Energy Weekly Report - 2024 02 06

OPEC+ remains firm in defending oil prices

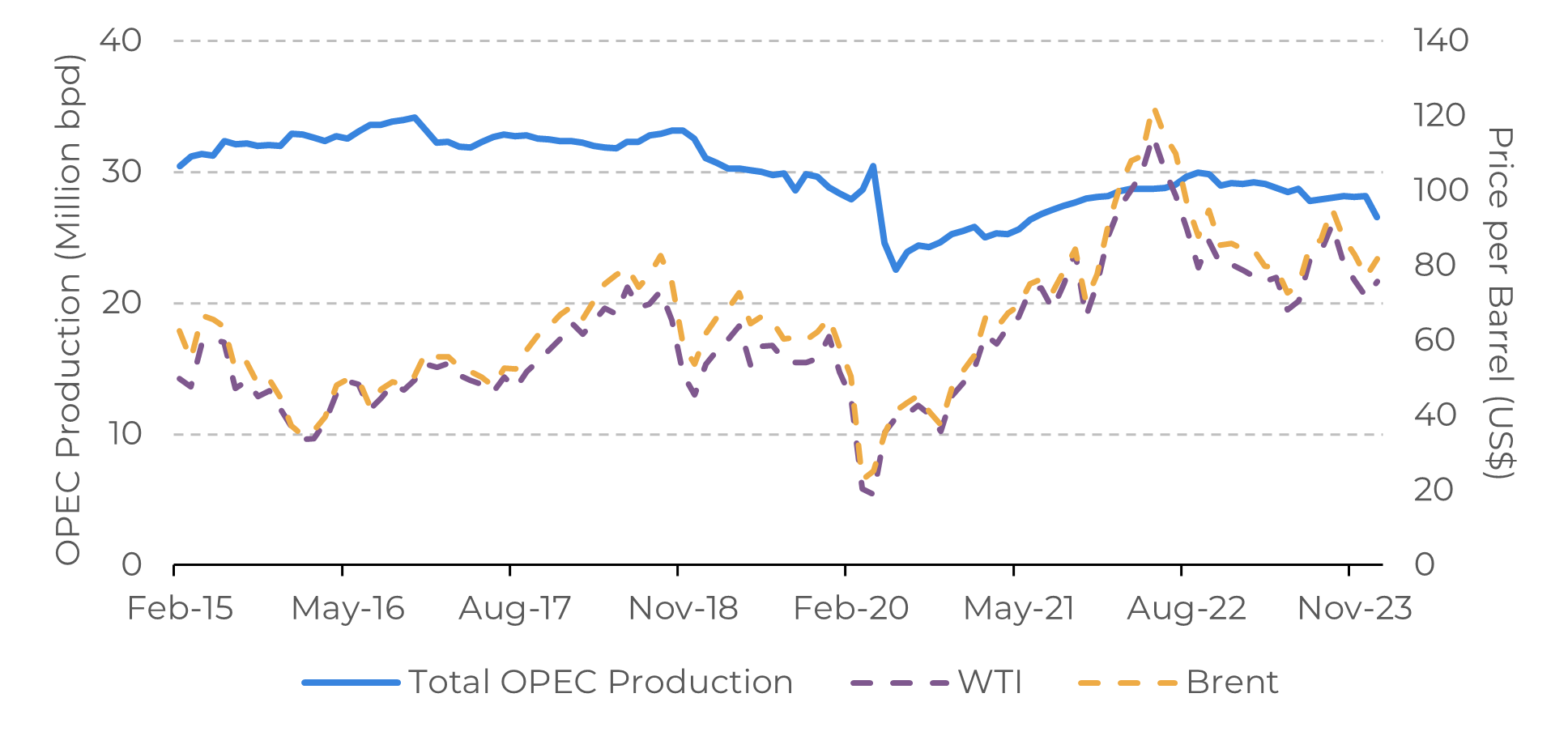

- The first meeting of OPEC+ maintained the voluntary cuts of the countries in order to defend oil prices. However, in March, when the next meeting will take place, the voluntary cuts may be revised, which could result in the return of 2.2 million barrels per day (bpd) to the market, leaving 3.66 million bpd in effect.

- OPEC's oil production recorded the largest drop in January 2024 since July of last year, remaining just above 26 million barrels per day (bpd), signaling the joint effort of countries to defend oil prices, particularly Saudi Arabia, which has been the main leader in this process.

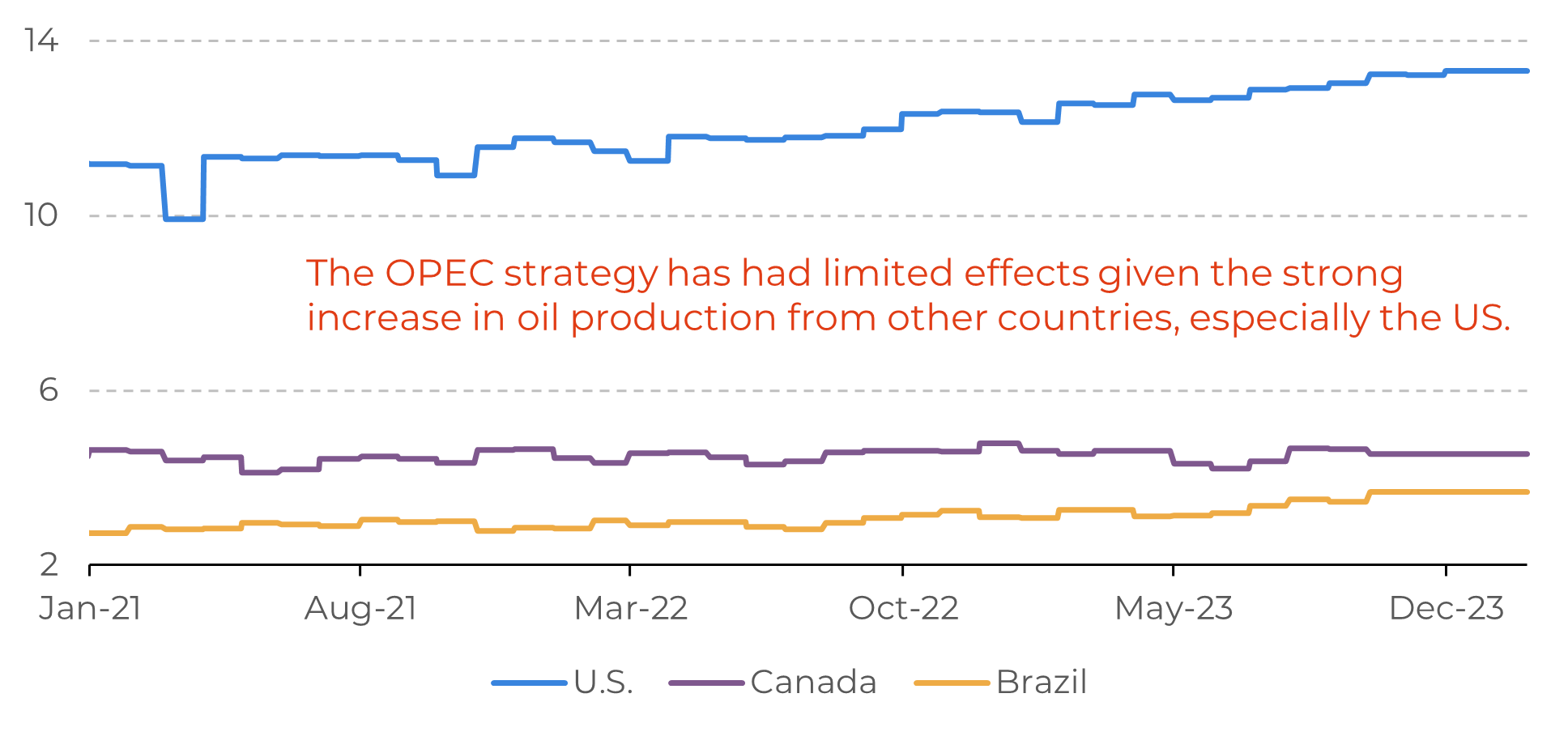

- Nevertheless, the growing oil supply worldwide from non-OPEC+ players, especially the US, is complicating the group's strategy. According to data from the U.S. Energy Information Administration (EIA), the world's largest economy produced 13.3 million barrels per day in November 2023.

Introduction

Once again, the OPEC+ meeting took place, this time demonstrating greater unity among members and reinforcing the commitment to support crude oil prices and keeping the voluntary oil production cuts, at least until March. Therefore, there were no changes in the current group output policy.

The latest developments in the energy complex, especially the conflicts around the Red Sea that have increased the risks of supply interruption, have brought some relief to the crude oil-exporting countries that find the current level of crude oil reasonable.

Although achieving results, the strategy of production restraint, which helped improve prices during the third quarter of 2023, also led to a loss of market share. As a consequence, some changes are beginning to take place, one of which is the review of the plan to expand total oil production capacity in Saudi Arabia.

Image 1: OPEC Production and Major Crude Oil Benchmarks

Source: Bloomberg

Image 2: Crude oil production of selected non-OPEC countries (Million bpd)

Source: Bloomberg

Saudi Arabia cancels plans to increase its production in the coming years

The output cuts have been one of the most powerful tools that OPEC and its allies have been using over the last years to stabilize prices at levels desired by the members, which is important since most of the public revenues depend on the price of crude oil barrels. However, pursuing this policy has come at a significant cost, particularly for Saudi Arabia.

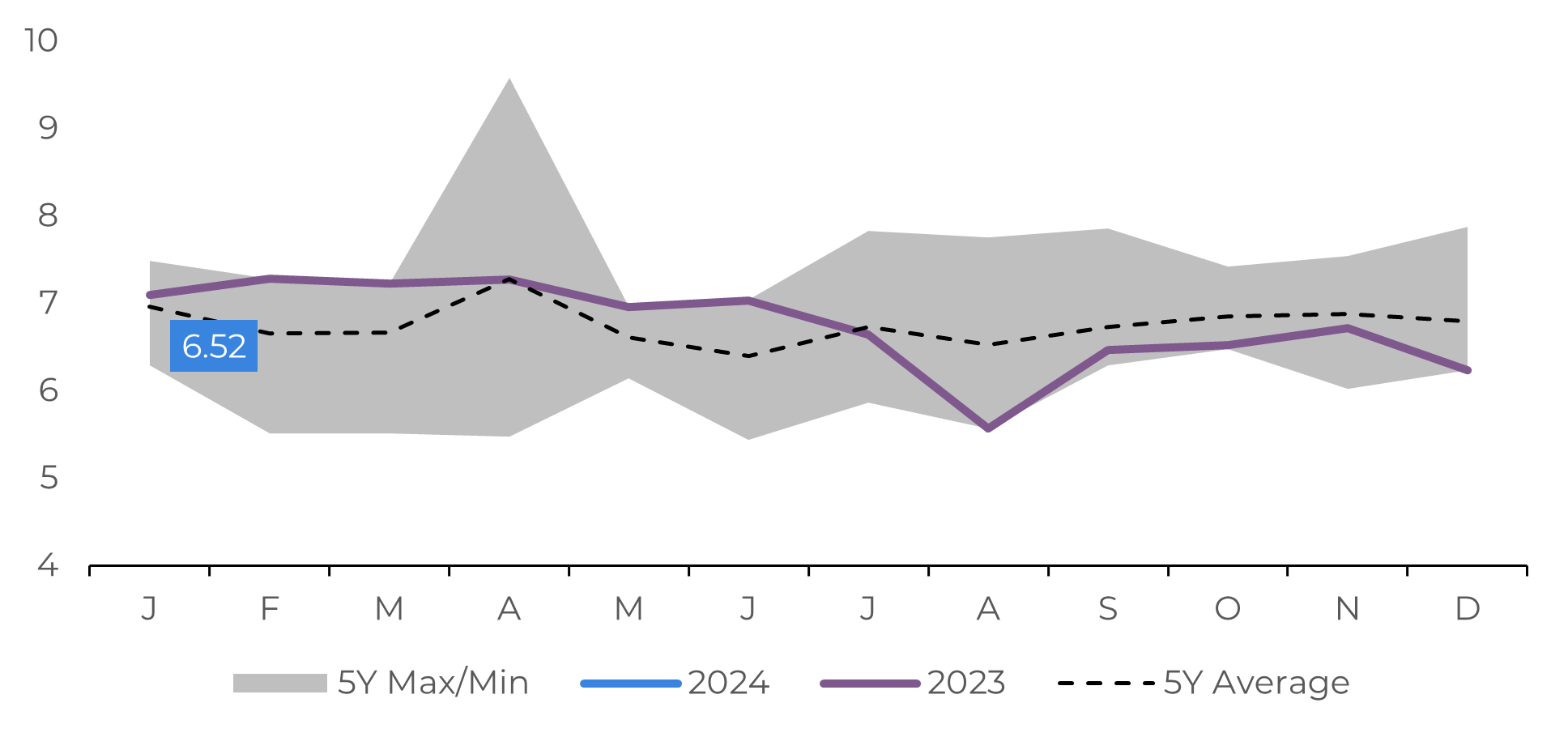

Reduced crude oil exports have squeezed their market share, especially in Asia. While higher prices per barrel are beneficial, the strategy is imposing a substantial decline in export volumes. One signal of the ongoing changes in the market was the reduction in February official selling price (OSP) of its flagship Arab Light crude to Asia countries, the lowest level in 27 months.

Image 3: Top Imports in Asia, January 2024 (Millions of barrels per day)

Source: Refinitiv

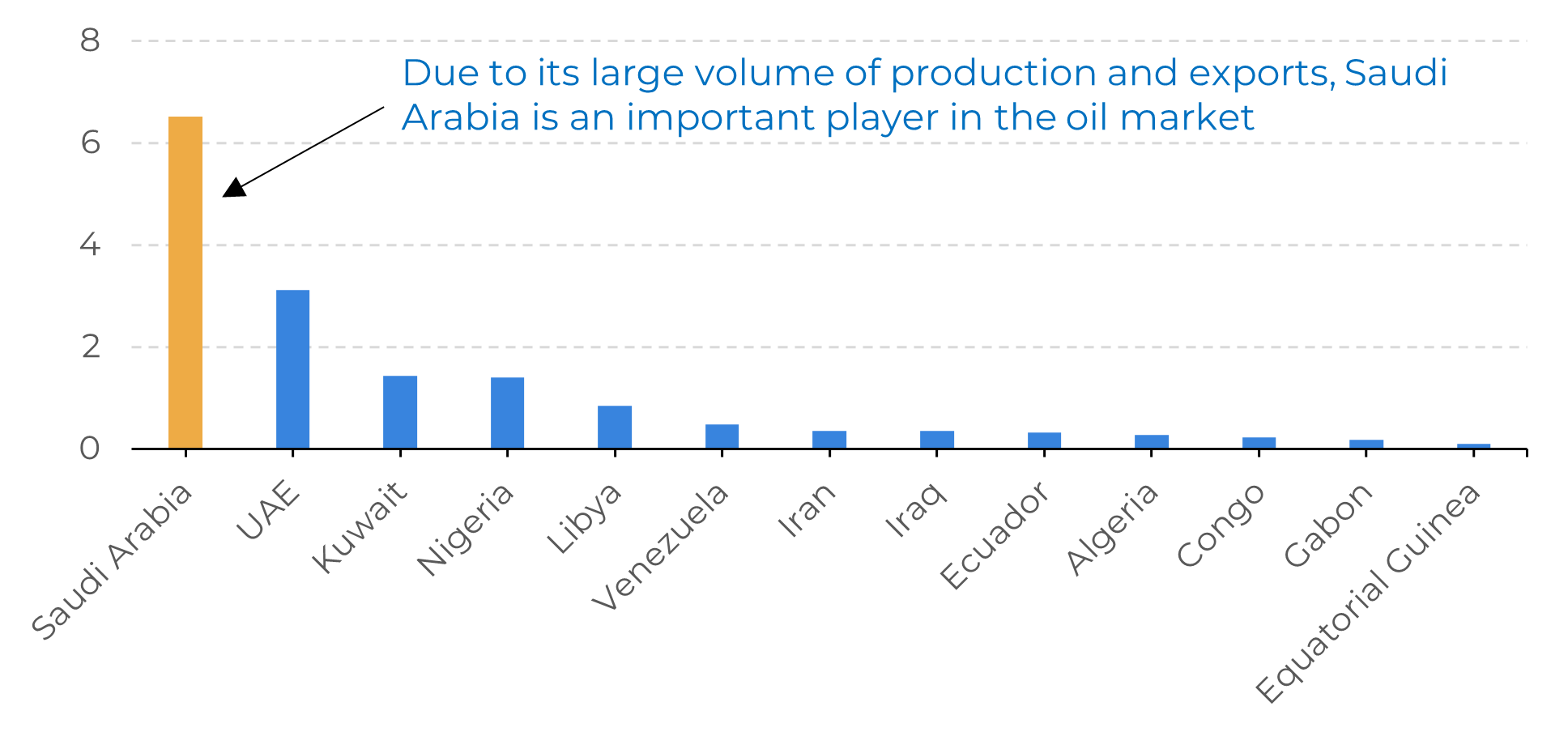

Even so, the country is very determined to follow this policy. Recently, to curb production, the Saudi government directed the state-owned Saudi Aramco to halt expansion plans, potentially limiting the country's production capacity to 12 million barrels per day (bpd), one million bpd below the 2020 target. Consequently, the country's future spare capacity will be diminished, potentially heightening risk sentiment in anticipation of future supply disruptions.

Currently, the availability of global spare capacity remains one of the factors tempering crude oil prices despite the growing risk of supply disruptions from the Red Sea region. Spare capacity serves as a significant market driver, and with Saudi Arabia's recent decision, we foresee a slightly more bullish outlook for the future.

Image 4: IND – Refining Capacity in Refineries (Millions bpd)

Source: Refinitiv

In Summary

The country is already working to establish important long-term fundamentals that could create a more bullish environment for oil, such as abandoning its goal of reaching a production capacity of 13 million barrels.

With reduced spare capacity, the world will be less prepared to face supply shocks, a risk that is becoming increasingly common due to geopolitical tensions. And, as it seems, OPEC+ members may benefit from this scenario, as higher oil prices are an important source of revenue for their public budgets.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

alef.dias@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.