Oct 31

/

Victor Arduin

Energy Weekly Report - 2023 10 27

Back to main blog page

"With the end of the driving season, demand is expected to shift from gasoline to distillates, such as diesel and heating oil, as consumption of these fuels increases during the winter season."

Gasoline was the main highlight of the energy sector in 2023, but now the focus shifts to distillates

- Gasoline had a very bullish year, being the most appreciated energy commodity throughout the year. However, demand is expected to decrease as we move closer to the winter.

- Lower expectations of an escalation in the Middle East have been reflected in the market with lower premiums in energy commodities, but the volatility component remains present.

- Additionally, just one week before the Fed’s meeting, the energy complex is balancing the risk of lower demand due to high interest rates against the fear of an escalation in the Middle East.

Introduction

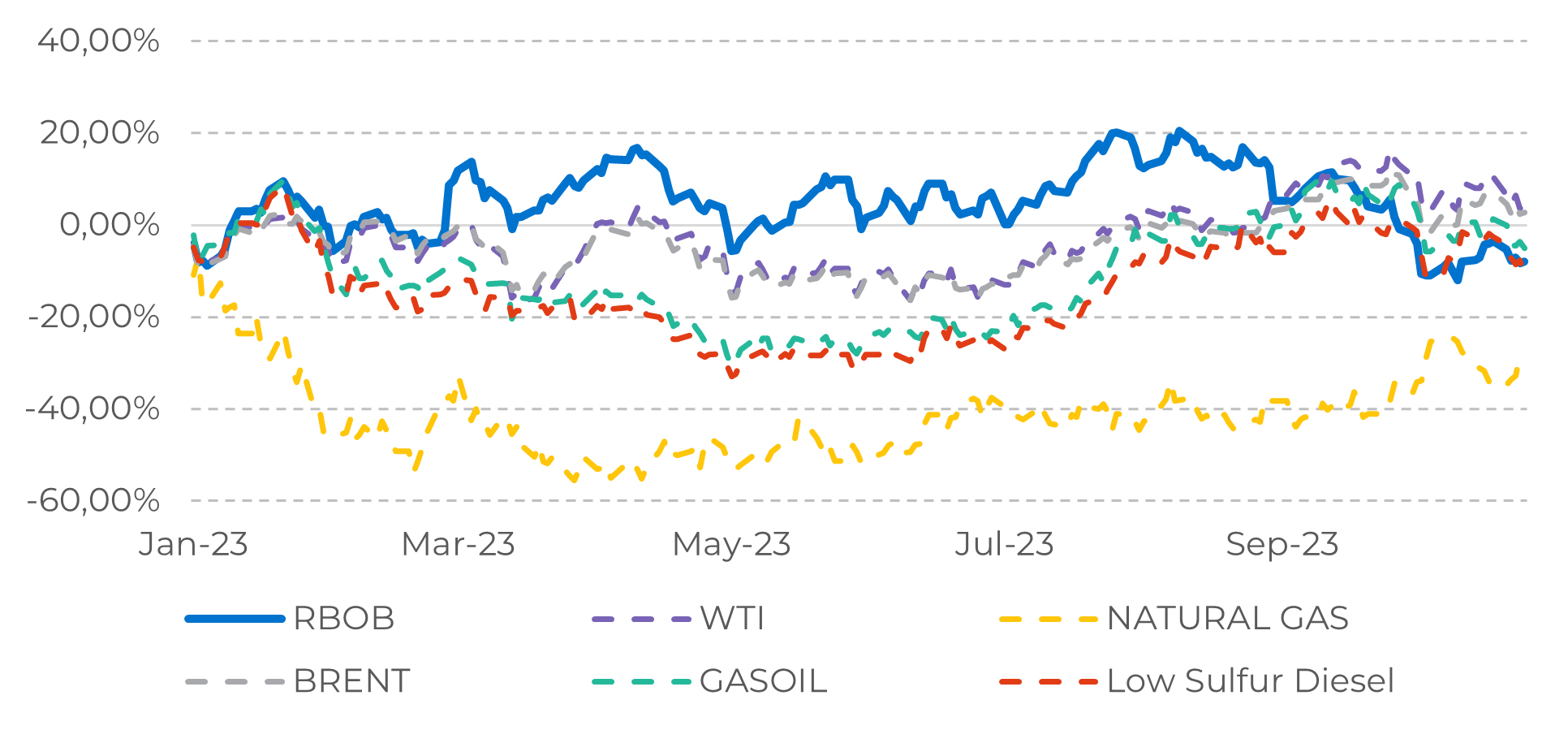

As we approach the end of the year, the energy complex has had a rather heterogeneous performance. While natural gas operated quite bearishly throughout the year, liquid fuels such as gasoline have had a strong appreciation.

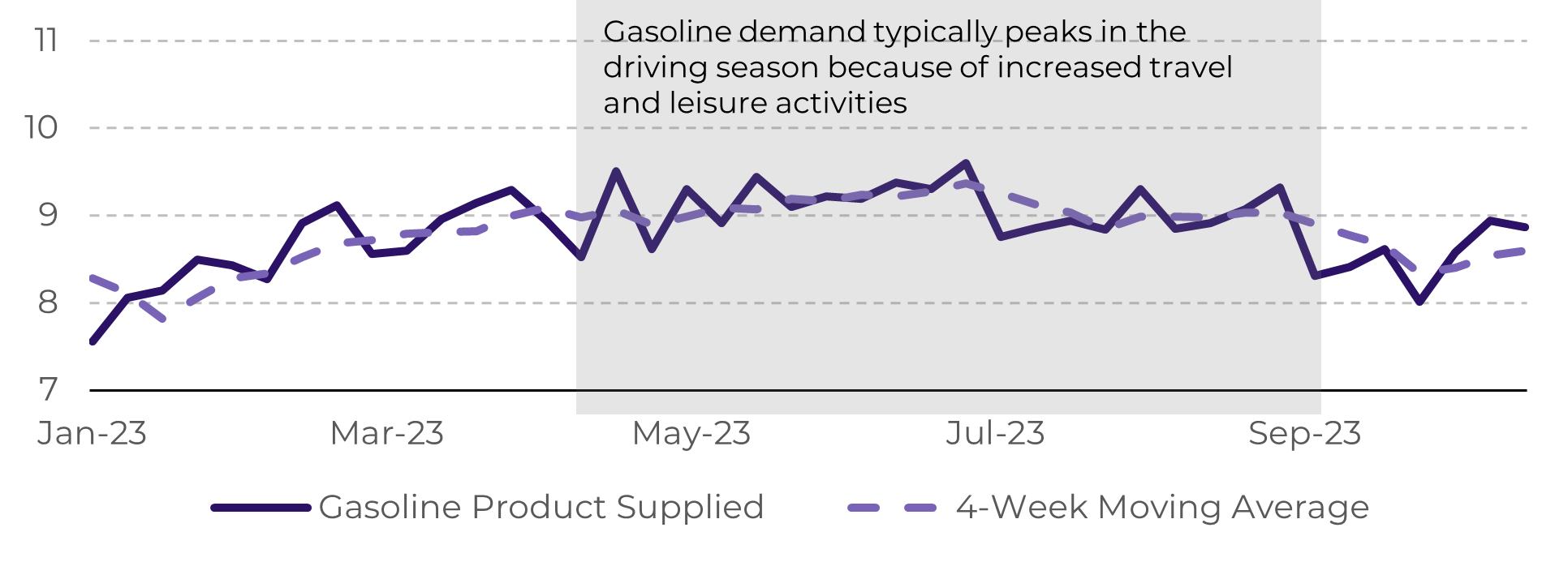

With the end of the driving season, demand is expected to shift from gasoline to distillates, such as diesel and heating oil, as consumption of these fuels increases during the winter season.

OPEC's actions have not only restricted global oil supplies, but are also forcing refineries to process light sweet crude, which is more difficult to produce distillates from. This is reducing their yield of distillates, while demand for them is increasing.

Image 1: Energy Commodity Performance 2023

(Normalized to December 30, 2022)

Source: Refnitiv

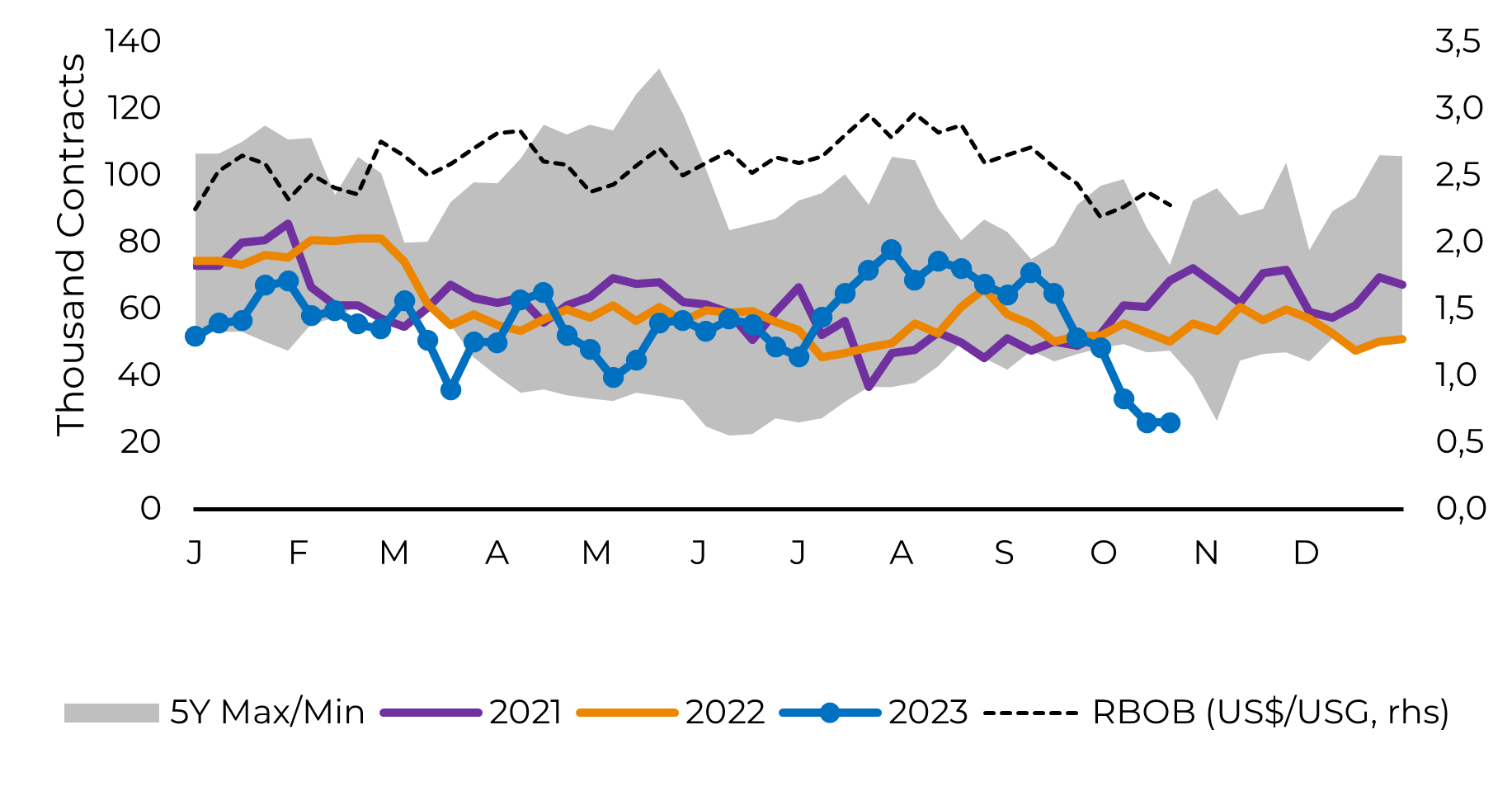

Image 2: Money Manager Net Long Positions in RBOB Futures

Source: CFTC

With the end of the driving season, gasoline demand likely fall

During the initial half of the year, gasoline stood out as the energy product that appreciated the most. High demand for travel and a robust household spending, promoted a bullish environment for this commodity. Nevertheless, as the driving season ended and with no significant risks of disruptions, such as hurricanes, RBOB has experienced a swift decline in value in recent weeks.

While further weakness in gasoline prices seems likely, it's important to note that market volatility can't be entirely ruled out. One significant factor that could potentially disrupt this downward trend is the Israel-Hamas conflict. Iran, the third-largest oil producer in OPEC, may face sanctions from Western nations or respond by blocking the Strait of Hormuz. Such actions could lead to an increase in oil prices, which are a primary cost in gasoline production. Geopolitical events worldwide continue to exert a strong influence on the oil market, potentially causing some fluctuations in the coming months.

Image 3: Gasoline Product Supplied (M bpd)

Source: Refinitiv

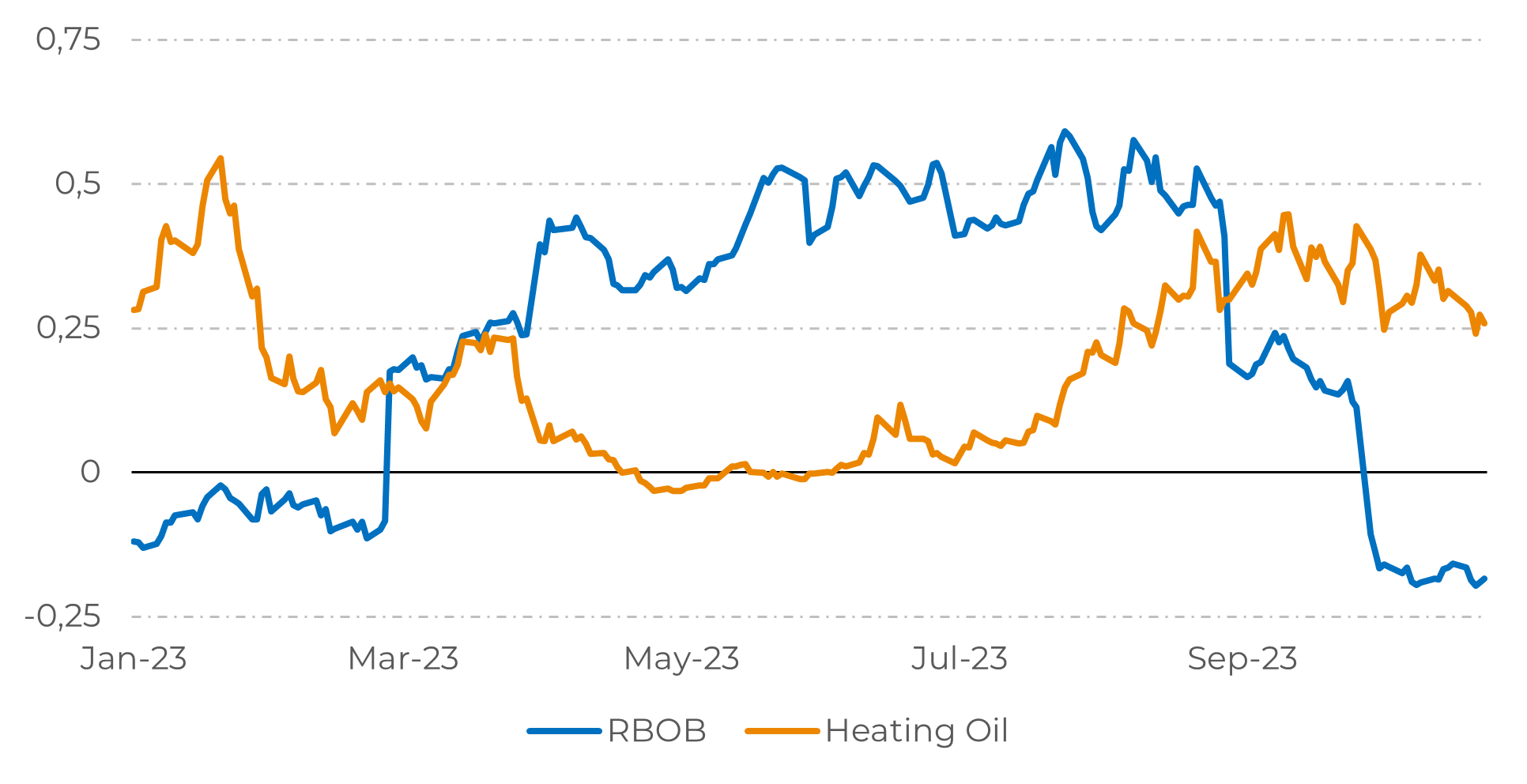

The price structure of gasoline contracts has been in contango since early October, and this is likely to continue widening into the coming months, as there is no sign of strong demand in the northern hemisphere that would disrupt typical stock building behaviors, while refiners are expected to increase distillate production to meet diesel and heating oil demand, which is expected to increase during the winter.

Furthermore, If it depends on OPEC+, middle distillates are expected to experience a bullish winter for 23/24. Cuts in production by Saudi Arabia and reduced exports from Russia are expected to limit the supply of heavy oil, which is used in the production of heating oil and diesel fuel. Consequently, refineries will need to rely more on light oil, which yields less diesel.

Image 4: RBOB and Heating Oil 6-Month Spreads (USD/gal)

Source: Refinitiv

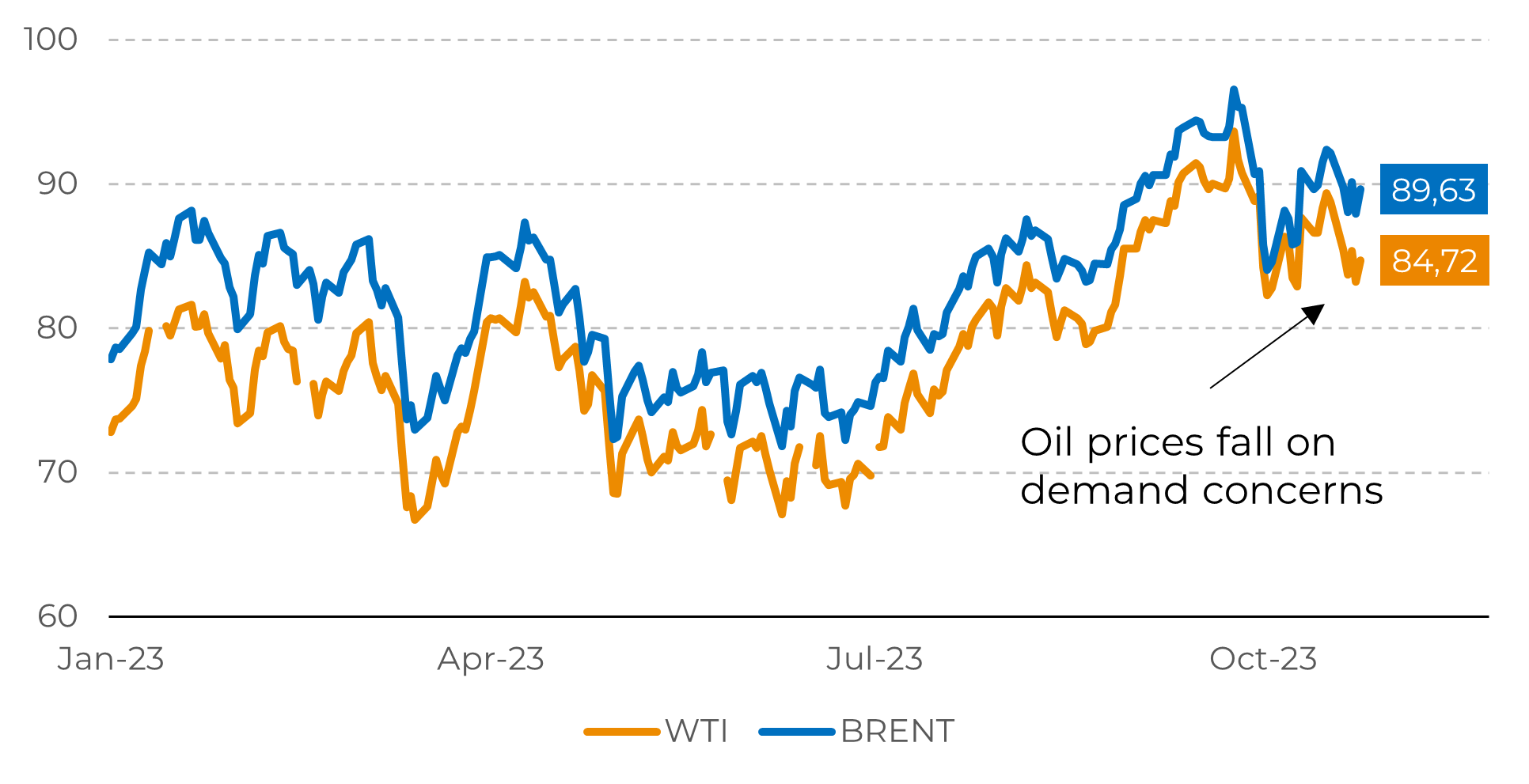

Oil prices weaken without further escalation in the Middle East

The geopolitical risks in the Middle East boosted the oil market in the week following the Hamas attack on Israel, with major benchmarks recording gains. However, as expectations of an escalation in the conflict have diminished, oil has been declining in recent days, pressured by concerns of lower demand and anticipation of signals to be given by the Federal Reserve (Fed) in its upcoming meeting.

Inflation remains high in the U.S., despite being significantly better than last year. The battle against high prices is ongoing and could result in two scenarios: higher interest rates for a longer period or even a small recession. Both possibilities have the potential to promote bearish sentiment in the energy complex.

Image 5: Oil Benchmarks (USD/barrel)

Source: Refinitiv

In Summary

With only a few days left until the next Fed meeting on October 31st and November 1st, the market is proceeding cautiously. Expectations are for another maintenance of interest rates at the current level of 5,25%-5,50%. However, even with no changes being expected, the market will anchor itself on the signals that may be given in the speech about future decisions on interest rates.

On the other hand, the geopolitical risks that initially increased the premiums of major oil benchmarks have since subsided, as the likelihood of an escalation in the Israel-Hamas conflict appears to be diminishing, though the risk remains.

High interest rates and a lack of significant supply disruptions are likely to limit support for a gasoline price increase, as concerns about lower consumption prevail in the market. Other refined products, such as diesel and heating oil, may outperform in a tight supply and high demand environment.

Weekly Report — Energy

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Pedro Schicchi

pedro.schicchi@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.