Energy Weekly Report - 2023 11 13

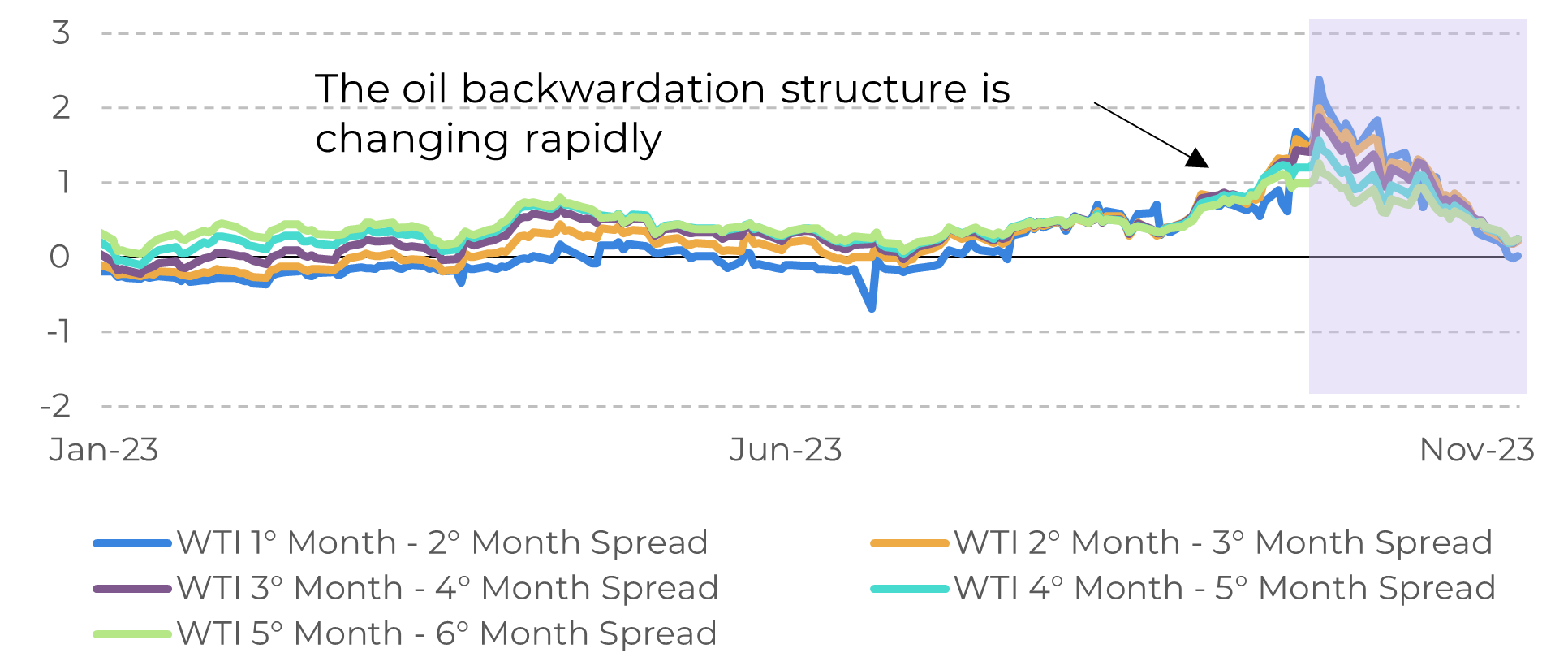

The price structure of oil undergoes a radical change

- Crude oil inventories may have risen by over 12 million barrels in the week ending November 3rd if the projections from the American Petroleum Institute are confirmed.

- The market is swiftly transitioning from a backwardation structure to contango, exerting additional pressure on the upcoming OPEC meeting to take supportive measures for prices.

- The international context poses challenges to the demand for energy commodities, with weak economic data in Europe and China, and demand in the United States falling below expectations.

Introduction

The macroeconomic context has been one of the main bearish factors for energy commodities in 2023. High interest rates in major world economies, impacting consumption and investment, along with the appreciation of the dollar, are factors likely to affect the demand for energy from fossil fuels.

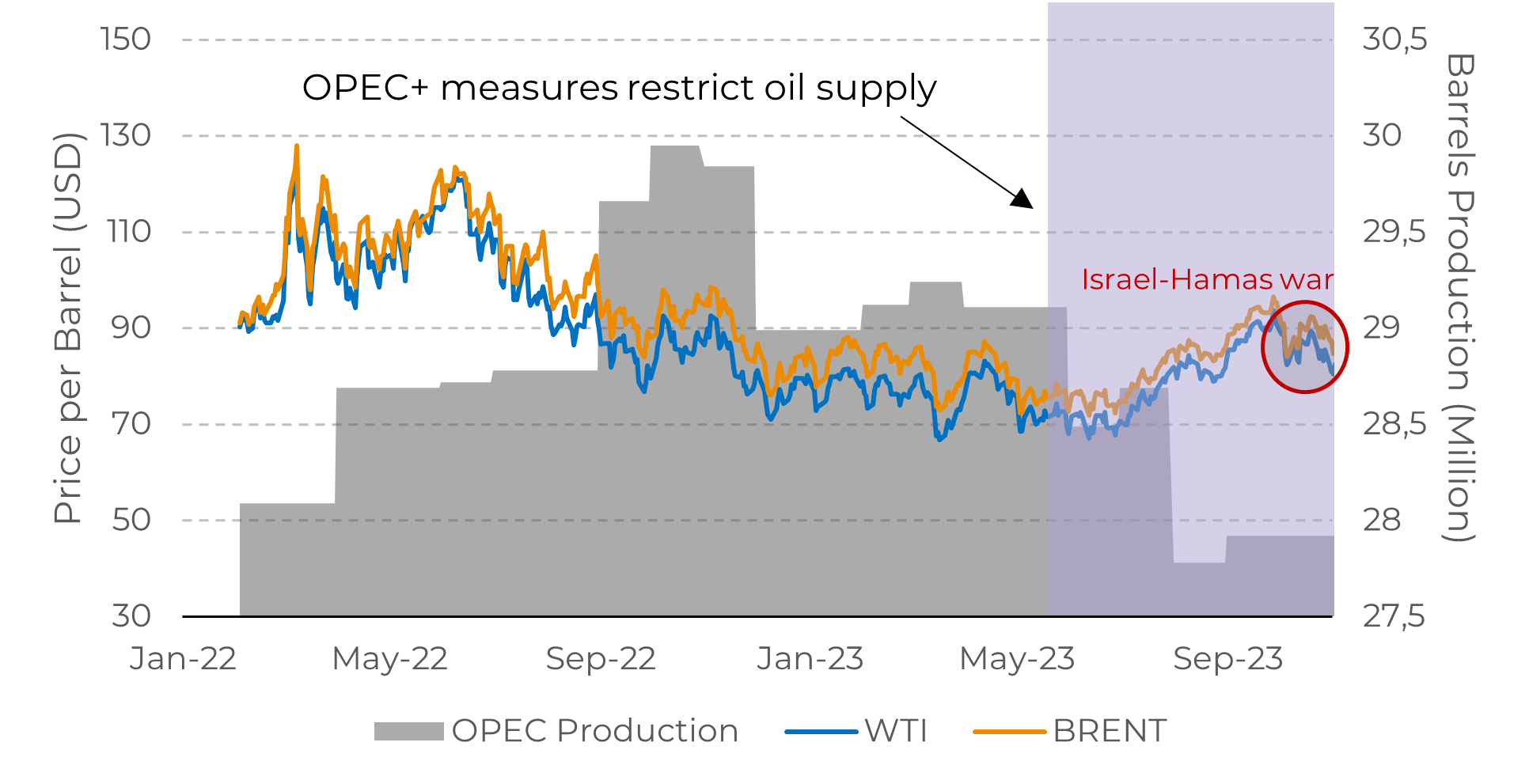

Indeed, the first half of 2023 was quite bearish for oil, with the price of the barrel accumulating losses until mid-year. This trend was only reversed after announcements of measures by OPEC+, led by Saudi Arabia and Russia, who declared supply restrictions.

Furthermore, during the second half of 2023, the conflict between Hamas and Israel introduced a new component of volatility that raised concerns in the market. Although both countries are not major oil producers, the fear that the escalation of the war could somehow involve Iran brought risks to global supply.

However, the scenario has changed rapidly. Since the highs recorded in September, major benchmarks have retreated substantially, a movement that was accentuated by the dovish signals from US monetary policy, which theoretically should provide more room for energy commodities to appreciate.

In this scenario, OPEC+ actions to support oil prices will be crucial. The group meets on November 26, with expectations that further measures will be announced to stabilize prices.

Image 1: OPEC Production vs. Major Crude Oil Benchmarks

Source: Refinitiv

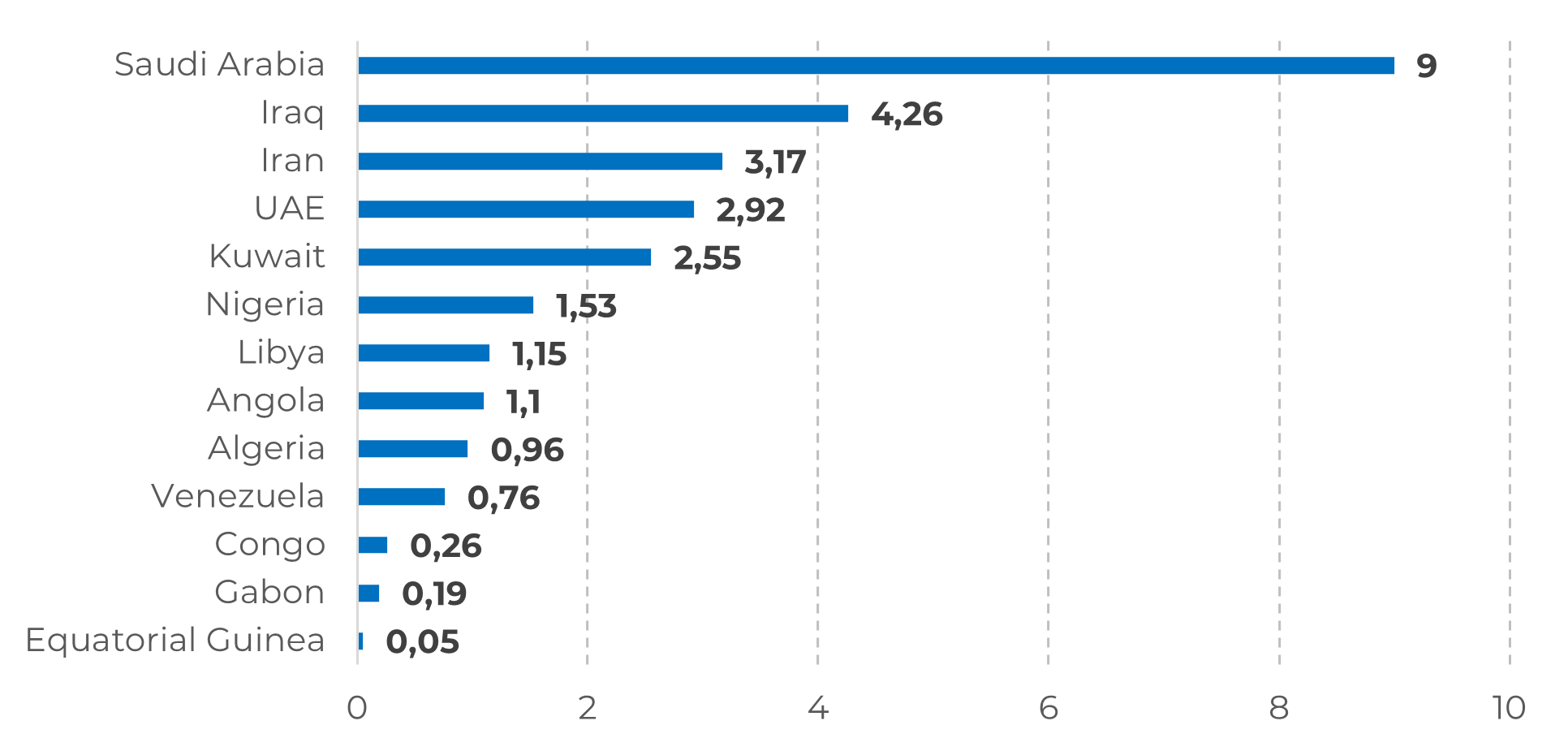

The reversal of the bearish market sentiment will depend on the measures announced by OPEC+

Image 2: OPEC-13 Production (Millions bpd)

Source: OPEC

With more oil entering the market, prices are finding little room to sustain themselves at current levels. Iraq is producing more oil than it had in the past five years, and Venezuela has received relief from Western sanctions, which should allow it to increase production in the long term.

Image 3: Spread of WTI Futures Contracts (spread in dollars)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.