Production and Monthly Exports from OPEC (M bpd)

Source: Refinitiv

In the meantime, there are discussions regarding Saudi Arabia's potential decision to prolong its voluntary reduction of 1 million barrels per day in output for the third consecutive month, possibly extending into October. Since June, the country has been working to limit global supply to balance the dynamics between oil demand and supply. Its production is now at its lowest level since 2021, with declines also being observed in exports.

Consequently, the risks of a sharp drop in oil prices, similar to what occurred in the first half of this year, are diminishing. The key driver behind this stronger performance in the second half is the notable supply deficits emerging in the market. Recently, the International Energy Agency (IEA) in Paris forecasts a deficit of 1.7 million bpd for the second half of the year.

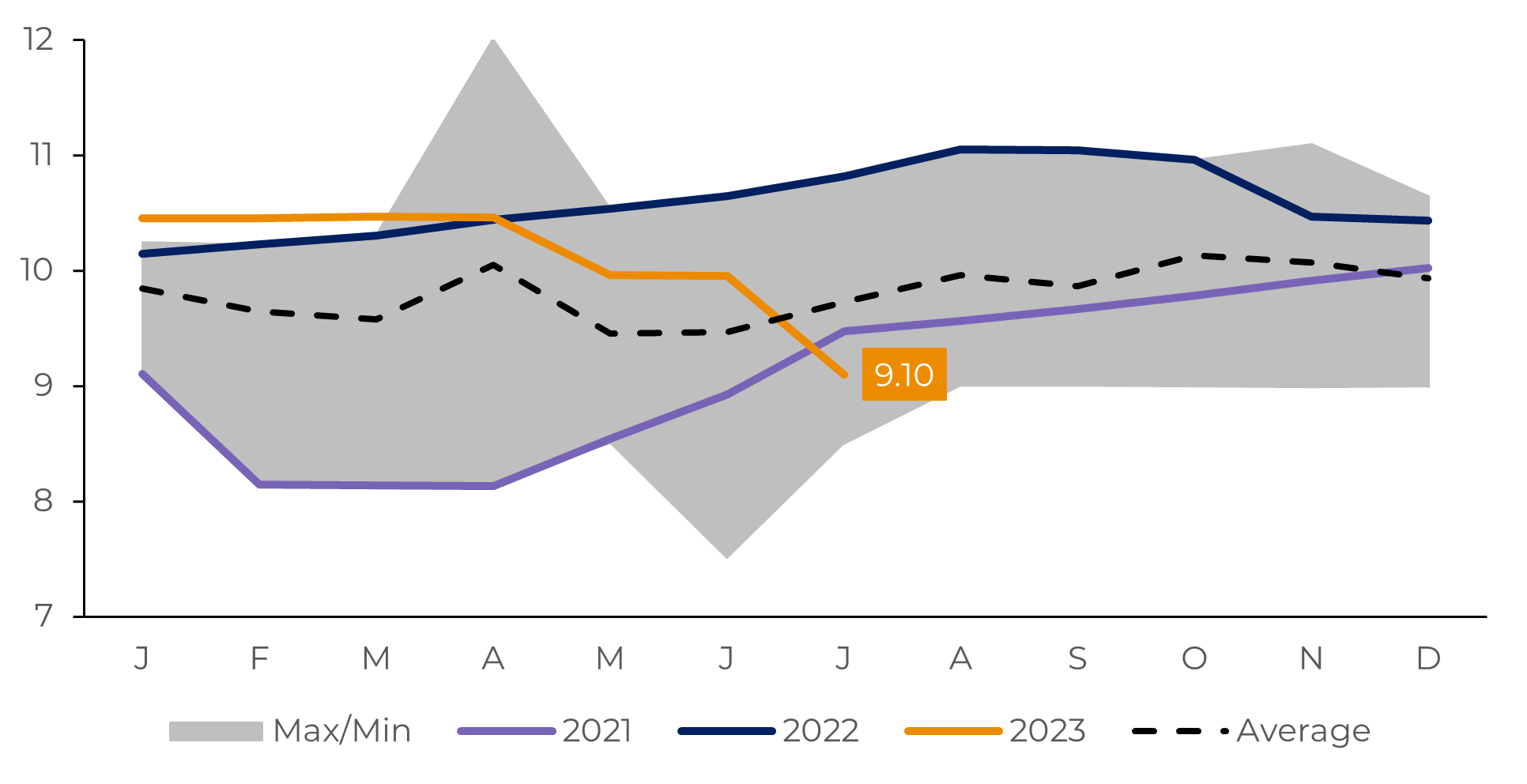

Image 4: Crude Oil Production Saudi Arabia (M bpd)

Source: Refinitiv

Market Remains in Backwardation

While the price curve continues to display backwardation, oil producers are incentivized to market their production in the near term, capitalizing on more favorable price conditions.

If additional stimulus measures from China contribute to a more optimistic sentiment regarding oil consumption in the country, coupled with supply constraints from OPEC+, it's likely that the price curve will remain in backwardation for the rest of the year.

However, oil prices are encountering growing resistance in reaching higher levels. After experiencing an increase of over 15% in July, concerns about the trajectory of interest rates in the United States and Chinese weak economic data are generating uncertainties regarding global energy demand.

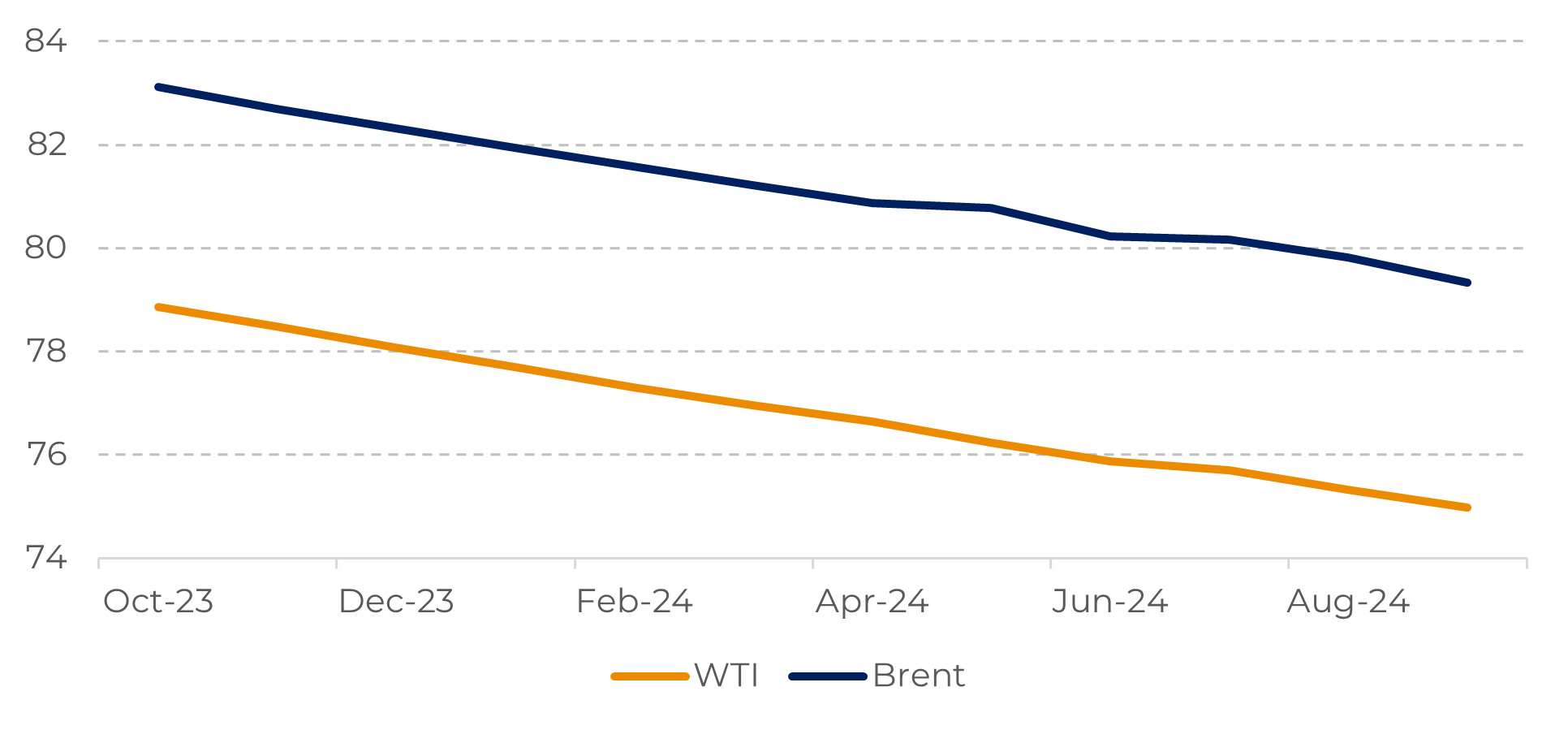

Image 5: Backwardation Curve WTI and Brent (U$/bbl)

Source: Refinitiv

In Summary

The efforts of oil production reduction by OPEC+ have played a crucial role in maintaining energy prices. However, if Chinese economic growth disappoints in the second half, it might potentially undermine the effectiveness of these measures that have limited global supply.

In recent weeks, a cautious approach has prevailed as investors seek more precise information about maintaining interest rates at elevated levels. Besides fostering a strengthening of the American currency, making energy commodities more expensive for holders of other currencies, it also increases the risks of a worsening economic situation, strongly correlated with oil consumption.

Therefore, the economic indicators that will be released in the upcoming weeks in the United States will play a crucial role in fostering greater market confidence that the restrictive monetary cycle is nearing its conclusion, redirecting attention to the tight levels of global oil inventory.

Weekly Report — Energy

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Natália Gandolphi

natalia.gandolphi@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.