Energy Weekly Report - 2024 02 12

Importance of American LNG in the Global Supply

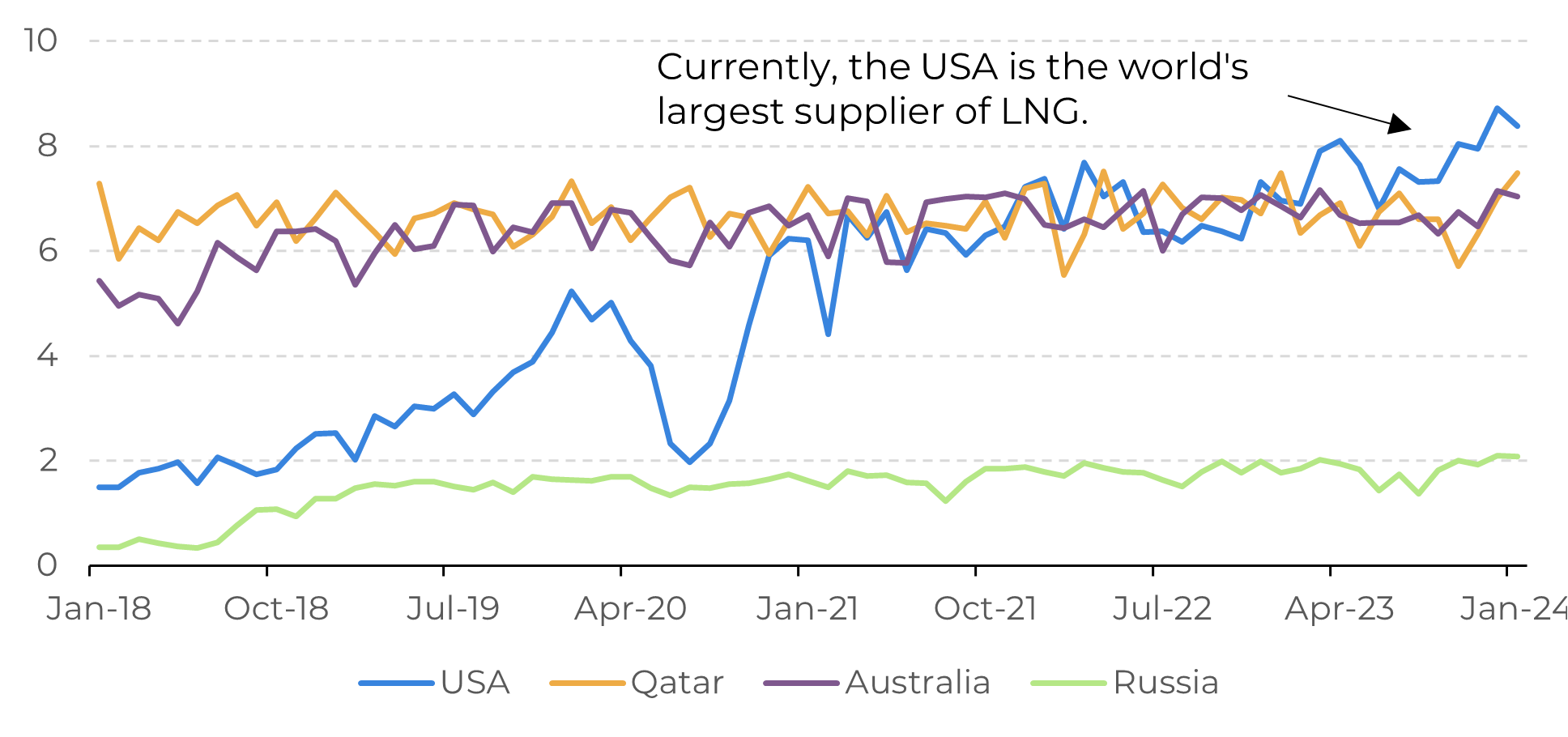

- Due to the increase in natural gas production in recent years, much of it from shale gas exploration, the United States has achieved the status of the largest exporter of LNG (liquefied natural gas), surpassing countries such as Qatar and Australia.

- In the coming years, new projects should allow for an increase of 63 million tons in production. However, with the decision to suspend new export licenses, four projects will be impacted, which could result in lower production capacity in the future or delays in project delivery.

- Lower export capacity in the coming years is a risk for the European market, which is heavily dependent on LNG imports to meet its domestic demand.

Introduction

Last month, the White House decided to suspend licenses for LNG export projects. This measure, in addition to responding to environmentalists' concerns about pollution from burning natural gas, seeks to bring greater stability to the country's domestic prices, which are increasingly subject to global risks.

The country currently has seven operational terminals with a production capacity of 87 million tons of LNG per year, a significant amount capable of supplying countries like Germany and France. With the recent changes, our analysis will discuss the possible impacts of this decision on the global natural gas market.

Image 1: Main LNG Exporters (Metric Tons)

Source: Bloomberg

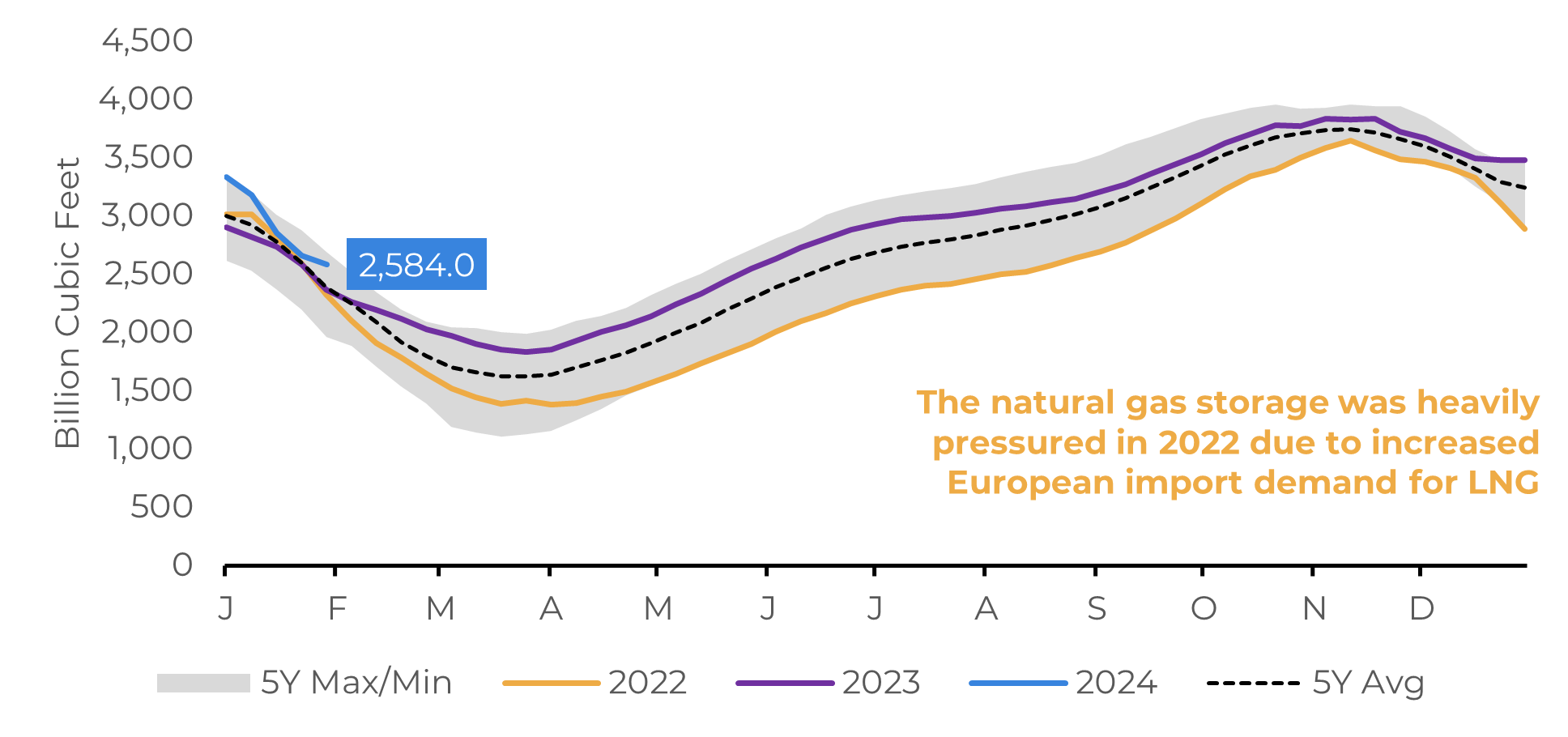

Image 2: USA - Gas in Underground Storage in Operation

Source: EIA

No significant impact on the LNG market in the short term

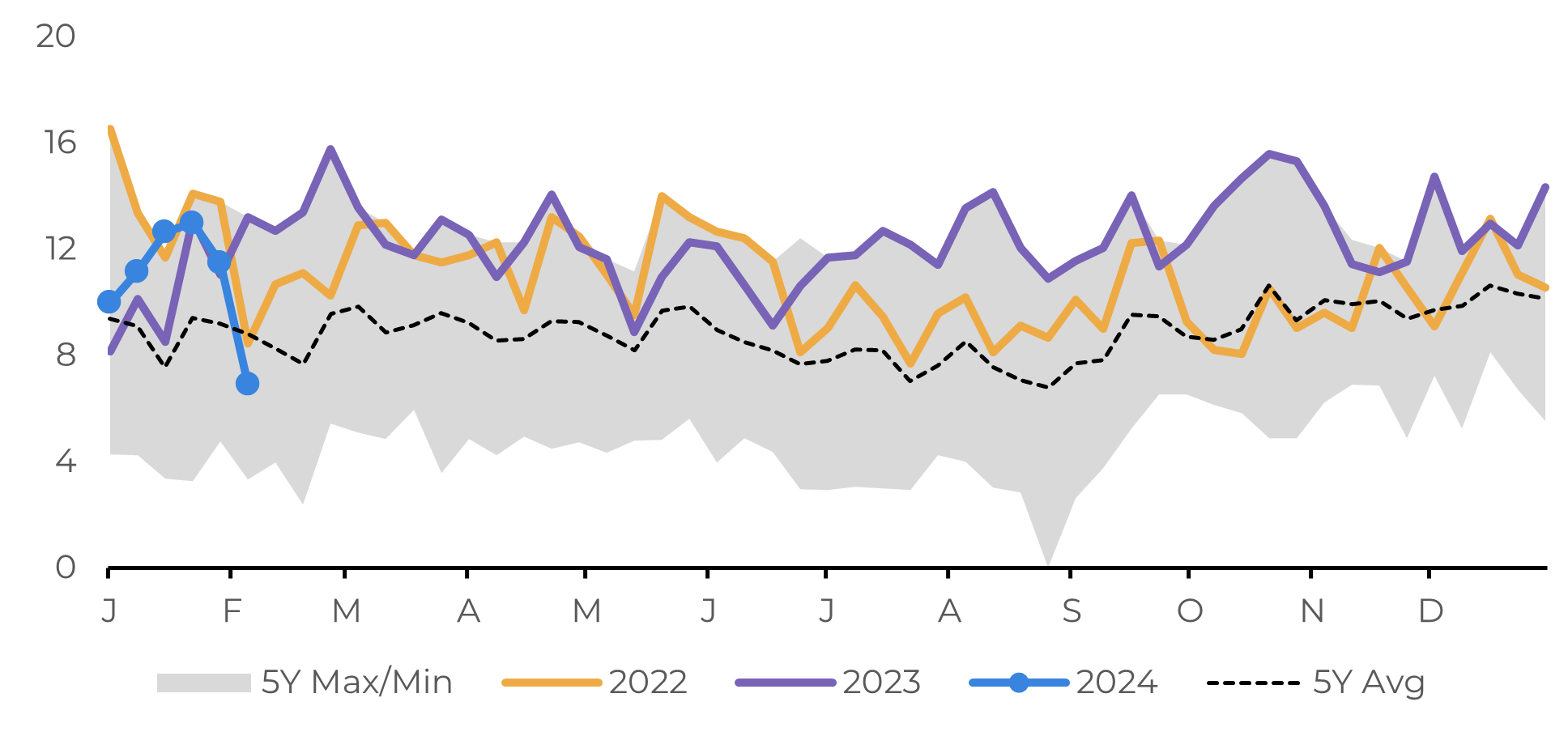

In the short term, the effects will be limited, as this is only a freeze on new export projects, which does not significantly alter the flow of exports in the country. However, if this measure is extended, especially considering the continued growth in LNG consumption globally, the European and Asian markets - the main destinations for American exports - will be significantly impacted. In December, more than 87% of American LNG exports went to these markets. Another possible outcome would be a recovery of the Russian LNG market in Europe, something not desired at the moment by the continent's leaders, who are seeking to support the Ukrainian war effort.

While the suspension could help reduce prices in the short term, it may have the opposite effect in the long term, as it will discourage investment. Some analyses quote amounts of around US$ 100 billion in 2023. Natural gas is an important energy commodity in the context of the energy transition, resulting in growing demand in recent years.

Image 3: USA - Net LNG Exports

Economic activity should increase LNG consumption in 2024

Source: Refinitiv

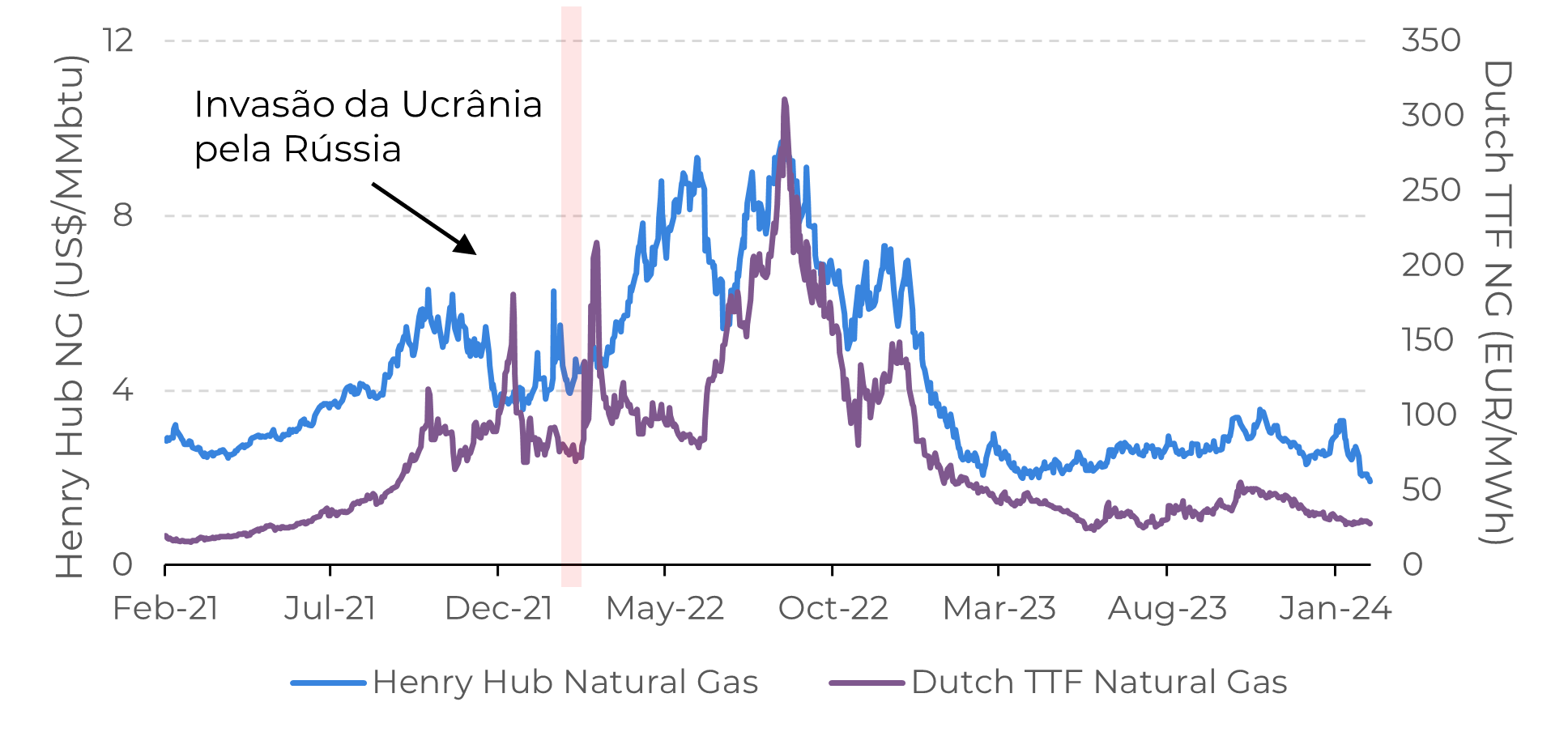

The global balance continues to tighten, with global demand for natural gas expected to grow by 2.5%, according to the International Energy Agency (IEA). As prices continue to converge towards more moderate levels, following a strong appreciation in 2022 due to Western sanctions against Russia, a further increase in demand for LNG is expected. For example, in 2024, the Henry Hub spot price is -20% and the Dutch TTF -48% when compared to levels in 2023. With cheaper natural gas, it becomes more economically advantageous compared to other energy commodities, which encourages its consumption.

Another factor that should help boost LNG consumption is a less restrictive monetary environment. Both the US and Europe are forecasting interest rate cuts this year, which should strengthen their countries' industries and consequently increase electricity consumption. For Europe, the main source of energy is natural gas, much of which is brought in via LNG vessels from the United States. Therefore, restrictions on American exports can affect the economy of the continent in the long term.

Image 4: Main Natural Gas References

Source: Refinitiv

Brazilian distributors adopt Henry Hub indexation to stabilize costs in the face of volatility

In Summary

Even so, it must be recognized that if this decision is prolonged, there will be a significant impact on the world balance sheet, especially for Europe, which depends on imports of American LNG.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.