Energy Weekly Report - 2024 01 22

In volatile markets, weather also influences crude oil prices

- North Dakota has been receiving special attention from the market; the low temperatures have been affecting oil and gas production in the state, increasing perception of tight market in US.

- Also, tensions in the Middle East continue to grow with the escalation of the Red Sea crisis and open conflict between Iran and Pakistan.

- As a result of these events, the major benchmarks closed last week with slight gains, with WTI ending at US$73.41 (+1.0%) and Brent at US$0.27 (+0.34%).

Introduction

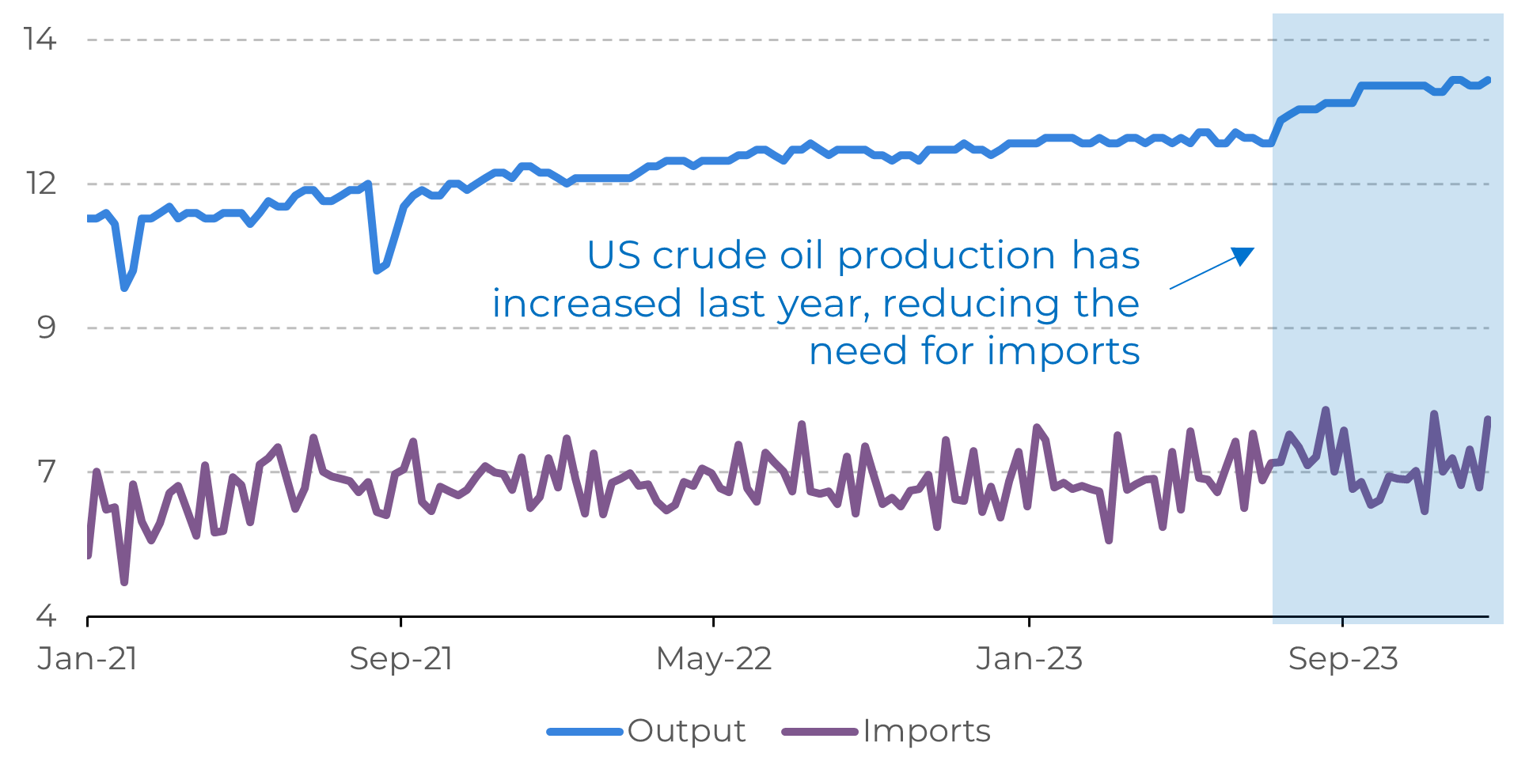

One of the major constraints against OPEC+ supply restrictions in 2023 was the increase in oil production from non-member countries, with one of the most significant being the United States. With more oil available in the country, there is less need for imports.

However, the harsh winter has reduced this availability, with North Dakota losing production by almost 650 thousand barrels per day (bpd). Additionally, tensions in the Middle East increase the sense of supply disruption risk. These two events are strengthening the backwardation in the major oil benchmarks.

Image 1: US - Crude Oil (Millions bpd)

Source: EIA

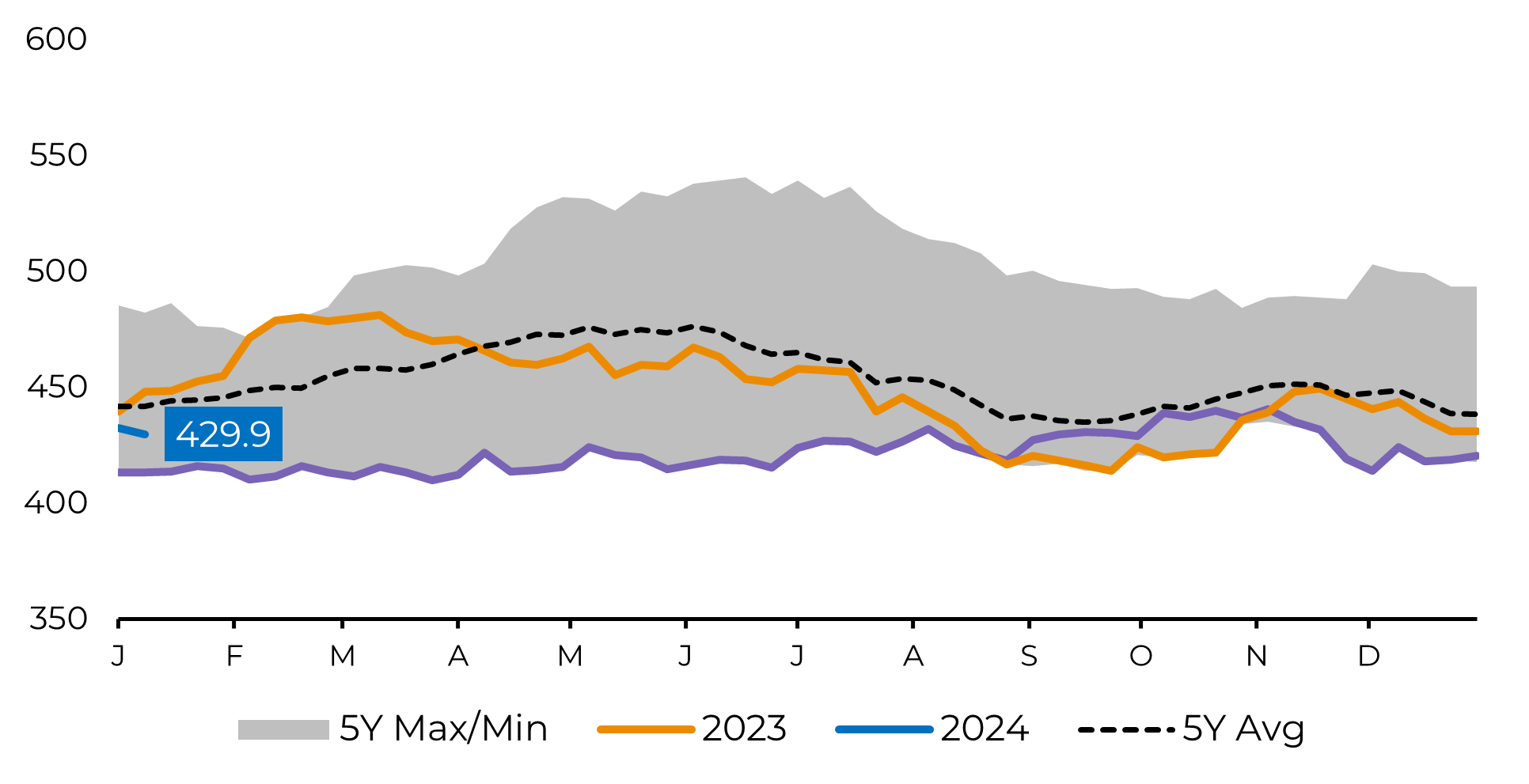

Image 2: US – Commercial Crude Oil Stocks (Millions bbl)

Source: EIA

Extreme weather affect crude oil production in North Dakota

Low

temperatures have become a new driver of volatility in the market, leading to

higher prices across the energy complex. This bullish sentiment has been

boosted by the 50% reduction in crude oil production in North Dakota,

approximately 650,000 bpd from its typical 1.24 million bpd of oil production.

Natural gas production, essential to the country's electrical grid, has also been hit hard. The cold weather froze gas wells, causing the lowest output in 11 months over the past week. Rebound to normal levels could take another month. This has led the energy balance a little bit more towards a deficit, likely pressuring crude oil stocks and increasing the withdrawals from underground gas storage in the United States.

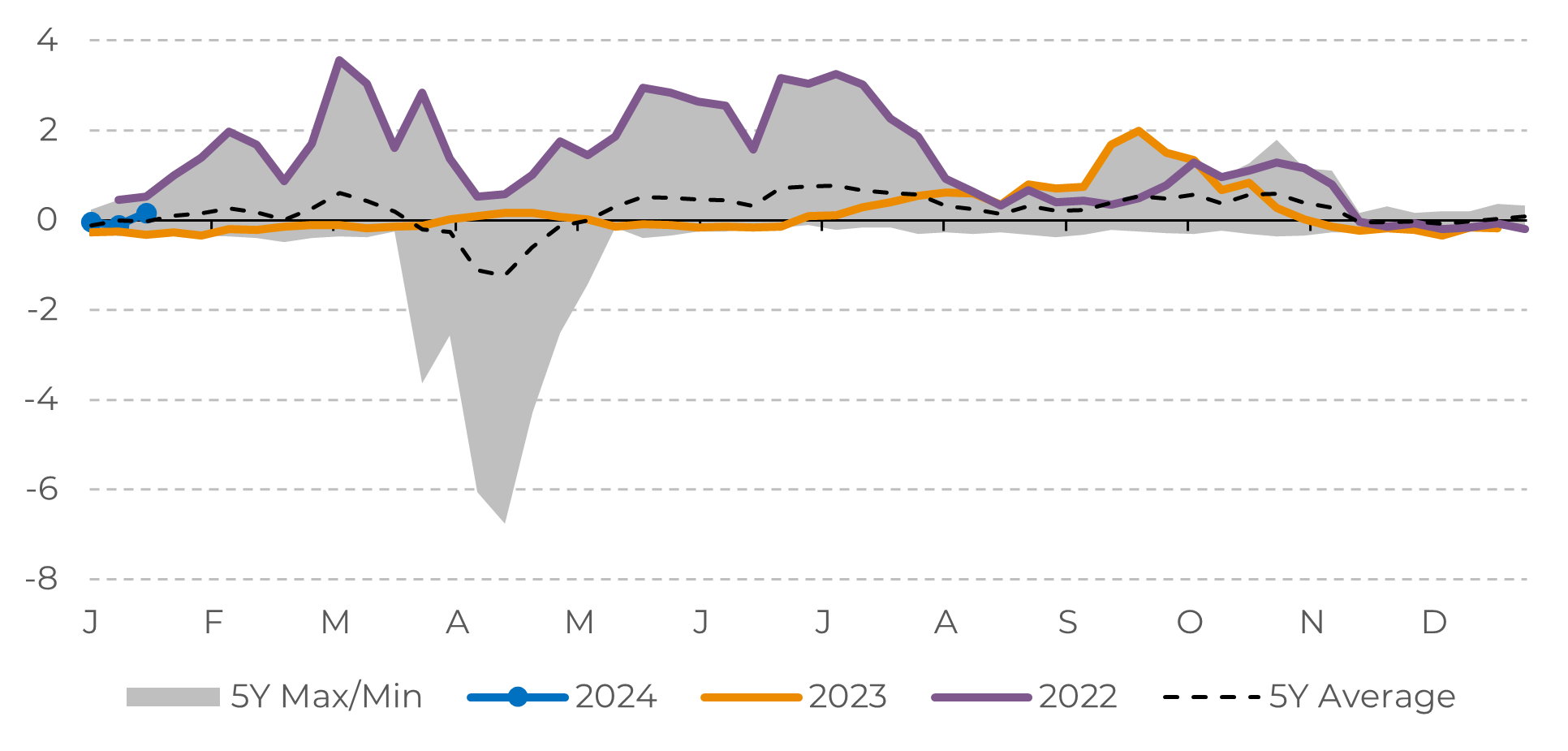

Image 3: WTI Front-Month Spread (USD/bbl)

Source: Refinitiv, hEDGEpoint

Meanwhile, as physical inventories decrease, the prices of nearby futures contracts become more expensive, known as backwardation. While WTI reflects the risks of production losses due to low temperatures, Brent has been suffering from geopolitical tensions in the Red Sea.

And here it is worth noting a significant risk to the market, if on the one hand the first should be reduced as winter ends, on the other hand conflicts in the Middle East could last longer, which may result in stronger backwardation for Brent crude oil when comparting to US crude oil benchmark.

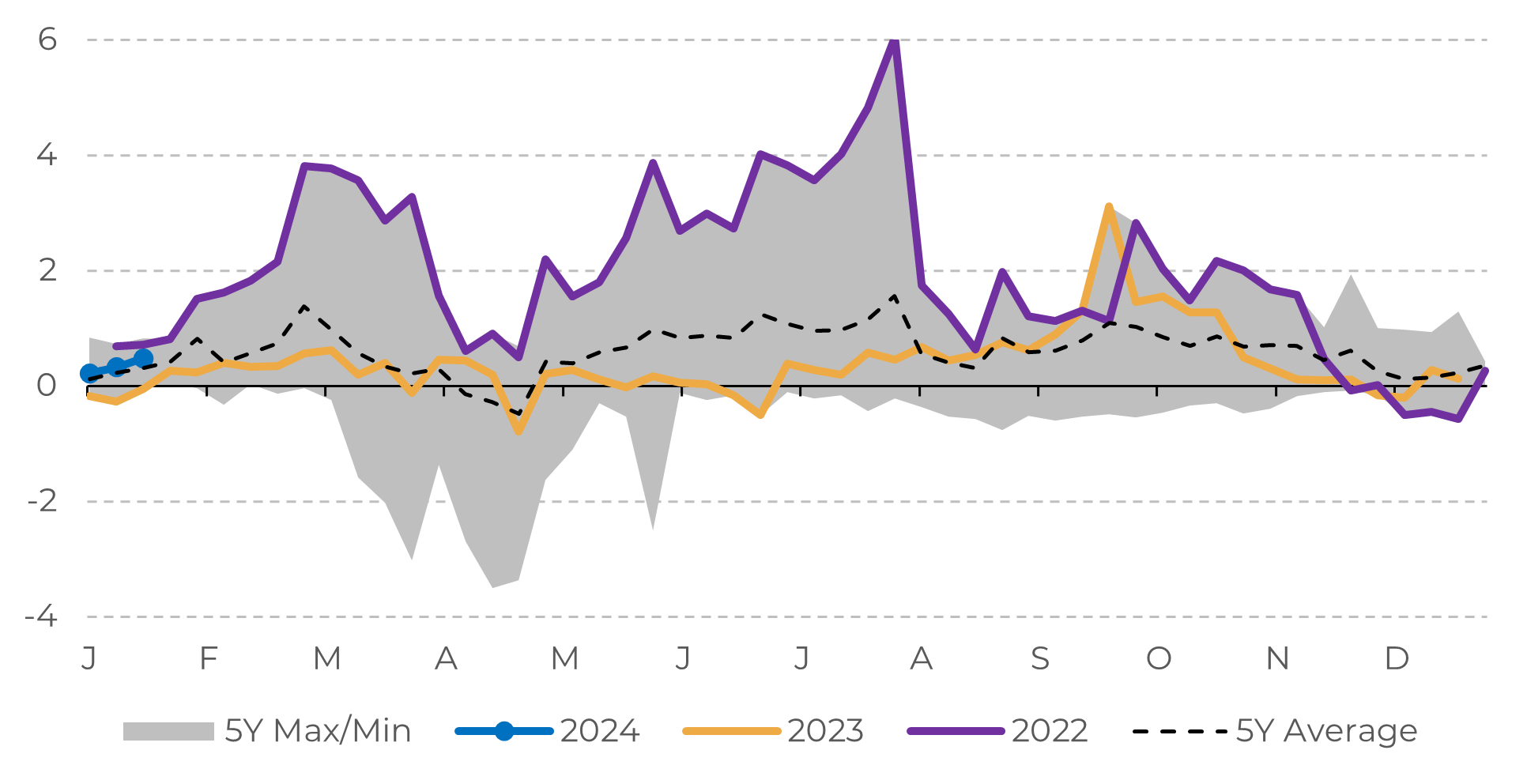

Image 4: Brent Front-Month Spread (USD/bbl)

Source: EIA

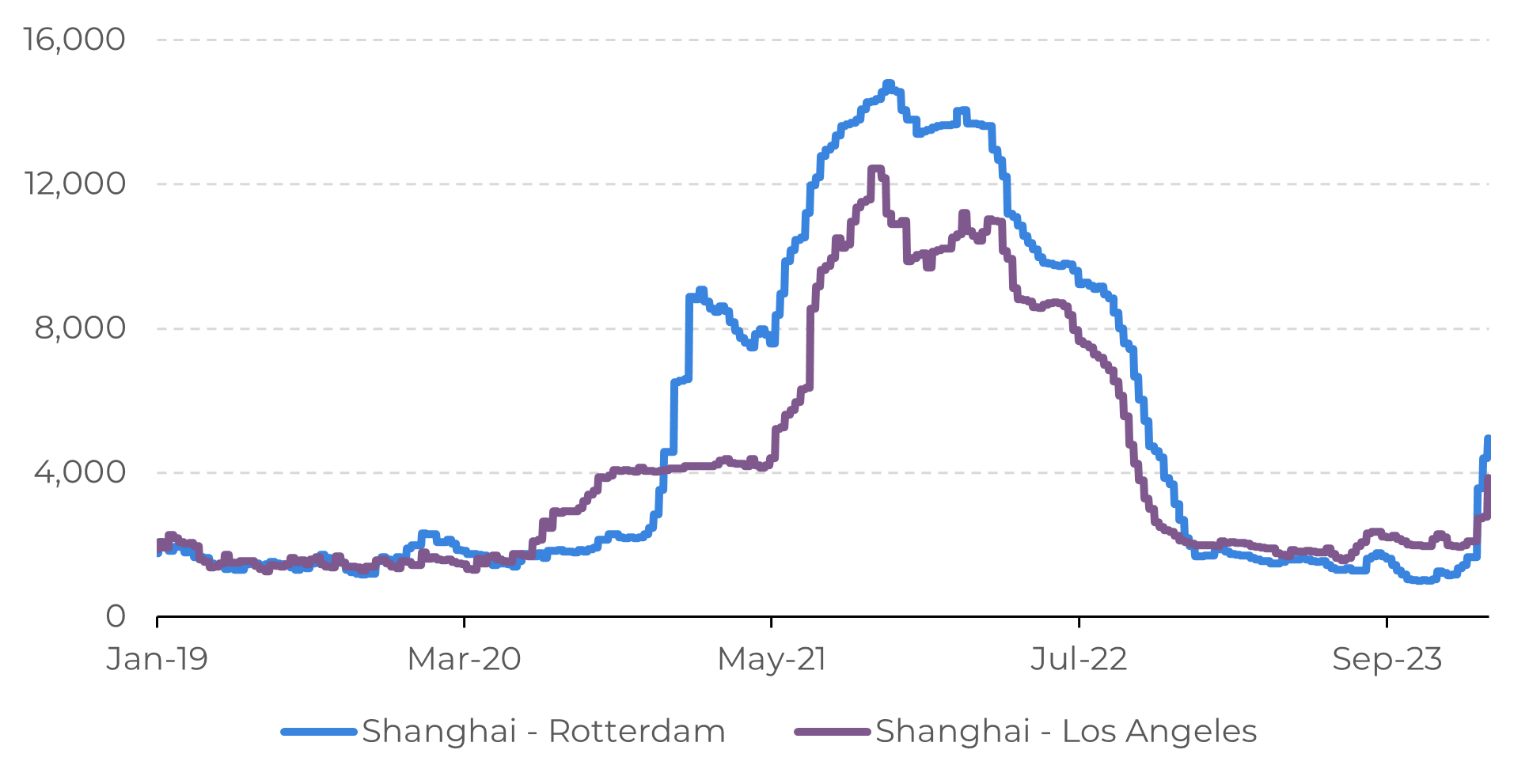

Crisis in the Red Sea increases transportation costs

Rising shipping costs are already a reality, potentially fueling inflationary pressures as a large portion of global trade relies on this crucial route. Despite most of the ships still using the route, there are companies sending their vessels to sail around Cape of Good Hope in Southern Africa, ultimately leading to more costs and longer travels.

This is affecting the competitiveness of the Brent benchmark, where the premium of the first-month contract to the second-month has risen to more than US$ 0.30 last Friday. Therefore, gradually, European refineries are seeing their margins being squeezed with rising costs. An additional challenge for a continent dealing with high-interest rates, reduced demand, and the risk of recession.

Image 5: WCI Container Freight Benchmark Rate per 40 Foot Box (USD)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.