Sep 1

/

Victor Arduin

Energy Weekly Report - 2023 09 01

Back to main blog page

"Despite U.S. refinery margins having fallen since the middle of 2022, they remain at historically high levels, resulting in substantial profits from oil product production."

Strong Refinery Margins Due to High Demand and Low Inventories

- Refineries are enjoying strong margins as robust demand outpaces supply increases, putting pressure on inventories and creating a tight market for gasoline and diesel.

- Middle distillates are beginning to outperform gasoline, emerging as the primary margin drivers. As the North Hemisphere approaches the end of summer, there will be increased demand for winter-grade fuels, including heating oil.

- Furthermore, unplanned outages and the hurricane season introduce increased uncertainty regarding refined products’ production in the United States.

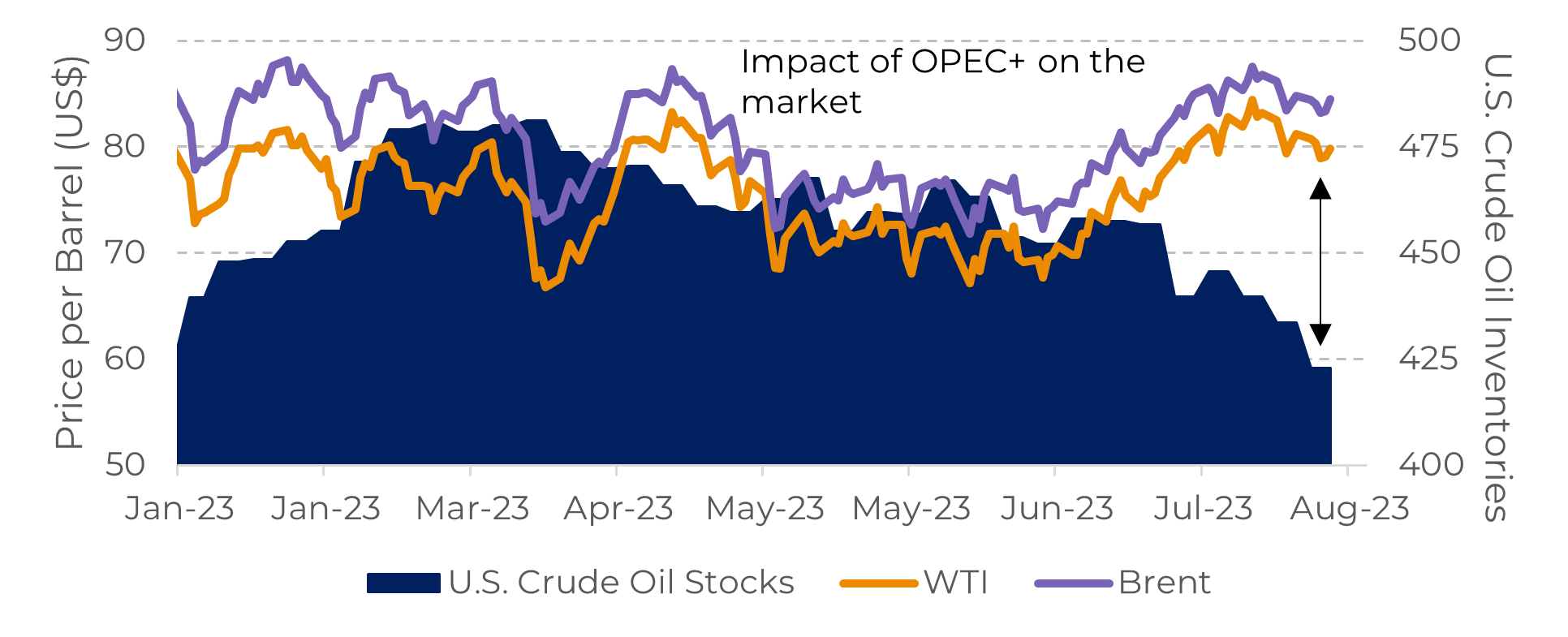

- The OPEC+ strategy to limit global oil supply is having effects. The United States has significantly reduced its oil inventories in five of the past six weeks.

Introduction

So far, 2023 has been marked by significant fluctuations in the energy complex, with a strong devaluation in oil prices early this year that was reversed in the second half. Also, concerns about low inventories are impacting gasoline and diesel prices.

Nevertheless, the refineries have nothing to complain about as they have achieved high profit margins during this year. Compared to historical values, margins remain at the top performances in recent years. Demand continues to grow, and due to limited expansion in production, a legacy of the COVID-19 period, the market may remain tight.

The rapid decline in American oil stocks reinforces the idea of a very tight market for this year. After two weeks of redution, the main benchmarks are expected to close the week with gains, thanks to OPEC+ measures.

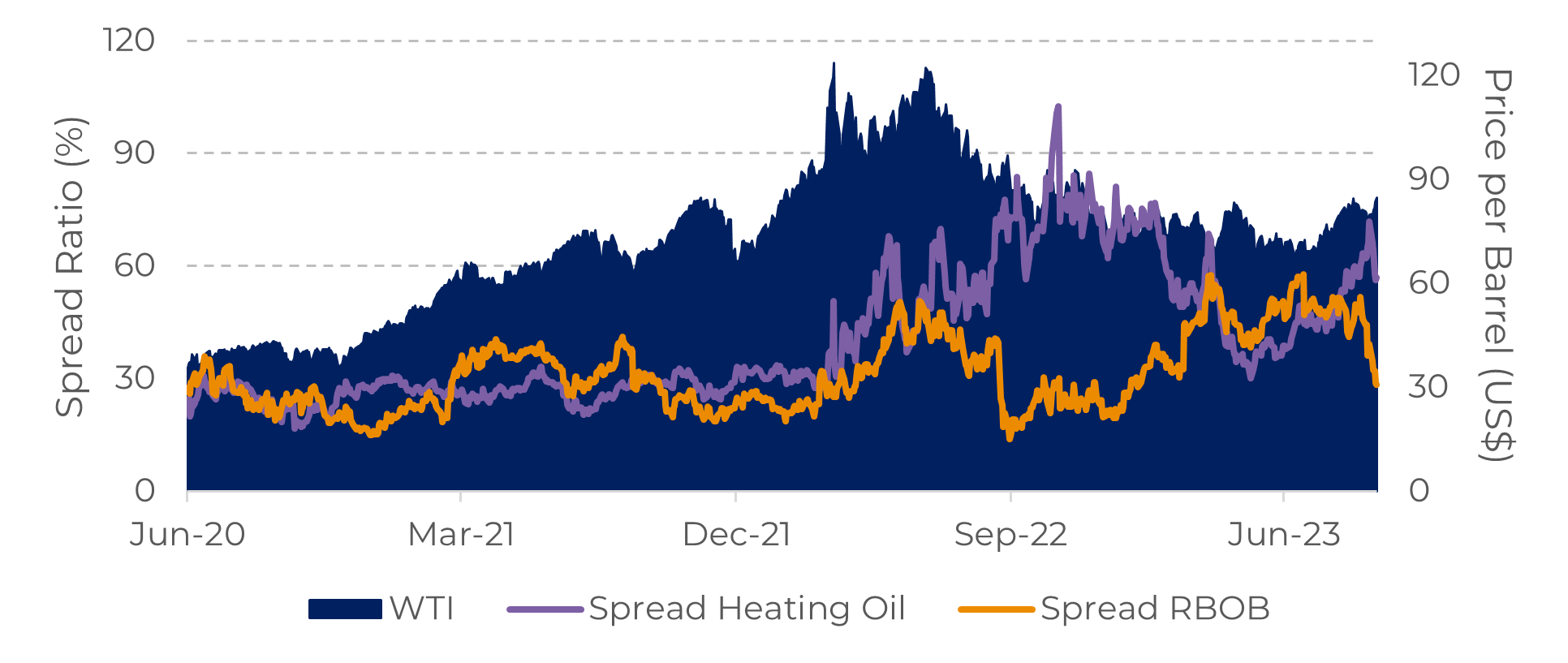

Image 1: Refined Products Crack Spread Ratio (%)

Source: Refinitiv

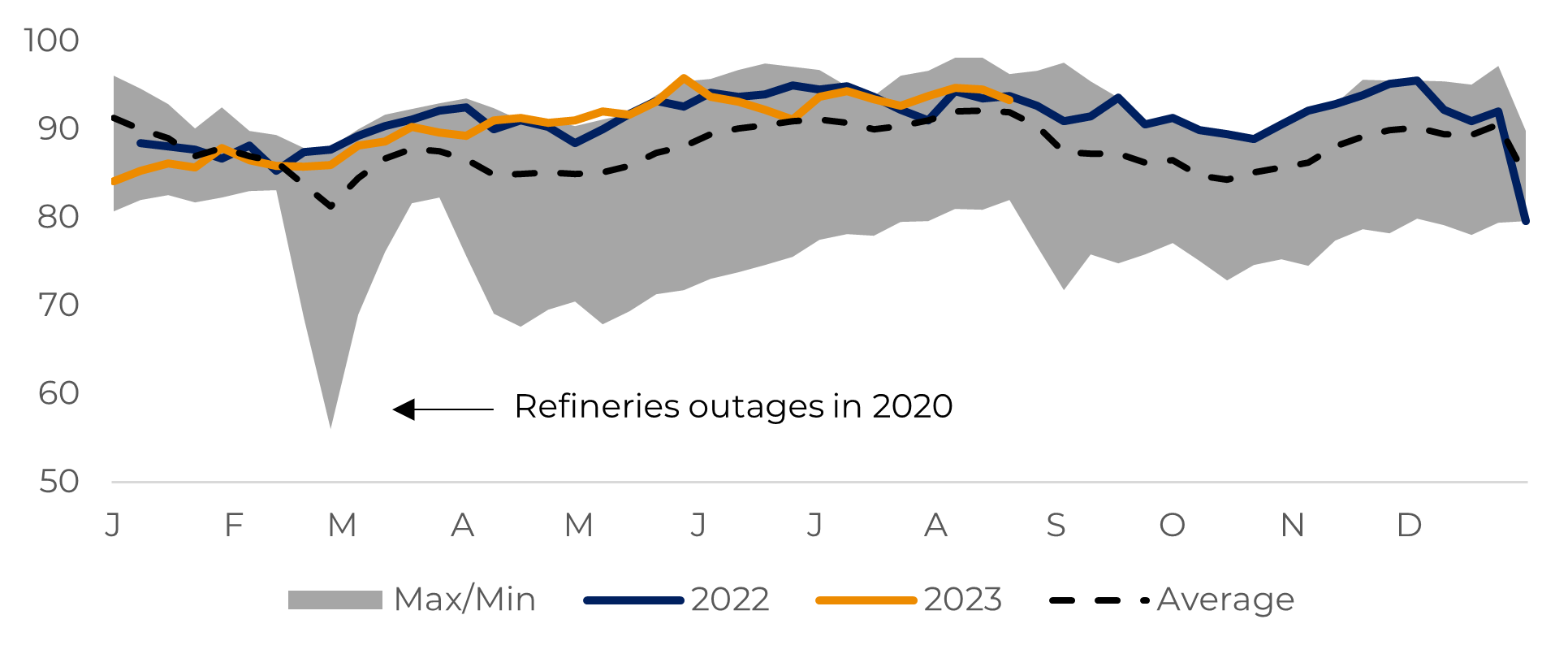

Image 2: Refinery Utilization in U.S. (%)

Source: Refinitiv

Crack Margins Throughout 2023

Despite U.S. refinery margins having fallen since the middle of 2022, they remain at historically high levels, resulting in substantial profits from oil product production. The reasons for this strong result are the persistent demand amidst lower-than-average inventories of gasoline and diesel. Additionally, the increase in demand has outpaced the net supply additions, resulting in market tightness.

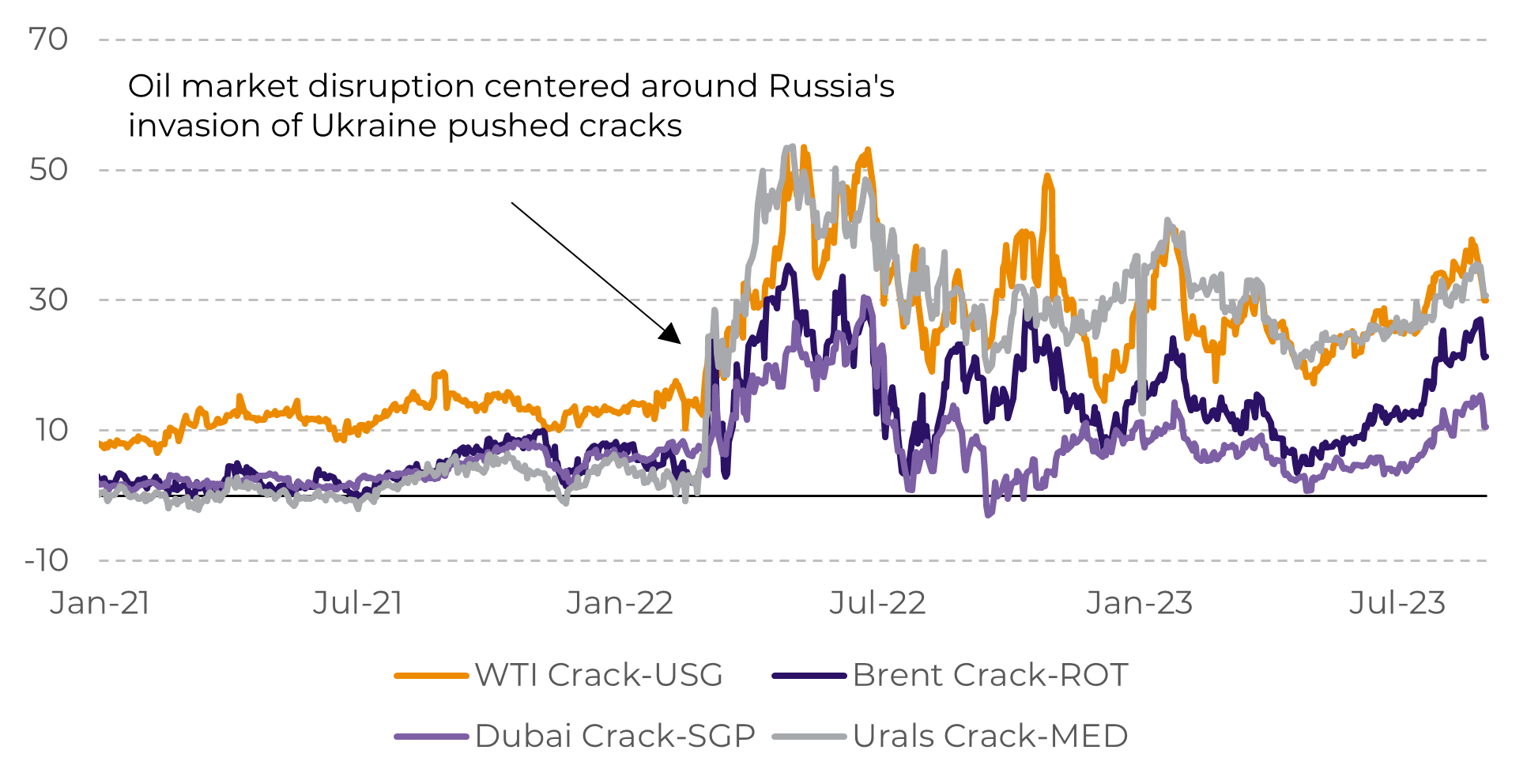

Meanwhile, the demand for middle distillates remains strong in various regions around the world. Recently, the Executive Vice President of Marketing at Phillips 66, a major American refinery, mentioned a 9% growth in demand in Latin America and 4% in Asia, further bolstering optimism regarding the excellent margins expected for the remainder of 2023. Profits from processing a barrel of crude oil at refineries have seen substantial gains, as indicated in chart 4. Despite crack spreads encouraging high refining utilization, inventory levels have not shown significant signs of buildup thus far.

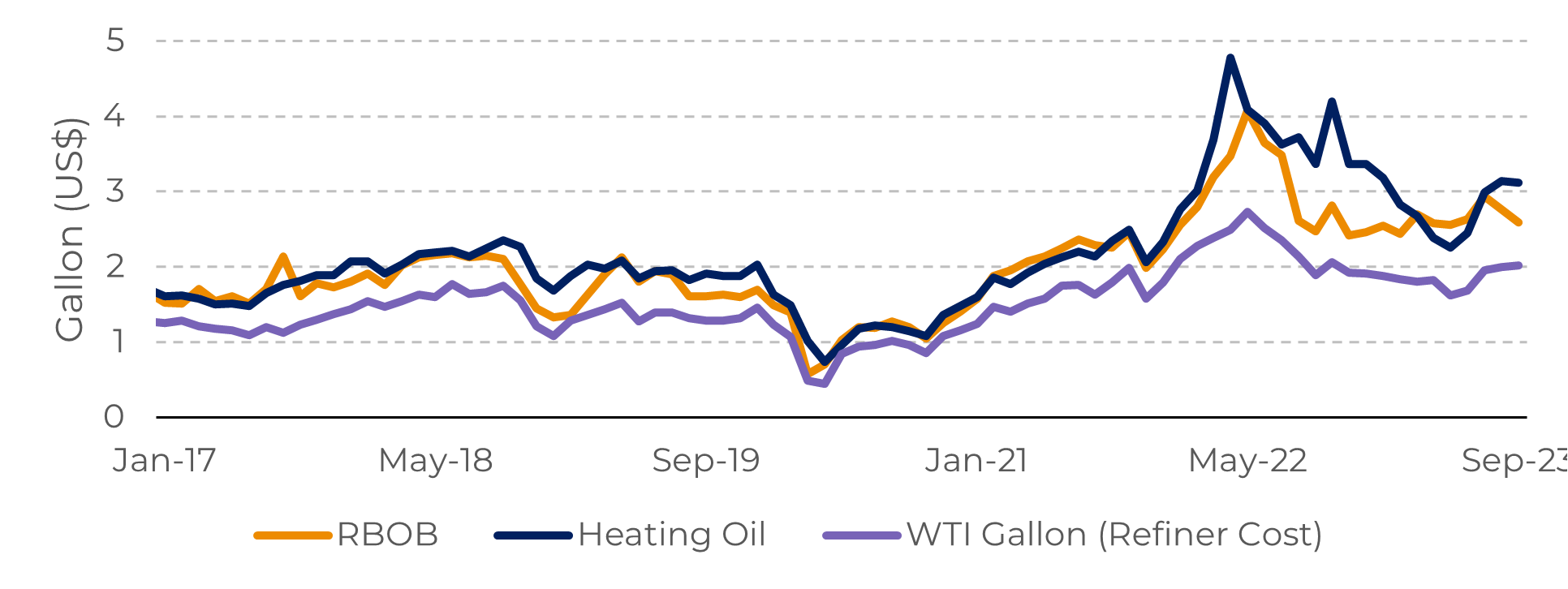

Image 3: U.S. Crude Oil and Refined Products Futures

Source: Refinitiv

Furthermore, additional factors are contributing to the upward momentum in refined product prices. For instance, a fire incident at the Garyville refinery has led to a halt in production on 25th of August. The facility is responsible for generating approximately 265 thousand barrels per day (bpd) of gasoline, which accounts for roughly 3% of the entire U.S. consumption. Moreover, the intense heat had affected the U.S. refining hub along the Gulf Coast resulting in outages.

The current trend shows middle distillates outperforming gasoline, taking the lead as primary margin drivers. Looking ahead, margins in the fourth quarter might experience a dip from their current levels. This forecast can be attributed to the expected decline in gasoline margins as refineries shift towards manufacturing more economically viable winter-grade fuels, including heating oil. However, future prices may remain favorable for refineries when compared to historical levels.

Image 4: Crack Refinery Profit by Region (US$)

Source: Refinitiv

OPEC+ in Focus

The market eagerly awaits the next steps of OPEC+. It is expected that Saudi Arabia may voluntarily cut its production by 1 million barrels per day (bpd). This perspective gained strength after the announcement last Thursday by Deputy Prime Minister Alexander Novak, stating that Russia has agreed to restrict its exports next month.

The strategy of OPEC+ countries to restrict the global oil supply seems to be working. The United States has significantly reduced its oil inventories in five of the most recent six weeks due to increasing exports and domestic demand, reinforcing the sentiment of a tight energy market for the rest of the year.

The strategy of OPEC+ countries to restrict the global oil supply seems to be working. The United States has significantly reduced its oil inventories in five of the most recent six weeks due to increasing exports and domestic demand, reinforcing the sentiment of a tight energy market for the rest of the year.

However, there are significant events that could jeopardize this rather bullish trend. A shift in U.S. monetary policy or an economic slowdown in the country could quickly push down oil prices.

Image 5: Major Oil Benchmarks vs. U.S. Crude Oil Inventories

Source: Refinitiv

In Summary

The strong margins gains from the refining market are the result of a structural change in the energy sector and are likely to take some time to reverse.

The pandemic, for example, significantly reduced the demand for refined products, affecting refineries' finances and reducing incentives for production expansion. Consequently, the world has seen fewer investments in the refining sector.

One of the few expansion projects is the Dangote refinery in Nigeria, which could alleviate diesel market tightness in 2024. However, despite being designed to become the world's largest refinery, it will take some time to reach its full production capacity.

In the mean time, the major oil benchmarks Brent and WTI are heading for another week of gains after losing momentum in the past two weeks. It appears that the OPEC+ supply restrictions are increasing their impact on the market. Despite the gains achieved so far, the risks of an economic slowdown or further interest rate hikes may exert a bearish impact on the oil trading market.

Weekly Report — Energy

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.