Energy Weekly Report - 2023 10 20

More Venezuelan oil helps, but it is not enough to solve the market deficit

- The US removed trade restrictions on Venezuela on October 18, which could ease the tight crude oil market supply.

- However, the impact is likely to be limited in the short term, as the country's production is still a fraction of what it was in the past.

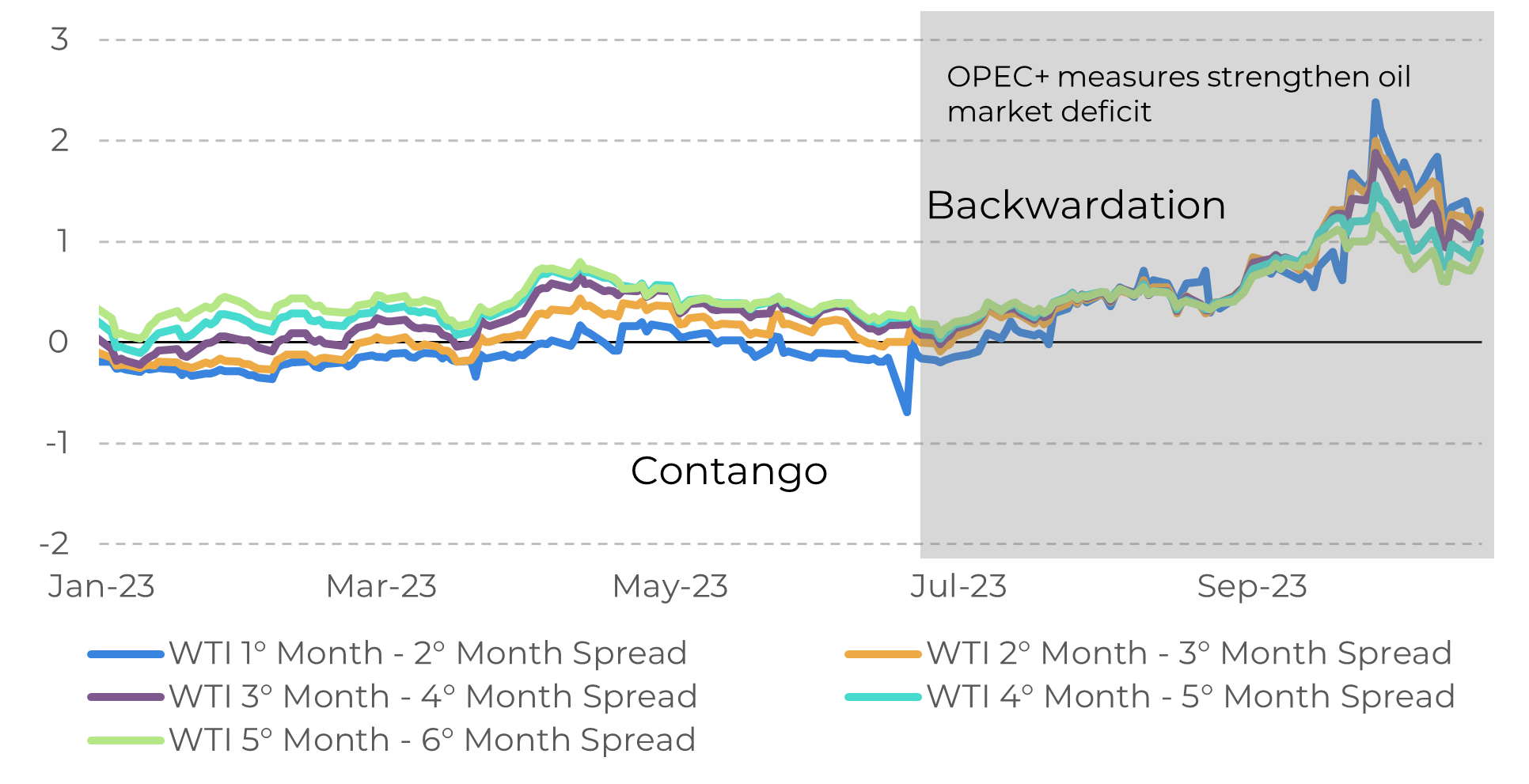

- The recent conflict between Israel and Hamas has added another factor of upward volatility to the backwardation curve for crude oil, which has strengthened over the past few months.

Introduction

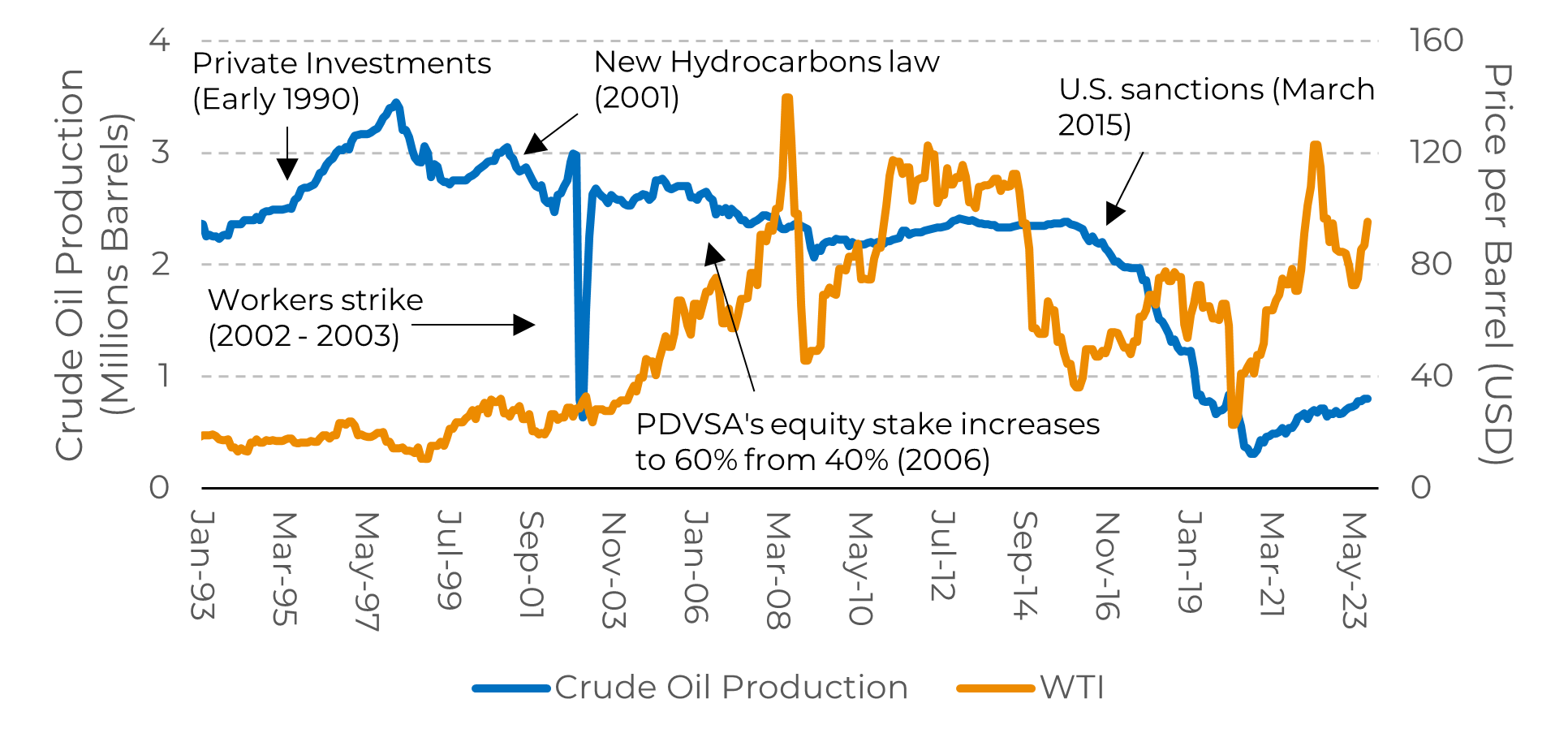

Venezuela is the country with the largest oil reserves in the world, with about 300 billion barrels according to OPEC data, equivalent to 17% of global reserves. However, the country's oil production has been declining since 2014 due to the political and economic turmoil the country is facing.

In addition, it is important to emphasize the role played by PDVSA (Petróleos de Venezuela, S.A.), the national oil and gas company, which is responsible for 90% of hydrocarbon production in the country. This giant oil company covers activities that include exploration, production, refining, in addition to expanding its operations to logistics and infrastructure.

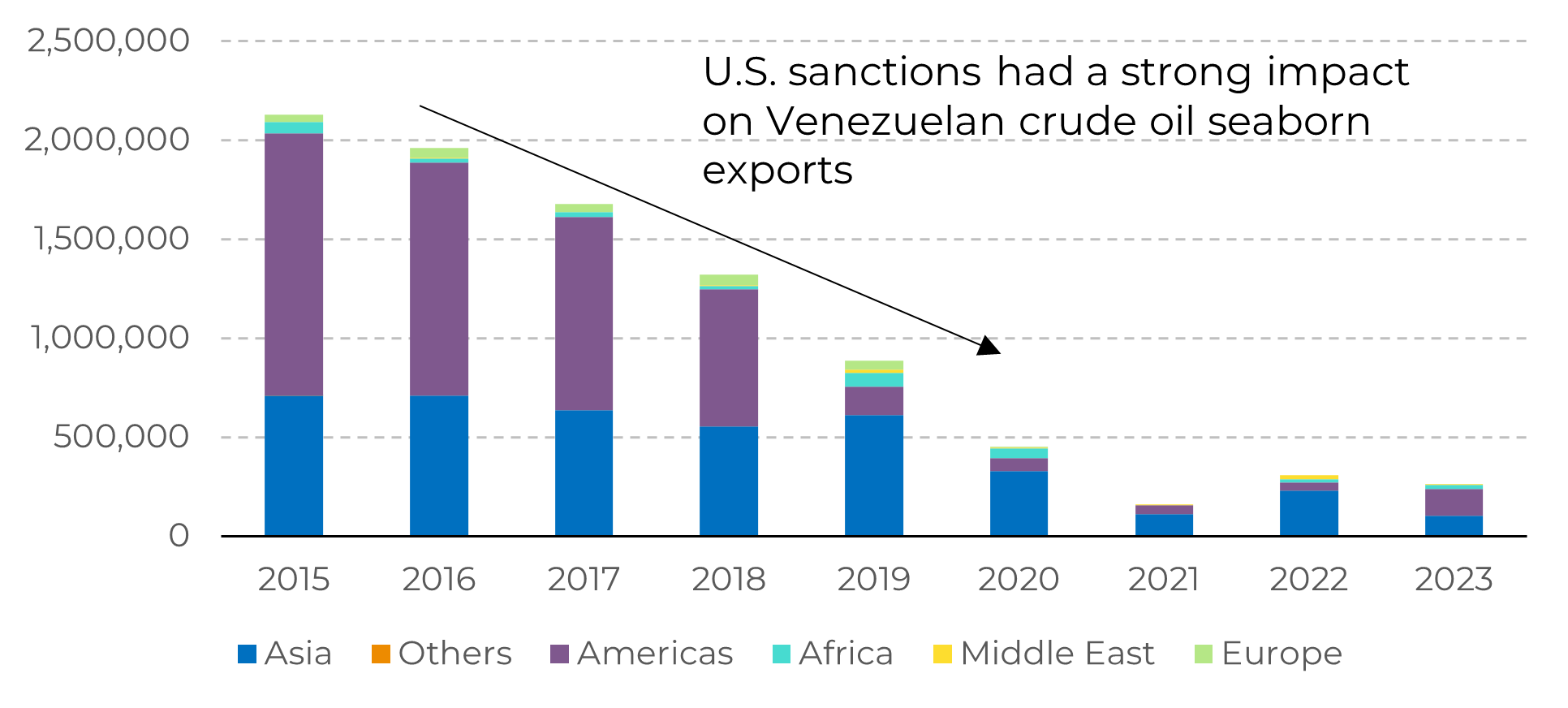

In 2015, the United States imposed economic sanctions on Venezuela with the aim of pressuring the country's government to implement democratic reforms. These sanctions resulted in a significant reduction in oil production and exports.

Therefore, in recent years, PDVSA has faced significant challenges due to a number of factors, such as mismanagement and the economic and social crisis in the country. As a consequence, Venezuela's oil production has fallen drastically, and PDVSA has lost much of its capacity.

Image 1: Venezuela Crude Oil Production and WTI

Source: OPEC, Bloomberg

Venezuela can help reduce the crude oil deficit, but it will take time

Factors such as underinvestment, poor maintenance, economic crises, and Western sanctions have significantly reduced Venezuela's oil production capacity. Now, with an agreement with Washington, Venezuela has the opportunity to invest in its energy sector and increase its production, but it will take time.

Image 2: Venezuela Crude Oil Seaborn Exports (Millions bpd)

Source: These numbers are from Refinitiv Ship Tracking App. These indicative figures may not match the official data published later

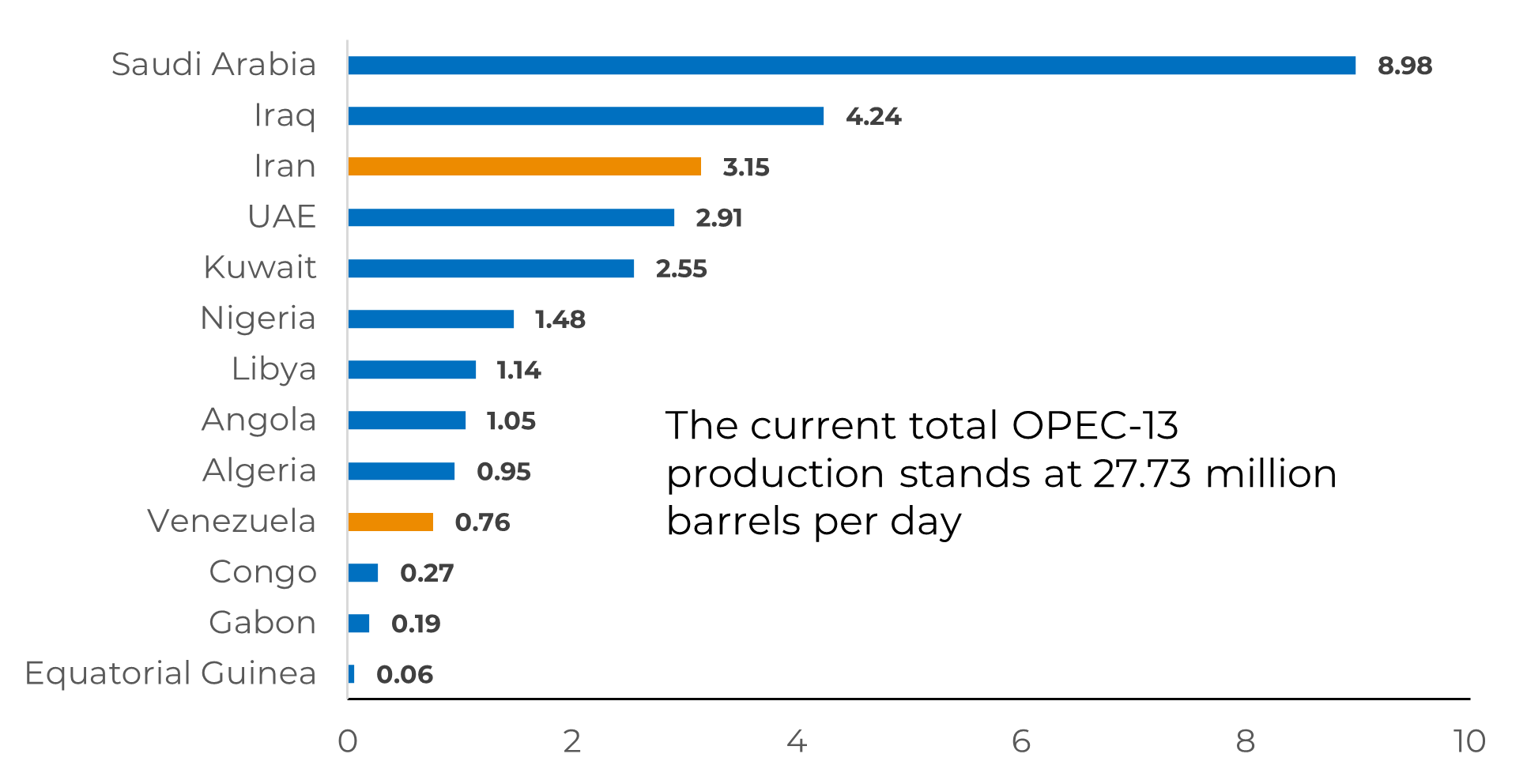

Image 3: OPEC-13 Crude Oil Production (Millions bpd)

Source: OPEC, Refinitiv

Oil prices continue to trend higher

The beginning of 2023 was a bearish start for oil, due to high interest rates in major economies fighting inflation. However, the situation changed substantially with actions by OPEC+, particularly Russia and Saudi Arabia, which reduced production and seaborn exports.

Since then, the backwardation structure has risen sharply, and the recent conflict in the Middle East is likely to strengthen the curve further by adding more upward volatility to the commodity. Even as Washington seeks to ease the rise in global oil prices by bringing Venezuelan oil back to the market, prices are likely to remain high through the end of the year.

Image 4: Higher Premium for Nearer WTI Contracts (USD Spread)

Source: hEDGEpoint, EIA

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.