Energy Weekly Report - 2024 01 15

The economic environment in 2024 might be bullish for gasoline

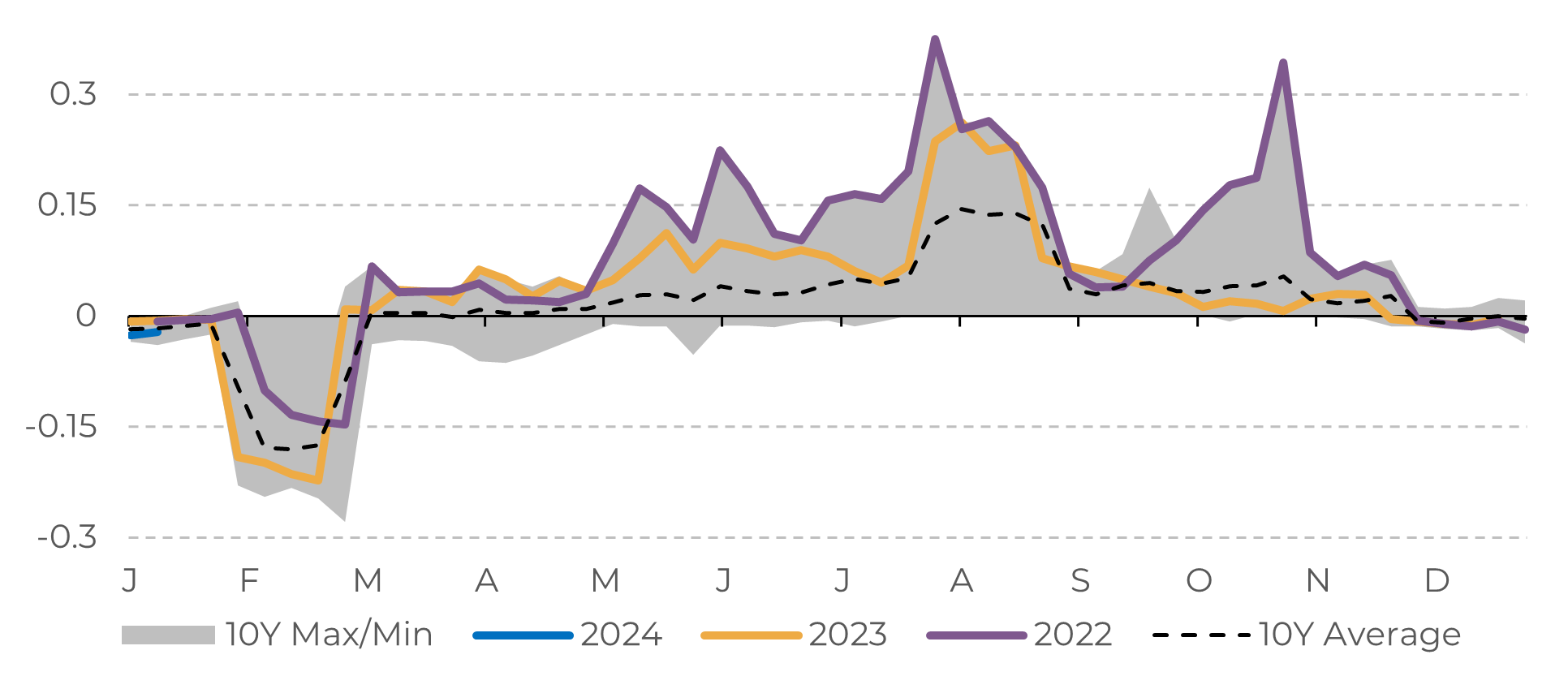

- The market has become quite apprehensive due to subdued demand data for energy commodities, reflected in lower premiums for various refined products.

- Despite significant risks, there are considerable fundamentals that could justify a bullish market for gasoline in 2024, something that is not currently being observed.

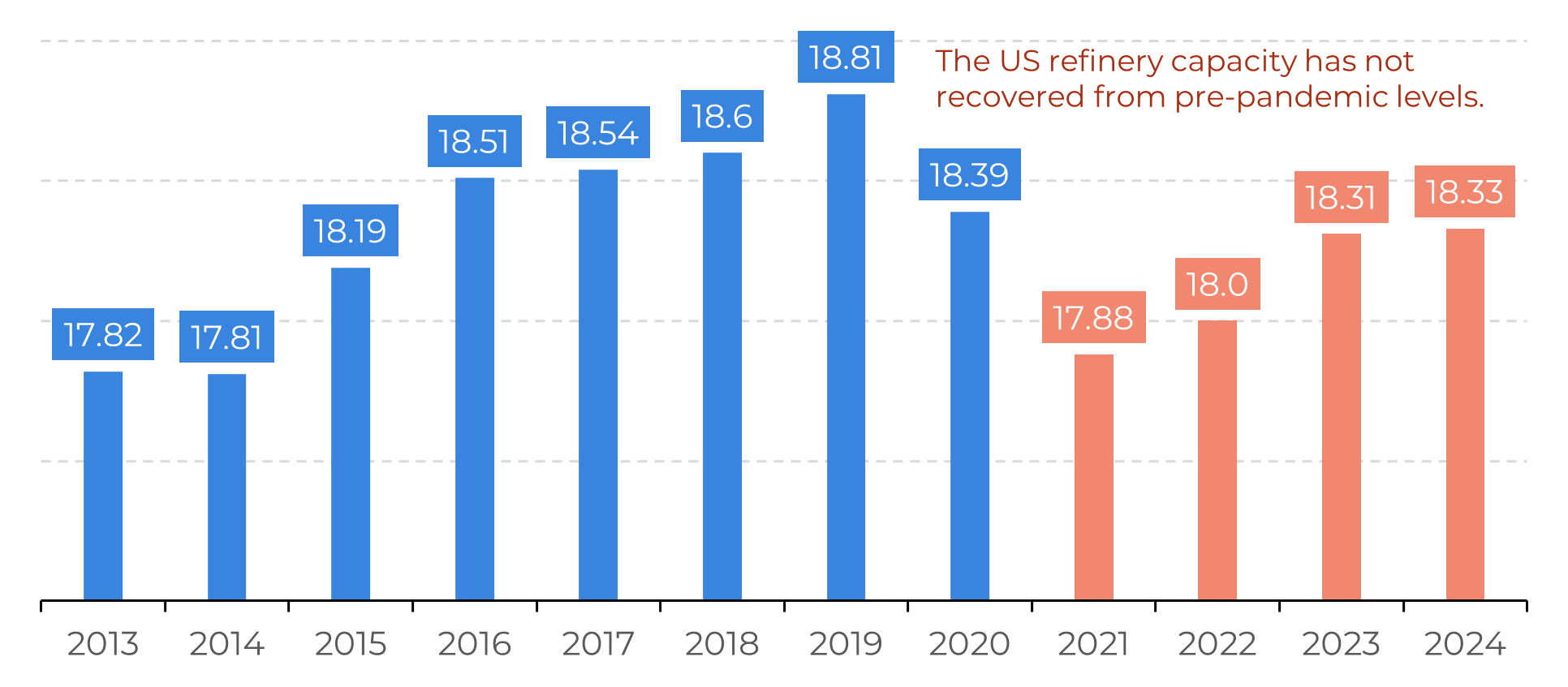

- Important to mention that the petroleum refining capacity is growing at a very slow pace, which is an advantage for current refineries. Also, this year there should be interest rate cuts, something that tends to increase energy consumption.

Introduction

The market sentiment has been bearish regarding the energy complex at the beginning of 2024. There are reasons for a more defensive reaction in energy commodities such as RBOB, but there are bullish fundamentals that are not being observed at the moment, and they could trigger an uptrend in prices.

It is important to emphasize that a "new normal" is said to have been established after the pandemic in many markets, and the energy complex is one of them. Fuels efficiency is improving, and the market is witnessing the ongoing transition of more sustainable options such as renewable fuels and electric cars, which may result in less gasoline consumption per person.

Amid this scenario, fossils have faced a limited expansion of their supply capacity, granting a significant advantage for already established refineries. The direct result of this trend is the recent backwardation observed in refined products futures, such as RBOB.

Image 1: US - Refinery Operable Distillation Capacity (millions bpd)

Source: Bloomberg

Image 2: RBOB Front-month (USD/gal)

Source: Refinitiv

Market is concerned about stock building, but is it a real problem?

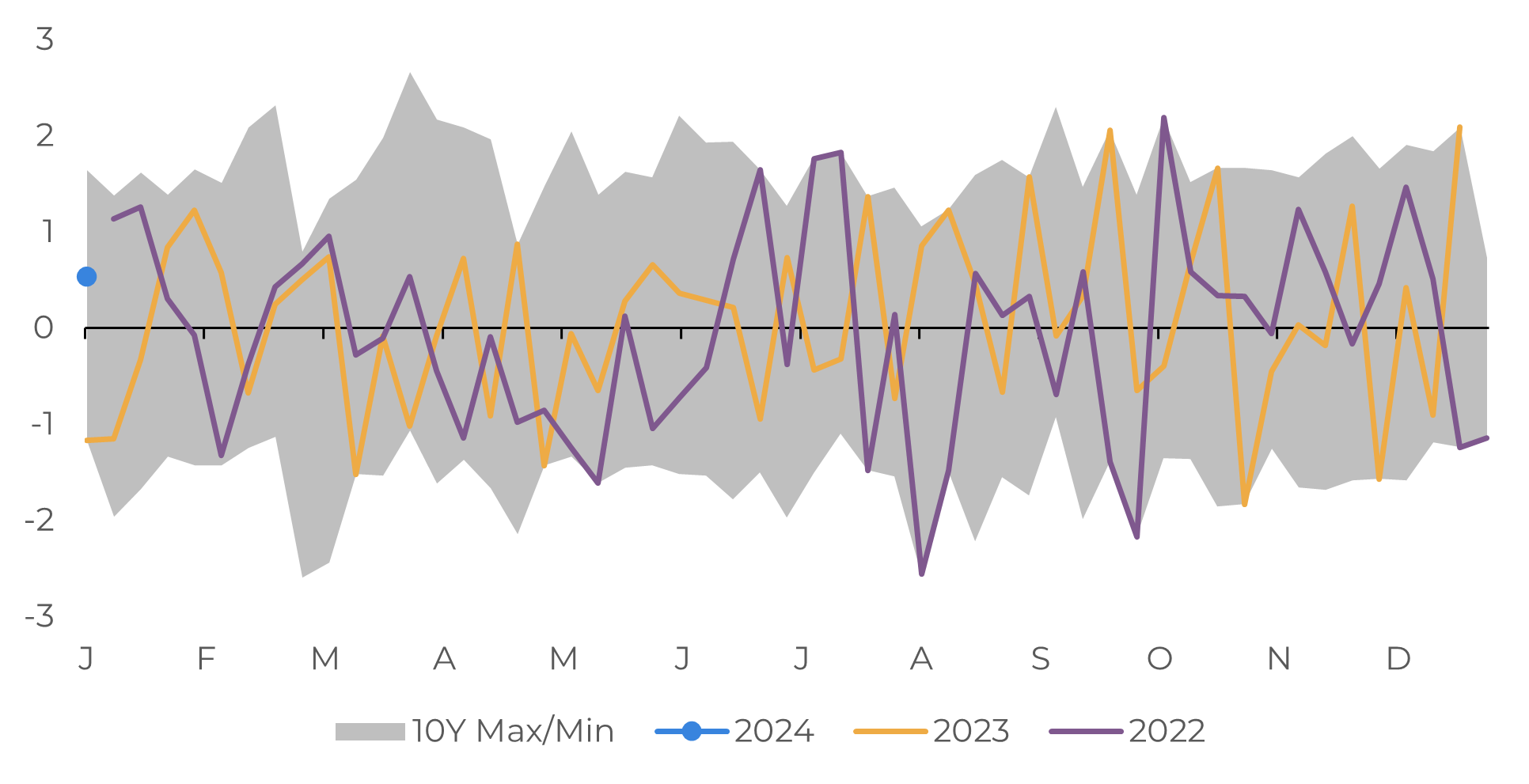

One of the most recent and concerning data was the strong rise of gasoline stocks in the last weeks, inducing a short-term correction in prices. There are reasons to be attentive, such as the export of refined products being lower than expected and a significant uncertainty regarding the economic situation in Europe, China, and US.

Nevertheless, the volume change in gasoline stocks from the end of 2023 and the beginning of 2024 within the historical background has been close to normal. One way to see this is to normalize the data to z-scores, a statistical measure that quantifies how many standard deviations a data point is from the mean of a dataset. In the example below, using a specific week, and its historical values for the same period, the z-scores have not showed a trend of abnormal stock formation. In this context, the gasoline inventories are only about 1% above the five-year average.

Image 3: US – Absolute Changes in Gasoline Inventories (Seasonal z-scores)

Source: Refinitiv, hEDGEpoint

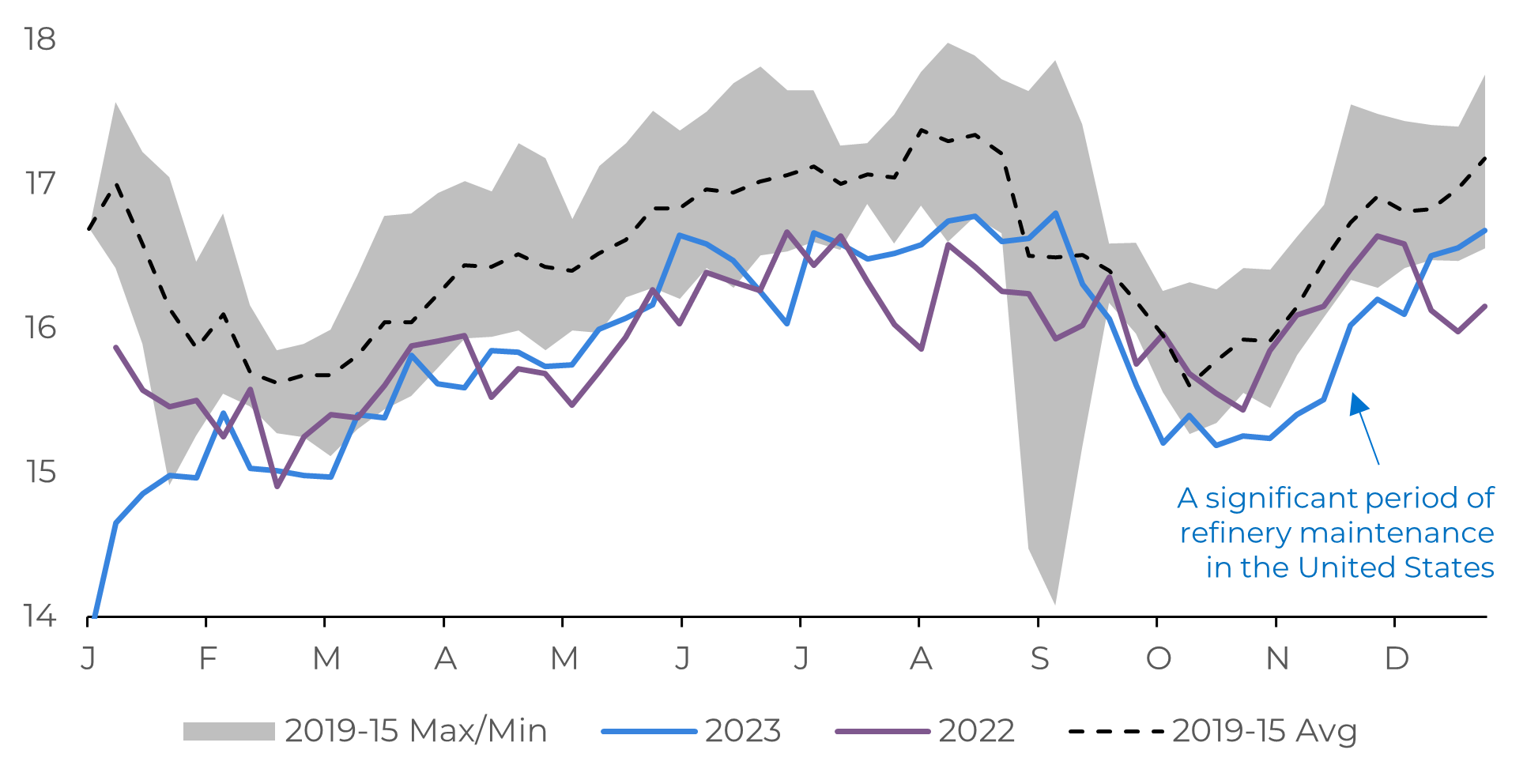

An explanation for the recent stock build-up is the increase in refining utilization, which remained inactive during a prolonged maintenance period in the fourth quarter of last year. As more oil has been processed, aiming to meet the demand for middle distillates, more light products, such as gasoline, have been coming into storage.

Gasoline cracks may not reach the levels seen in 2023 or 2022, which were extremely profitable, but margins may find room in 2024, especially if major economies avoid a recession, as is the likely scenario at the moment. A more dovish monetary policy, a resilient job market, and economic improvements are a few reasons to believe that gasoline consumption should remain high in the United States this year. Without mentioning the risks of disruptions in oil supply, a current concern in the Middle East, specifically in the Red Sea. The latter has introduced volatility to the energy complex and could potentially influence crude oil prices — the primary cost in gasoline processing.

Image 4: US – Crude Oil Input into Refineries (Millions bpd)

Source: EIA

Conflict in the Red Sea brings more volatility to the crude oil market

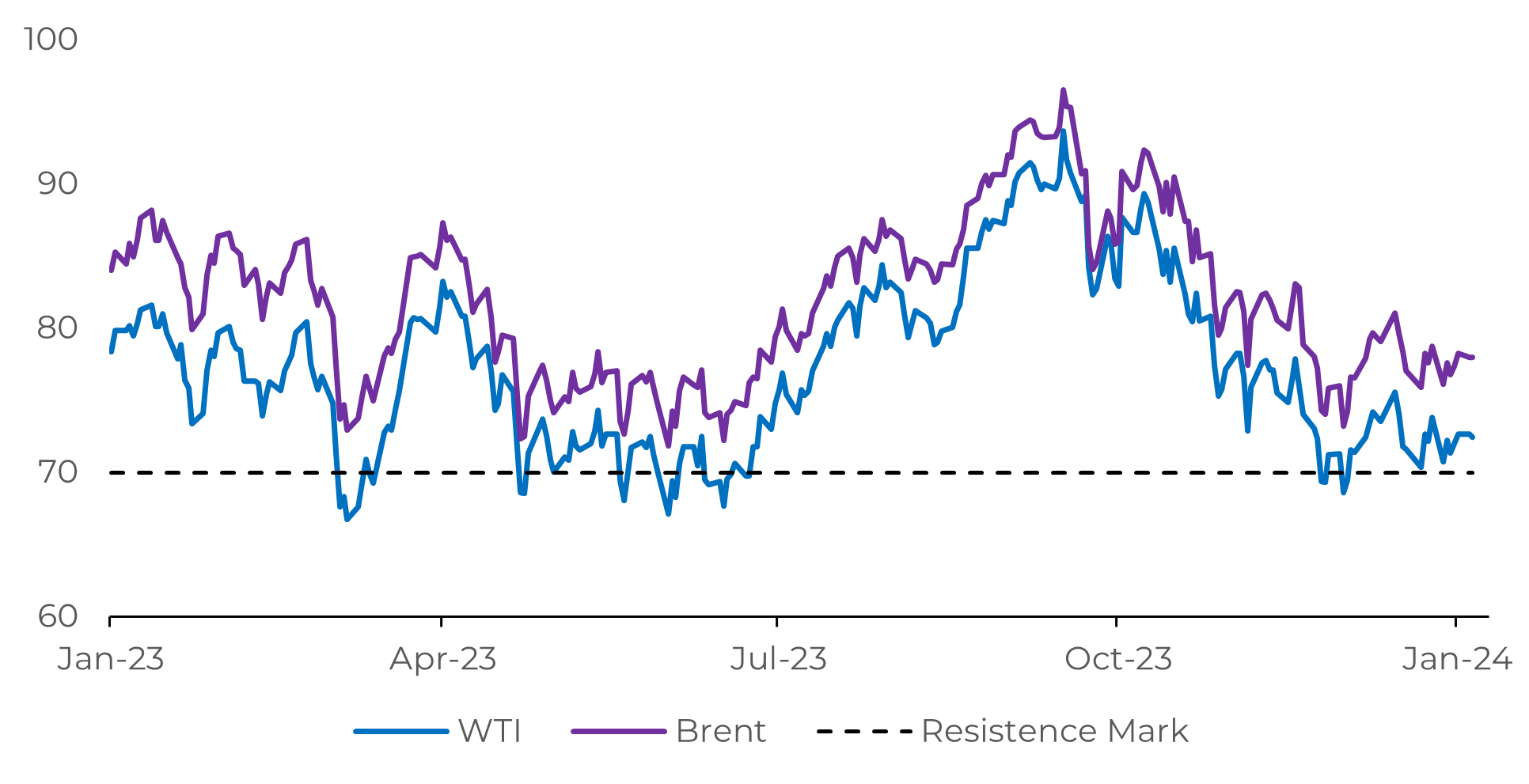

Once again, military movements in the Red Sea have brought volatility to the crude oil market, as the U.S. and British conducted air and sea strikes in response to attacks by the Yemeni Houthi militia on ships in the Red Sea.

The market's reaction was initially bullish, with crude oil prices climbing over 4% on the last day of January 12th due to supply concerns. However, the gains were later reversed, and WTI closed at 72.68 (-1.53%).

Demand concerns continue to outweigh tensions in the Middle East, but prices have find strong resistance above WTI US$ 70.00 a barrel. Furthermore, OPEC’s meeting in February could bring clues about the cut policy that will be practice over 2024, bring more support to energy commodities.

Image 5: Major Crude Oil Benchmark Prices (USD/bbl)

Source: Refinitiv

In Summary

Therefore, if a recession is avoided in the world's largest economies, which is the most likely scenario at the moment, the demand for gasoline products is expected to grow this year. Even though the profit margins may not be as high as they were in recent years, they should still be above the historical average.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.