Energy Weekly Report - 2024 01 02

The new year may bring potential bullish environment for the energy complex

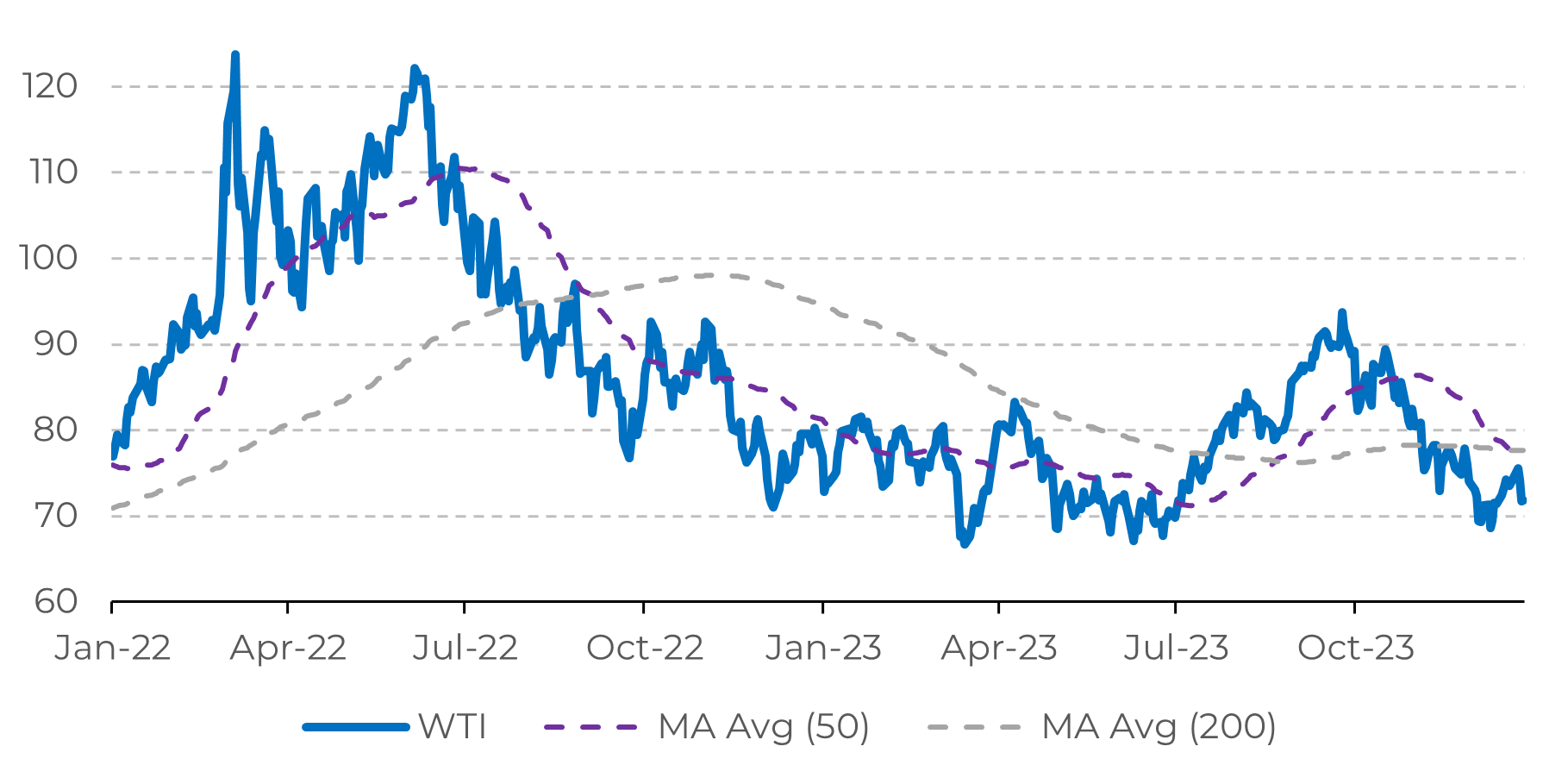

- The last week of 2023 recorded another loss for oil, with WTI falling more than 2%.

- Demand data does not boost market confidence, with significant uncertainty coming from the United States and economic disappointment in China.

- Nevertheless, 2024 could be a more bullish year, especially with the prospect of a less restrictive interest rate environment than the past year.

Introduction

The last week of the year reflects concerns about the energy sector, where fundamentals continue to raise worries due to decelerating demand, and signs of reduced cooperation among OPEC+ member countries, which could result in increased oil supply in the future. However, there are some bullish signals, which brings a prospect of correction for the main oil benchmarks in the near future.

China's crude oil consumption was below expectations in 2023

First, let's check some of the key events that have fueled this bearish sentiment for oil, which has seen significant declines in its prices since late October.

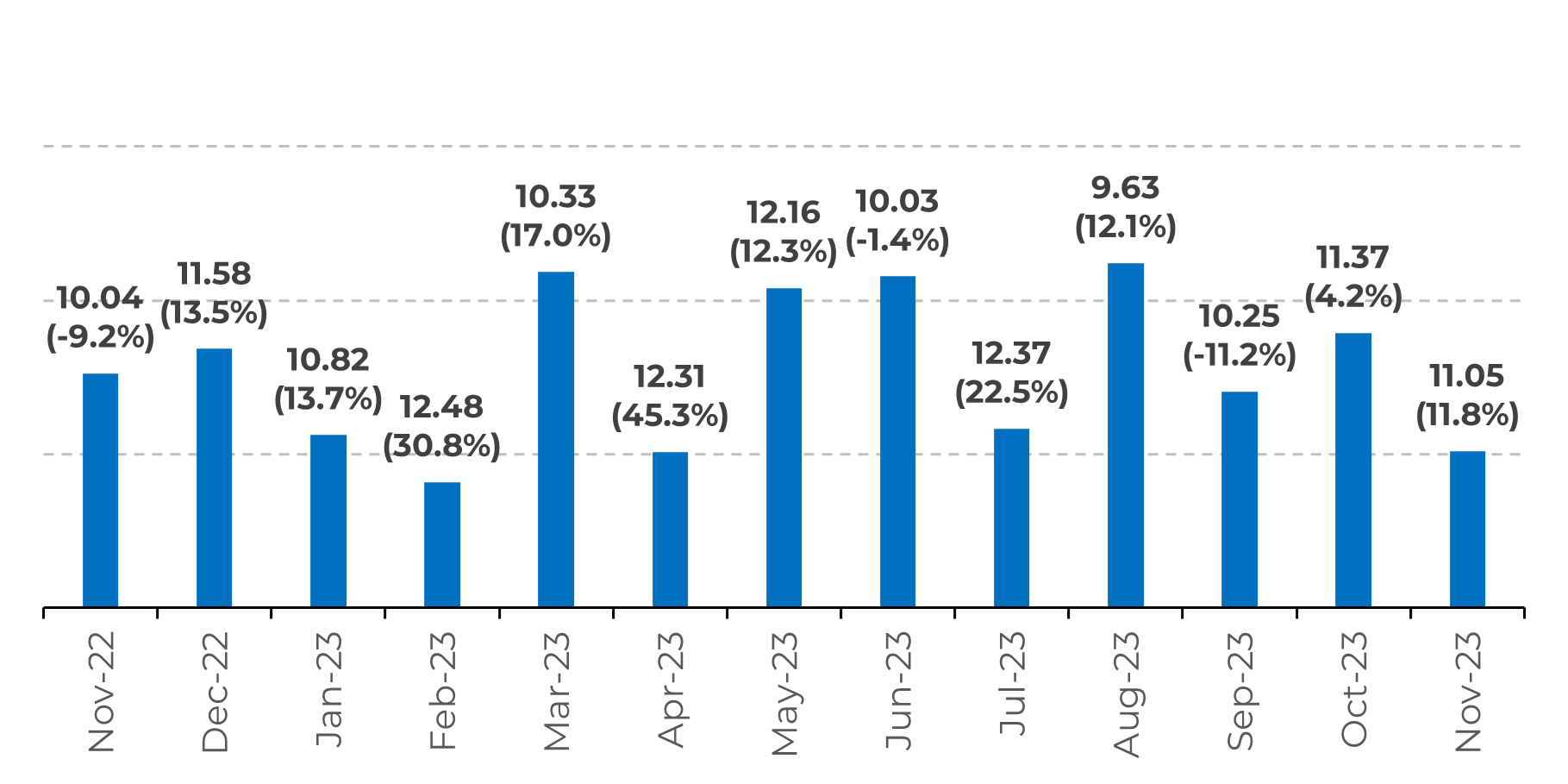

One of the major drivers of demand is China, the Asian giant and the world's largest oil importer. It was believed that the reopening of its economy this year would boost oil consumption. Indeed, the country's imports grew significantly by 12.1% in the first 11 months of the year. However, the International Energy Agency (IEA) predicted a 1.8 million bpd increase for the country, till in November, China recorded an increase of only 1.21 million bpd, below expectations.

The macroeconomic situation in China demands careful attention, although the economic issues are sometimes exaggerated by the media. There is an ongoing structural change in the country that is currently significantly impacting the real estate sector, one of the most important sectors of the economy. Additionally, deflation in the country brings insecurity for investors and consumers. Therefore, with the economy growing at a slower pace, energy consumption has also experienced slower growth.

Image 1: China - Crude Oil Imports (Millions bpd) & Growth YoY (%)

Source: Bloomberg

Gasoline consumption is rising in the United States

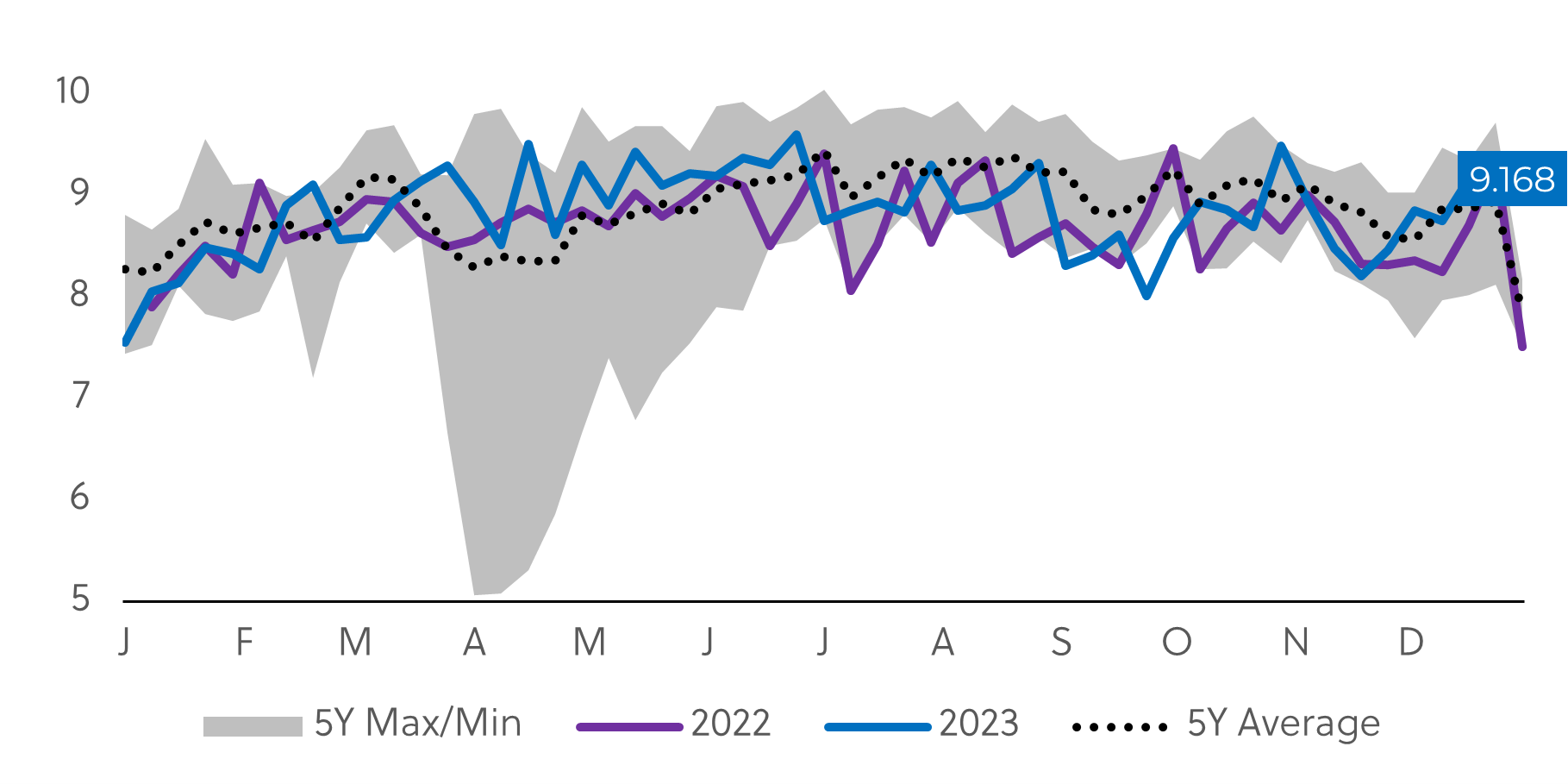

This is explained, in part, by the strong resilience of the labor market, which bolsters gasoline consumption, while high-interest rates have posed more obstacles to the industrial sector, the primary consumer of diesel. However, the overall outlook is not as bad as it seems. It's important to notice, though, that the post-pandemic recovery of the country's oil consumption has been at a slow pace.

Image 2: US - Gasoline Demand (millions bpd)

Source: Reuters

Concerns arise regarding the supply side of crude oil

The most recent of these triggers were the attacks by the Houthi militia on oil tankers in the Red Sea, apparently to harm shipments associated with Israel, but which often resulted in attacks on various ships unrelated to the conflict, supporting prices.

In Summary

Image 3: WTI Prices (USD/bbl)

Source: Reuters

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.