Energy Weekly Report - 2023 10 16

Iran's Oil Exports Increase in 2023

- Iran has been increasing its presence in the global oil market, primarily due to higher demand from China and strategies to camouflage the origin of the commodity.

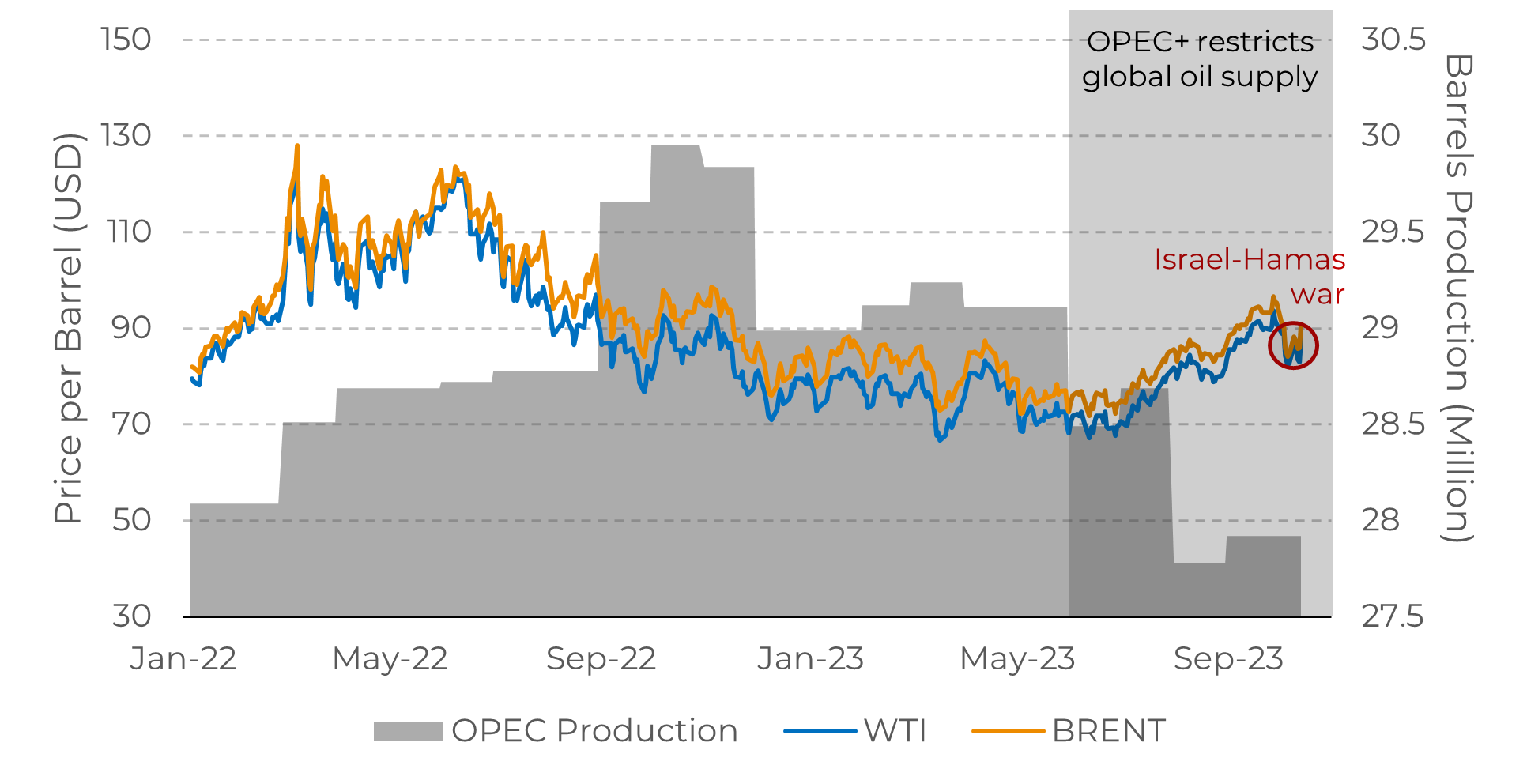

- The combination of high demand for oil and limitations in supply due to OPEC+ measures creates a favorable environment for Iranian oil.

- Iran is generating more revenue from oil in 2023, thanks to increased exports and high prices. This is strengthening the country's budget, which is highly dependent on oil and gas exploration.

Introduction

Iran

is one of the most significant producers and exporters of oil and natural gas

in the Middle East. According to OPEC data, the country holds the

second-largest natural gas reserves and the fifth-largest oil reserves in the

world. Therefore, Iran is a major player in the global energy market.

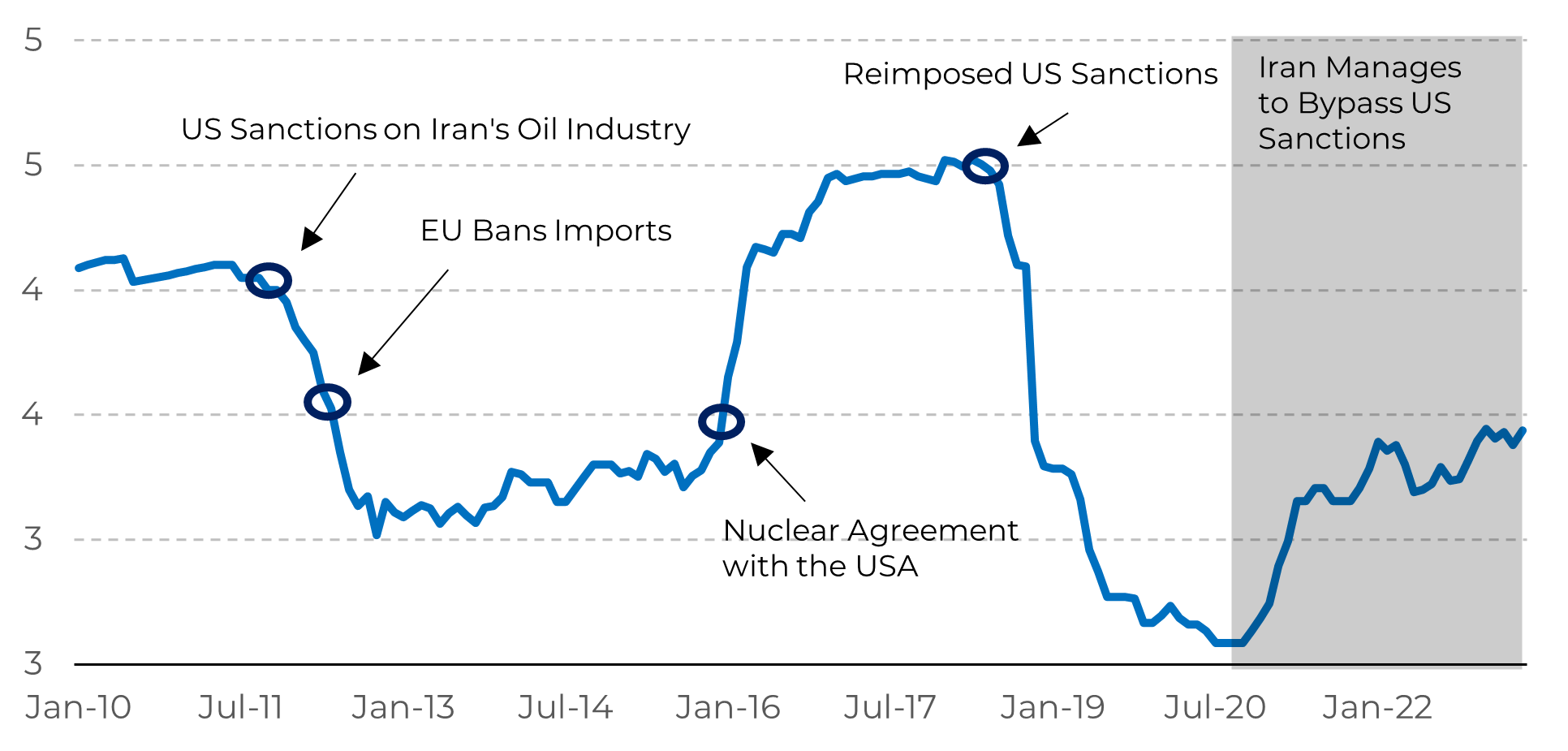

However, sanctions imposed by the United States in 2018 and 2019 heavily restricted the country's crude oil and condensate exports.

Furthermore,

the COVID-19 pandemic had a considerable impact on Iran's finances, resulting

in a significant reduction in investments in oil and gas exploration

infrastructure. The drop in energy commodity prices due to the pandemic also

contributed to the reduction in the country's oil exports.

Nevertheless,

in recent years, the country has managed to circumvent Western sanctions,

resulting in a significant increase in its exports. Iran has employed various

techniques to disguise the origin of the oil, such as ship-to-ship transfers at

sea, transshipment through the United Arab Emirates, or labeling it as

different types of fuels.

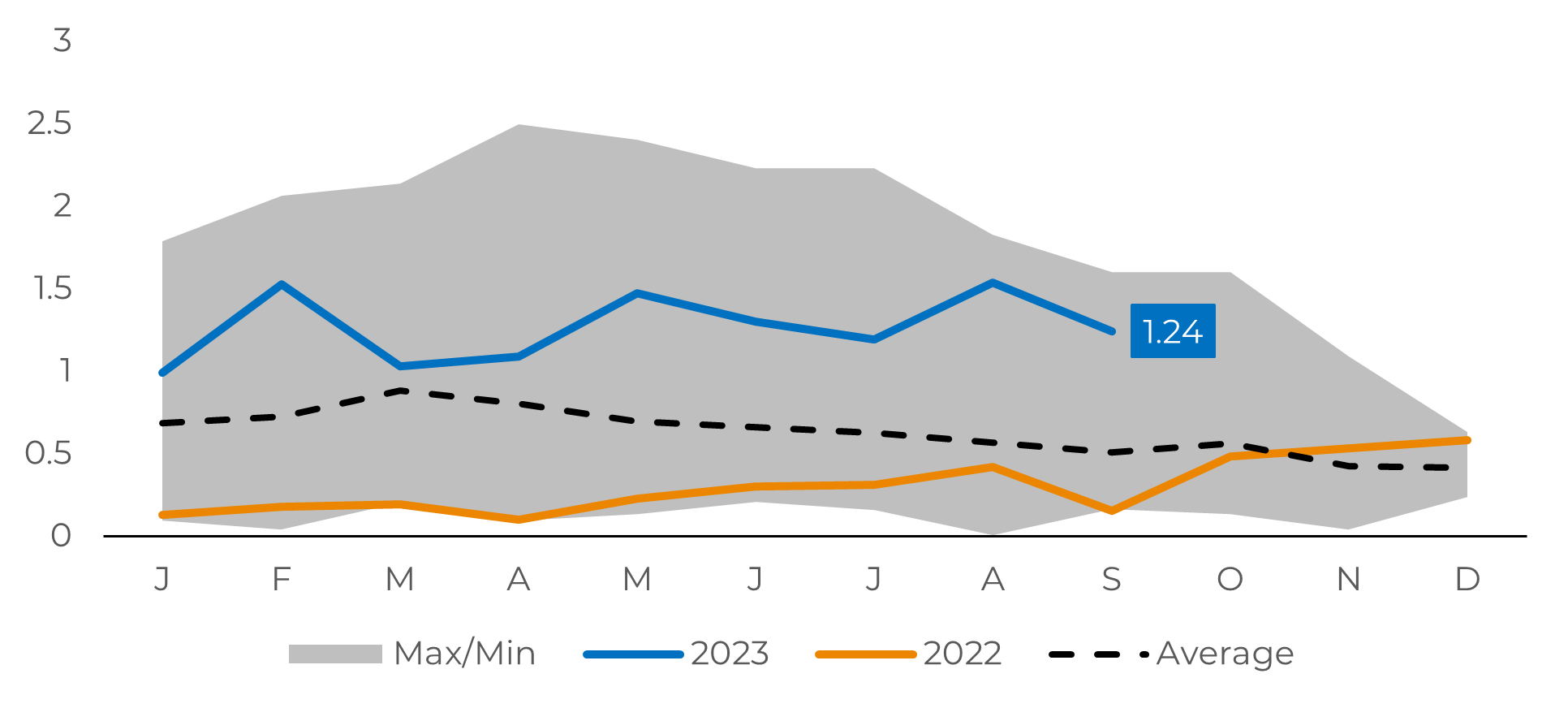

As of September 2023, Iranian exports are estimated to be close to 1.5 million barrels per day (bpd), according to the International Energy Agency (IEA) data. However, the numbers could be higher due to the difficulty in tracing the origin of Iranian oil.

Image 1: Iran's Oil Production (millions of barrels)

Source: Bloomberg

Tehran's oil revenue has increased over the past three years

Furthermore, Iran has been blending its crude oil according to API standards, which is appealing to destinations like China and other Asian countries, as its quality is suitable for the refineries in this region.

Although there are no official statistics for Iranian exports, there is a consensus among ship-tracking companies that Iran's exports are steadily increasing.

Image 2: Iran's Oil Exports (millions of barrels)

Source: Bloomberg

Image 3: Crude Oil Prices vs. OPEC Production (millions of barrels)

Source: OPEC, Refinitiv

Conflict between Hamas and Israel may affect oil transportation in the Strait of Hormuz

The Strait of Hormuz is a vital waterway

that connects the Persian Gulf to the Indian Ocean, serving as one of the key

global routes for maritime transportation. This passage is crucial,

facilitating the movement of about one-third of the world's exported crude oil.

In

2023, data from the International Energy Agency (IEA) indicates that

approximately 22 million barrels of crude oil per day were transported through

the Strait of Hormuz. The main oil exporters through this strait are Iran,

Saudi Arabia, the United Arab Emirates, and Iraq.

Thus, the conflict between Israel and Hamas keeps the market on alert, as a potential involvement of Iran with local extremist groups could escalate the conflict, endangering the maritime passage of Hormuz - something the country has threatened in the past.

Image 4: Strait of Hormuz

Source: hEDGEpoint, EIA

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.