Energy Weekly Report - 2023 11 20

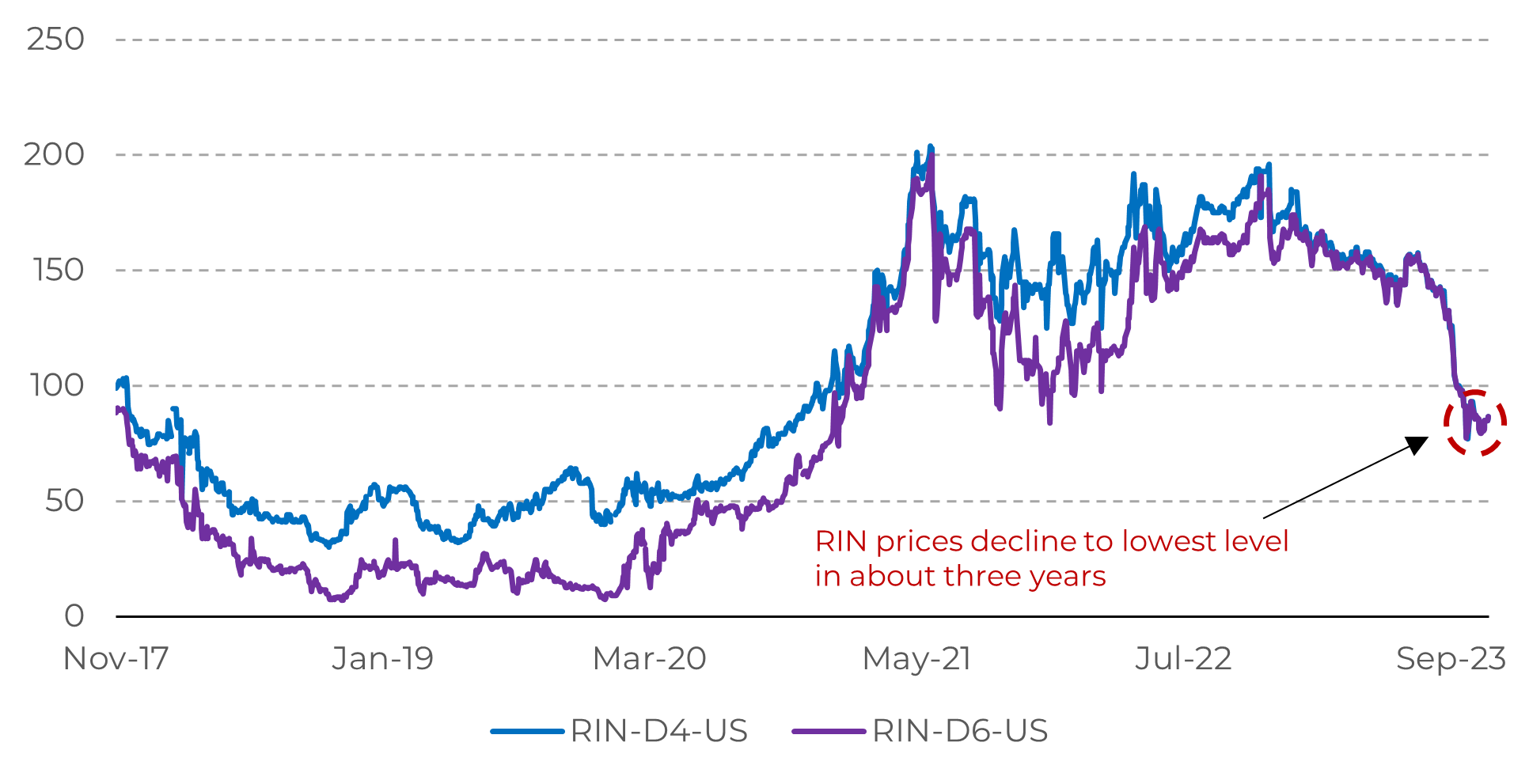

RIN prices collapse in 2H 2023

- Remarkably, the RINs market has witnessed considerable volatility in recent months, largely reflecting the lower costs of soybean oil and the increased production of renewable diesel.

- One of the main effects of the increased supply of soybean is a reduction in BO-HO margins, which results in lower RIN prices.

- Furthermore, the US production capacity for renewable diesel in 2023 is expected to surpass biodiesel production capacity for the first time.

Introduction

Furthermore, renewable diesel production in the U.S. has grown substantially in recent years, boosting the supply of RINs in the market, as it generates more credits than biodiesels.

Image 1: Biomass-based diesel and ethanol RIN Prices (RIN/USG)

Source: Refinitiv

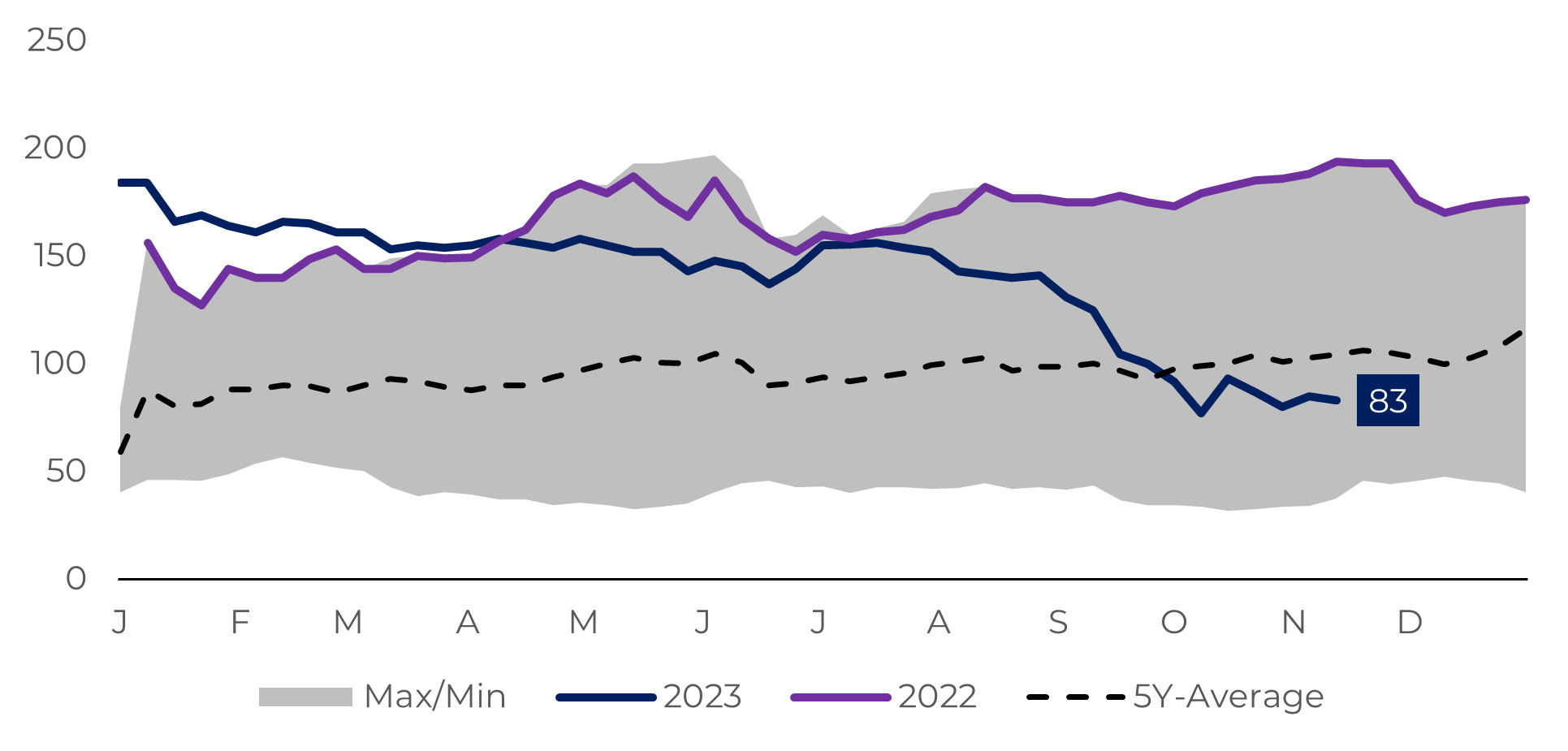

Image 2: Seasonal biomass-based diesel US (RIN/USG)

Source: Refinitiv

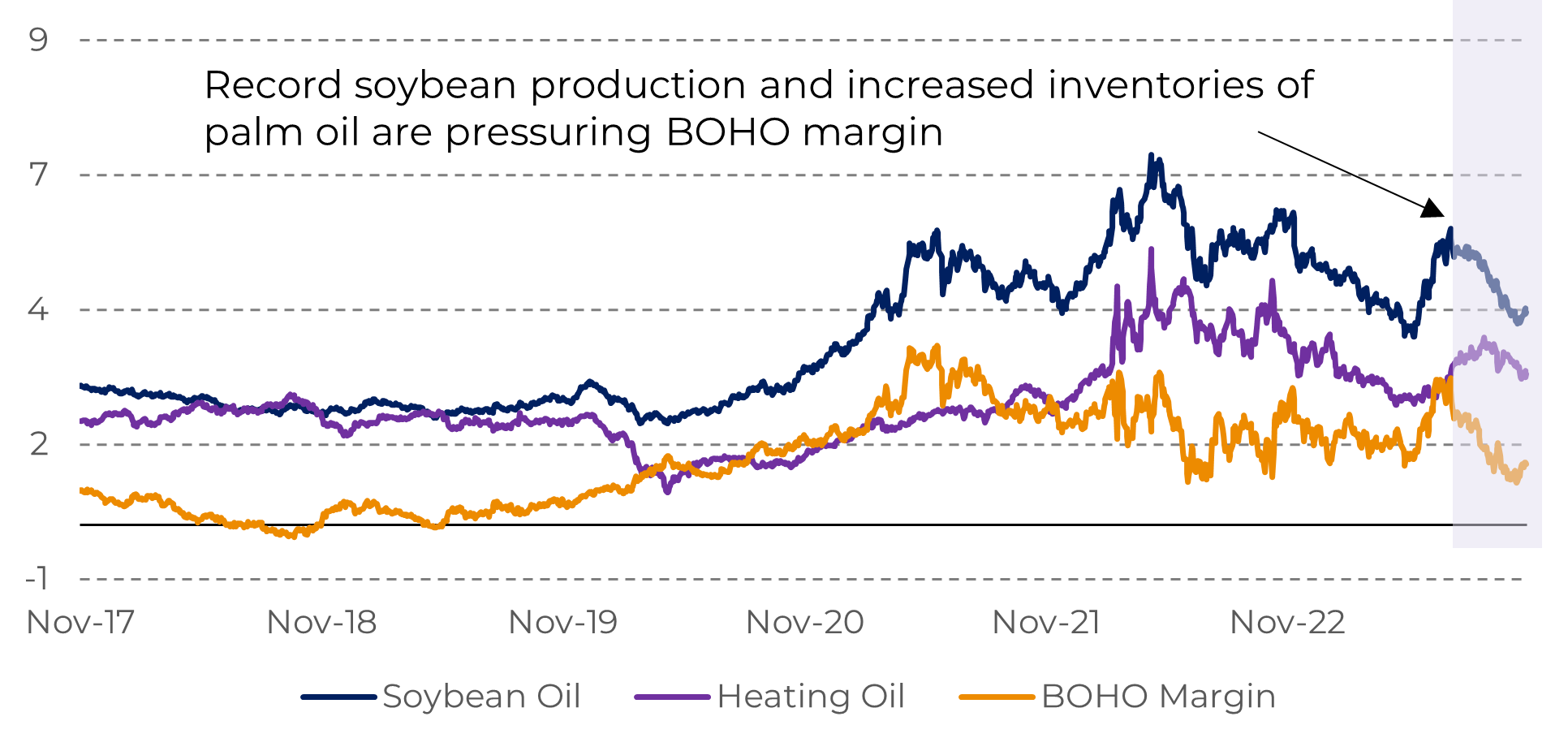

BOHO margins have shrunk considerably in recent months

Since July of this year, a significant decline has been observed in the BO-HO relationship, reflecting market fundamentals in both the agricultural and energy complex.

Image 3: Front-month Soybean and Heating Oil Prices (Gal/USD)

Source: Refinitiv

One

reason is the expectation of record soybean oil production in Brazil's current

crop (2023/24). The greater availability of the product results in downward

pressure on its prices, as shown in the chart above. Another reason is that

heating oil prices have fallen with less intensity, reflecting lower stocks in

the United States and the resilience of its economy.

Meanwhile, palm oil, a substitute for soybean oil, also experiences higher supply in the market, offering little support for the appreciation of soybean oil. Therefore, in the coming weeks, if heating oil remains resilient, possibly reflecting OPEC measures, there is likely to be a further reduction of the BO-HO spread.

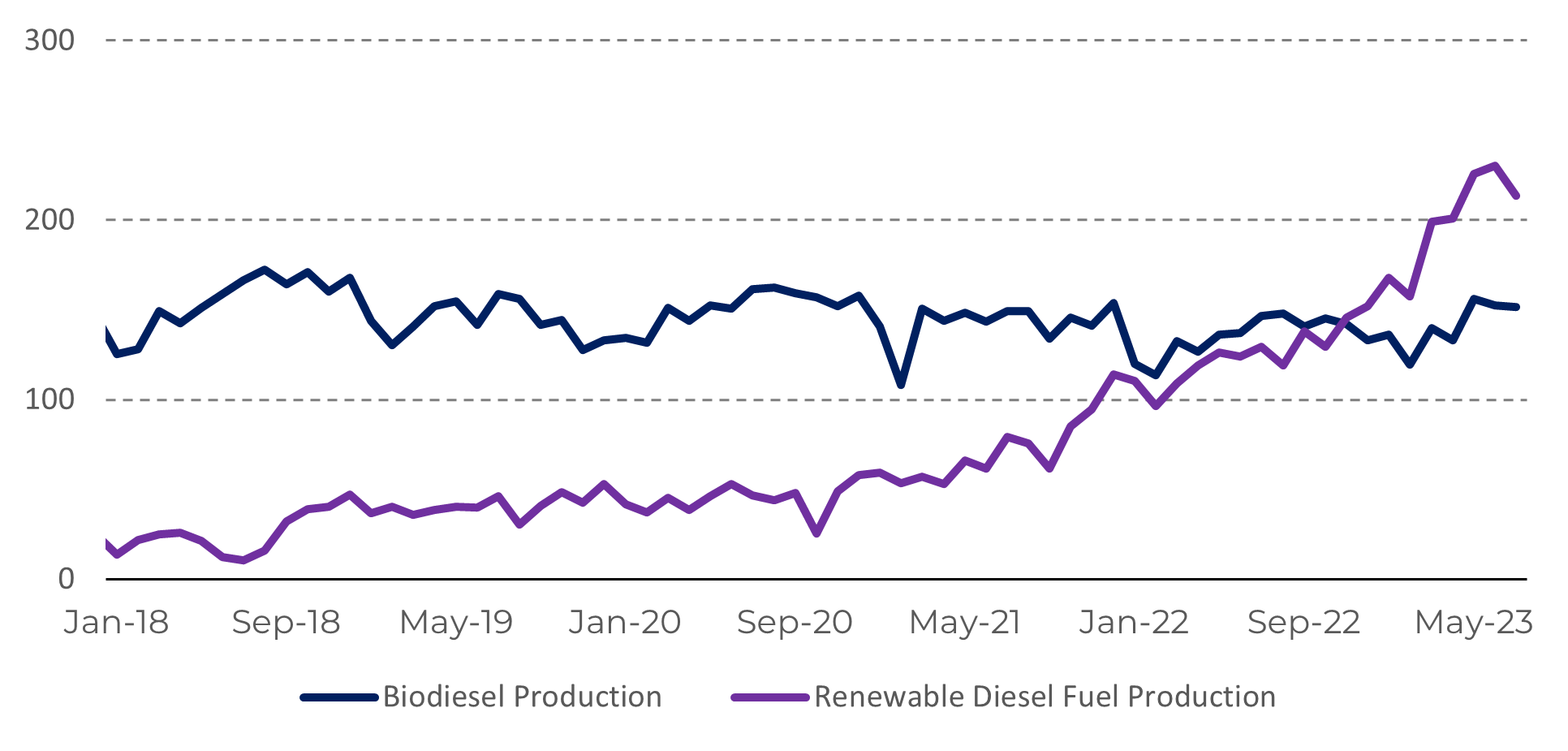

Unprecedented Renewable Diesel Production in the United States

The

United States has made significant developments in its renewable diesel sector.

In 2023, according to the Energy Information Administration (EIA), the

country's production capacity for renewable diesel and other biofuels reached 3

billion gallons per year, surpassing biodiesel production capacity for the

first time.

On one hand, this is a significant step in the energy transition. On the other, the production of renewable diesel has also been one of the reasons behind the sharp increase in RINs in the market, as renewable diesel generates 13% more RINs than biodiesel per blended gallon.

Image 5: Monthly Production of Renewable Diesel and Biodiesel (Million Gallons)

Source: Refinitiv

In Summary

It is

important to note that the energy complex has faced great volatility. In recent

weeks, the cost of oil has dropped significantly, which is a primary expense in

middle distillates production such as heating oil.

Strong

economic data from the American economy and its low middle distillates

inventories keep the market expectations bullish for this refined product.

However, a revision of these expectations is possible, especially with growing

concerns about China's energy consumption and a potential recession in Europe.

Thus, if there is a decline in heating oil prices, there may be an increase in the BO-HO relationship, which would have a bullish impact on the RINs market. In this context, the repercussions of OPEC's actions, which may be announced on November 26th, will be crucial in determining the price action of petroleum refined products in the coming months.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.