Energy Weekly Report - 2024 01 08

Greater supply has outweighed the effects of conflicts in the Middle East

- Difficult to predict, geopolitical tensions in the Middle East have been one of the main driving forces behind the recent increase in oil prices.

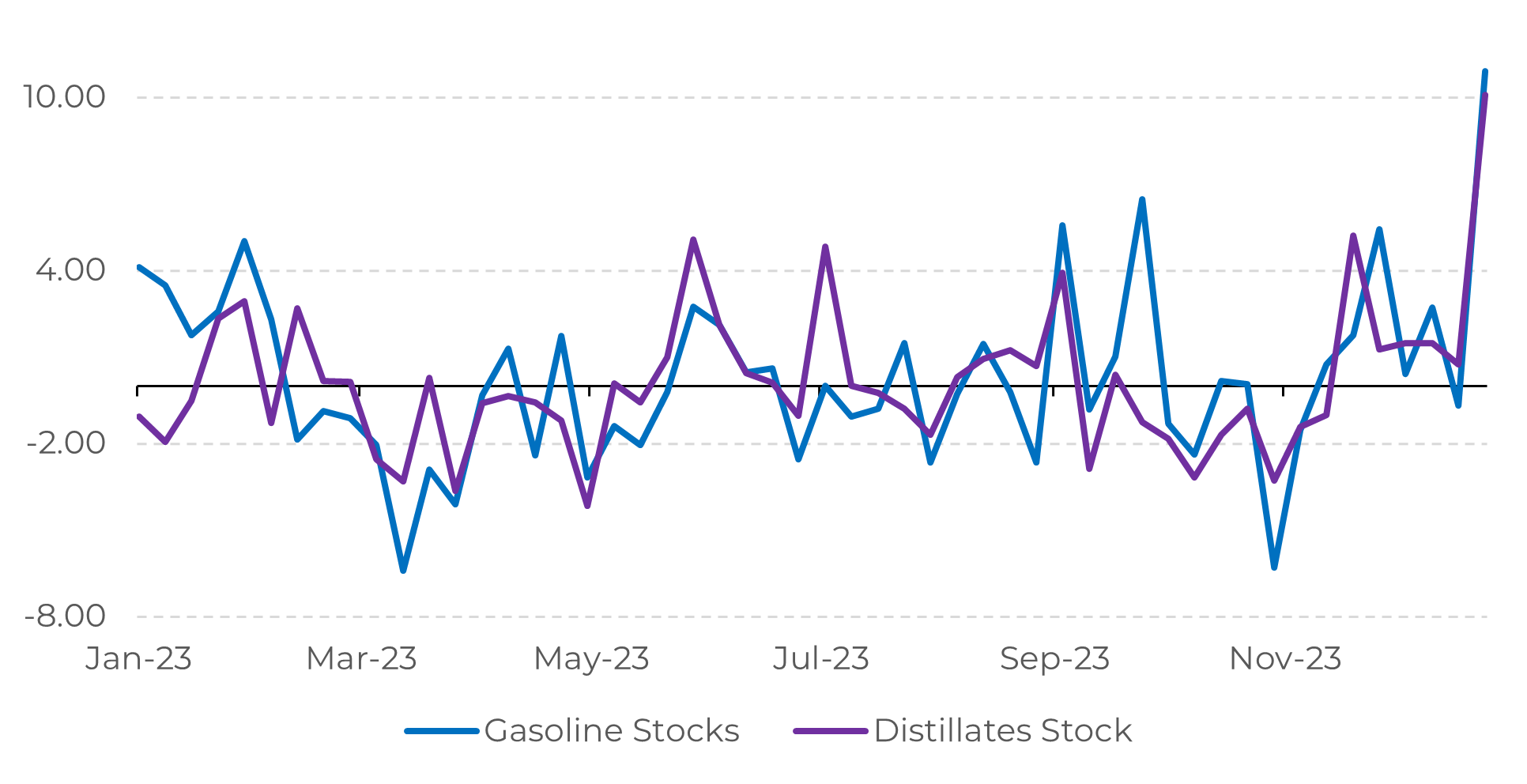

- However, demand continues to show signs of lower resilience, particularly in the United States, where refined product inventories increased significantly last week.

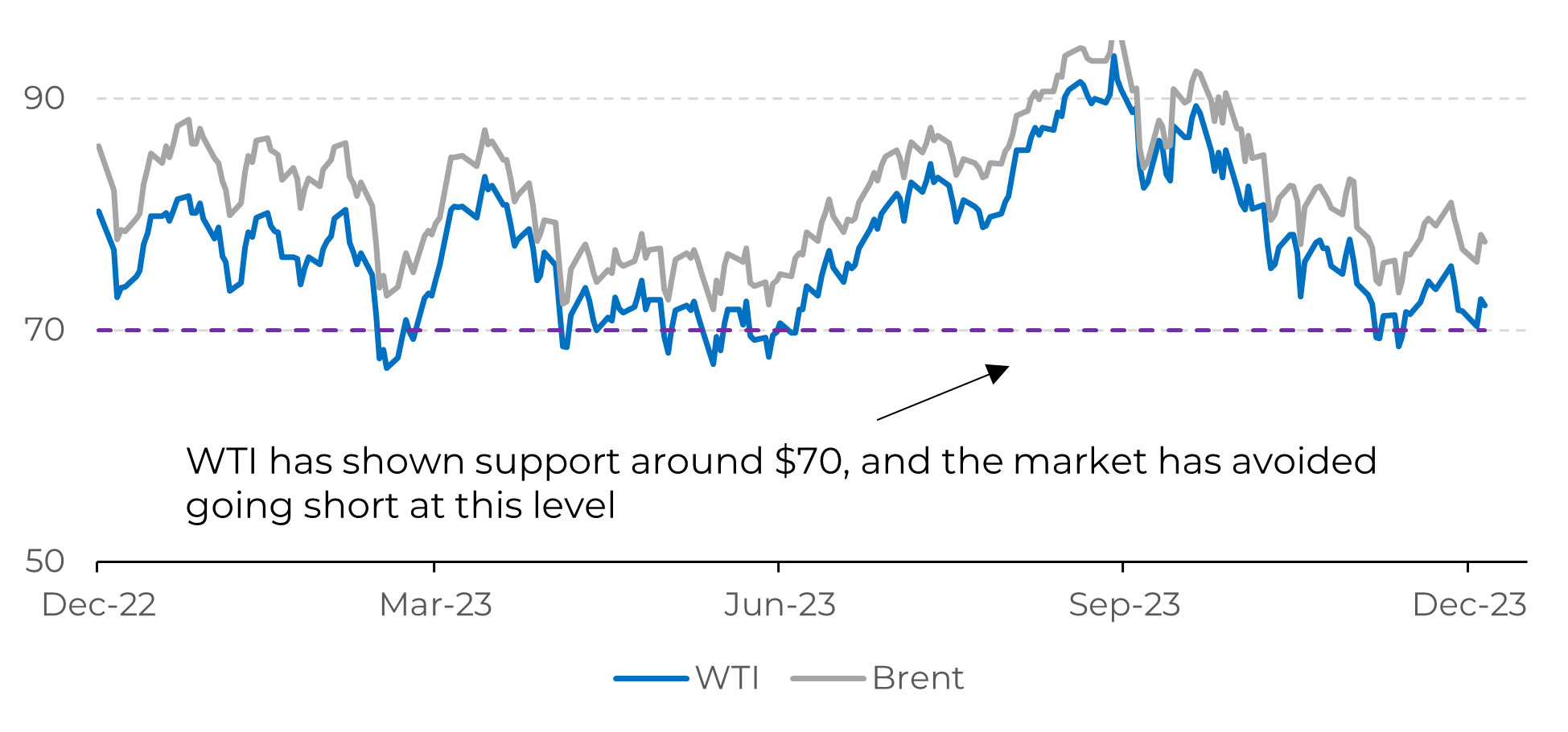

- Faced with high volatility, the market has positioned itself with WTI at US$ 70, but has found little enthusiasm for a stronger push above US$ 75 a barrel.

Introduction

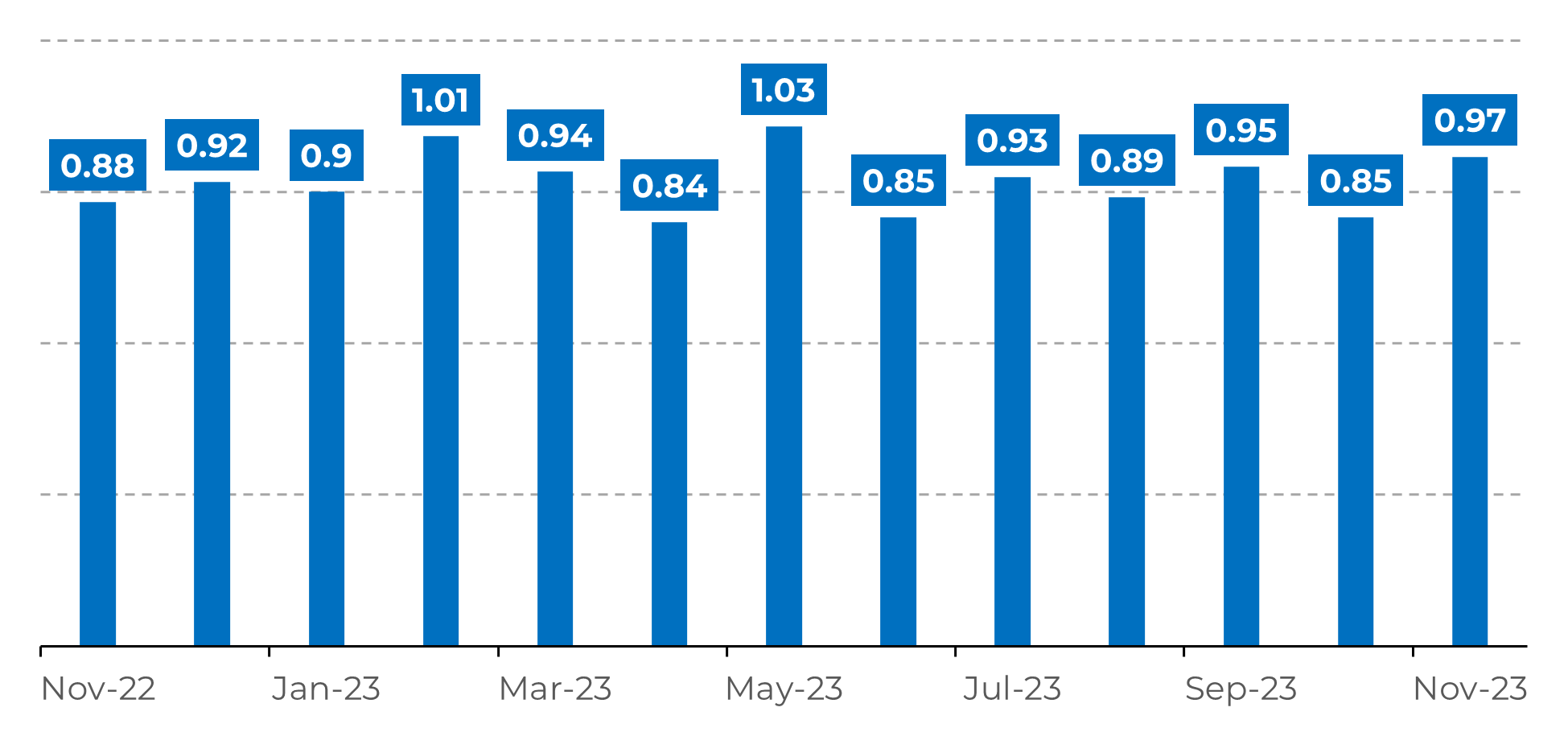

One of the largest oil fields in Libya, the Sharara field, was blocked last week by protesters in the country, leading to an increase in crude oil prices. Now, the production of 300,000 barrels of oil per day is under threat, introducing a bullish factor into the market.

Meanwhile, tensions in the Red Sea are raising the risk of disruptions to global supplies, particularly after the Iranian ship's arrival in the region. This crucial maritime route is vital for global trade and high volume of oil transportation.

Once again, traders are optimistic about a potential improvement in crude oil prices due to supply concerns. However, it is important to observe that there is a lot of uncertainty, especially in light of EIA data revealing a significant buildup in refined product inventories in the United States.

Image 1: Major Crude Oil Benchmark Prices (USD/bbl)

Source: Refinitiv

Image 2: Libya Monthly Crude Oil Exports (Millions bpd)

Source: Refinitiv

Oil prices faces volatility due to protests in Libya and escalating tensions in the Middle East

First and foremost, it is necessary to acknowledge that the political challenges in Libya are significant. The closure of its main oil field, capable of producing 300,000 barrels of oil per day, increased the risk of less availability of crude oil. Furthermore, escalating tensions in the Red Sea, stemming from the conflict between Israel and Hamas, heighten the possibility of disruptions in oil supply.

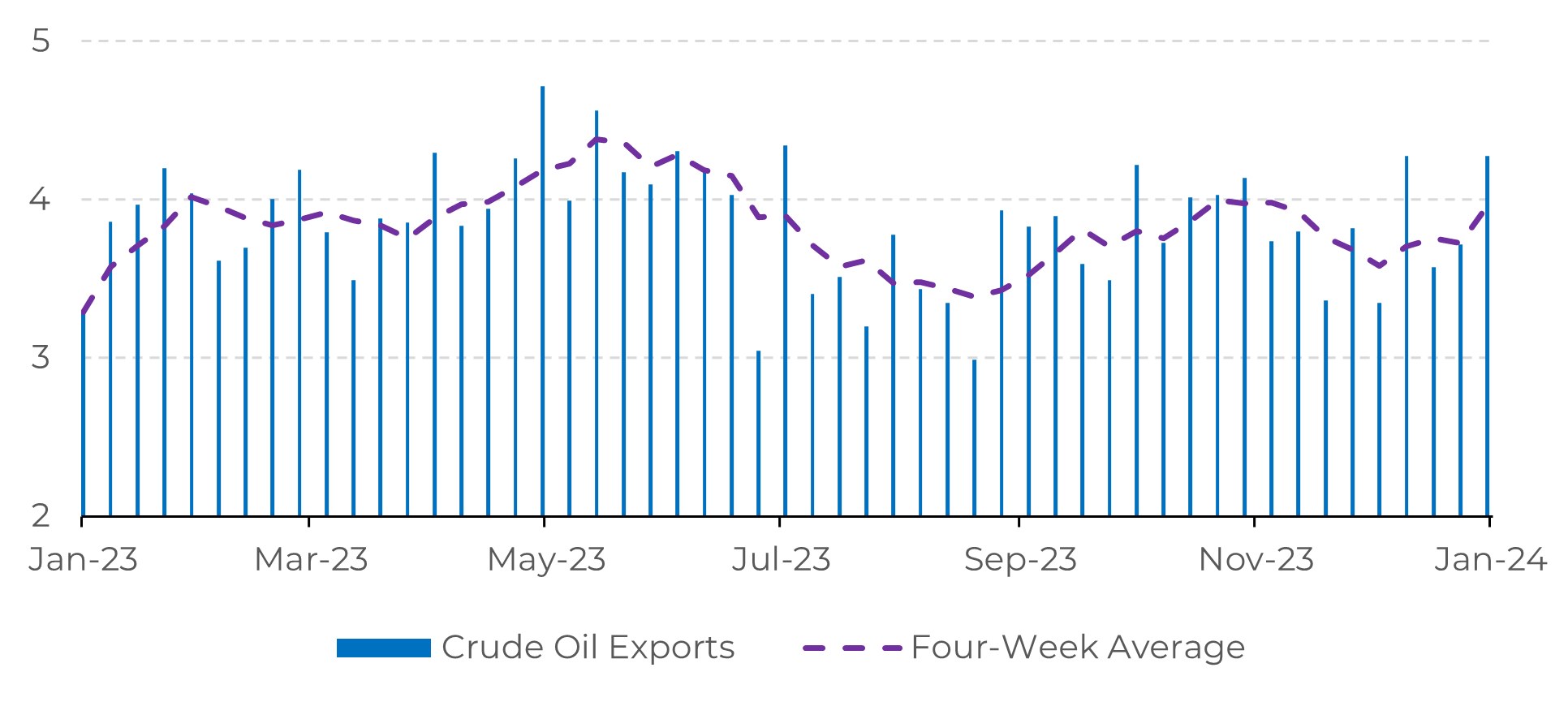

However, these events bring more volatility than confirmation for a bullish market. There is an increasing amount of oil being produced, which reduces the current market deficit and offsets the risks mentioned above. Russia exported around 3.78 million bpd in the last week of 2023, a level not seen since July. Venezuela, a country previously sanctioned by the West, increased its exports by 12% in 2023 to approximately 700,000 barrels per day.

Image 3: Weekly Russia’s Crude Oil Exports (Millions bpd)

Source: IMF

While production is increasing globally, there is still considerable uncertainty about energy demand in the world's major economies, typically resulting in more bearish sentiment over the market. For example, last week there was an increase of over 10 million barrels in gasoline and heating oil inventories in the United States, indicating that refineries may require less crude oil in the upcoming weeks.

That said, it is important to recognize that 2024 may be better. The prospect of interest rate cuts in March of this year should boost energy commodities. Since the energy complex generally reflects macroeconomic trends, a less restrictive monetary cycle will be a supportive factor for prices. Furthermore, the WTI's historical performance has shown strong resistance at $70, so there is no evidence to suggest that oil will fall to much lower levels than the current ones.

Image 4: US - Weekly Change Change (millions bbl)

Source: Bloomberg

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.