Energy Weekly Report - 2023 11 06

Fuel crisis in Argentina puts price controls in check

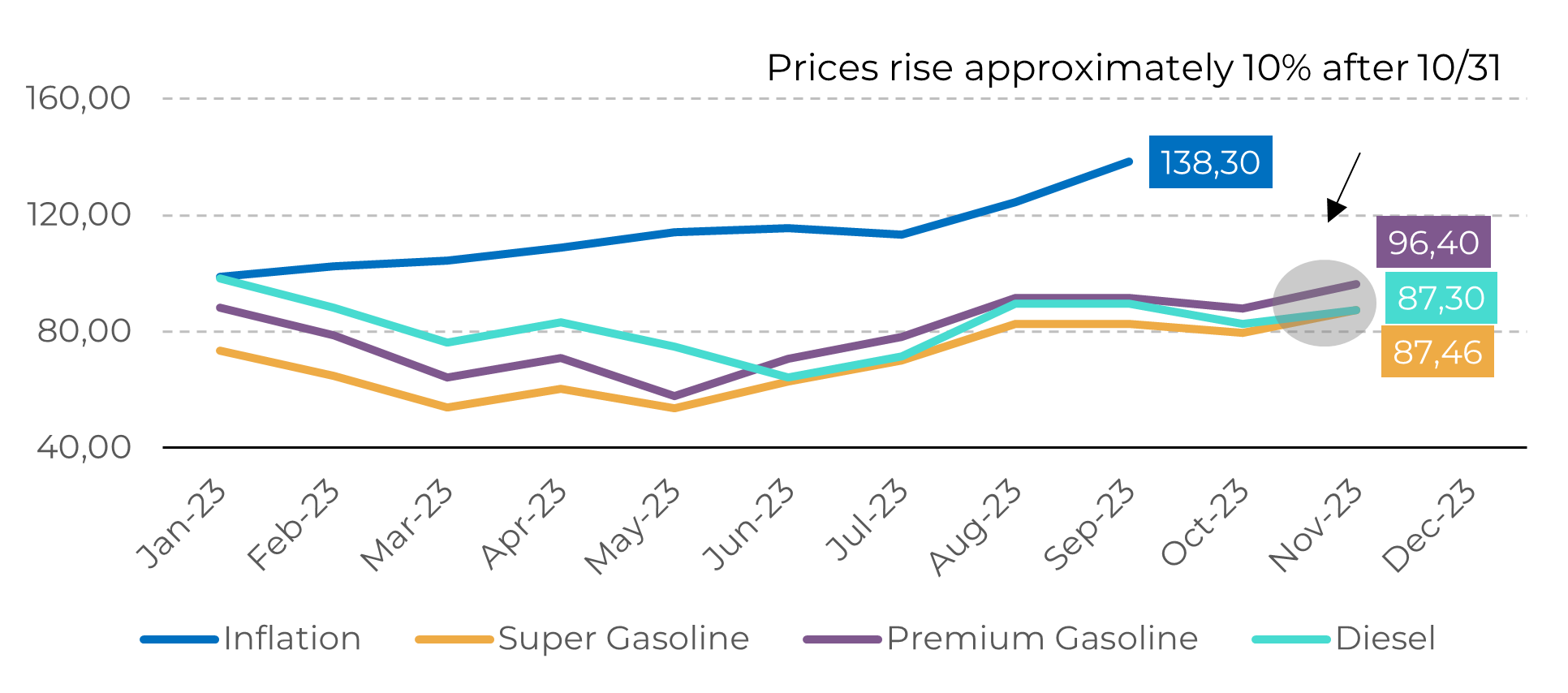

- After the expiration of the “Precios Justos” program, gasoline and diesel prices saw an increase of approximately 10% on November 1st.

- Price controls imposed by the Argentine government to curb inflation are cited as the primary cause of fuel shortages in the country.

- The situation is currently returning to normal, but the risk of fuel shortages are still be possible in the coming months.

Introduction

The lack of gasoline and diesel supply at the country's gas stations is a reflection of the economic crisis and price controls. Despite producing more oil than its domestic demand, the country faces serious issues in its energy complex.

Furthermore, in an attempt to curb inflation, the government, through its mixed-capital company, the oil company YPF, sells oil barrels to the country's refineries at a price below the international market rate. This results in a "cheapening" of refined products, even if done artificially.

One of the challenges is that it's not enough to possess oil; it needs to undergo a refining process to convert it into products ready to meet market demands. In this regard, Argentina's refineries production are not enough, so fuel imports are necessary to satisfy the country’s consumption.

However, purchasing finished products from foreign suppliers requires dollars, as a significant portion of energy commodities are traded in the US currency, which is scarce in Argentina due to its strict exchange controls.

So, how can the portion of the market that cannot be satisfied with domestic fuel production be served? The answer is imports. However, how can this operation be made viable if price controls remove the market incentives to bring fuels from outside of Argentina?

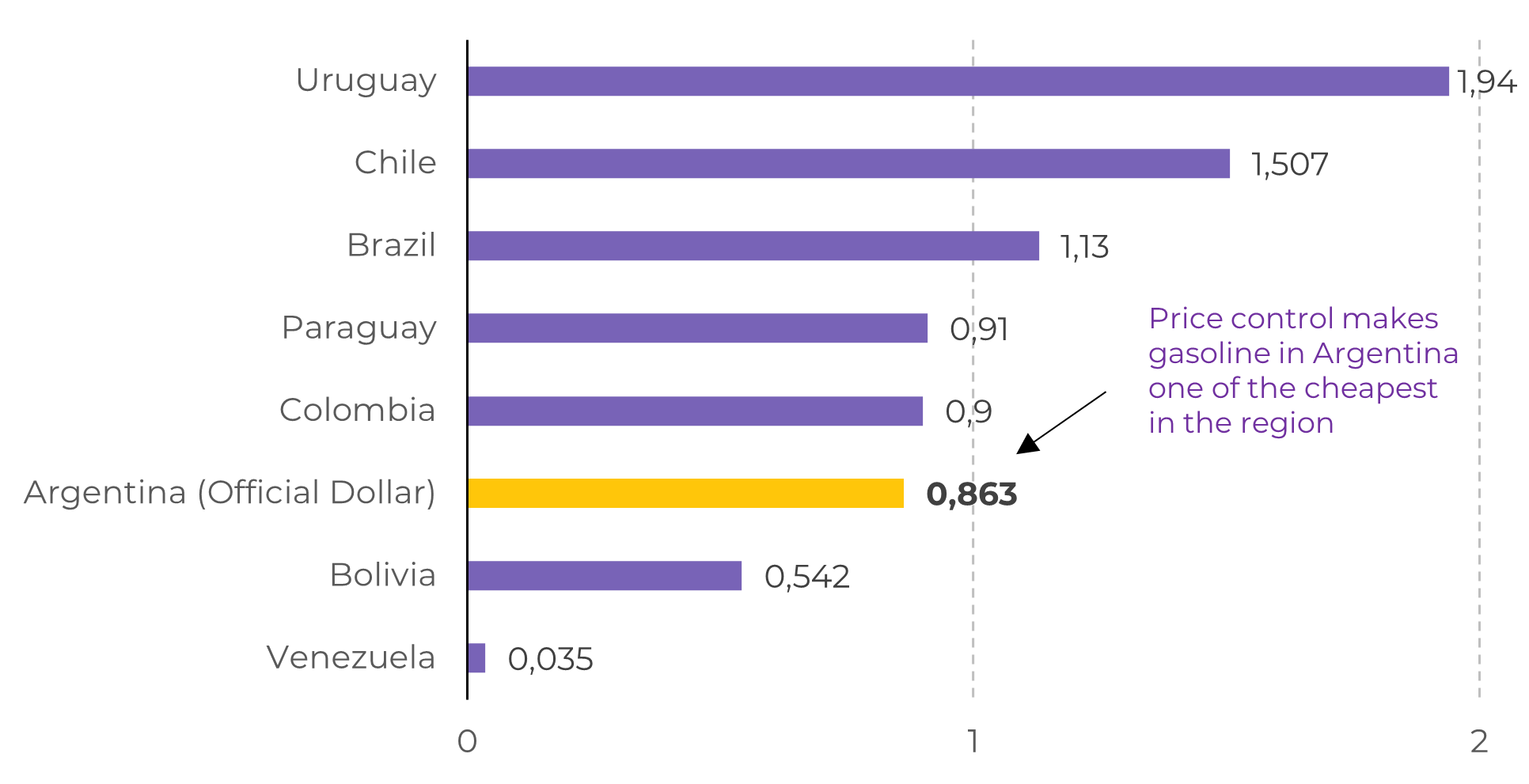

Image 1: Gasoline Prices in the Region (USD per liter)

Source: Global Petrol Prices (Octane-95, 30-Oct-2023)

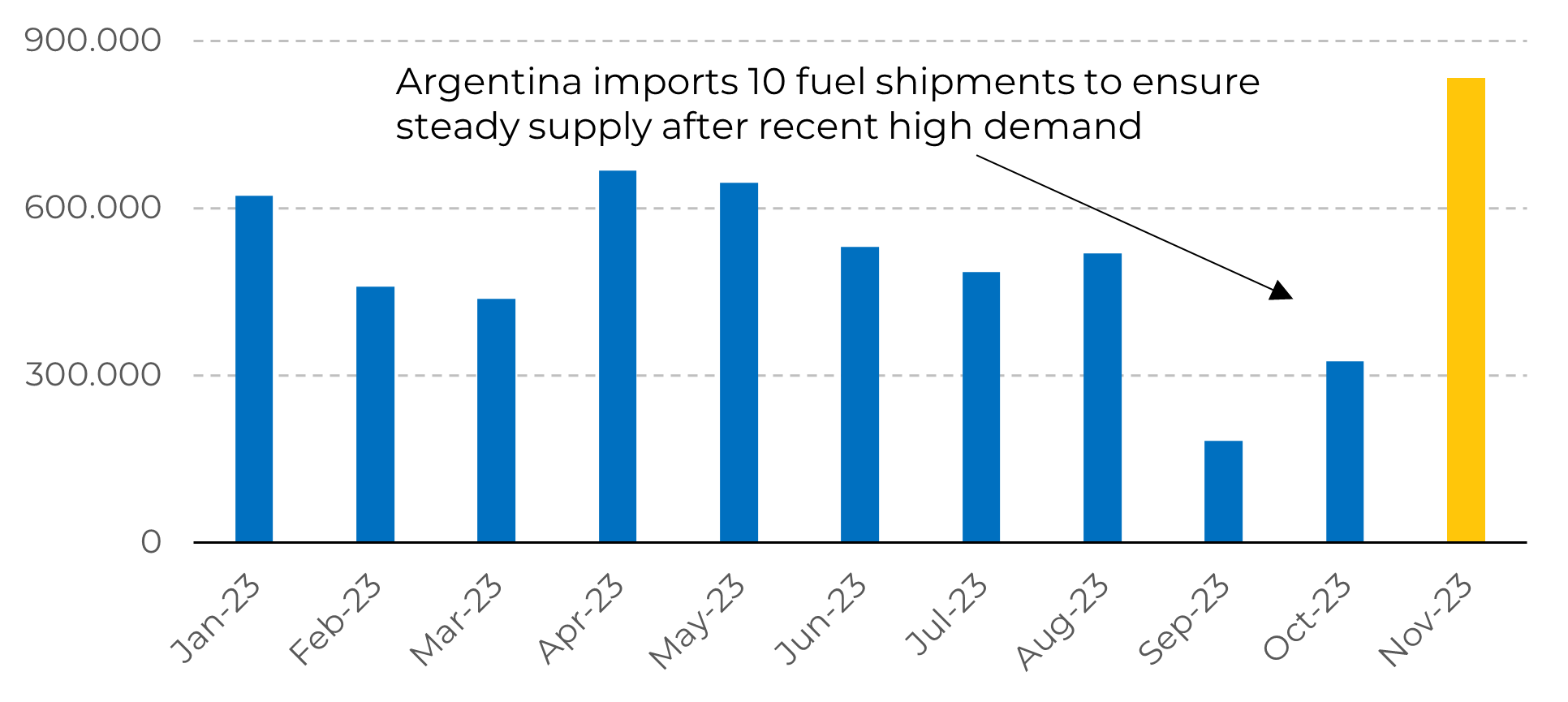

Gasoline imports increased substantially in November

Image 2: Inflation Variation & Fuel Prices YoY (%)

Source: INDEC, Surtidores

Image 3: Gasoline Imports (barrels)

Source: These numbers are from Refinitiv's ship tracking application, and these indicative figures may not correspond to officially published data later on.

Argentina has one of the most "discounted" oil in the world

The main reason the Argentine government is able to keep fuel prices low is by selling its crude oil to domestic refineries at an agreed-upon price of $56 per barrel (referred to as the 'barril criollo'). This is significantly lower than the main international benchmarks, where WTI is around $82 and Brent is approximately $86 on November 3rd.

In contrast, Russia, which faces sanctions from G7 countries, making it more difficult to sell its oil, theoretically undervalues it, sells Urals for over $70 in the international market, above the price ceiling imposed by the United States and its allied countries of $60. Therefore, Argentina's oil accesses the local market at prices lower than those of Western-sanctioned countries.

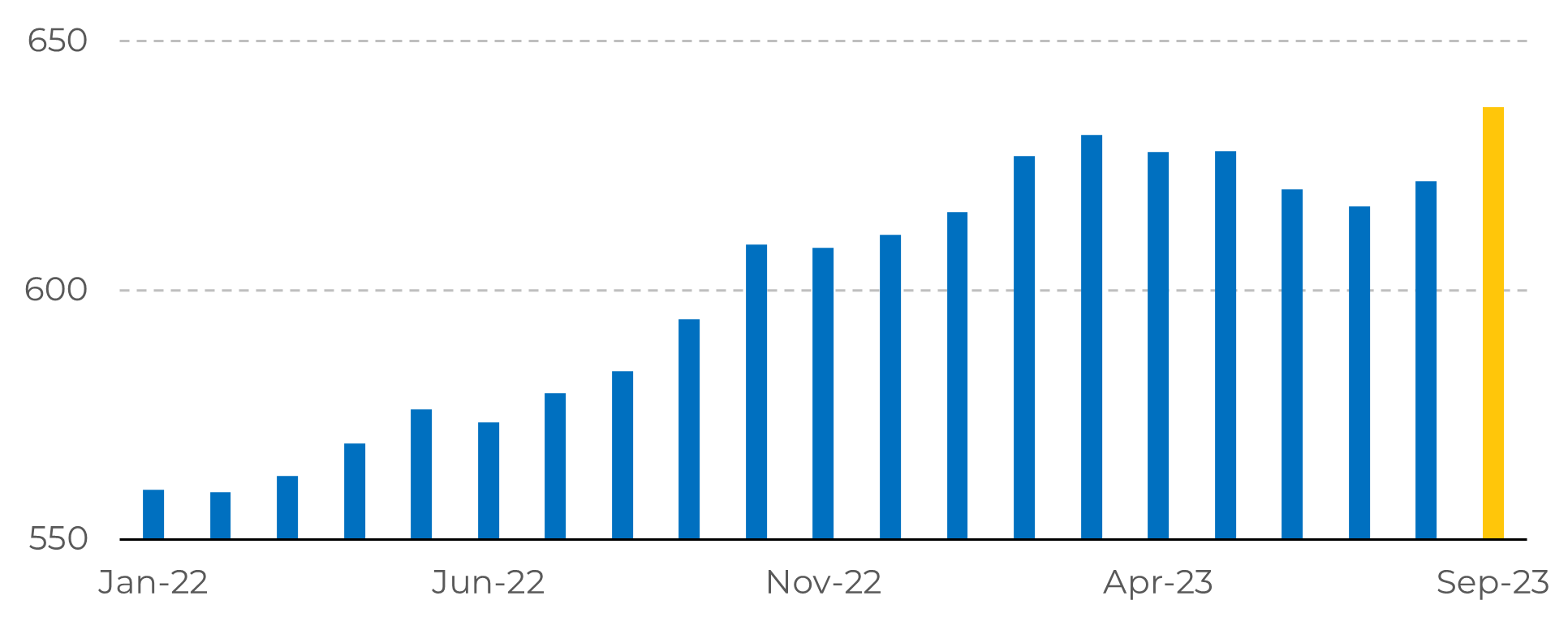

Image 4: Oil Production - Argentina (thousand bpd)

Source: hEDGEpoint, EIA

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.