Dec 11

/

Victor Arduin

Energy Weekly Report - 2023 12 11

Back to main blog page

"The drop in crude oil costs over the past months has kept refining product margins stable, such as gasoline and heating oil. As result, the WTI 3:2:1 crack spread remains above its five-year average at $22.56."

Refineries Reap Benefits from Falling Oil Prices

- The significant decline in oil prices has been a positive factor for refineries, as it is the primary cost of producing refined products. While this has helped keep margins stable for now, there are worrying signs.

- The United States is accumulating more gasoline and middle distillate inventories, which should soon impact market spreads.

- Given this context, the end of 2023 heads towards a devaluation in the energy complex, and 2024 could be quite challenging with current market risks.

Introduction

Though the energy complex faced challenges throughout 2023, particularly towards the end of the year when crude oil prices declined, refineries have still seen robust profit margins.

Furthermore, challenges for 2024 mount amid a high-interest-rate environment, reduced demand, and signals of diminished cooperation among OPEC+ countries.

However, this is a consequence of the sharp fall in oil prices in recent months, the main input in the gasoline production, middle distillates, and other fuels. The rising inventories in the United States are a sign that cracks may soon decline.

Furthermore, challenges for 2024 mount amid a high-interest-rate environment, reduced demand, and signals of diminished cooperation among OPEC+ countries.

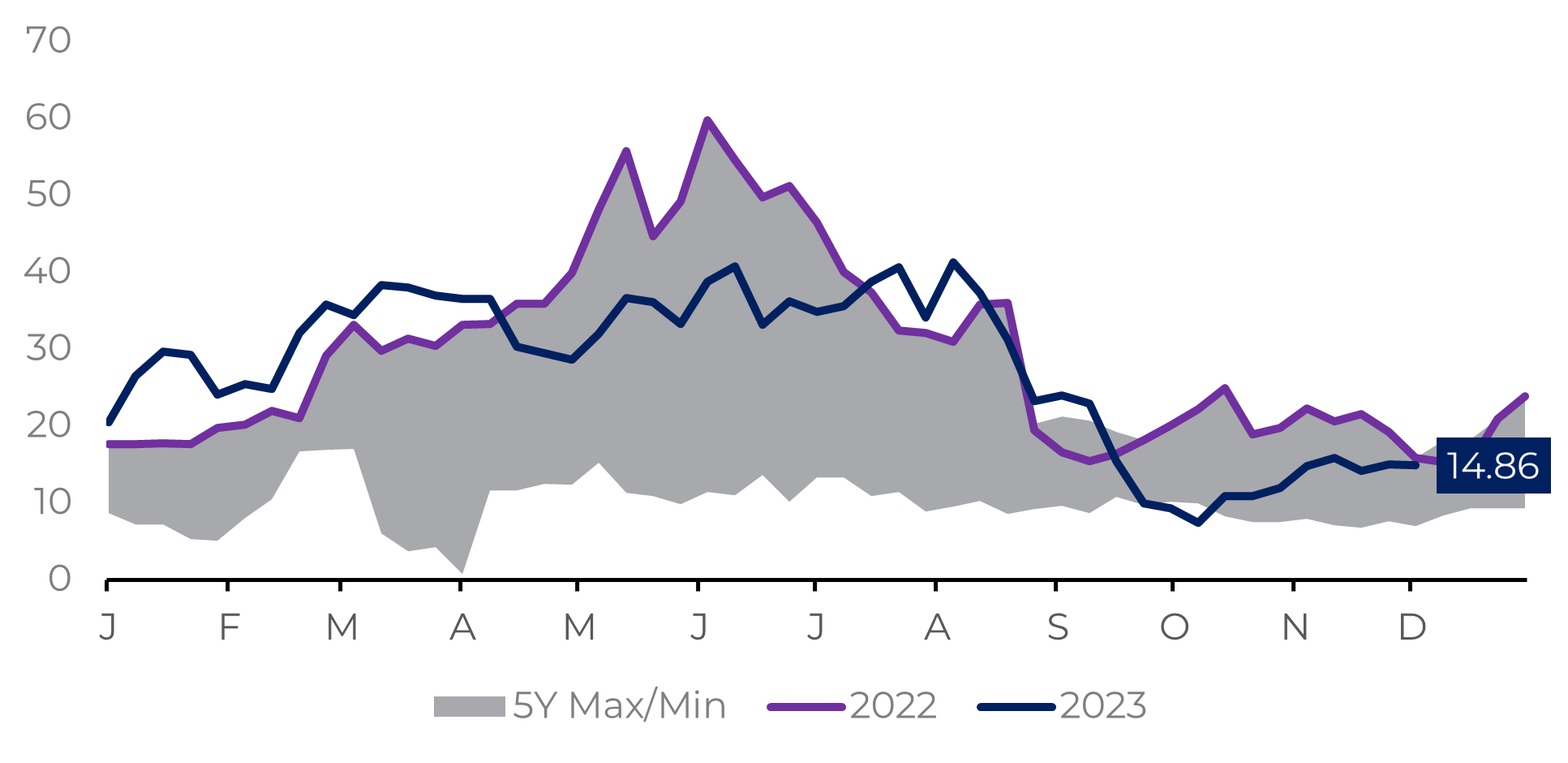

Image 1: RBOB Vs. WTI (US$/bbl)

Source: Refnitiv

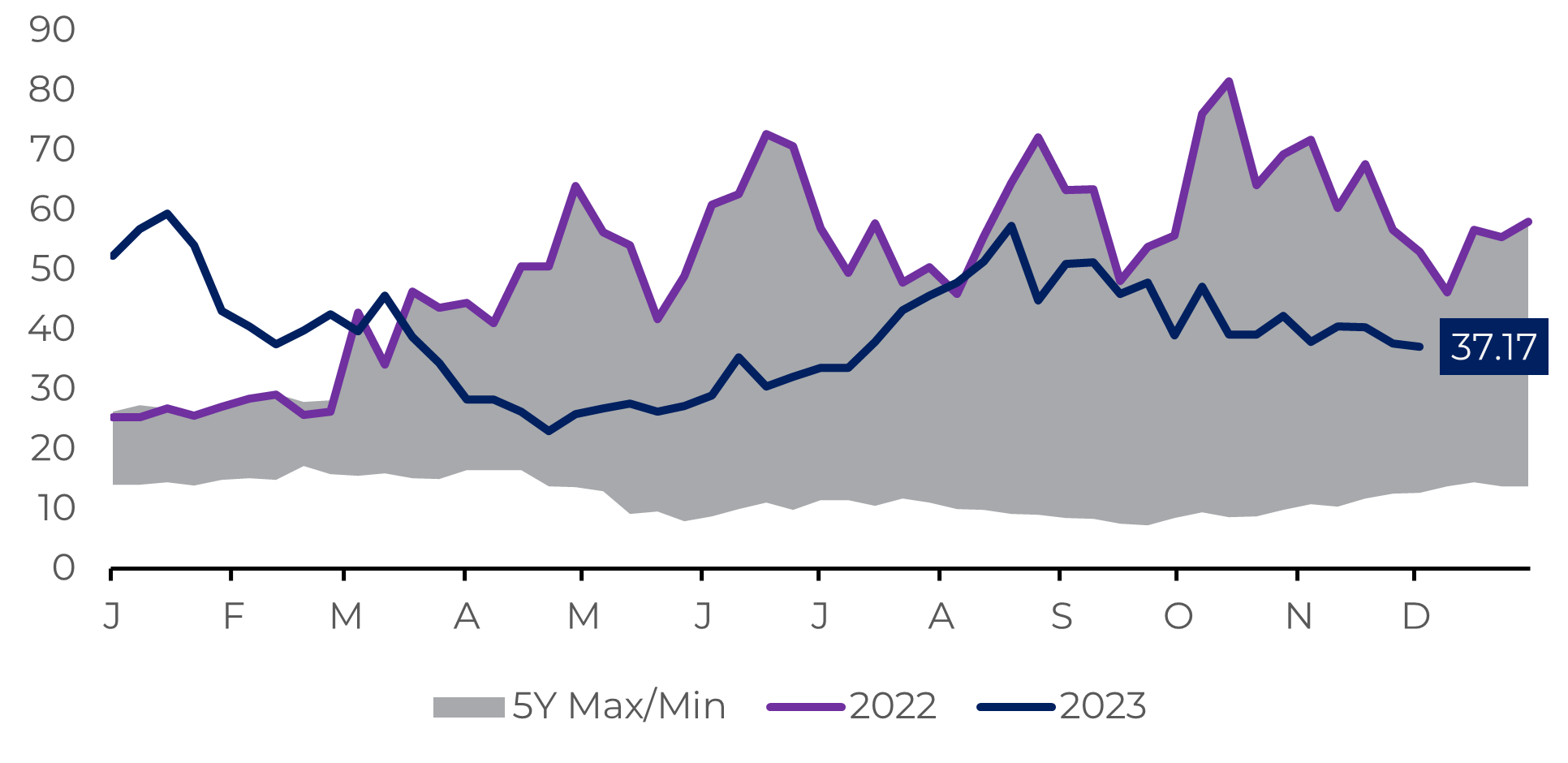

Image 2: Heating Oil Vs. WTI (US$/bbl)

Source: Refinitiv

Refining margins are holding steady, but there are risks ahead

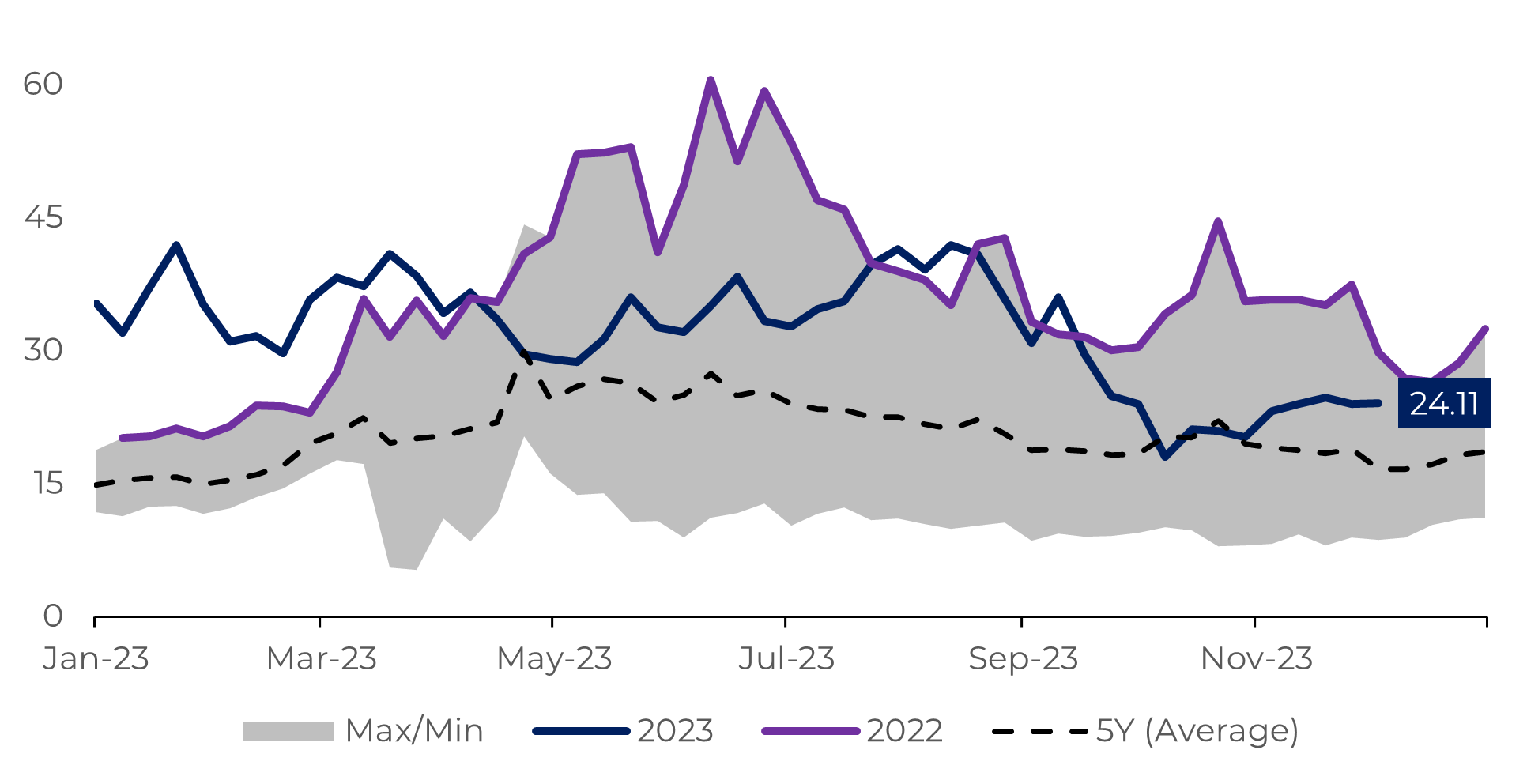

The drop in crude oil costs over the past months has kept refining product margins stable, such as gasoline and heating oil. As result, the WTI 3:2:1 crack spread remains above its five-year average at $22.56. This measure indicates that the refining process is generating healthy profits currently, despite the overall decline in the energy complex.

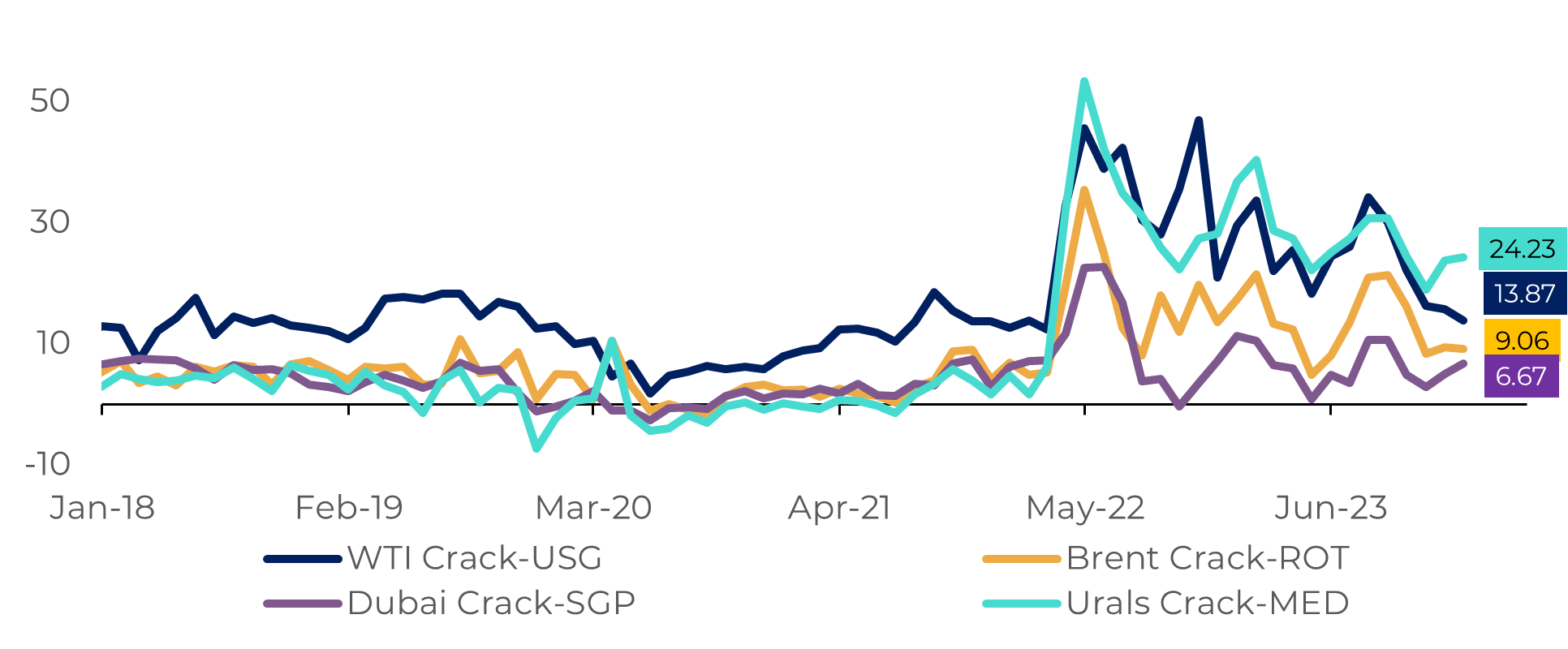

This trend is evident in other cracks benchmarks as well, some experiencing an even greater intensity. In this context, Saudi Arabia recently announced discounts to its buyers to maintain market share in a more competitive environment, where sanctioned oil like Urals, from Russia, allows refineries to achieve better margins. In historical terms, post-COVID-19 refining margins have remained exceptionally high.

Image 3: WTI Crack Spread (USD/3:2:1 bbl)

Source: Bloomberg

However, it is important to mention that this current environment may not be sustainable in the future. Recent increases in US inventories signal the potential for a market surplus. Gasoline stocks, already surpassing their five-year average, and are trending upward.

At this moment, refineries are striving to boost the production of middle distillates, which currently offer better profit margins. However, this effort to increase middle distillate production will ultimately long-term inventory growth.

If that weren't enough to bring a more bearish outlook, it is also important to consider the current complicated macroeconomic environment. Higher interest rates, a possible recession in Europe, and lower demand in China may directly impact the energy complex.

Image 4: Crude Oil Crack Refinery Profit (USD/bbl)

Source: Refinitiv

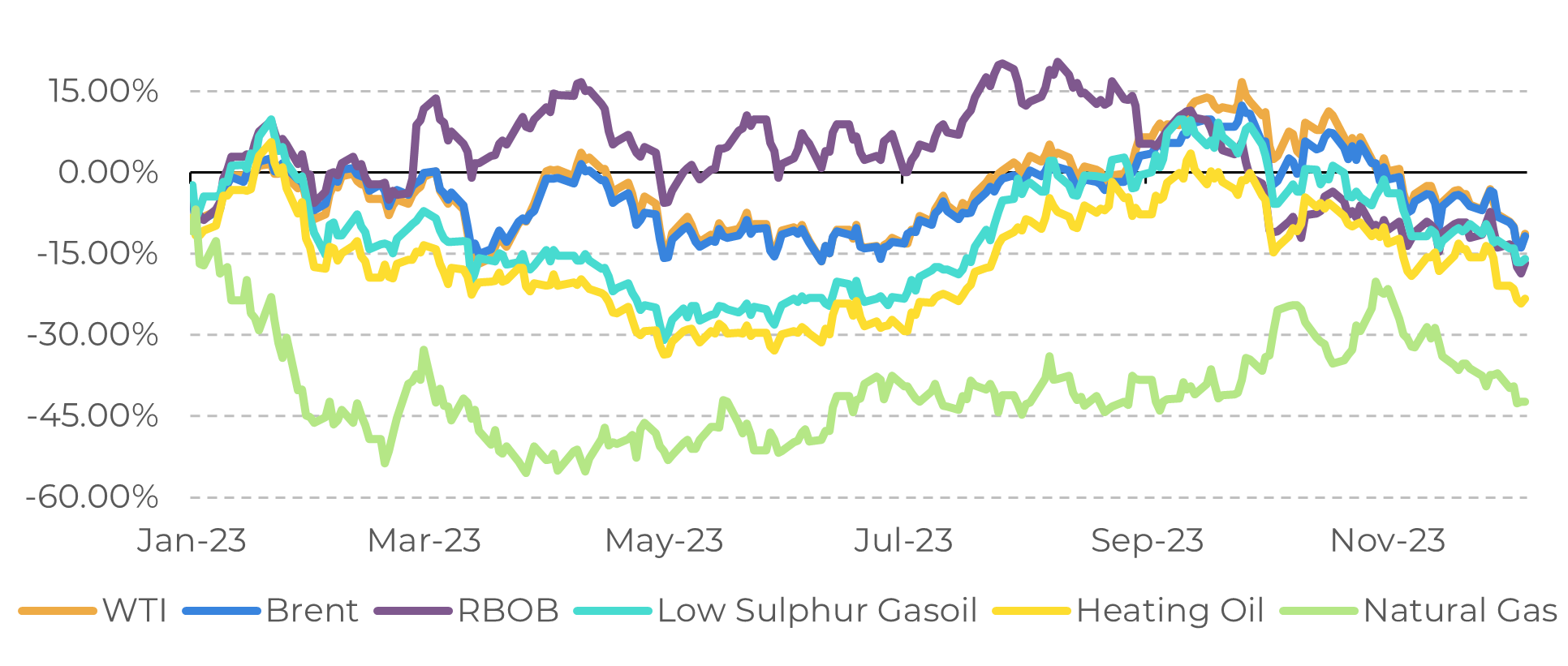

Energy commodities are headed to conclude the year on a downward trend

After an exceptionally bullish 2022 for energy commodities, this year is on track to end with a general devaluation of the energy complex. This is explained by the abrupt fall in oil, the key input and cost, of various refined products.

The restrictive interest rates environment, concerns about a recession in Europe, and lower demand in the United States, which is increasingly accumulating more stocks, are the main causes of the recent fall in the main oil benchmarks. Just this month, WTI has fallen by 4.73 (-6,23%) and Brent by 6.99 (-8,44%) USD/barrel.

While the downside risks on the demand side are significant, the supply side is not much different. The OPEC+ group showed less coordination in its production cuts strategy at its last meeting, and non-OPEC countries are gaining more market share. As a result, the energy deficit is significantly smaller than expected months ago, when the main oil benchmarks were above 90 USD.

Image 5: Energy Commodity Performance 2023 (Normalized to December 30, 2022)

Source: Refinitiv

In Summary

Although the energy complex is heading towards a devaluation in 2023, it is important to consider that 2022 was an extremely bullish year for energy commodities.

The Russian invasion of Ukraine increased the risk of oil and natural gas supply disruptions to Europe, significantly raising the value of these resources. Therefore, it is natural for prices to correct towards values that are, in historical terms, more “normal”.

So far, we have observed that refineries have enjoyed healthy margins. Despite gains being less significant compared to last year, this year has seen high refining spreads when considering its historical series.

However, the fall in oil prices, reflecting demand risks, may soon impact refinery margins, especially with the increase in gasoline and middle distillate inventories in the United States.

In this context, the coming year is expected to be more challenging for energy commodities, which will eventually reflect lower margins for refineries.

Weekly Report — Energy

Written by Victor Arduin

victor.arduin@hedgepointglobal.com

victor.arduin@hedgepointglobal.com

Reviewed by Livea Coda

livea.coda@hedgepointglobal.com

livea.coda@hedgepointglobal.com

www.hedgepointglobal.com

Disclaimer

This document has been prepared by hEDGEpoint Global Markets LLC and its affiliates ("HPGM") exclusively for informational and instructional purposes, without the purpose of creating obligations or commitments with third parties, and is not intended to promote an offer, or solicitation of an offer, to sell or buy any securities or investment products. HPGM and its associates expressly disclaim any use of the information contained herein that may result in direct or indirect damage of any kind. If you have any questions that are not resolved in the first instance of contact with the client (client.services@hedgepointglobal.com), please contact our internal ombudsman channel (ouvidoria@hedgepointglobal.com) or 0800-878-8408 (for clients in Brazil only).

Contact us

hedgepointhub.support@hedgepointglobal.com

ouvidoria@hedgepointglobal.com

Funchal Street, 418, 18º floor - Vila Olímpia São Paulo, SP, Brasil

Check our general terms and important notices.

This page has been prepared by Hedgepoint Schweiz AG and its affiliates (“Hedgepoint”) solely for informational and instructional purposes, without the purpose of instituting obligations or commitments to third parties, nor is it intended to promote an offer, or solicitation of an offer of sale or purchase relating to any securities, commodities interests or investment products. Hedgepoint and its associates expressly disclaim any use of the information contained herein that directly or indirectly result in damages or damages of any kind. Information is obtained from sources which we believe to be reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. The trading of commodities interests such as futures, options, and swaps involves substantial risk of loss and may not be suitable for all investors. You should carefully consider wither such trading is suitable for you in light of your financial condition. Past performance is not necessarily indicative of future results. Customers should rely on their own independent judgement and/or advisors before entering in any transaction.Hedgepoint does not provide legal, tax or accounting advice and you are responsible for seeking any such advice separately.Hedgepoint Schweiz AG is organized, incorporated, and existing under the laws of Switzerland, is filiated to ARIF, the Association Romande des Intermédiaires Financiers, which is a FINMA-authorized Self-Regulatory Organization. Hedgepoint Commodities LLC is organized, incorporated, and existing under the laws of the USA, and is authorized and regulated by the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA) to act as an Introducing Broker and Commodity Trading Advisor. HedgePoint Global Markets Limited is Regulated by the Dubai Financial Services Authority. The content is directed at Professional Clients and not Retail Clients. Hedgepoint Global Markets PTE. Ltd is organized, incorporated, and existing under the laws of Singapore, exempted from obtaining a financial services license as per the Second Schedule of the Securities and Futures (Licensing and Conduct of Business) Act, by the Monetary Authority of Singapore (MAS). Hedgepoint Global Markets DTVM Ltda. is authorized and regulated in Brazil by the Central Bank of Brazil (BCB) and the Brazilian Securities Commission (CVM). Hedgepoint Serviços Ltda. is organized, incorporated, and existing under the laws of Brazil. Hedgepoint Global Markets S.A. is organized, incorporated, and existing under the laws of Uruguay. In case of questions not resolved by the first instance of customer contact (client.services@Hedgepointglobal.com), please contact internal ombudsman channel (ombudsman@hedgepointglobal.com – global or ouvidoria@hedgepointglobal.com – Brazil only) or call 0800-8788408 (Brazil only).Integrity, ethics, and transparency are values that guide our culture. To further strengthen our practices, Hedgepoint has a whistleblower channel for employees and third-parties by e-mail ethicline@hedgepointglobal.com or forms Ethic Line – Hedgepoint Global Markets.Security note: All contacts with customers and partners are conducted exclusively through our domain @hedgepointglobal.com. Do not accept any information, bills, statements or requests from different domains and pay special attention to any variations in letters or spelling, as they may indicate a fraudulent situation.“HedgePoint” and the “HedgePoint” logo are marks for the exclusive use of HedgePoint and/or its affiliates. Use or reproduction is prohibited, unless expressly authorized by HedgePoint. Furthermore, the use of any other marks in this document has been authorized for identification purposes only. It does not, therefore, imply any rights of HedgePoint in these marks or imply endorsement, association or seal by the owners of these marks with HedgePoint or its affiliates.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.

To continue using the Hedgepoint HUB, please review and accept the updated terms.