Dec 4

/

Victor Arduin

Energy Weekly Report - 2023 12 04

Back to main blog page

"The entry of Brazil into OPEC is a significant milestone, as it brings the country closer to other relevant geopolitical players in crude oil market. However, it is still uncertain what role Brazil will play in the organization, as the country does not intend to participate in OPEC's production quota system."

OPEC+ Opens Its Doors to Brazil

- As expected, following the 36th meeting of the OPEC and its allies, production cuts were announced, totaling 2.2 million bpd for the beginning of 2024.

- Furthermore, Brazil was invited to join the organization. Despite being an important entity in the oil market, the question arises as to whether its entry hinders the country's ambition to become a leader in the energy transition.

- In recent times, Brazil has solidified its position as one of the main oil producers in the region and a significant supplier of liquid fuels worldwide.

Introduction

Brazil has consolidated itself as an important oil producer in Latin America, surpassing neighbors that historically held the largest productions in the region, such as Venezuela and Mexico. In addition, Brazil's total liquid production is expected to reach a staggering 4.08 million barrels per day (bpd).This gives Brazil a competitive advantage in the global energy market, as it can produce both fossil fuels and renewable energy sources.

The entry of Brazil into OPEC is a significant milestone, as it brings the country closer to other relevant geopolitical players in crude oil market. However, it is still uncertain what role Brazil will play in the organization, as the country does not intend to participate in OPEC's production quota system.

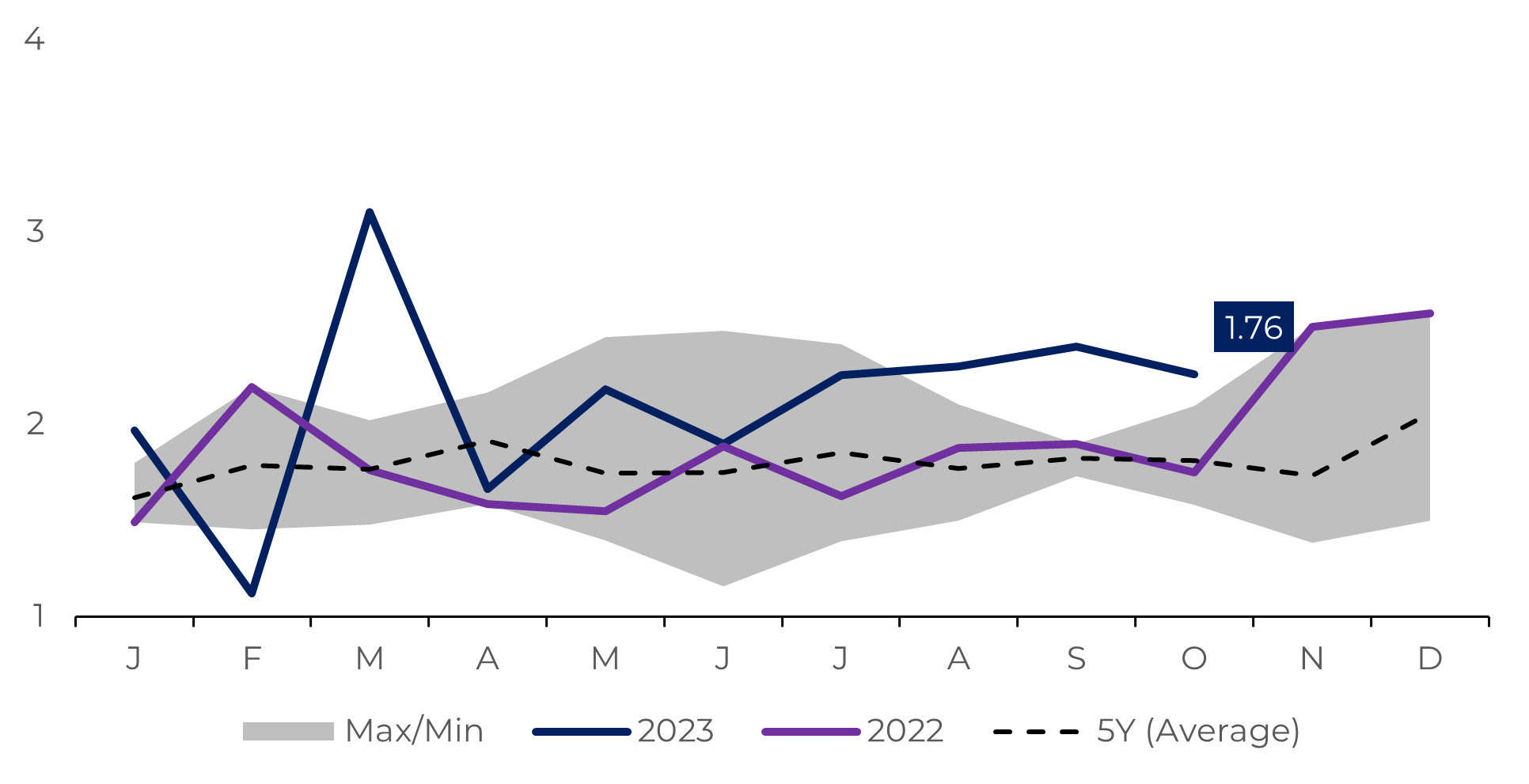

Image 1: Montly Crude Oil Exports - Brazil (M bpd)

Source:

Bloomberg, hEDGEpoint

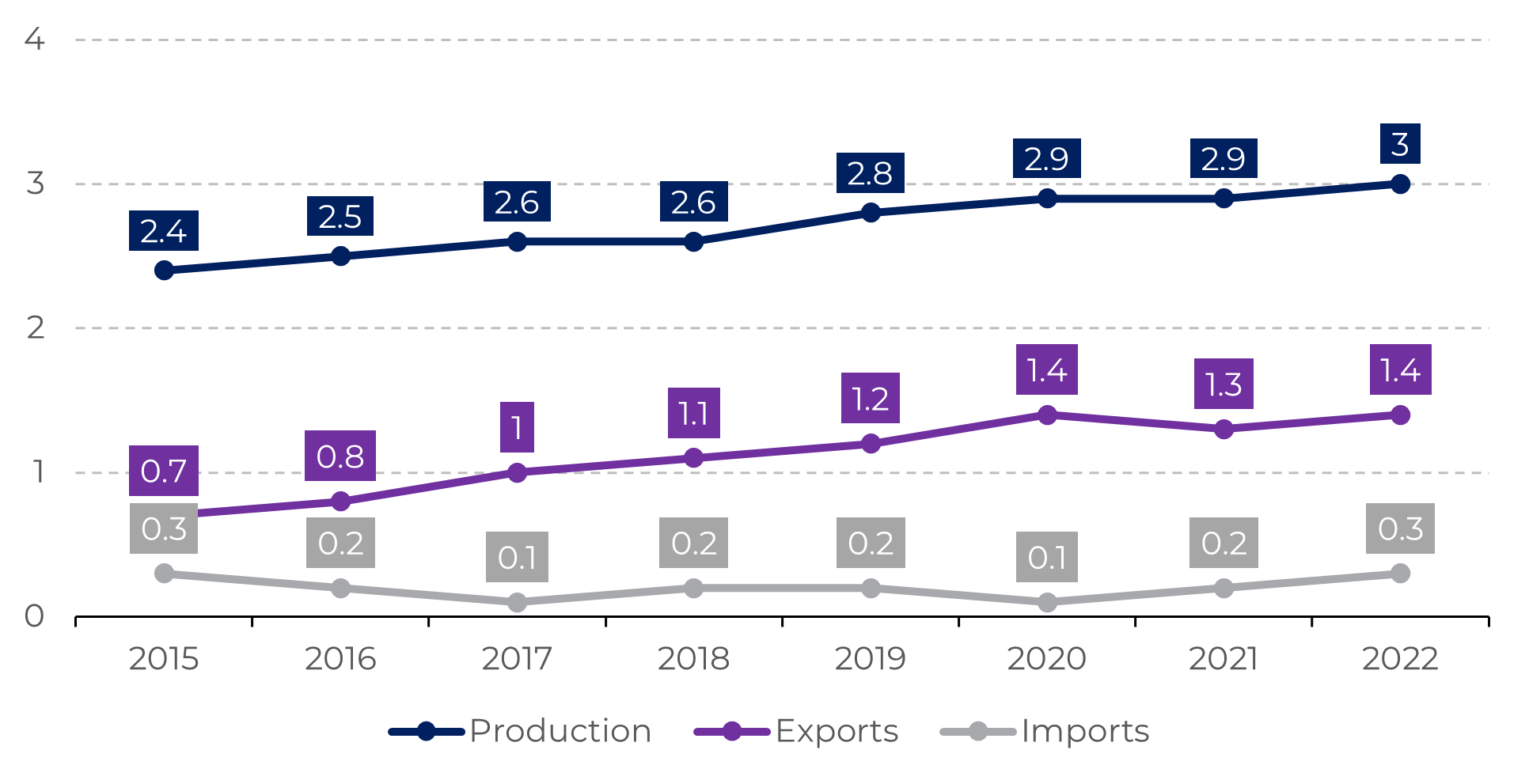

Image 2: Annual Crude Oil Production, Imports & Exports - Brazil (M bpd)

Source: ANP

Brazil's entry into OPEC+ raises questions

Last week, Saudi Arabia, Russia, and members of OPEC+ agreed to reduce oil production by 2.2 million barrels per day (bpd) at the beginning of next year. Despite being an important move in support of prices, the main oil benchmarks closed lower, with WTI at $74.07 (-1.95%) and Brent at $78.88 (-2.11%).

If announcements of production cuts were, to some extent, expected by the market, the announcement of Brazil's invitation to join OPEC+ was a surprise. The Brazilian government confirmed that it is analyzing the invitation to join the organization in January of 2024.

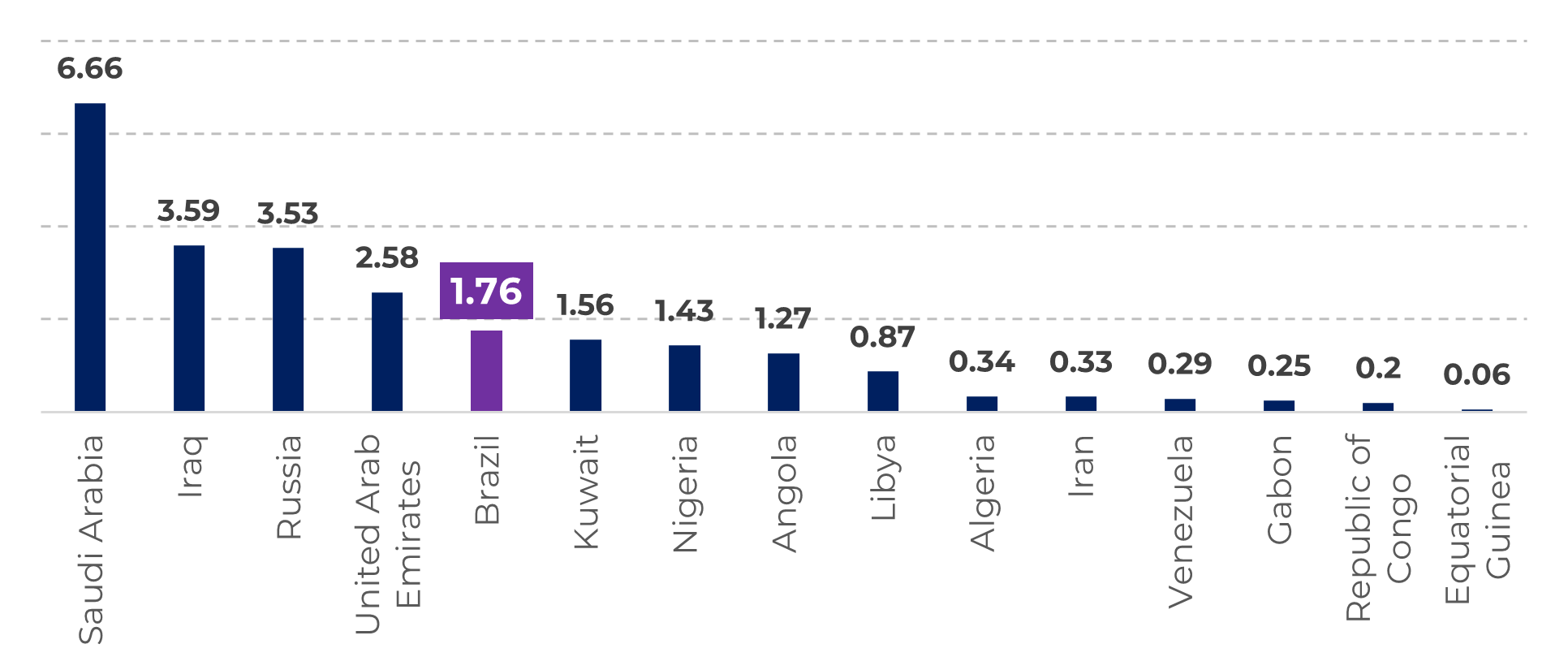

There is no doubt that Brazil has consolidated itself as an important energy supplier in the international arena, both with fossil and renewable fuels. An example of this strength is that if the country's entry is confirmed, it would be the fifth largest exporter, with crude oil volume of 1.76 million bpd in October.

Image 3: October Crude Oil Export – OPEC & Brazil (M bpd)

Source: Refinitiv, ANP, Bloomberg

Brazil's potential accession to OPEC+ raises questions about its commitment to leading the energy transition. How can it influence the world toward renewable fuel consumption while participating in the world's largest fossil energy alliance? Additionally, joining the organization's quota system could hinder Brazil's ambitious goal of increasing oil production to 5 million barrels per day by 2030. Currently, the country's oil production stands at around 3.3 million barrels per day.

Jean Paul Prates, CEO of Petrobras, the Brazilian state-owned company responsible most of the country's production, mentioned that Brazil would not participate in the quota system, but rather play an observer role in the organization.

In this context, the country's invitation to join the organization reflects the contradiction that marked the last meeting of OPEC+. While some countries are seeking to restrict oil supply in the market, others want to increase production. How can a consensus be built on a joint strategy to support prices if new members are not committed to the group's production policy?

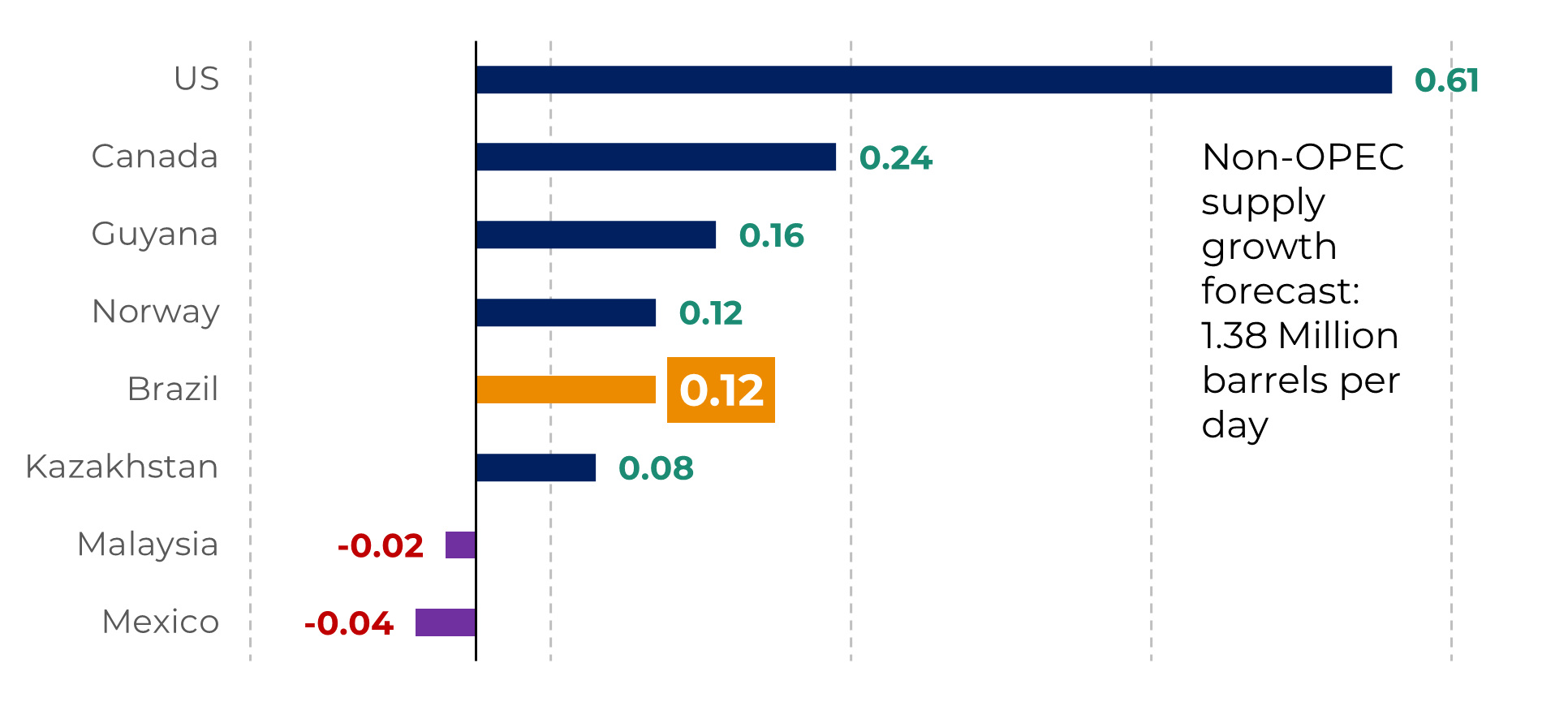

Image 4: Annual Liquids Production Changes YoY - Selected Countries Forecast in 2024 (M bpd)

Source: OPEC

In Summary

While Brazil's unexpected invitation to join OPEC+ has raised questions, there are some potential advantages to consider. One would be gaining advance access to information on the group's actions, as OPEC+'s decisions have a significant impact on the energy commodities market. Additionally, joining the organization could improve ties with economically powerful countries like Saudi Arabia, United Arab Emirates, and others.

However, it is important to consider other challenges. Production cuts made by the organization generally have an upward impact on oil prices, resulting in higher prices of refined products, such as gasoline and diesel, ultimately exerting inflationary pressure.

In addition, joining the association of oil-producing and exporting countries could impact Brazil's image as a leader in the energy transition. Brazil has a high competitive advantage in the low-carbon hydrogen market, in the replacement of fossil fuels with biomass and biofuels, in electrification, and in carbon capture and storage.

For now, it's important to await the developments that will unfold in the coming months. There is a process to be followed before confirming Brazil's entry into OPEC+, making it clearer what role the country will play in the organization.

Weekly Report — Energy

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Alef Dias

alef.dias@hedgepointglobal.com

alef.dias@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.