Energy Weekly Report - 2024 01 29

India: the future of global oil trading

- The energy complex is undergoing transformations. Not only because of the possibilities of renewable fuels gaining space in the energy matrix or new technologies allowing displacement without the need for petroleum products, such as electric cars, but also because new countries are assuming a position as the main driver in the market.

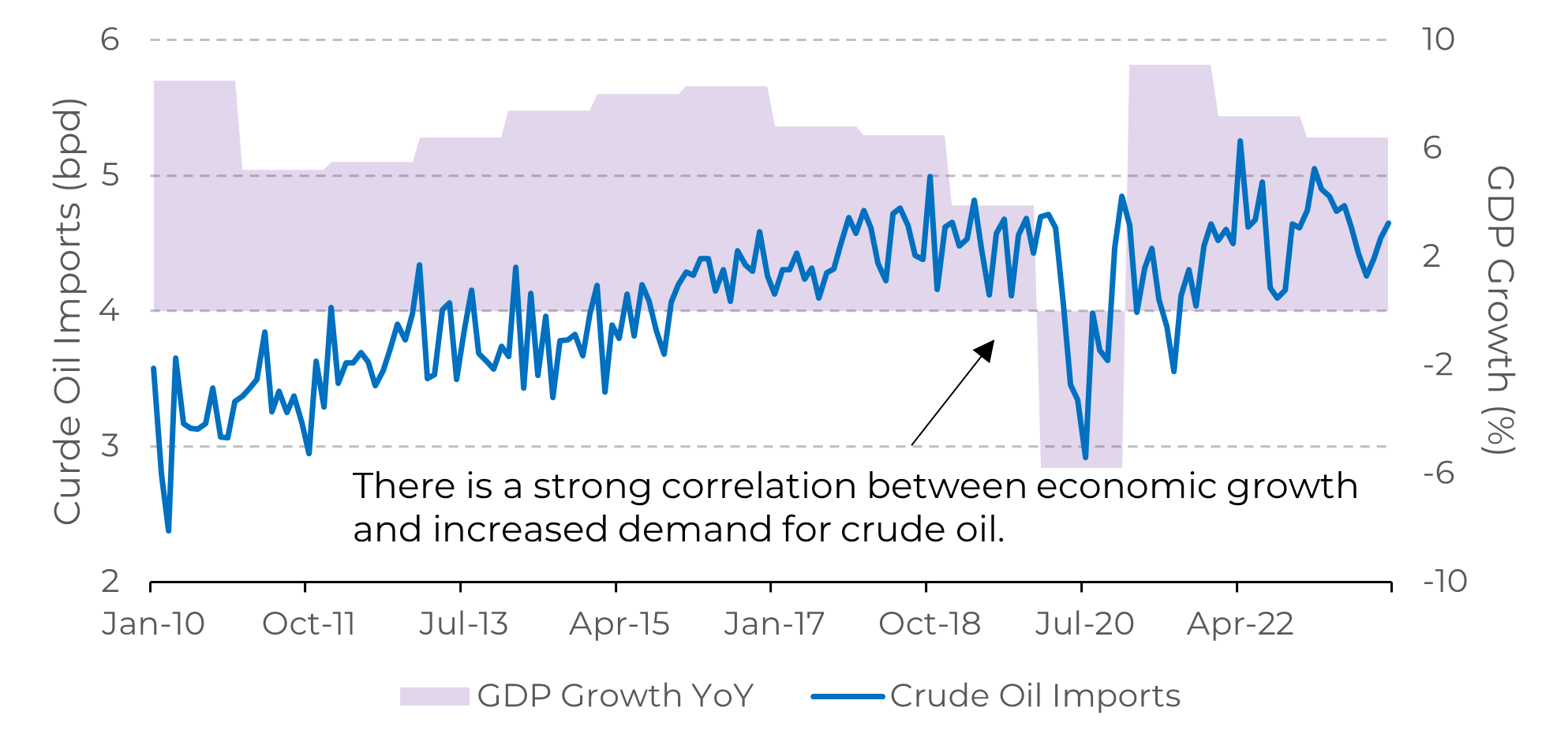

- While China has reduced its dependence on oil, due to the electrification of its passenger fleet, India has increased its energy consumption, which has resulted in an increase in its oil imports. This trend is expected to continue in the coming years, when in 2030 the South Asian country is expected to add more demand to the global energy balance than China.

- In this scenario, the expansion of its refining park will be essential to understand the pace at which the country's oil demand will grow. Despite growing rapidly, the country can adopt the environmentally friendly technologies available in the market in other countries, which could ultimately slow down its demand for fossil fuels, even as its energy demand increases.

Introduction

For many years, China has been the leading driver of global oil demand. As the world's largest oil importer, economic data from China has always provided important insights into the global energy balance. However, this is changing as more electric vehicles fill the streets of the world's second-largest economy. Now, India, the world's fifth-largest economy with projected growth of 7.3% in 2023, is gradually gaining relevance in crude oil markets.

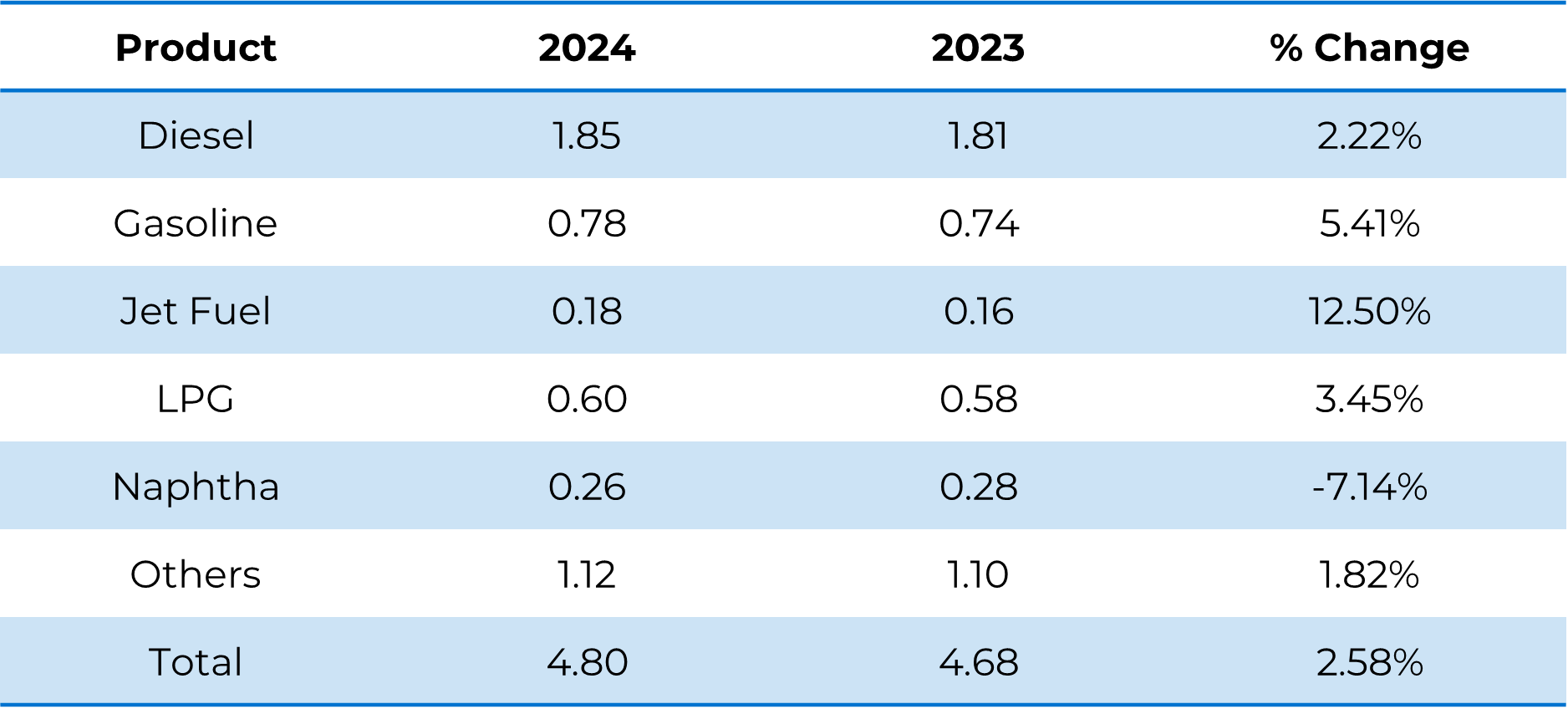

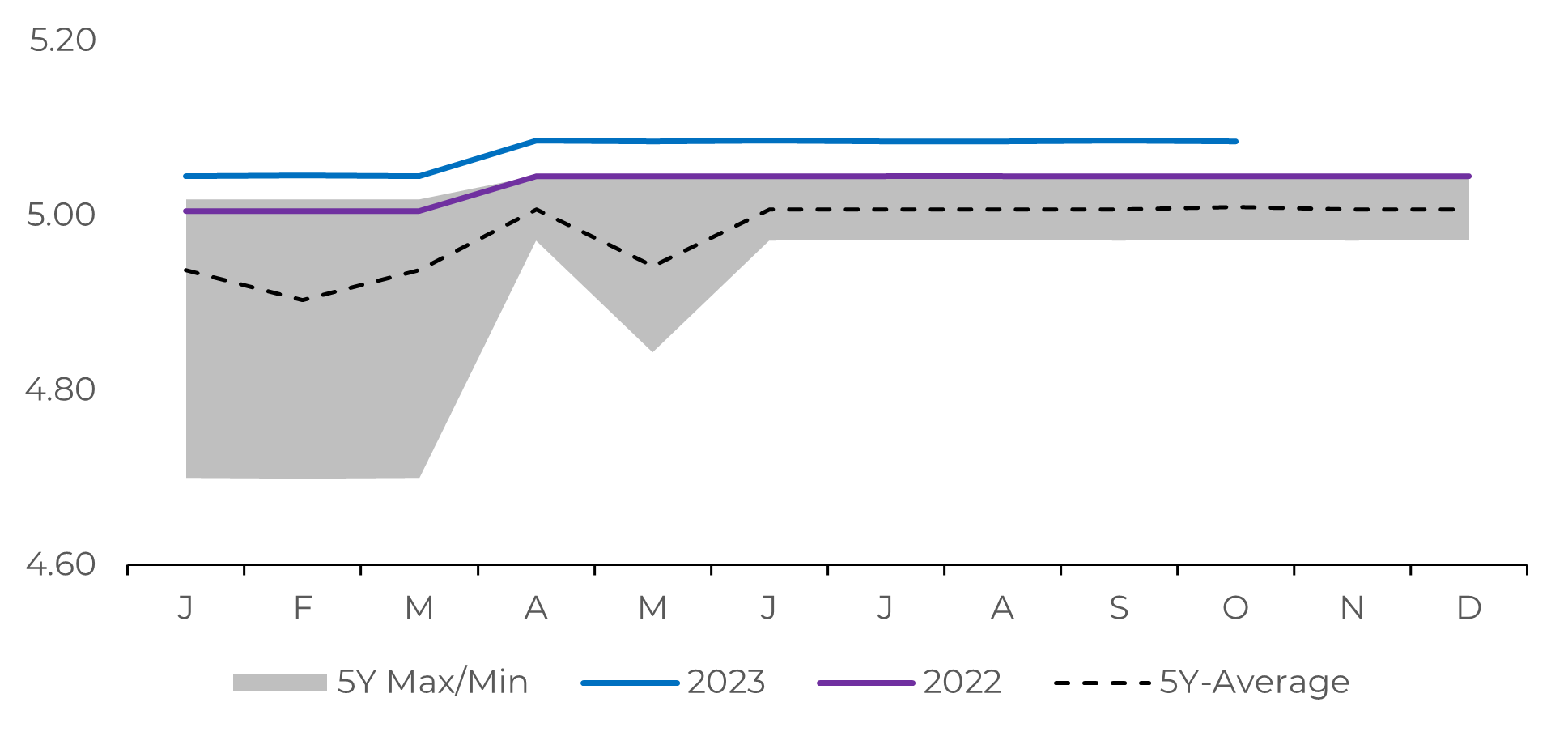

The South Asia’s economy is growing rapidly, increasing its demand for energy and, consequently, for petroleum products. In this sense, it is expected that by the end of 2028 the country will expand its oil refining capacity by approximately 1.12 million barrels per day, an increase of 22% in the coming years. Therefore, more oil will be needed to meet the country's domestic demand.

With a wide availability of suppliers, the highlight in 2023 was Russian oil. In addition to offering substantial discounts compared to other counterparts, India managed to secure more flexible payments, a significant advantage for its countries' refineries.

Image 1: IND – Crude Oil Imports (bpd) and GDP Growth YoY (%)

Source: Refinitiv

Image 2: Refined Products Forecast Production (Millions bpd)

Source: Bloomberg

With more growth, there is a greater need for oil

According to data from the Indian Ministry of Petroleum and Natural Gas, India's oil consumption reached 231 million tonnes (4.64 million barrels per day) in 2023, a significant increase of +5.48% when compared to the 219 million tonnes (4.40 million barrels per day) recorded in 2022. This represents a little over 5% of the current global oil consumption, whereas in 2002, just over 10 years ago, the country held a 3% market share.

On one hand, the country provides important insights into the pace of global oil consumption; on the other hand, weaker-than-expected data or reductions in its imports result in bearish volatility for the energy complex. After strong import growth in the first 9 months of the year, India slowed its import pace in the last quarter, something that helped weaken prices of the main crude oil benchmarks, with WTI falling by US$ -19,14 (-21.08%) and Brent by –US$ 18,27 (-19.17%) per barrel.

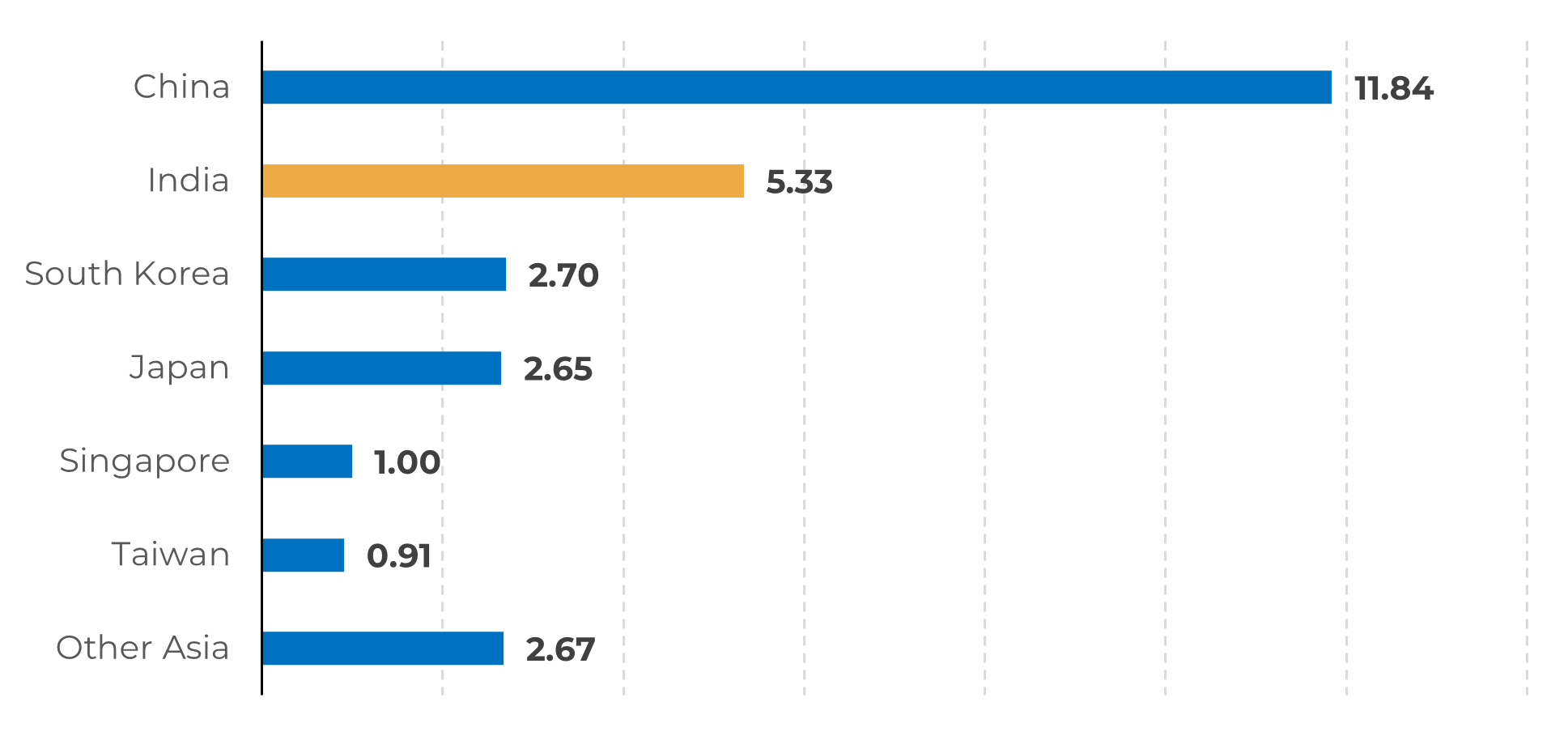

However, it is important to note that China will remain the world's largest oil importer for quite some time. For example, the second-largest economy in the world reached 11.84 million barrels per day (bpd) in crude oil imports so far this year, more than double the volume imported by India, which was 5.33 million bpd. Even with the electrification of its fleet, many sectors of the Chinese economy, such as transportation, civil construction, and agriculture, will continue to rely on petroleum products.

Image 3: Top Imports in Asia, January 2024 (Millions of barrels per day)

Source: Refinitiv

On one hand, the country provides important insights into the pace of global oil consumption; on the other hand, weaker-than-expected data or reductions in its imports result in bearish volatility for the energy complex. After strong import growth in the first 9 months of the year, India slowed its import pace in the last quarter, something that helped weaken prices of the main crude oil benchmarks, with WTI falling by US$ -19,14 (-21.08%) and Brent by –US$ 18,27 (-19.17%) per barrel.

Image 4: IND – Refining Capacity in Refineries (Millions bpd)

Source: CMIE – Centre for Monitoring Indian Economy

However, it is important to note that China will remain the world's largest oil importer for quite some time. For example, the second-largest economy in the world reached 11.84 million barrels per day (bpd) in crude oil imports so far this year, more than double the volume imported by India, which was 5.33 million bpd. Even with the electrification of its fleet, many sectors of the Chinese economy, such as transportation, civil construction, and agriculture, will continue to rely on petroleum products.

Source: Refinitiv

In Summary

More than just looking at the final consumption of refined products, it will be important to observe the growth of India's refinery capacity, which, when processed, becomes the products available to the population.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.