Energy Weekly Report - 2023 09 11

Importance of LNG for Maritime Transport

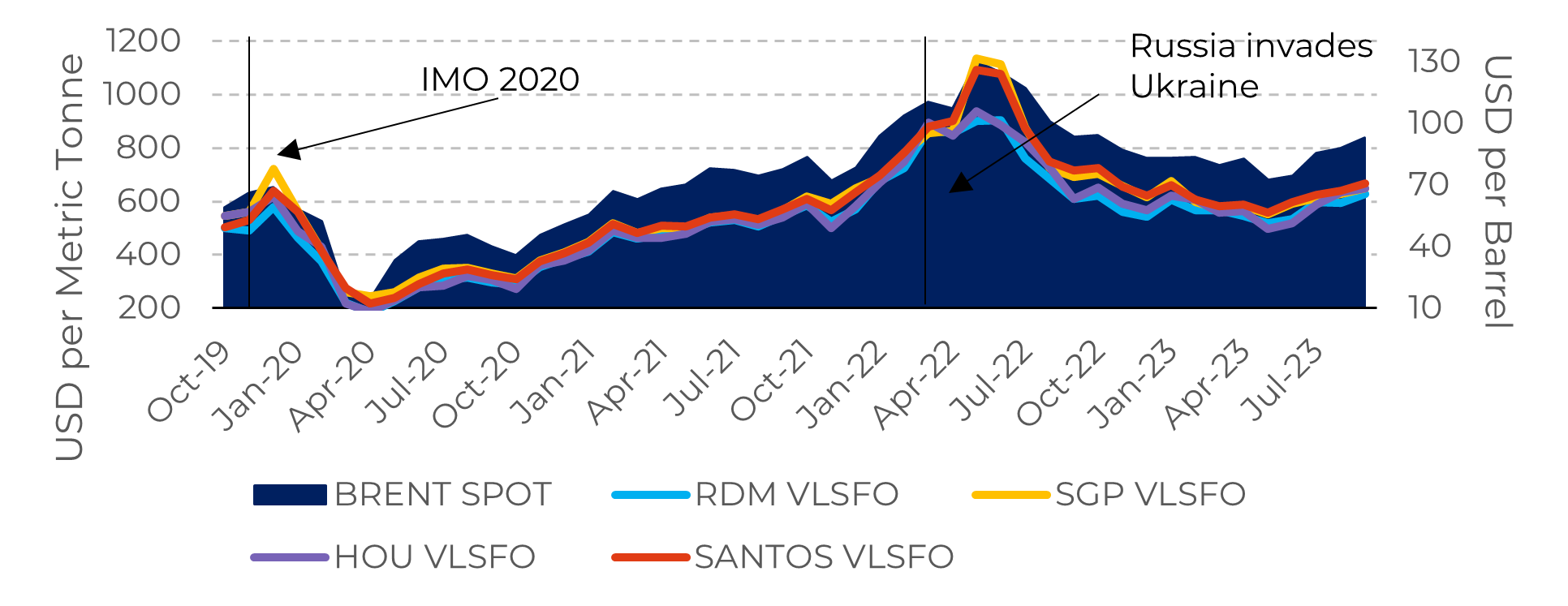

- IMO 2020 marked a crucial transition towards more sustainable fuels, with LNG emerging as an economically advantageous option this year, which could have significant implications for the maritime transport sector.

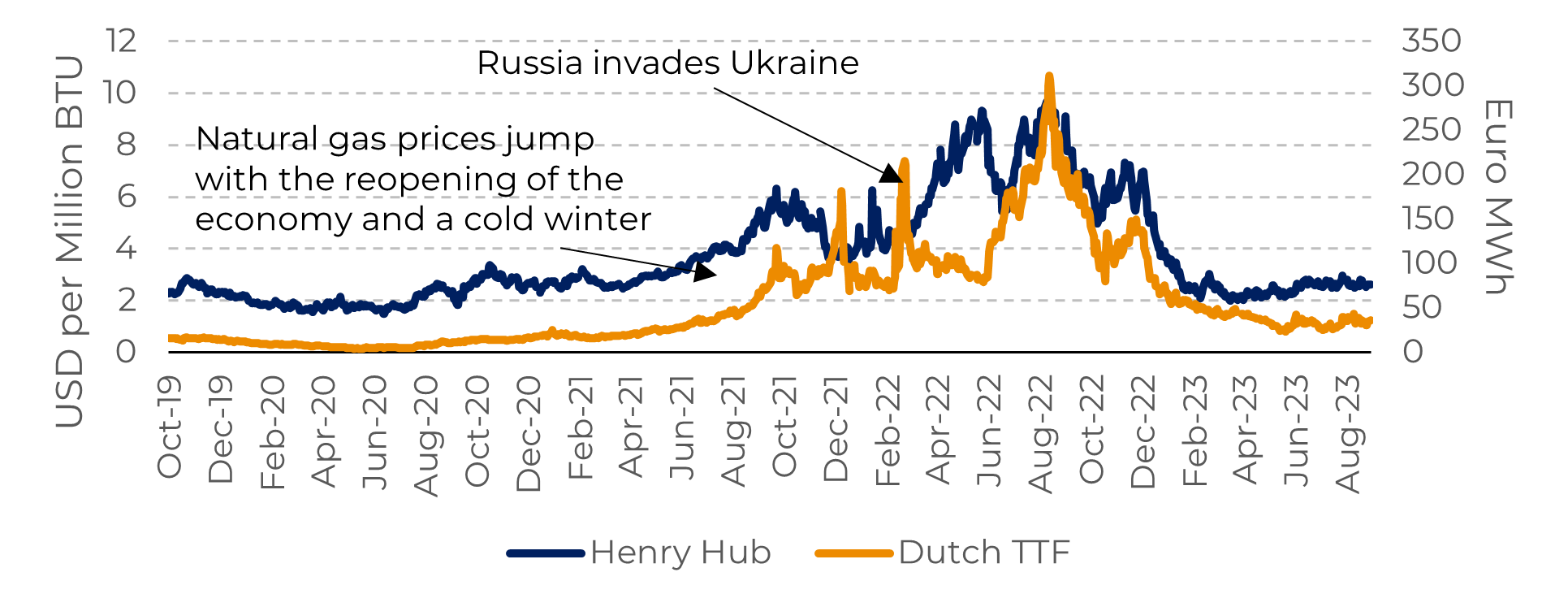

- The factors pressuring natural gas prices also strengthen LNG as a viable option. Production in the United States is on the rise, with record-breaking prospects in 2023, and European stocks are robust, reducing the risk of shortages.

- New inflation data in the United States this week are causing concerns in the market. A more restrictive interpretation of the price landscape in the country could raise expectations for further interest rate hikes this year.

- Although OPEC+ has established fundamentals that restrict the oil market, a stricter stance on U.S. monetary policy could promptly reduce global demand.

Introduction

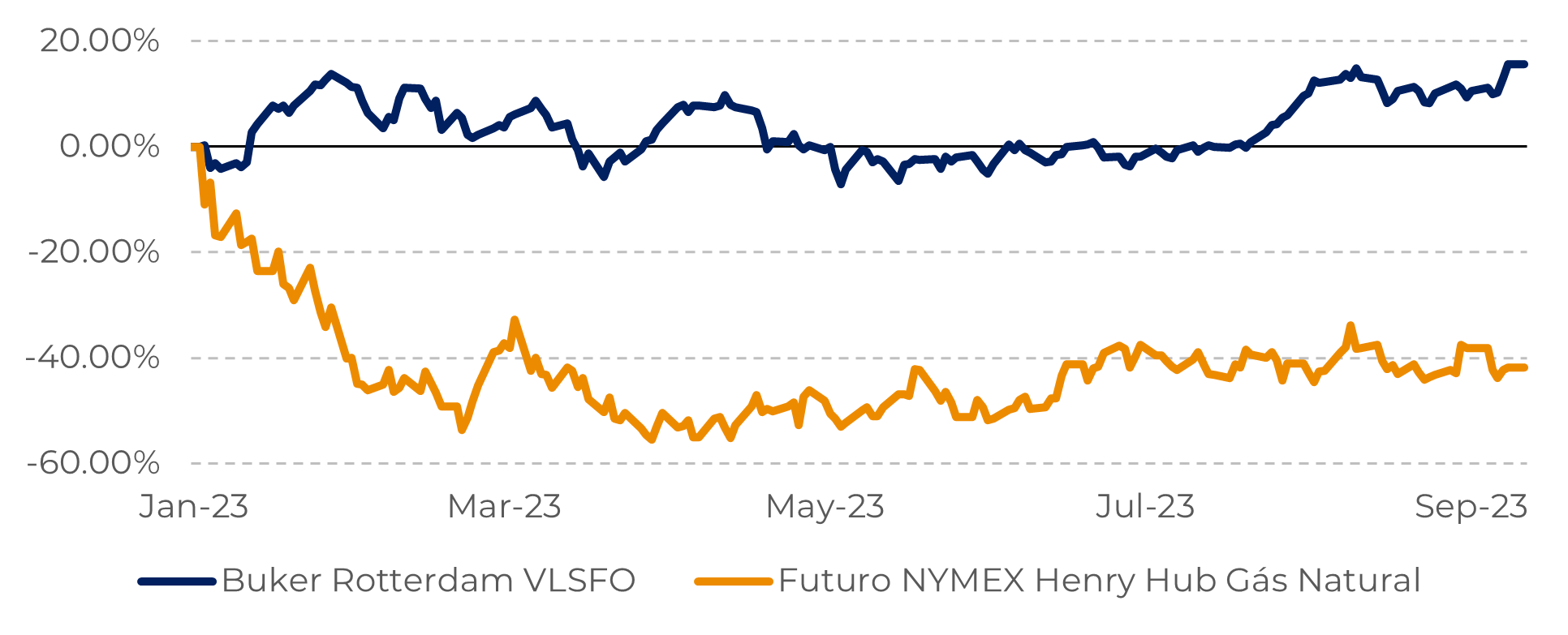

Image 1: Performance VLSFO vs. Natural Gas (Indexed on 30/12/2022)

Source: Refinitiv

Natural gas emerges as a viable option for maritime fuel

Image 2: Brent Spot Price Compared to VLSFO

Source: Refinitiv

Image 3: Key Natural Gas Futures Benchmarks

Source: Refinitiv

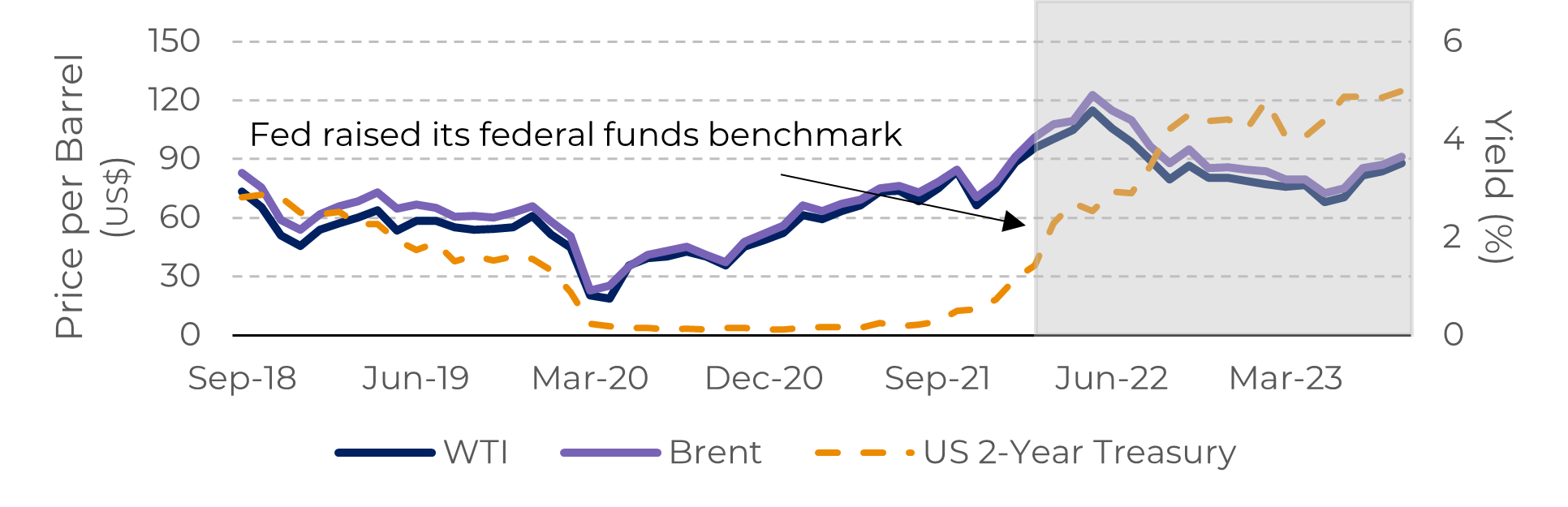

Interest rates are one of the impediments to oil

The elevation of interest rates, used as a monetary policy tool to combat inflation, has proven effective but significantly impacted the price of oil in the first half of 2023. As U.S. prices stabilized at more comfortable levels, Brent and WTI have found room to recover, as evidenced by Chart 4.

The market will be closely watching the August inflation outcome, which will be released on September 13. A very high number could fuel concerns that the Federal Reserve (Fed) will keep interest rates higher for longer or raise them in the coming months. This would give the market fewer reasons for a bullish position on energy commodities.

The market expects the U.S. Central Bank to keep interest rates unchanged at its meeting on September 20. However, expectations for a rate hike in the November meeting are increasing, which would result in a bearish sentiment for oil.

Image 4: Comparison between Major Oil Benchmarks and 2-Year U.S. Treasury

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.