Energy Weekly Report - 2023 12 26

Angola's departure from OPEC signals the fragility within the oil supply organization

- OPEC became a smaller group, with 12 members, following Angola's departure.

- Angola wants to increase its production since its economy relies on oil exports, but it will face challenges.

- Furthermore, Angola's departure exposes the group's vulnerability and weakens Saudi Arabia's leadership.

Introduction

The current situation in the energy complex is challenging for countries dependent on oil revenue, particularly those participating in the world's largest oil-producing and exporting alliance – OPEC+.

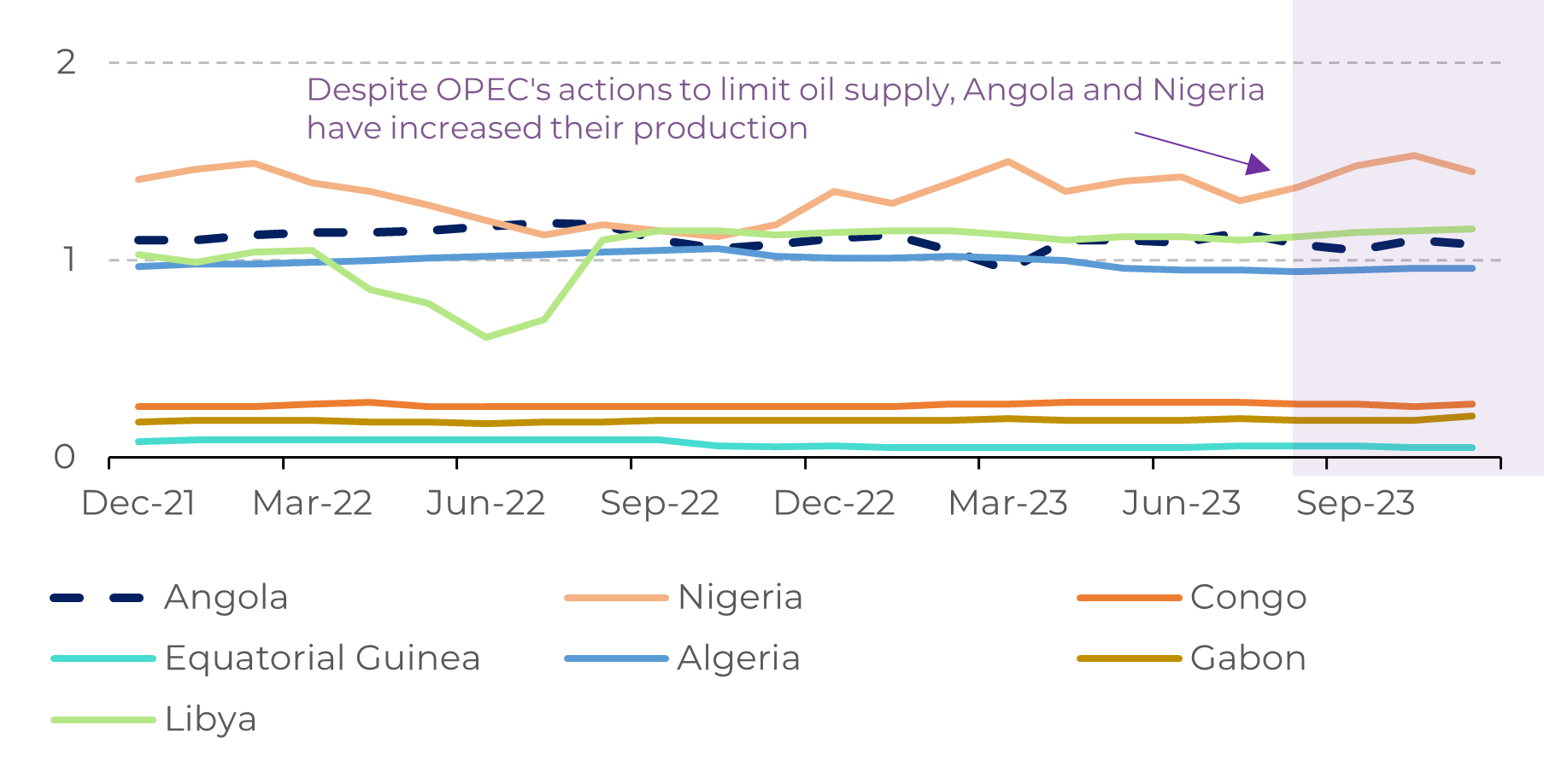

While countries like Saudi Arabia aim to demonstrate the organization's unity in reducing global oil supply to bring, in their words, stability to oil price volatility, other nations seek to increase their market share, especially African countries like Angola.

Furthermore, the last organization meeting was marked by a delay, a result of internal disagreements regarding each country's production quotas. Since then, the market has reflected lower expectations for a deficit in the supply of oil.

Not only are there bearish signals emerging from the commodity supply, but also on the demand side there are many concerns. U.S. continues to accumulate stocks of refined products, a sign that refineries may need less oil in the coming weeks, in addition to the risks of lower demand in China and Europe.

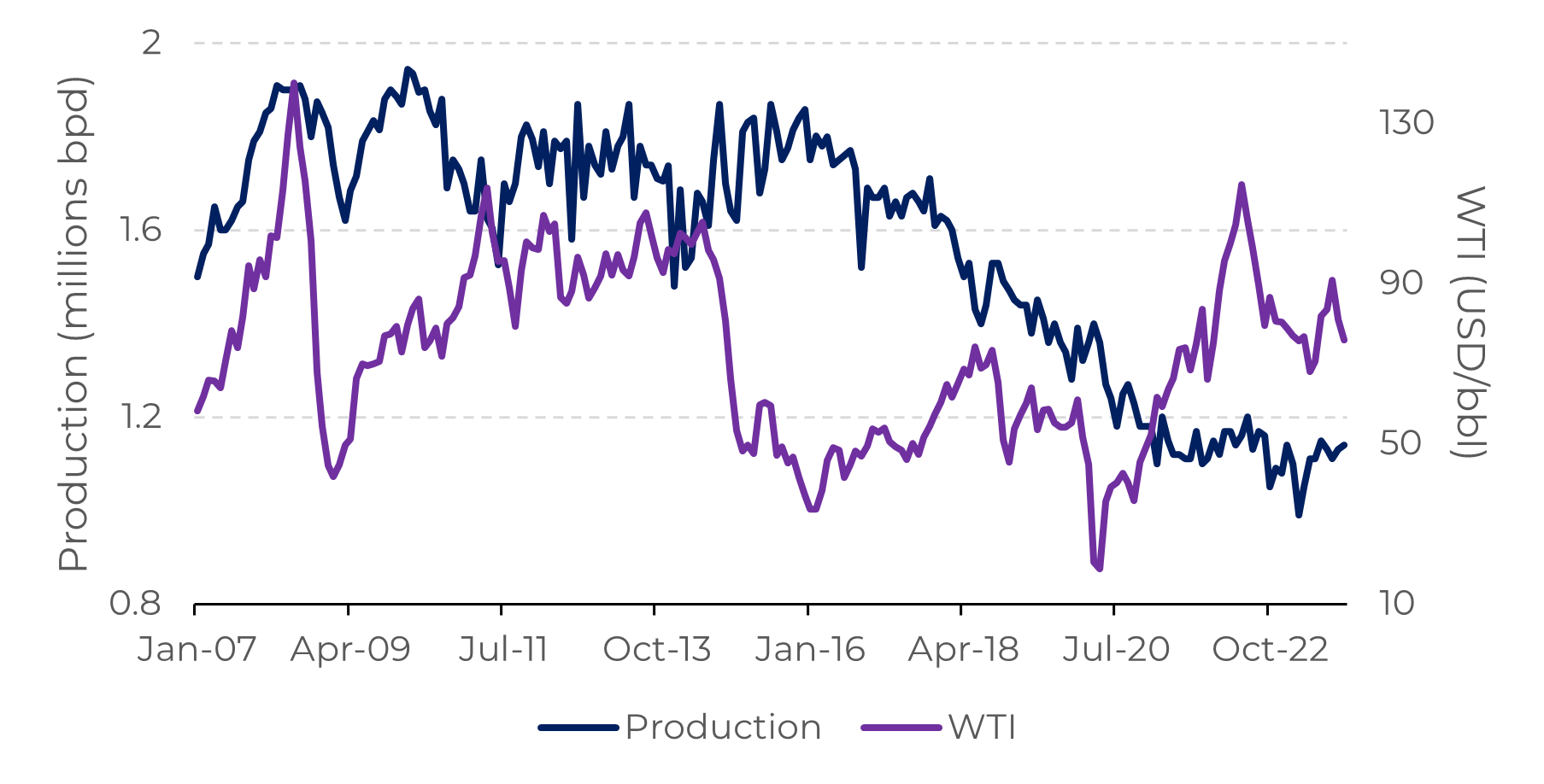

Image 1: Angola Crude Oil Production (millions bpd) vs WTI (USD/barrel)

Source: Bloomberg

Image 2: Crude oil production African Members (millions bpd)

Source: Refinitiv

What are the reasons for Angola's exit from OPEC?

Let's understand a bit about the context in which the country found

itself. Angola joined OPEC in 2007 when the country's production was around 1.9

million barrels per day (bpd). Today, the country produces 1.1 bpd,

approximately 45% less than its peak over 15 years ago. The reasons range from

a lack of investment to the absence of new oilfield developments. Also, during

this period, to further complicate oil exploration for the country, oil prices

fell significantly, only rebounding to higher levels in 2022.

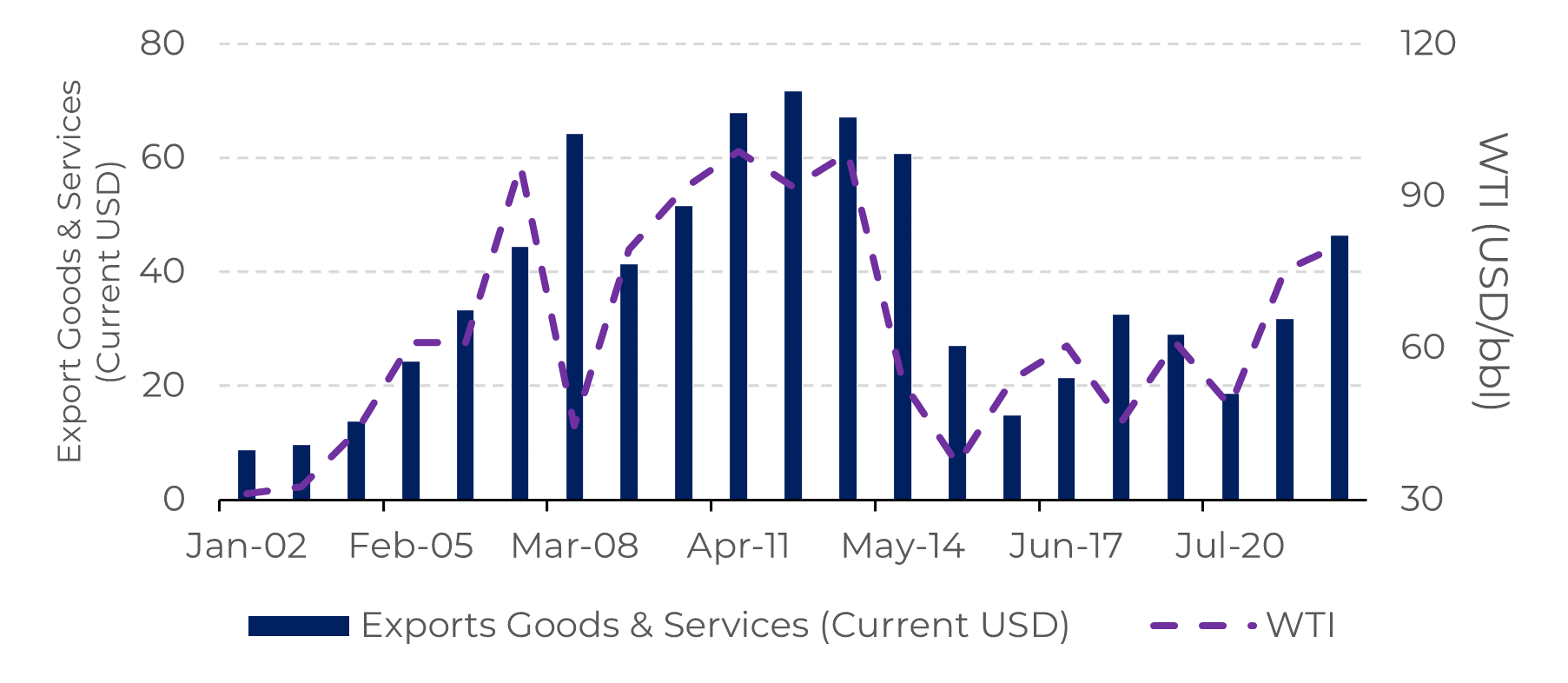

Image 3: Angola's Export Goods & Services and Crude Oil Prices

Source: IMF

Since approximately 90% of Angola's exports in 2022 consisted of oil and

gas, the country is heavily reliant on crude oil production. While the government

seeks to diversify the economy, oil is likely to remain the country's primary

export commodity in the near future.

Now, in practical terms of supply and demand, what changes with Angola's

exit from OPEC? Not much...

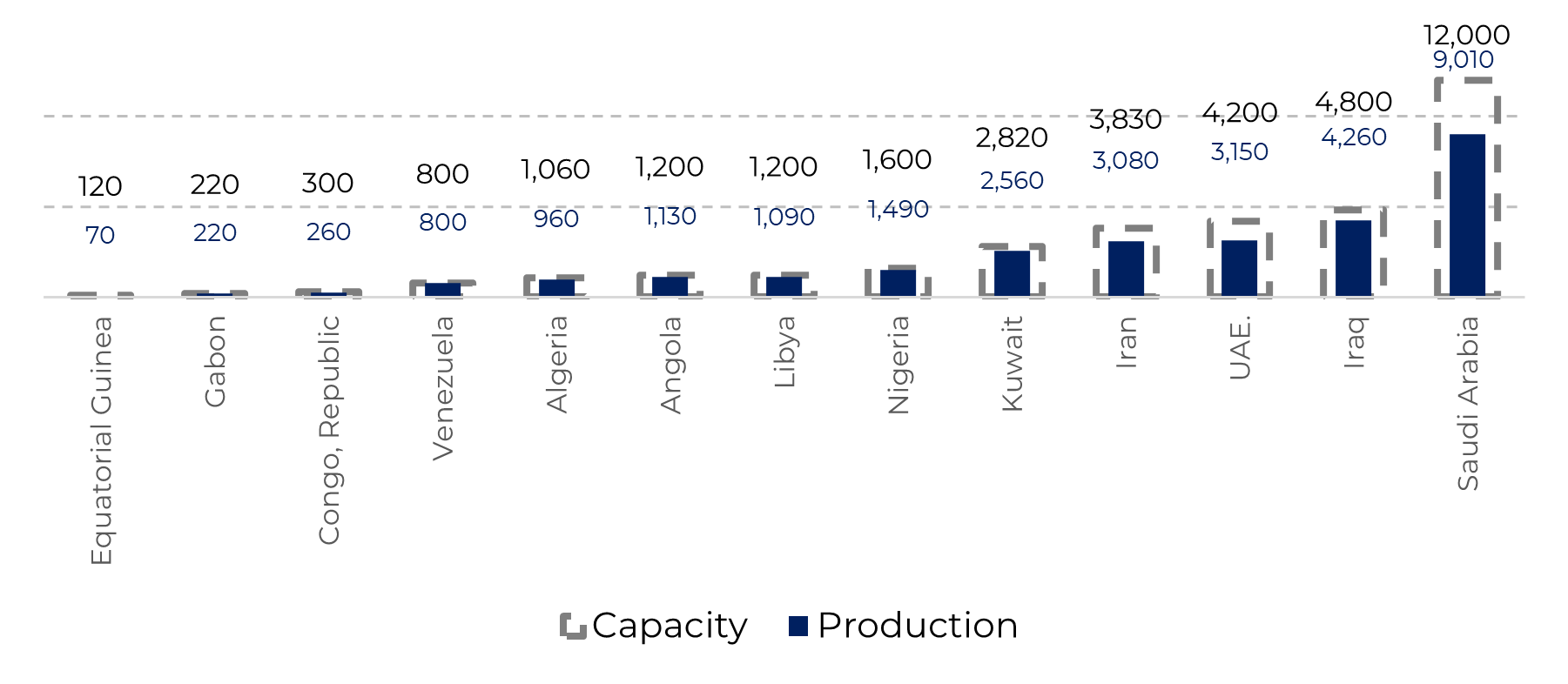

Even if Angola seeks to increase its production, the country faces many challenges. First, the country's output is very close to capacity, so there is no idle space that the country could activate at this moment. Looking over the horizon, attempting to expand its capacity depends on a lot of investment, something that the country does not have now, and it also faces a shortage of foreign investors. Furthermore, even if it did happen, it would take some time to be realized. Therefore, Angola's exit is more worrisome for what it means than for what it results in.

Image 4: OPEC crude oil output and capacity (millions bpd)

Source: Bloomberg

In Summary

Unlike Angola, they have unused capacity that can be activated, jumping from the current 3.1 million barrels per day (bpd) to 4 million bpd, and able to concentrate investments that could raise their production to nearly 5 million bpd.

Therefore, as mentioned earlier in this article, the power of each member measured in production capacity, the UAE becomes a very influential member and desired to remain in the organization, even if Saudi Arabia needs to make concessions in the group's quota system.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com