Energy Weekly Report - 2023 09 29

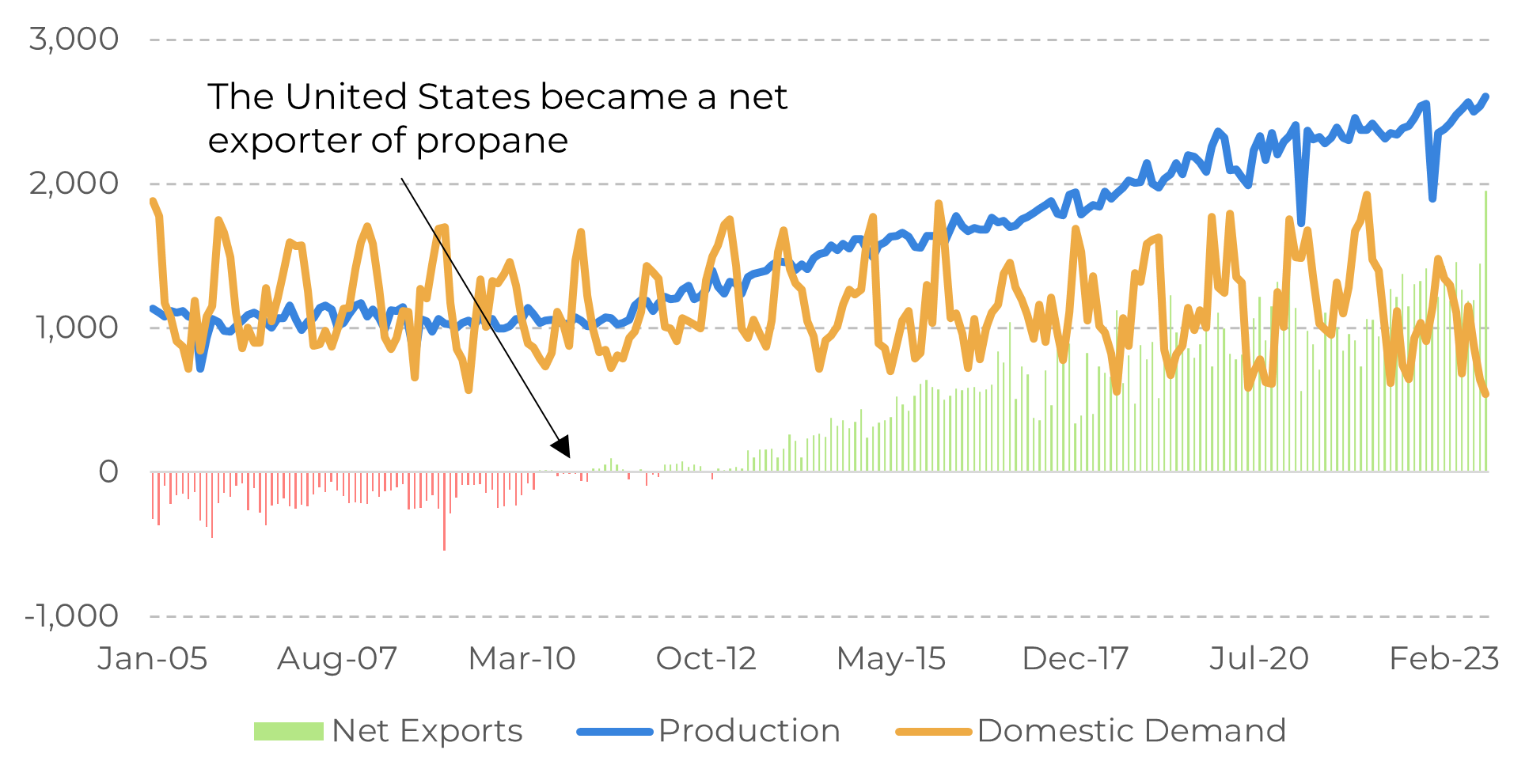

U.S. propane market: what to watch in the end of 2023

- In addition to the demand having little incentive in the United States, the current supply of propane has exceeded its volume, generating an excess in the market.

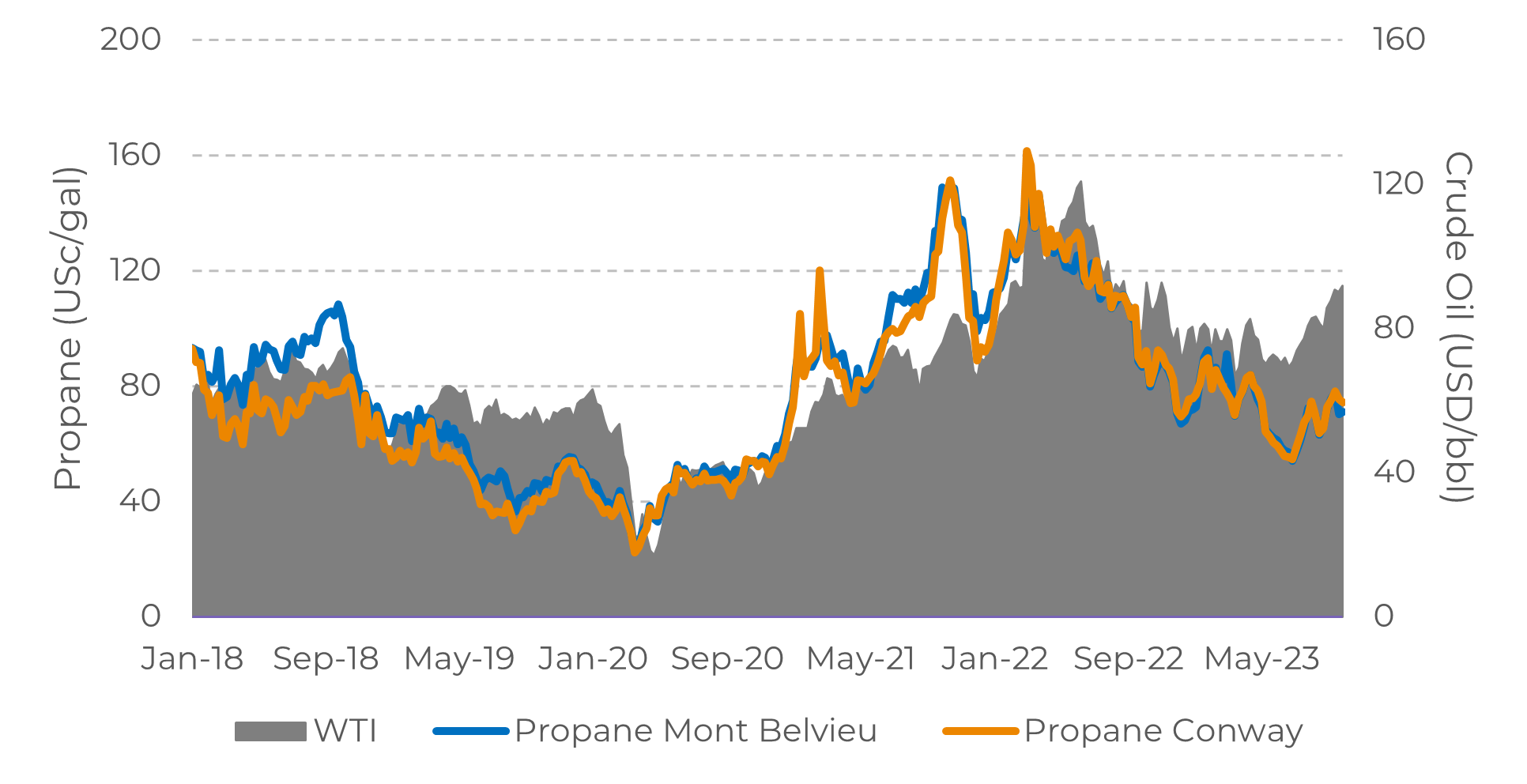

- Crude oil prices have been more supportive of propane prices than propane fundamentals, due to OPEC+ measures and a recent rally in oil prices.

- Rising interest rates and a potential recession could dampen demand for energy and commodities, including propane.

Introduction

Image 1: U.S. Days of Supply of Propane/Propylene

Source: EIA

What is driving the market in 2023?

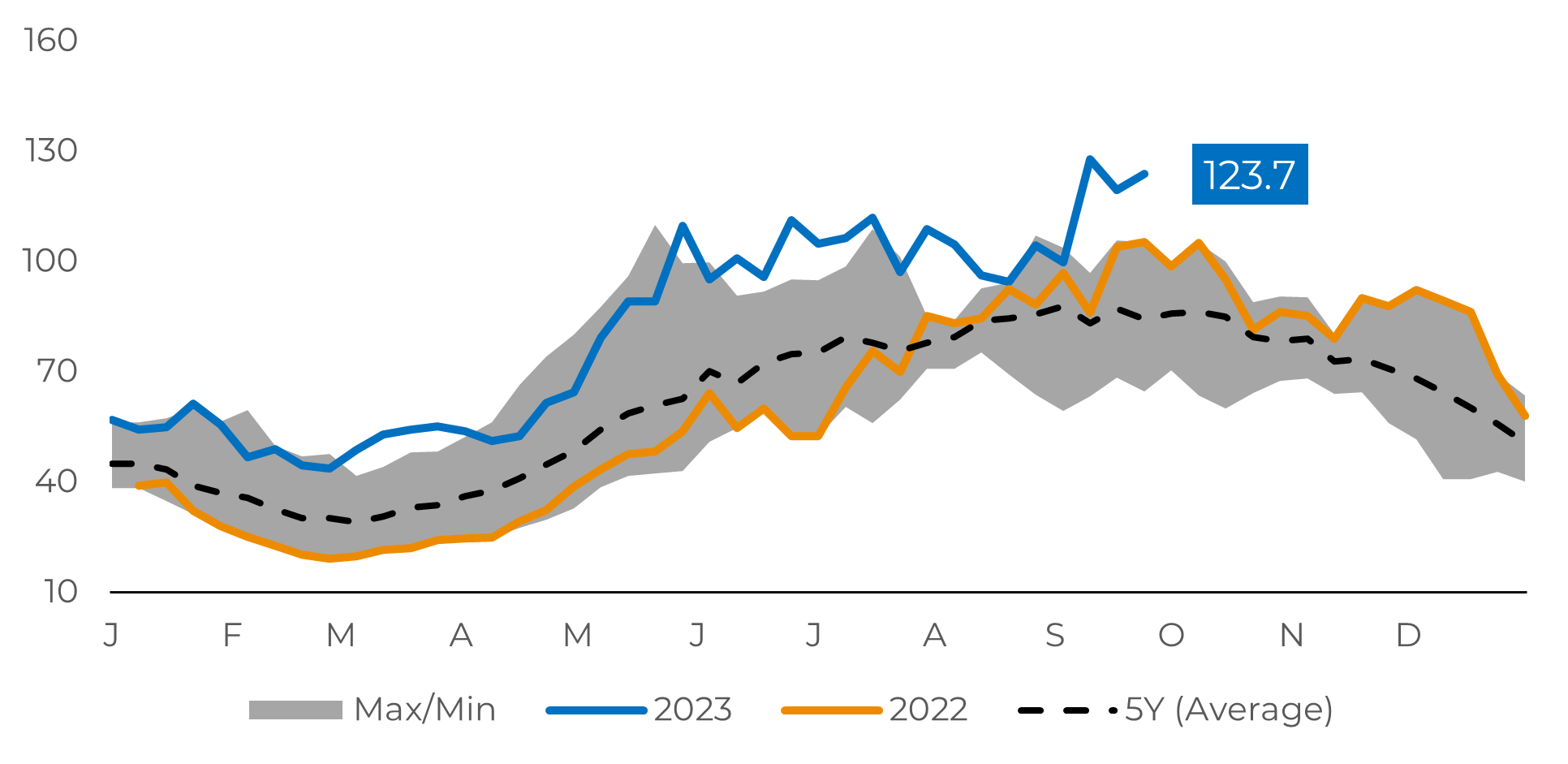

Image 2: U.S. Days of Supply of Propane/Propylene

Source: EIA

Image 3: Relationship between Crude Oil (USD/bbl) and US Propane FOB Prices (USc/gal)

Source: EIA

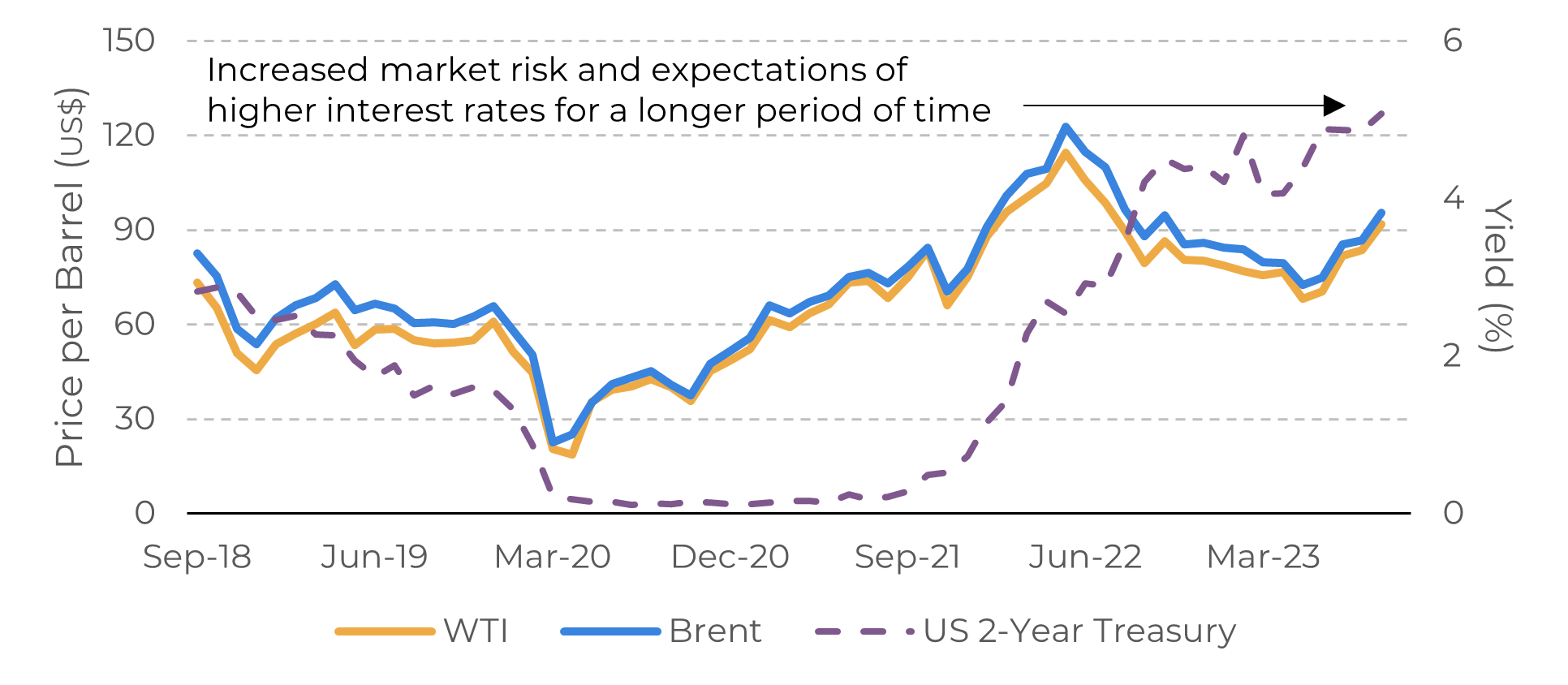

The restrictive interest rate scenario persists

Concerns

about inflation and interest rate trajectory in the United States have grown.

Federal Reserve Chairman Jerome Powell announced that interest rates are

expected to remain higher for a longer period than desired. In this context,

two scenarios may unfold: a new interest rate hike in November, leading to an

extended period of higher rates, or a recession in the country due to the

adverse impact of high borrowing costs on the economy.

In both scenarios, commodities, especially oil, are expected to face challenges in appreciating. As shown in Chart #4, the US 2-year yield is still rising, which could potentially impact the demand for energy in the upcoming months, much like it did in the first semester of this year. A decrease in crude oil prices likely exert downward pressure, leading to a bearish trend in propane prices.

Image 4: Crude Oil Benchmark Prices vs. 2-Year Treasury Yields

Source: Refinitiv

In Summary

Amid a bearish outlook, the significant highlight has been the record-breaking exports. Despite facing competition from Russian and Iranian oil, which is heavily discounted due to economic sanctions imposed on these countries, American propane has increased its presence in key markets, particularly in Asia, where there is a high demand for polypropylene.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com