Energy Weekly Report - 2023 11 27

After delay, OPEC+ may announce measures to support oil prices

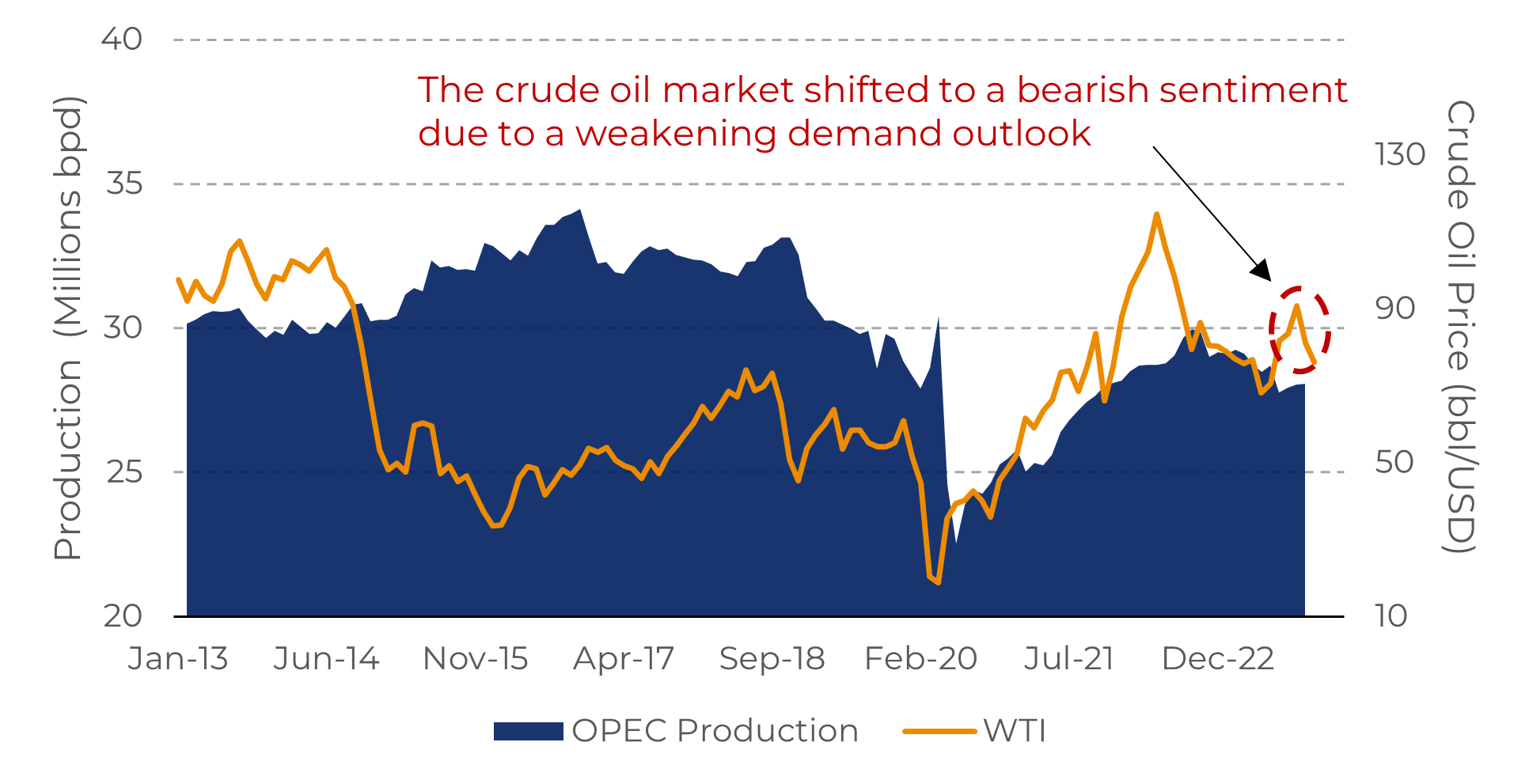

- After a week of high volatility due to the postponement of the OPEC+ meeting, the main oil benchmarks are set to recover recent losses.

- The production quotas for members of the African continent are one of the main points of discussion in OPEC+. Nevertheless, an agreement should be reached on November 30.

- The macroeconomic environment for 2024 appears to be more favorable for the energy complex, but significant risks persist on the demand side, requiring actions from OPEC+ to support prices.

Introduction

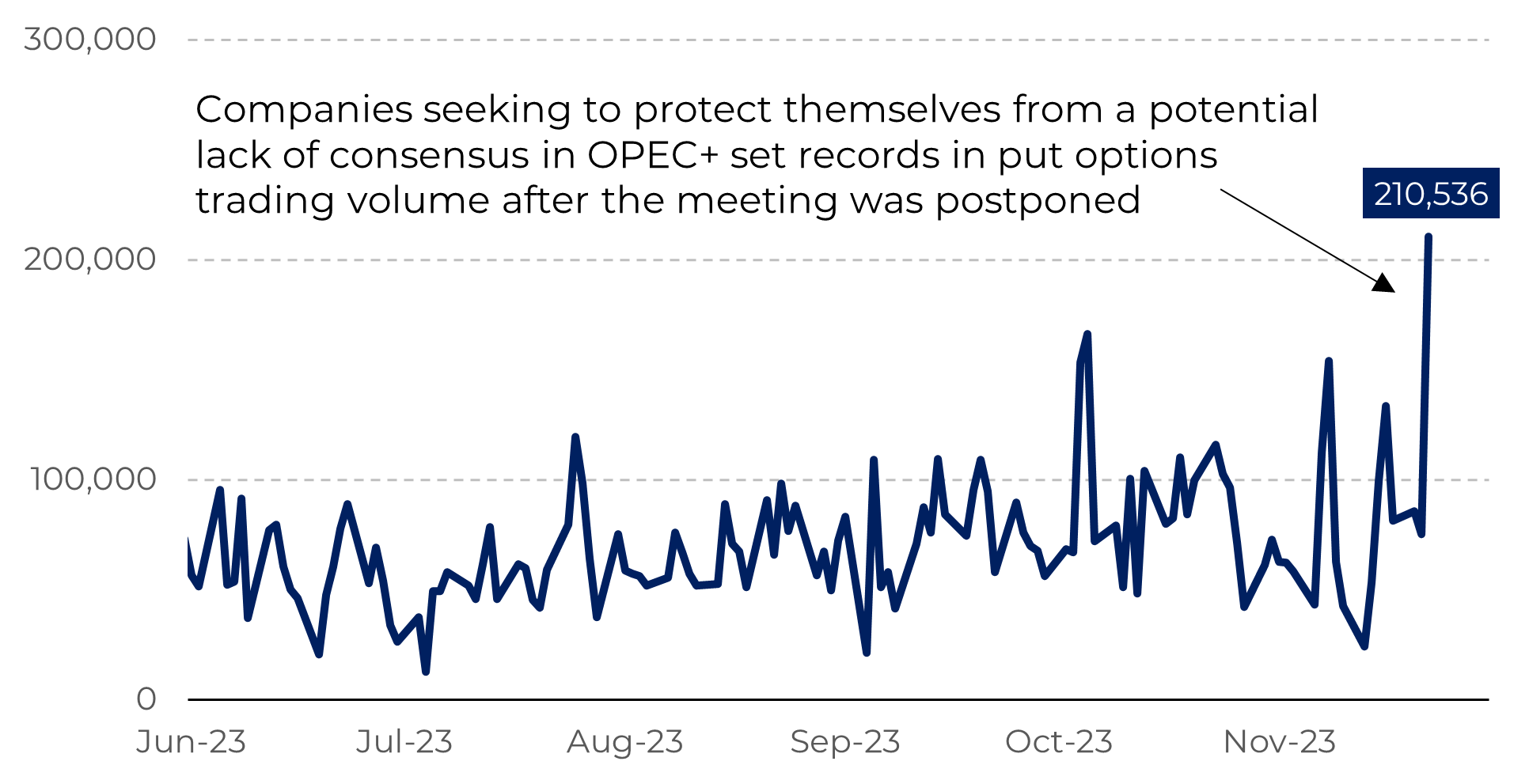

OPEC+ meeting was initially scheduled for November 26, but due to internal disagreements, it had to be rescheduled for November 30. Despite the group sharing a common interest in the stability of oil prices, the delay was not well-received by the market, causing significant volatility last week.

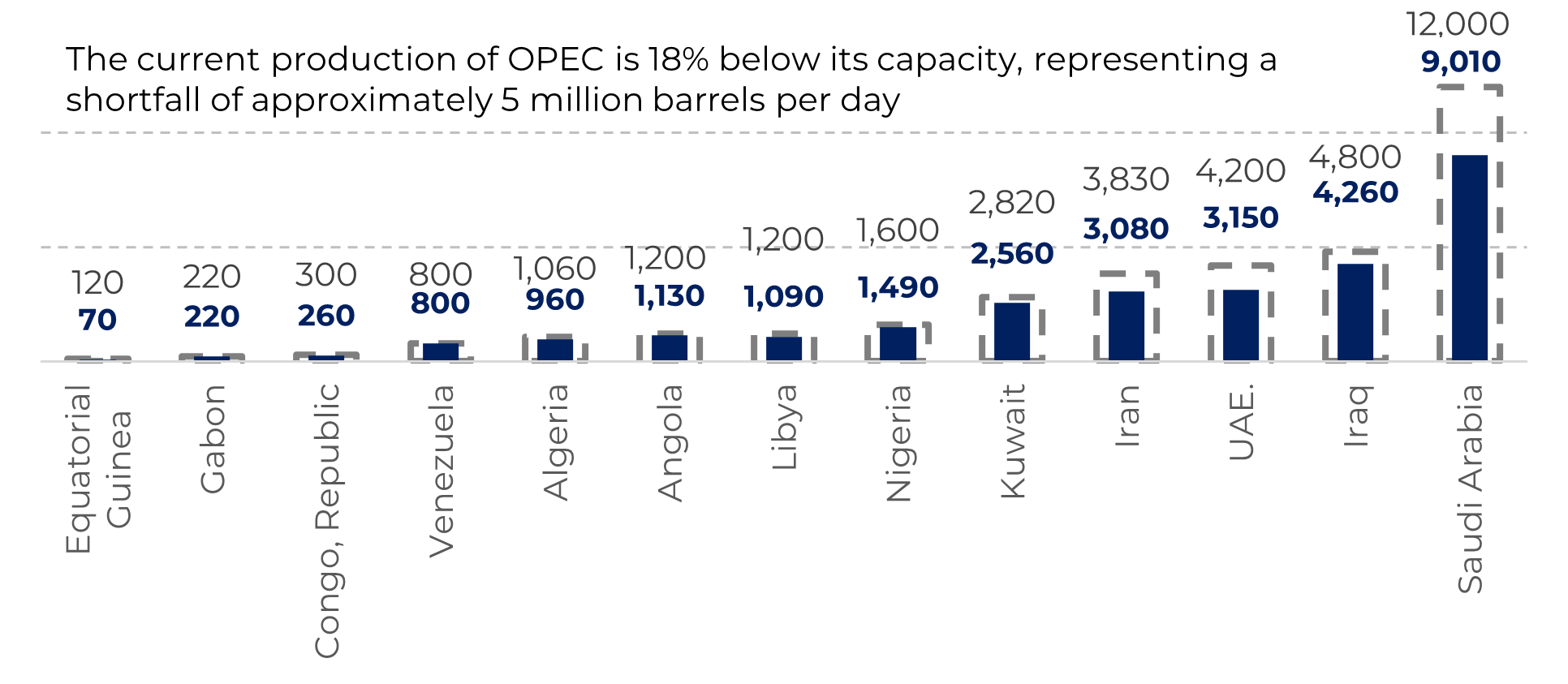

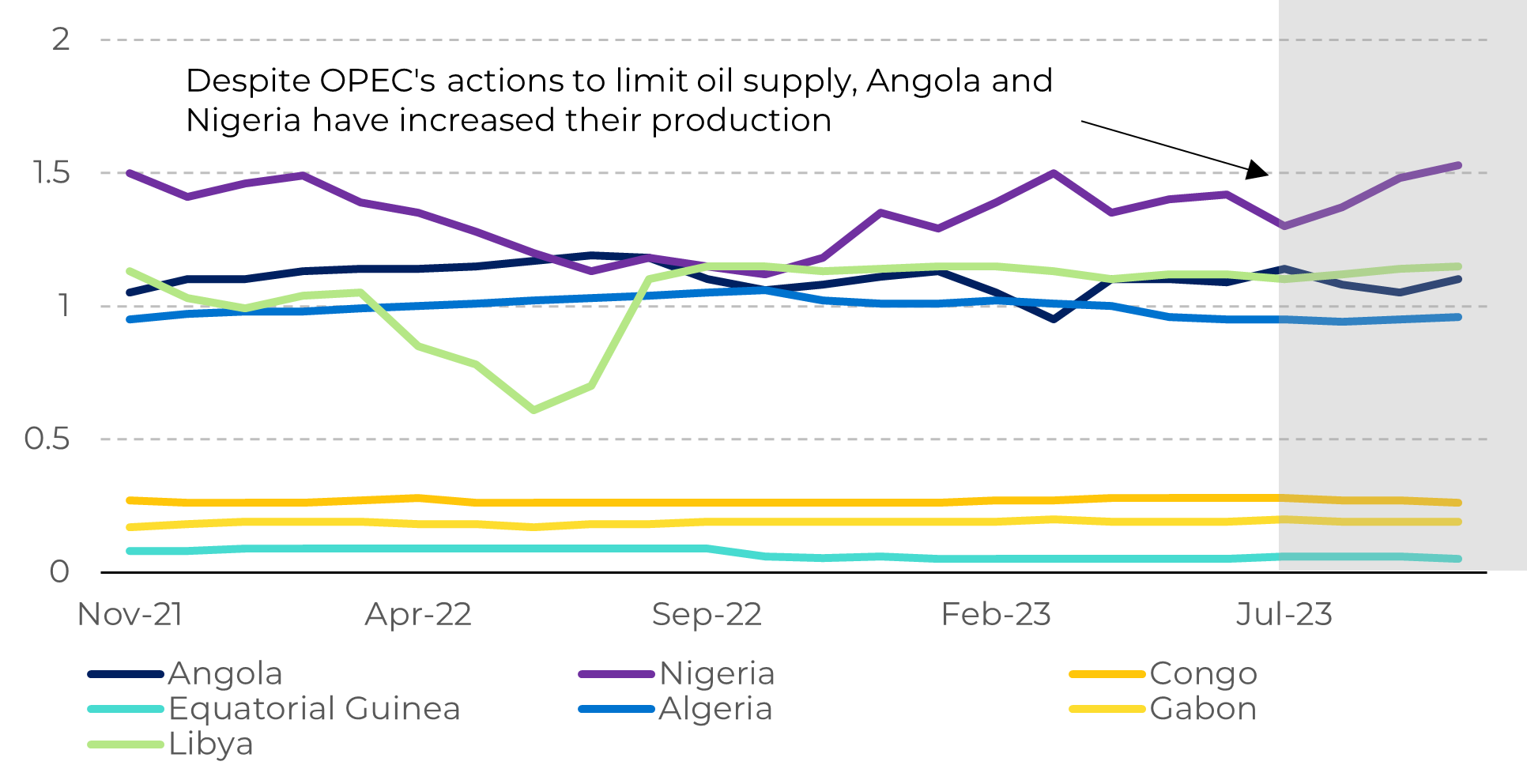

Due to the group's economic and development level heterogeneity, some countries face more challenges in meeting the production quotas allocated by the organization. Countries like Congo, Nigeria, Angola and Equatorial Guinea are examples of this, as they were unable to reach the allocated production level in the past years and, therefore, received lower targets at the last June meeting of OPEC+.

Nevertheless, some of these nations are addressing their infrastructure issues and boosting their oil production. Therefore, the current challenge for the group is to reach a consensus on production levels for the upcoming year. For instance, Nigeria is currently producing close to its quota of 1.38 million barrels per day (bpd), but below the estimated 1.58 million bpd considered for the next year.

The announcements from the meeting scheduled for November 30 will be crucial to support to oil prices that have suffered significant losses in recent weeks. Despite last week's disagreements, OPEC+ is expected to reach a compromise with African oil producers on production levels for 2024.

Image 1: OPEC Production Versus WTI

Source: Refinitiv

OPEC+ members focus on the production level for 2024

Image 2: October OPEC crude oil output and capacity (millions bpd)

Source: OPEC

Image 3: OPEC African member countries' crude oil output (millions bpd)

Source: Refinitiv

The postponement of the OPEC+ meeting has intensified the volume of put options in the market

Image 4: Brent put option volume (Contracts)

Source: OPEC

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.