Energy Weekly Report - 2023 09 15

The U.S. Relevance as a Global Supplier of Natural Gas

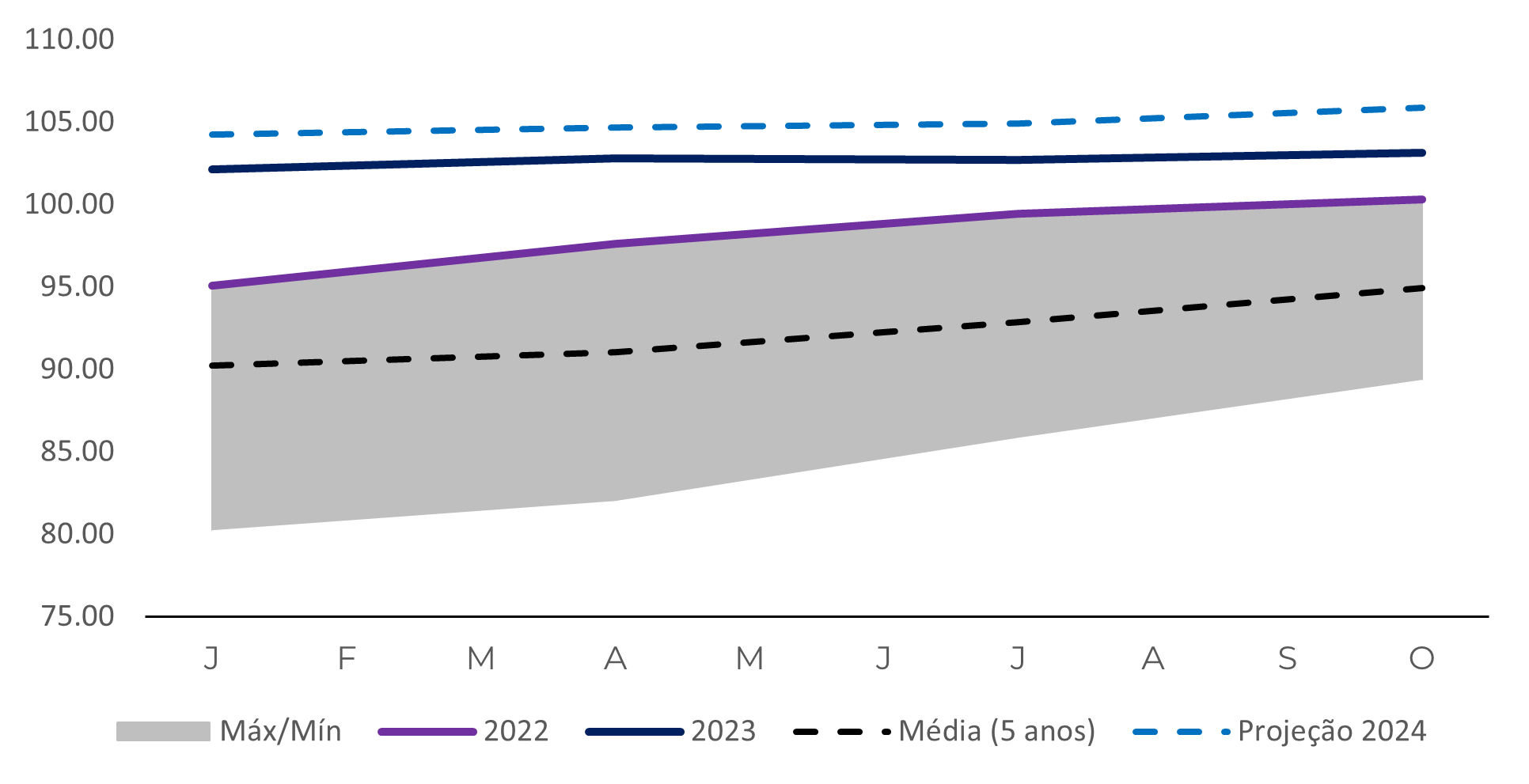

- The EIA projects an increase in dry gas production in the U.S. for 2023 and 2024, highlighting the nation's robust capability to supply the world with this cleaner energy source.

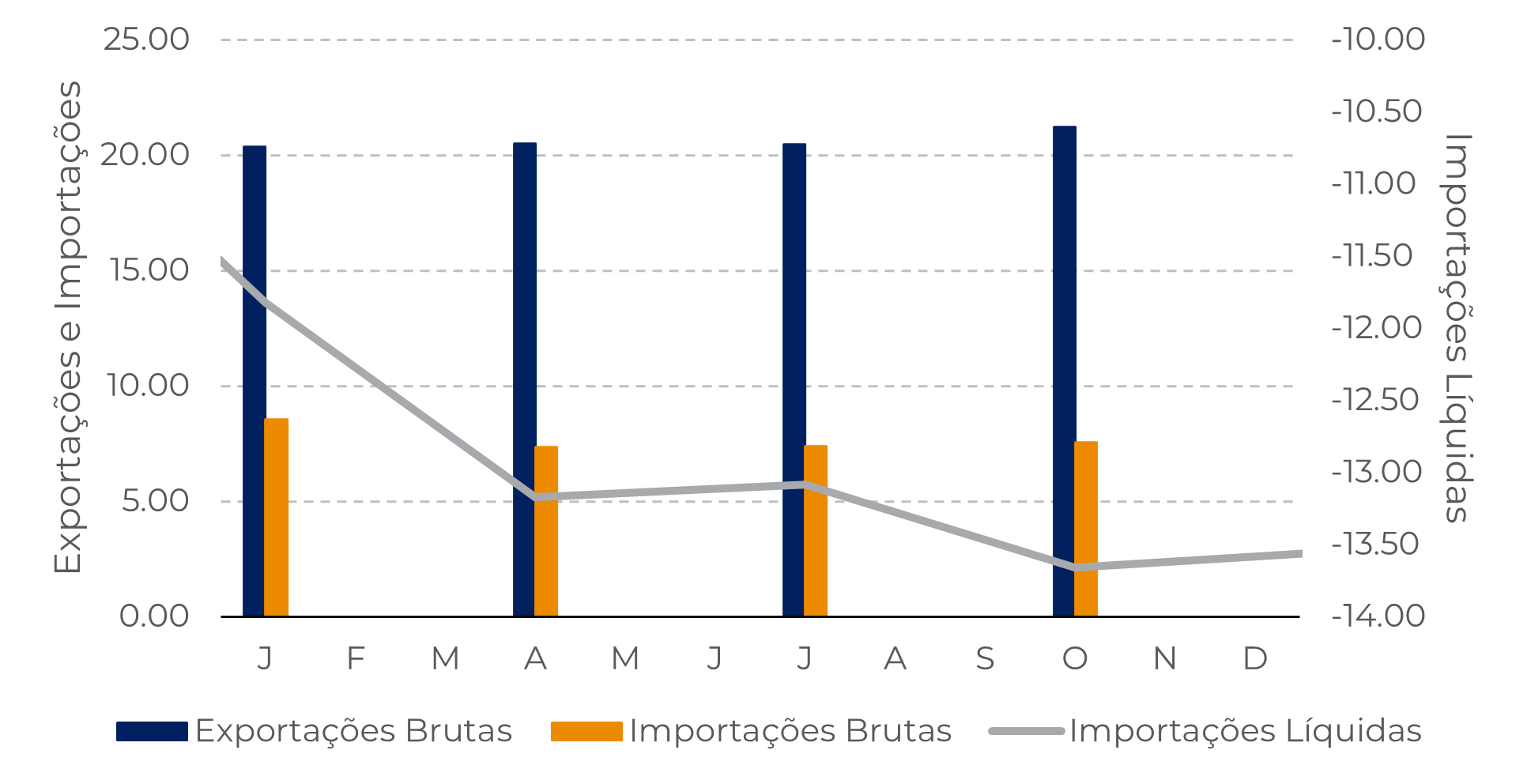

- The increase in natural gas exports from the country is a clear indicator of its increasing importance, solidifying its position as a major supplier for Mexico via pipelines and Europe, through shipments.

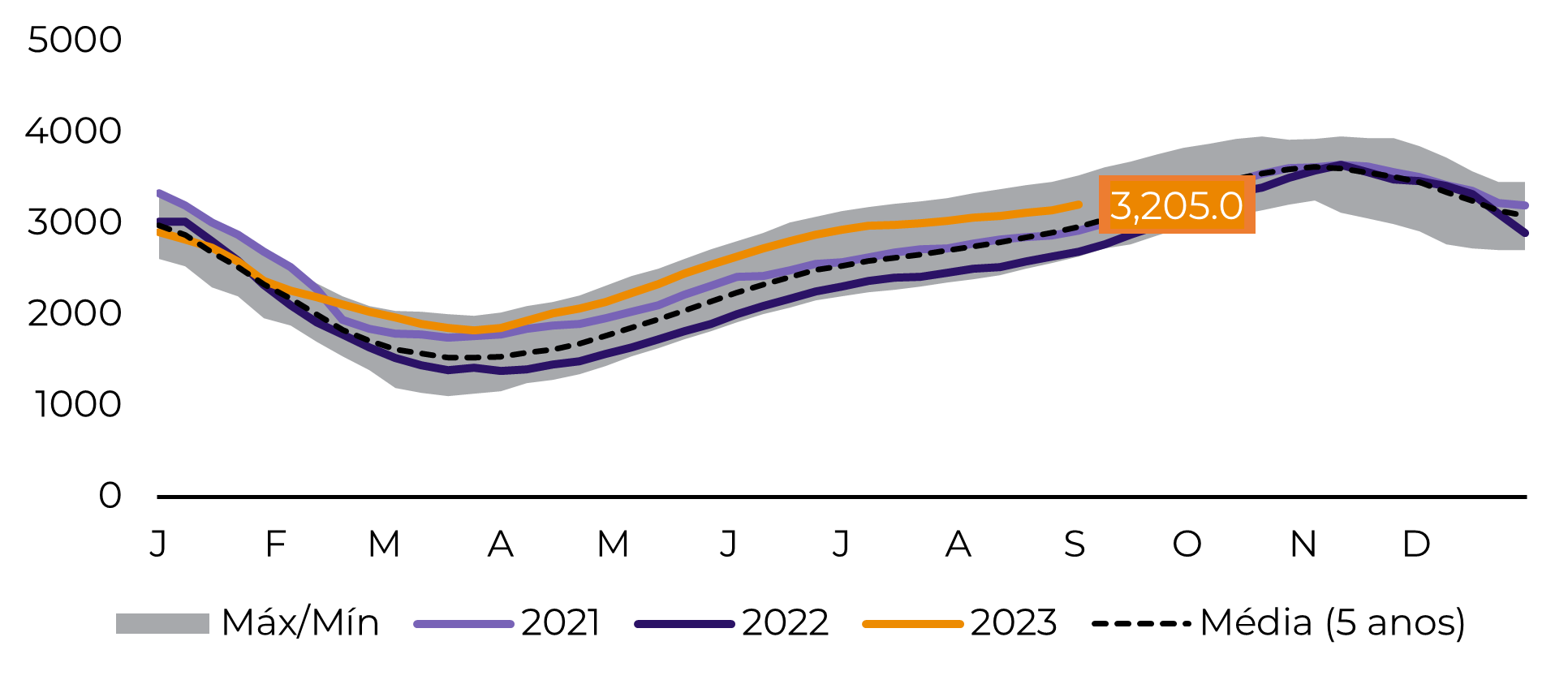

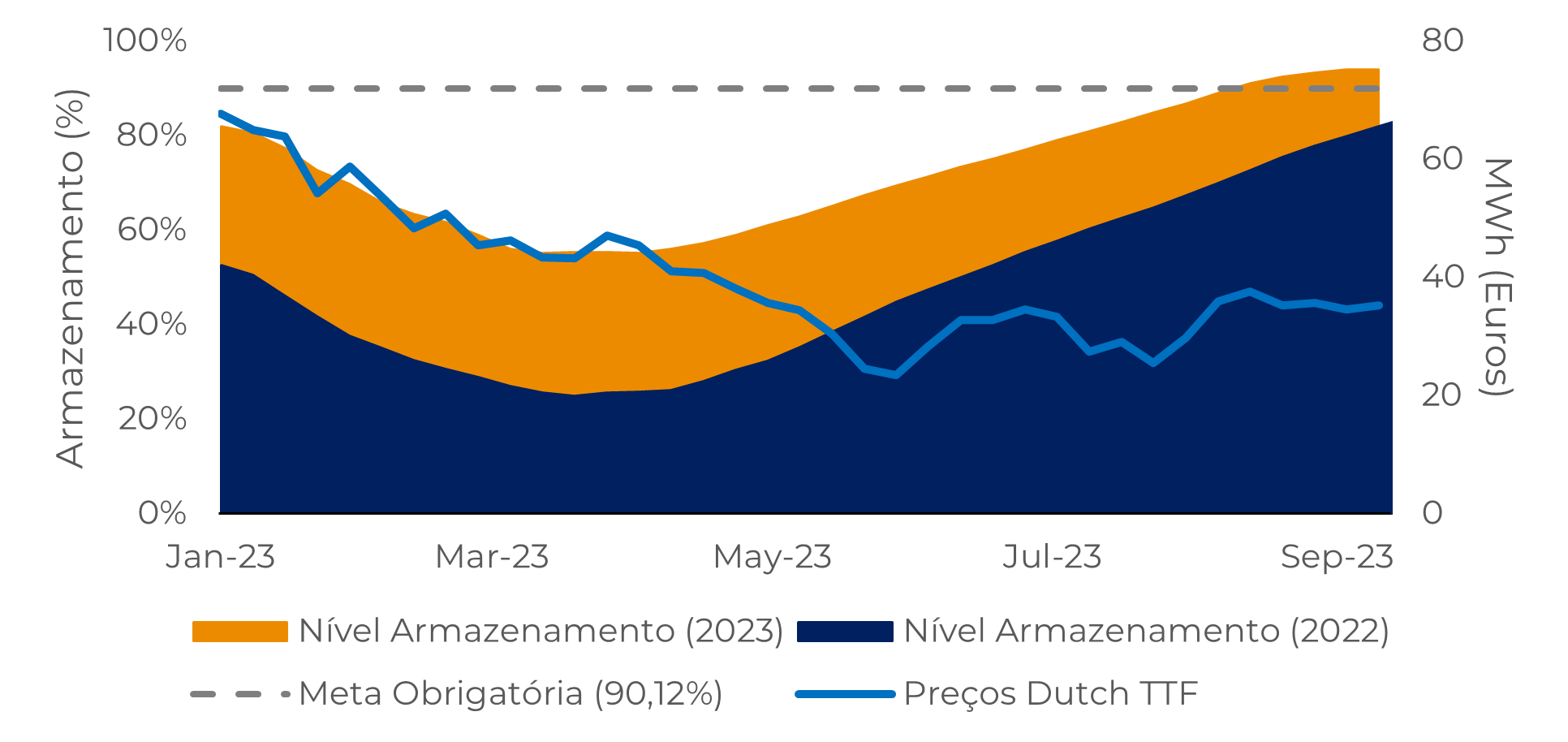

- Europe has a record-high volume of natural gas storage in September, reflecting the mild temperatures on the continent, economic activity slowdown, and high prices that suppressed consumption during the last winter.

Introduction

Image 1: U.S. Working Gas In Underground Storage (Bcf)

Source: EIA

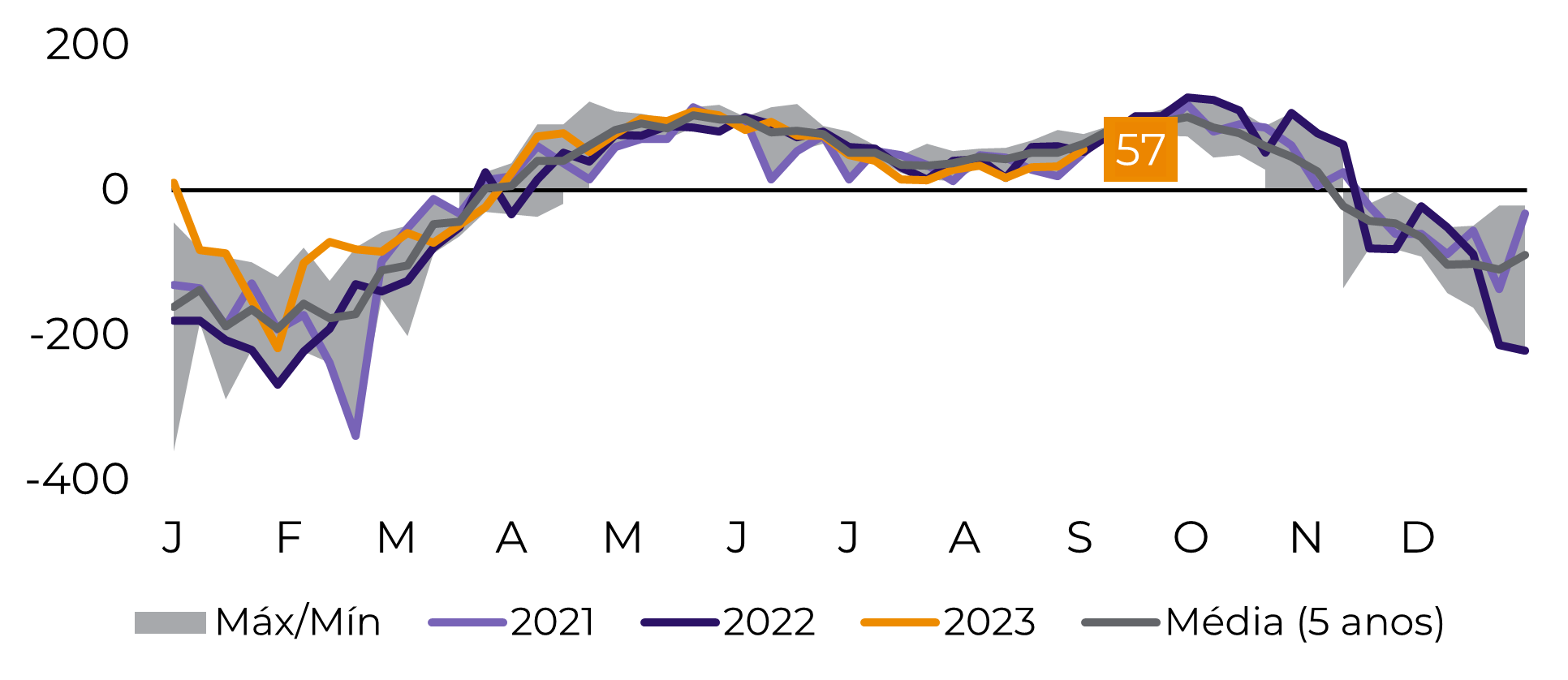

Image 2: U.S. Weekly Change in Working Gas In Underground Storage (Bcf)

Source: EIA

Four consecutive years of surging natural gas production

Image 3: U.S. Dry Gas Natural Gas Production (Bcf/d)

Source: Refinitiv

Image 4: U.S. Natural Gas Trade Balance (Bcf/d)

Source: Refinitiv

Europe's natural gas consumption was subdued in 2023

In

2022, Europe emerged as the primary importer of LNG from the United States.

This shift was driven by a confluence of factors, including elevated

international natural gas prices, supply disruptions following a reduction in

Russia's pipeline exports to the region, and the expansion of U.S. liquefaction

capacity. Together, these circumstances created the ideal scenario for

increased European dependence on U.S. natural gas production. In other words,

2022 was very bullish for natural gas contracts.

However, the subdued natural gas consumption this year, influenced by a deceleration in economic activity and milder temperatures, has allowed Europe to meet its storage target well ahead of schedule. In the absence of supply constraints, prices have notably declined since the previous year. Nevertheless, the world is contending with mounting uncertainty regarding potential future events that could disrupt global natural gas logistics. Attacks in the Black Sea, as well as unplanned outages in Norway and Australia, are potential risks capable of driving prices higher.

Image 5: European Gas Storage Levels and Dutch TTF Futures

Source: Refinitiv

Persistent Risks in Logistics and Energy Supplies

The world has witnessed various events capable of disrupting logistics and energy supplies. The COVID-19 crisis significantly impacted global oil transportation, and the war in Ukraine restricted Europe's access to natural gas from Russia. Although the peak phases of these events may be in the past, the lingering risks persist, capable of affecting prices at any given moment.

For example, workers in Australia initiated a strike at LNG facilities due to disputes over pay and working conditions. Australia ranks among the world's largest LNG exporters, serving Asian countries as a major supplier. Any disruption in supply could intensify competition in Asia for LNG shipments, potentially affecting prices in both Europe and the United States.

Meanwhile, Norway's largest gas field is now in its third week of maintenance, and it will experience more significant capacity restrictions than originally anticipated.

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.