Energy Weekly Report - 2024 02 19

What can we expect from gasoline consumption in the coming months?

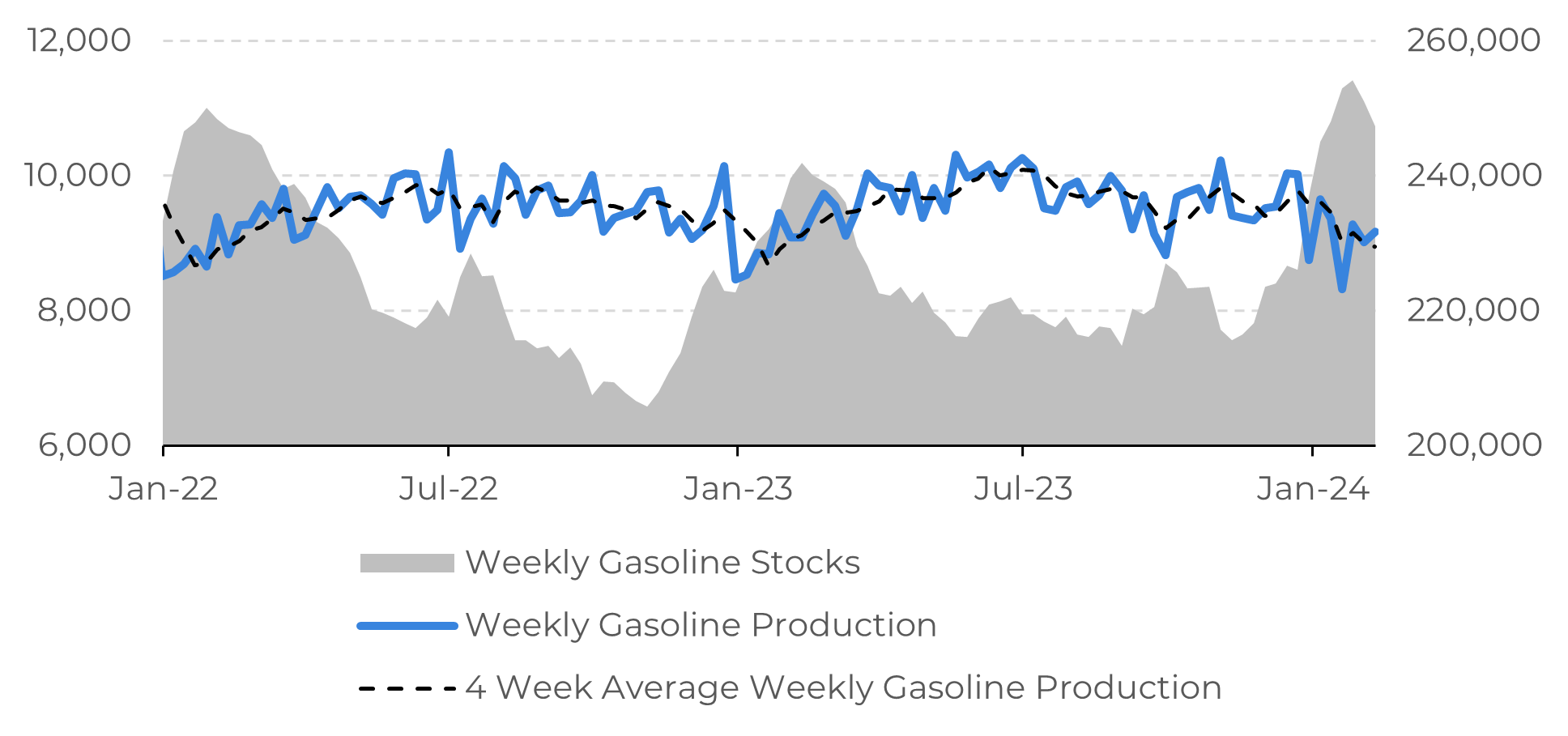

- In recent weeks, gasoline production in the United States has been hampered by unscheduled maintenance at one of the country's largest refineries. As a result, the country's stocks fell by 3.7 million barrels last week.

- The winter months, when mobility is reduced in the country, are usually a time for stockpiling, but production has been hampered, which could have an impact, especially if demand for gasoline is higher than expected in the upcoming Driving Season.

- There are several reasons to believe in an increase in gasoline consumption. We are in a year of interest rate cuts in the world's largest economy, and the country's labor market remains resilient. This should theoretically favor gasoline consumption.

Introduction

While oil prices are caught between geopolitical tensions in the Middle East, with the potential to jeopardize global supply, and the late start of interest rate cuts in the US, thus weakening demand for oil, a curious scenario is shaping up for refined products, especially gasoline.

In the last month, refining activity in the United States has been significantly affected by low temperatures, reducing vehicle mobility and, consequently, gasoline consumption. Currently, the country has stocks of 247 million barrels of gasoline, an amount higher than that seen in 2023 and 2022.

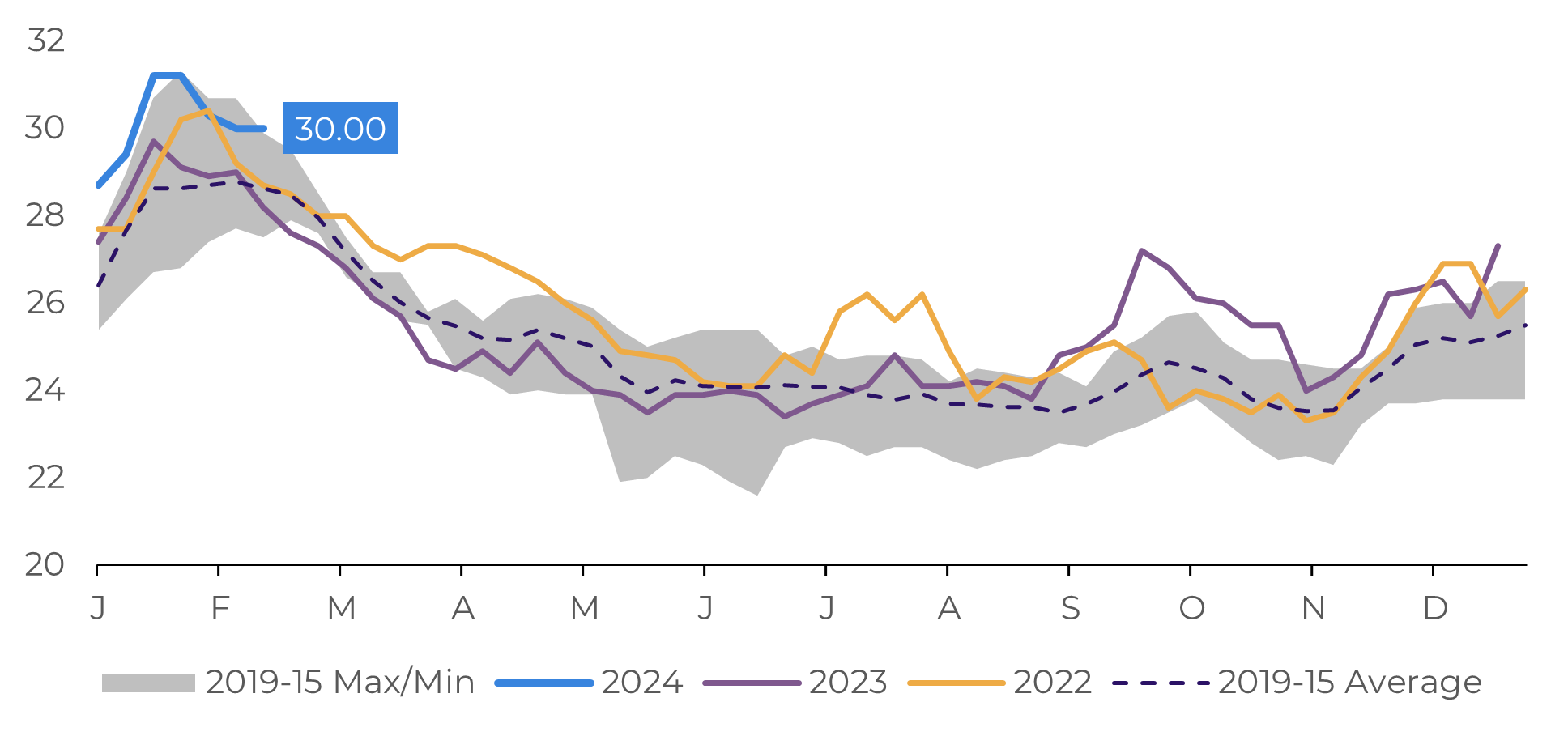

The question that remains is whether these stocks will be sufficient to meet demand in the country over the coming months, a period when gasoline consumption increases substantially.

Image 1: USA - Gasoline Production and Stocks (Millions of BBL)

Source: EIA

Image 2: USA - Gasoline Supply Days (stocks/demand)

Source: EIA

March is a turning point for gasoline consumption in the United States

February is usually a month of lower demand for oil in the United States; however, gasoline prices have reacted due to an unscheduled shutdown at BP's refinery in Whiting, Indiana, at the beginning of the month. As one of the largest refineries in the country, and the largest in the Midwest, this facility is capable of producing 435,000 barrels per day, a fairly significant volume. Although the country's ample stocks are helping to limit the impact of a major refinery shutdown, this would be the time to build up reserves to meet demand during the summer months, known as the Driving Season.

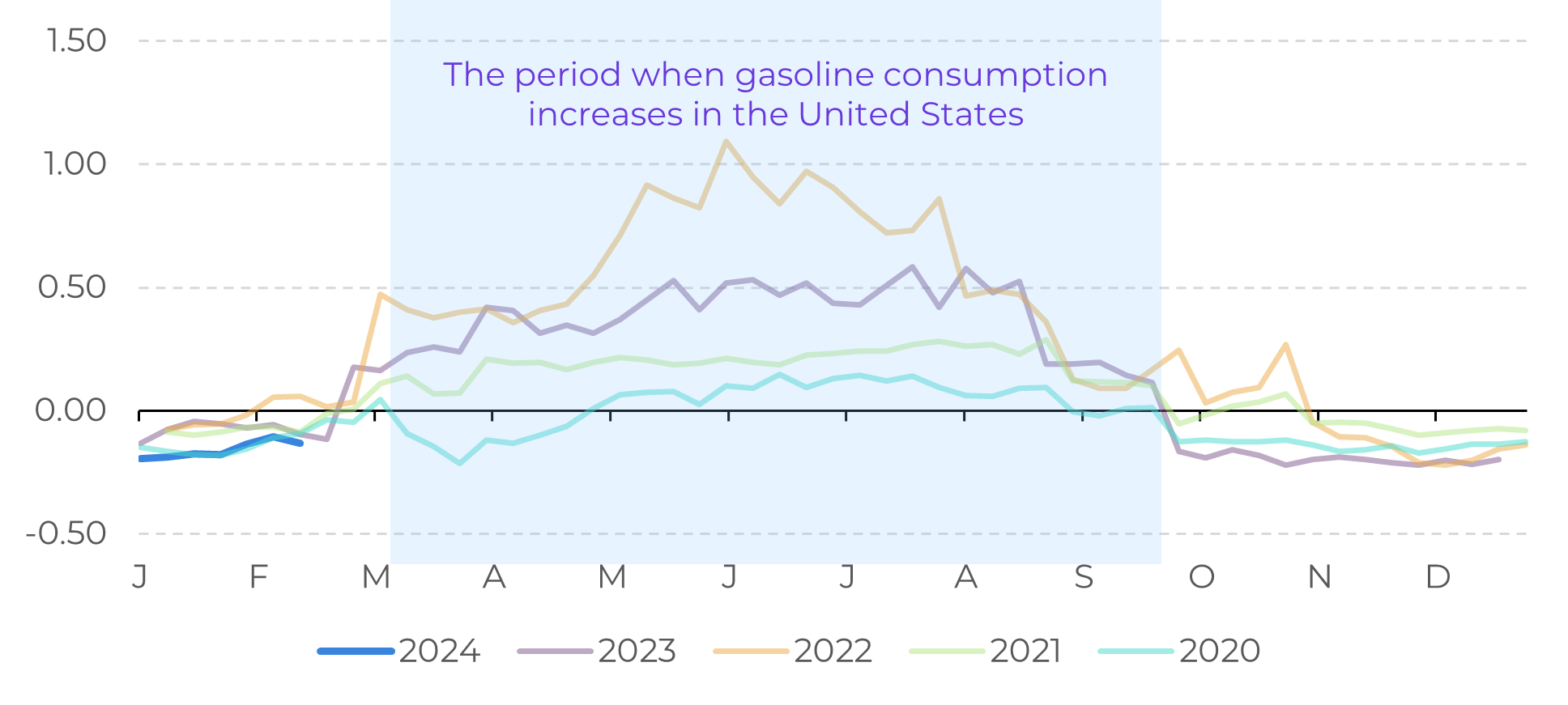

In this sense, the market seems to have adopted a more bullish stance towards the commodity. In January, the RBOB, the benchmark contract for gasoline, closed at US$2.18/gal (up 3.84% in the month), and everything indicates that February should close with a new rise. In fact, February and March are periods that generally strengthen the backwardation of gasoline, where the prices of futures contracts for immediate delivery are higher than the prices of contracts for future delivery. From this perspective, when compared to the trajectory of recent years, the scenario doesn't look very promising, but we need to consider some important variables for 2024.

Image 3: RBOB Month 1 Vs. Month 6 (US$/gallon)

Less restrictive monetary environment should help US consumption

Source: Refinitiv

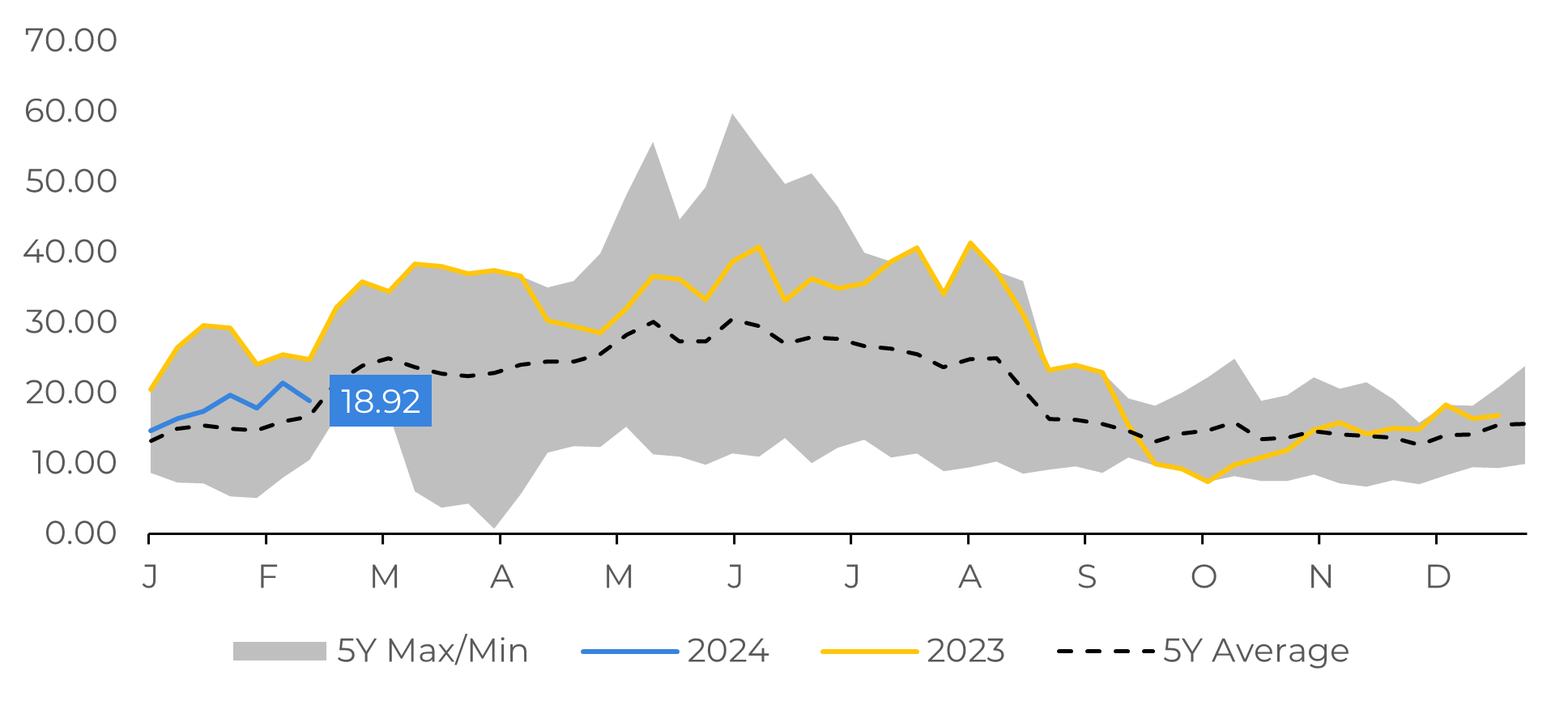

The big expectation in the economic scenario for 2024 is a possible interest rate cut by the Fed, the US central bank. This move should boost demand and weaken the dollar, which is especially relevant considering that most of the world's commodities are traded in dollars. This also applies to assets in the energy complex. The country's labor market remains resilient, with the non-agricultural payroll registering an increase of 353,000 jobs. With more people working, fuel consumption increases. In addition, the current conflict in the Middle East could potentially jeopardize supplies in Europe, which could raise the price of oil, the main input in gasoline production.

For the time being, the scenario shows no signs of a less well-supplied market. Unlike in previous years, stocks are still high and demand has been affected by the low temperatures. Even so, it will be important to see if there is a reversal of this scenario in March, which may surprise the market due to the good performance of the American economy and the upside risks for oil. For the time being, these risks are being outweighed by a slightly later-than-expected interest rate cut in the United States, but increased demand in the coming weeks could change this sentiment.

Image 4: RBOB Crack Spread (USD/BBL)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.