Energy Weekly Report - 2023 12 18

China Shows Signs of Reduced Demand for Fuels

- A more "robust" economic recovery from China was expected after a prolonged period of lockdown in the country. Despite some concerns arising from the nation, the energy sector has shown resilience.

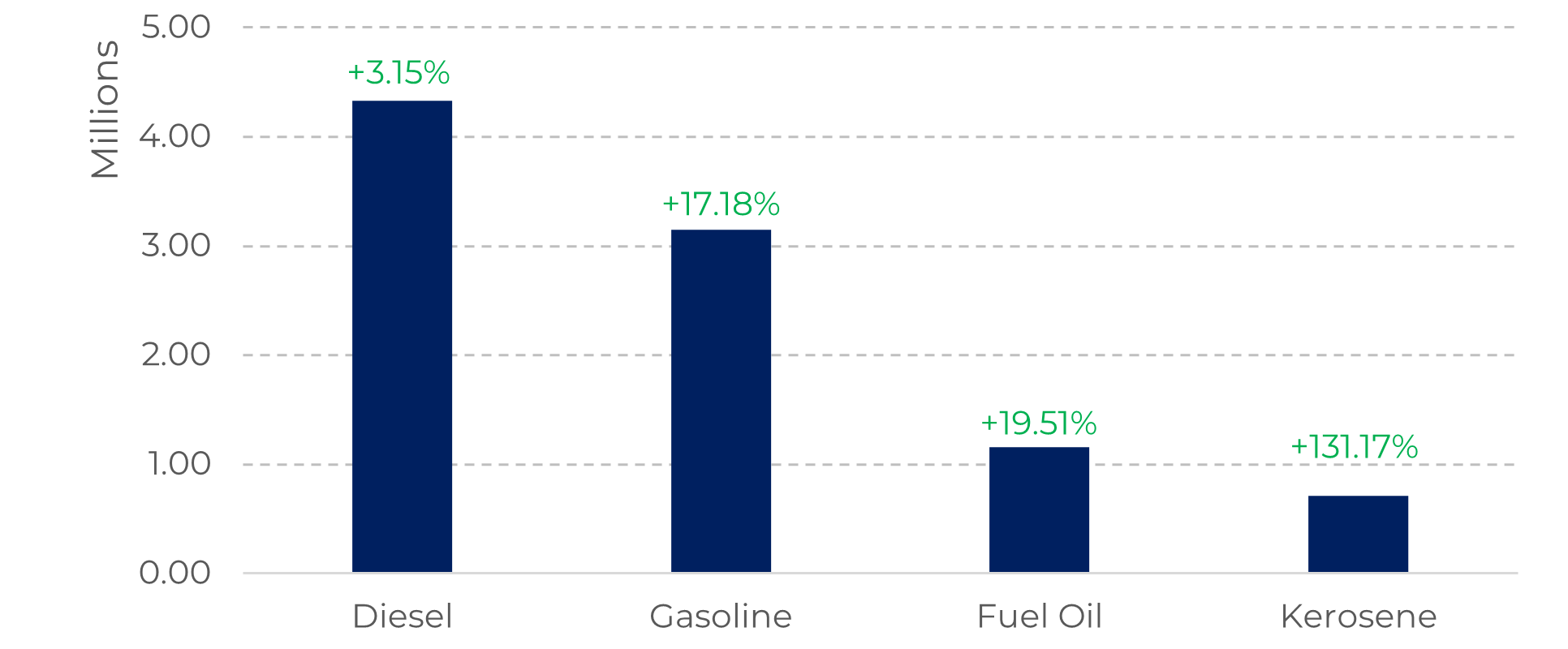

- An example was the substantial growth in the consumption of transportation fuels, especially gasoline and jet fuel, benefiting from the easing of circulation restrictions in the country.

- However, the country's demand is somewhat disguised as it has been importing more oil than necessary, largely due to discounted prices from countries like Russia.

Introduction

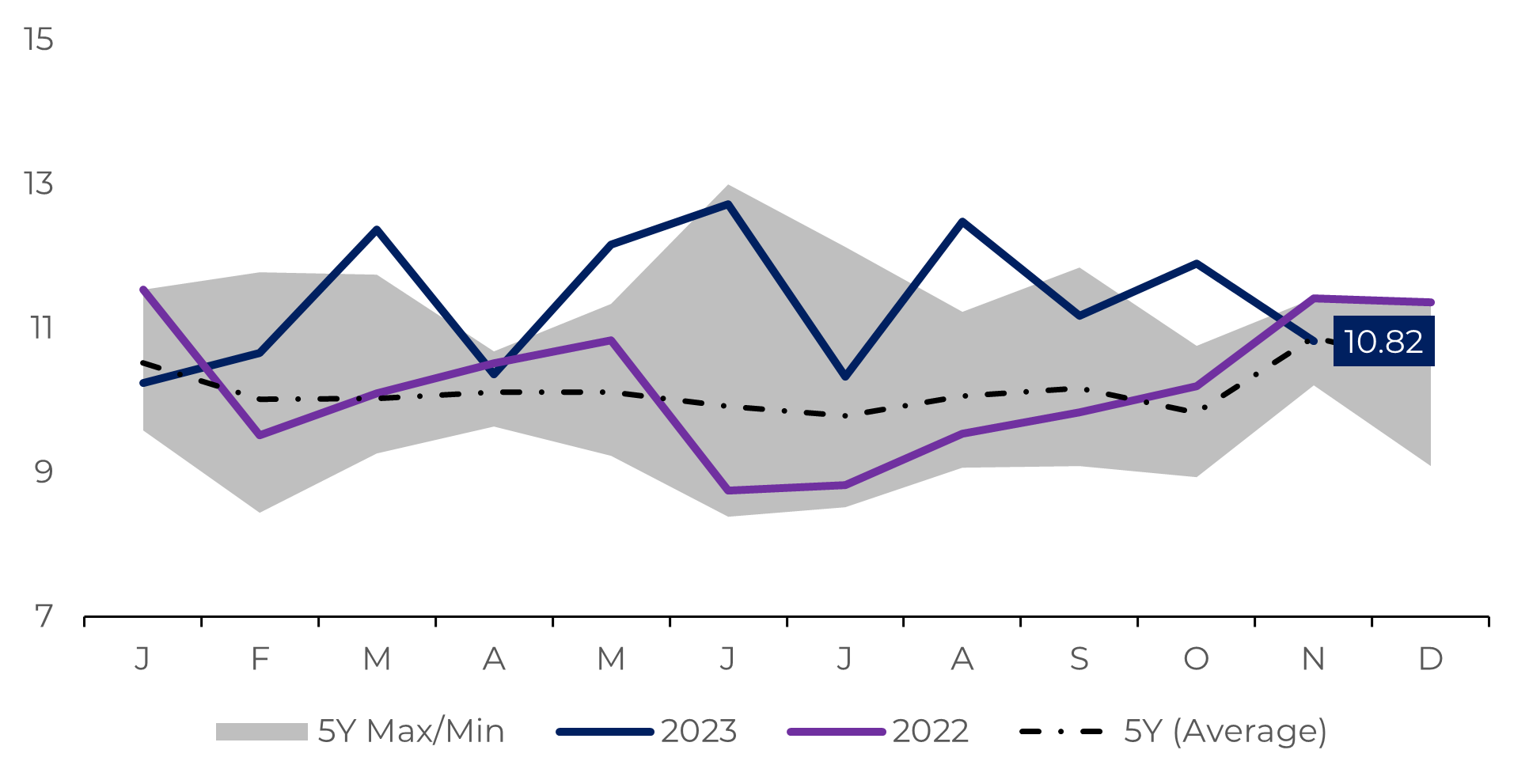

China plays an important role in the global energy complex. Due to the size of its economy, the country needs to import large volumes of oil to meet its domestic needs, which has largely driven a bullish sentiment in the market for this year. However, in recent months, there has been a decline in oil imports, and the availability is even greater than the country's needs.

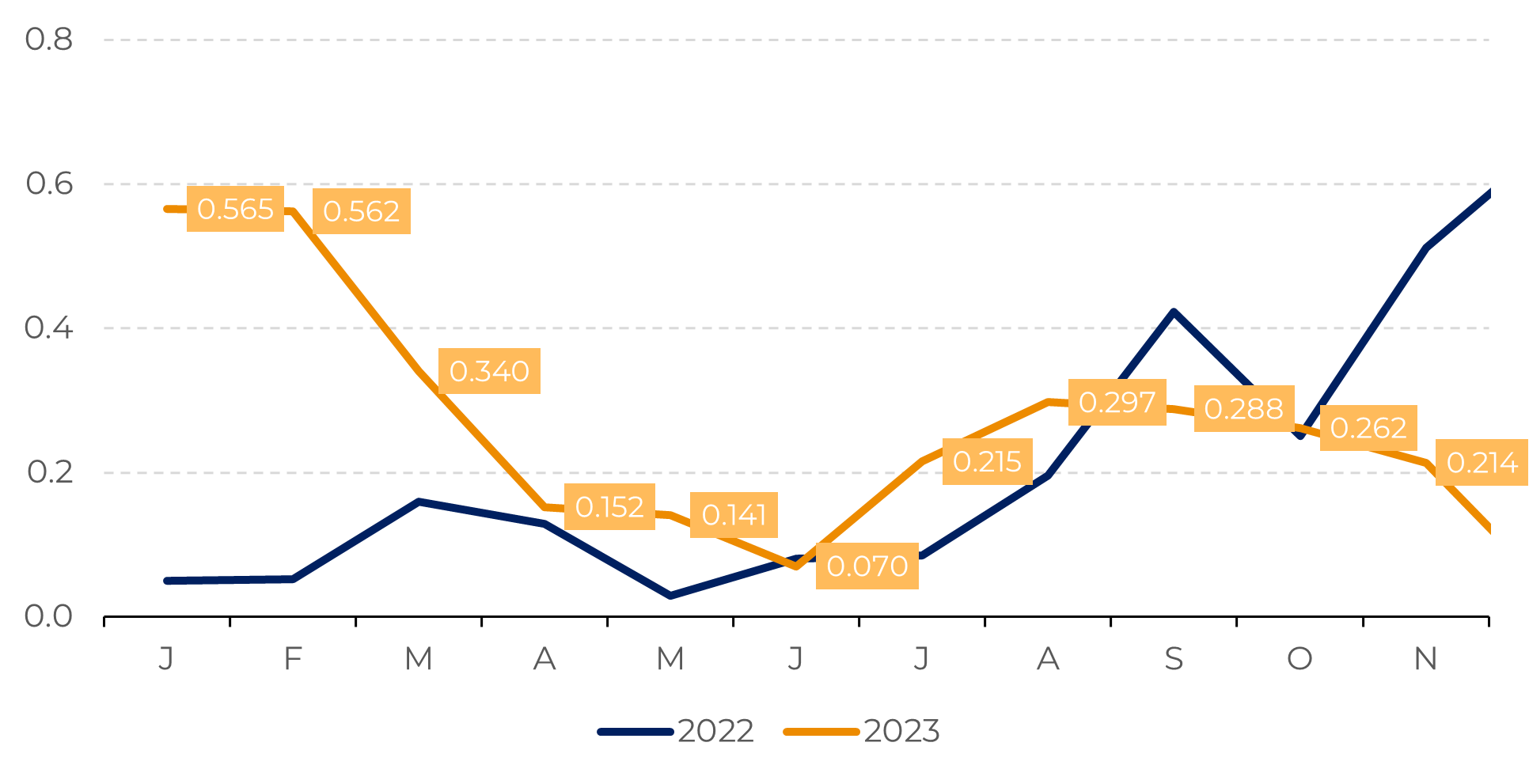

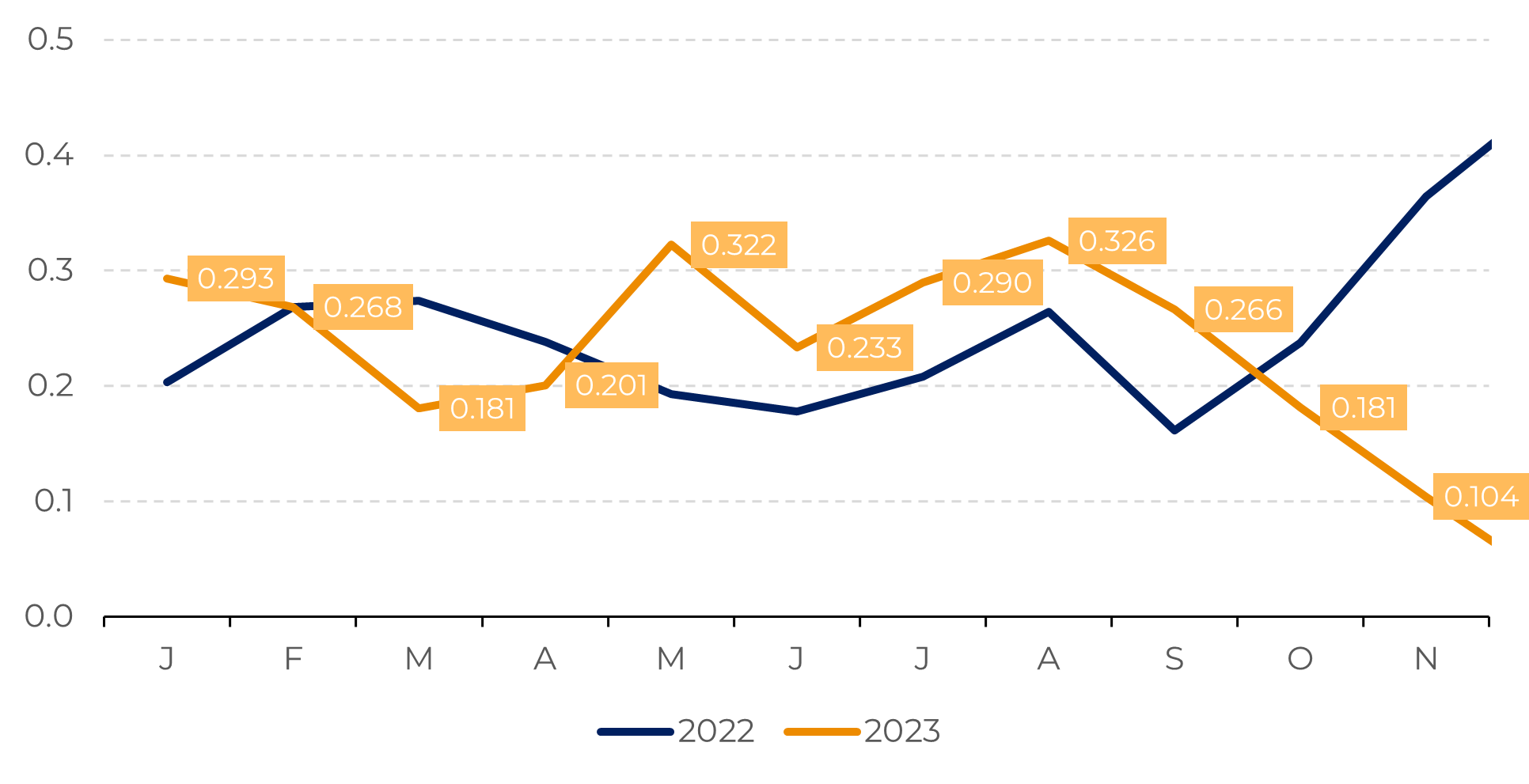

While

the pandemic's restrictions previously allowed China to use its refining

capacity to meet external demand, leading to a surge in exported petroleum

products in 2022, this scenario is unlikely to persist this season. Several

factors contribute to this: Beijing's prioritization of domestic needs,

resulting in reduced export quotas, coupled with declining global profit

margins for these products, reducing the incentive for outward shipments of

gasoline and diesel.

Image 1: Gasoil Exports – China (M bpd)

Source: Refnitiv

Image 2:

Gasoline Exports – China (M bpd)

Source: Refinitiv

Consumption of transport fuels grows in China, but is losing momentum

Not only have crude oil imports in the country reached record levels, but there has also been a substantial increase in the demand for transportation fuels, specifically gasoline (+17,18%) and jet fuel (+131,17%) when compared to the previous year. Having said that, one would expect a more bullish market for oil, at least when it comes to China demand, but that is not the case.

Image 3: Crude Oil Imports – China (M bpd)

Source: Bloomberg

Much of the increase in the consumption of petroleum-derived products is associated with suppressed demand from an extended period of lockdowns in the country. It is natural that this year's reopening would provide a boost in demand, but the question remains: will it be sustained into 2024?

Image 4: Growth Apparent Demand for Transport Fuels – China (%)

Source: Bloomberg. Note: Apparent demand is calculated by deducting net exports from production (apparent demand = production + imports - exports)

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

pedro.schicchi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.