Energy Weekly Report - 2024 02 26

After substantial demand for propane last year, what to expect in 2024?

- Reduced oil supply from OPEC+ nations due to supply restriction policies has led to a notable surge in American propane exports over the last few years.

- While supply opportunities emerge, the demand scenario also improves, with increasing manufacturing activity around the world, potentially boosting propane consumption, especially in Asia.

- Currently, spot prices at Mont Belvieu, the hub for propane trade, are higher than the same period last year, driven by the cold temperatures of January, which increased heating demand and strained stocks.

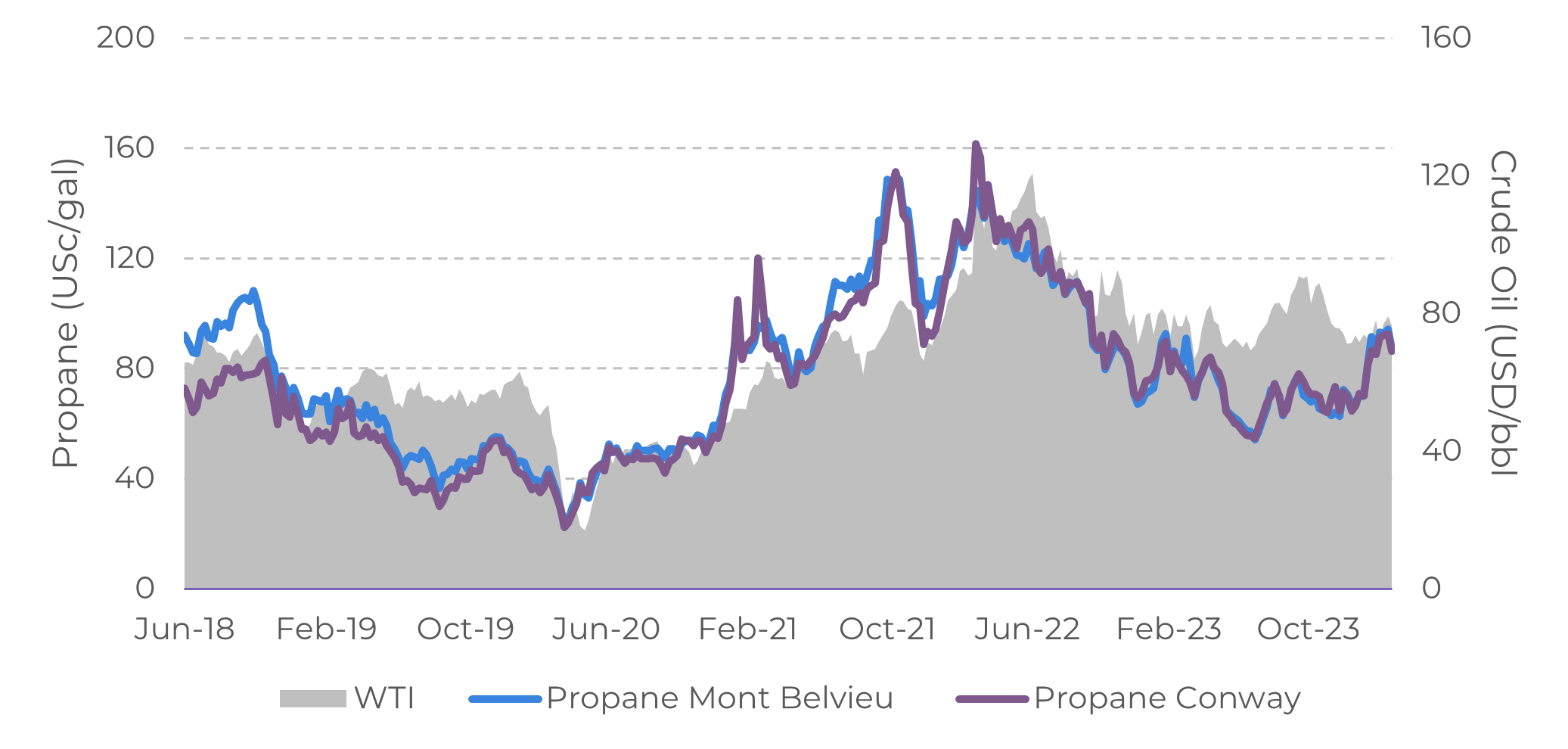

- However, a few challenges loom on the horizon. The delay in interest rate cuts in the U.S. could impact the recovery of manufacturing activity, while OPEC+ gradually increasing their production in the second semester of 2024 could affect the current support for crude oil prices, which correlates with propane prices.

Introduction

Propane is one of the most common fuels in the world, and its use varies widely, being employed in both residential heating and cooling as well as in the industrial sector. It is used in the petrochemical sectors, as propylene, derived from propane, is a key ingredient in the production of plastics used in various sectors such as automotive, construction, textiles, and others.

As a portion of the global propane is produced from oil extraction and refining processes, decisions made by OPEC+ impact the supply of this product. Additionally, the significant increase in oil and natural gas production in the United States has led to a substantial increase in its supply, resulting in record levels of stocks in the country for much of 2023.

Due to recent events in the energy complex, let's examine the factors that have impacted this product and outline a scenario for possible developments in the coming months.

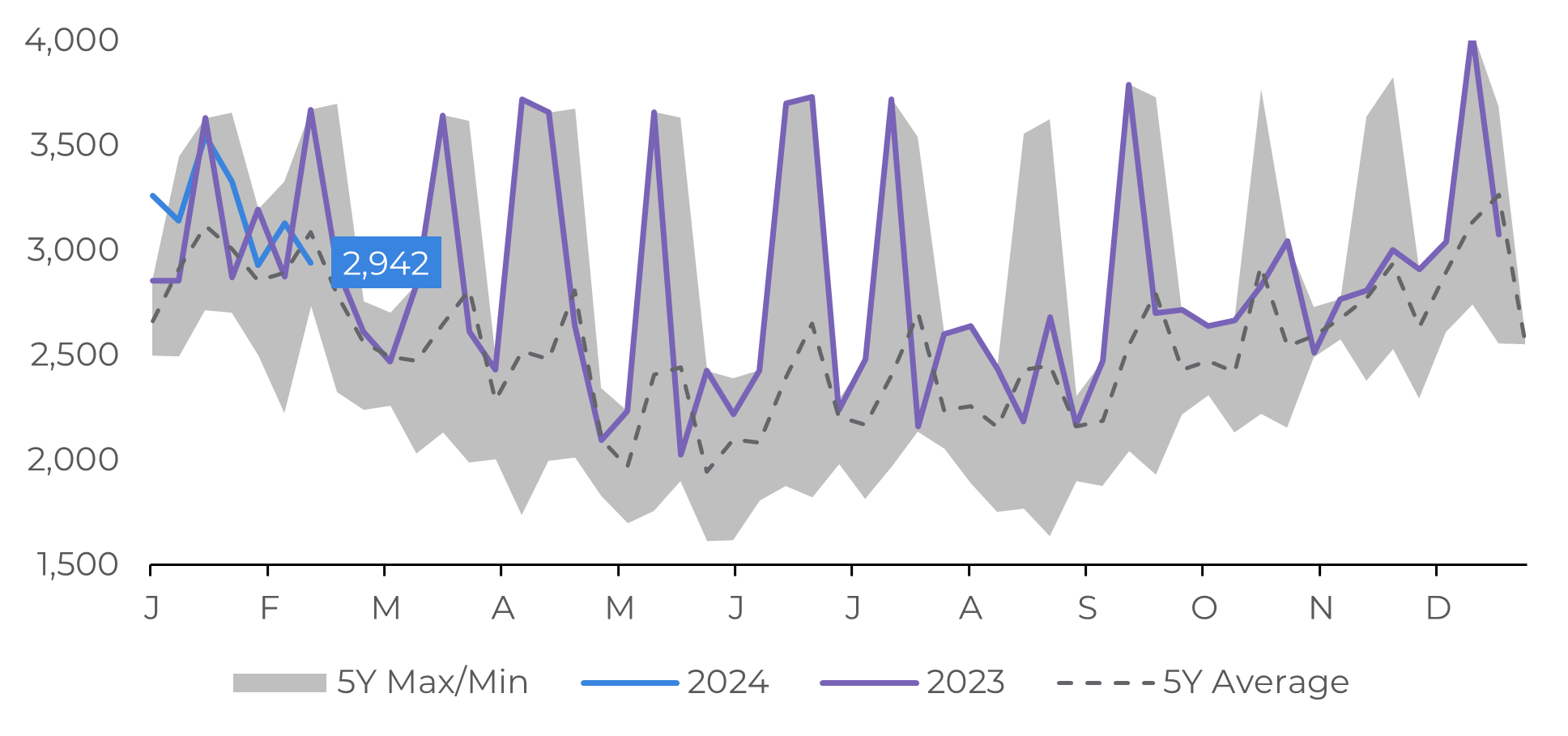

Image 1: USA – Propane/Propylene Output Implied Demand (Million Barrels)

Source: Bloomberg; Note: Implied demand calculations include products exported to other countries

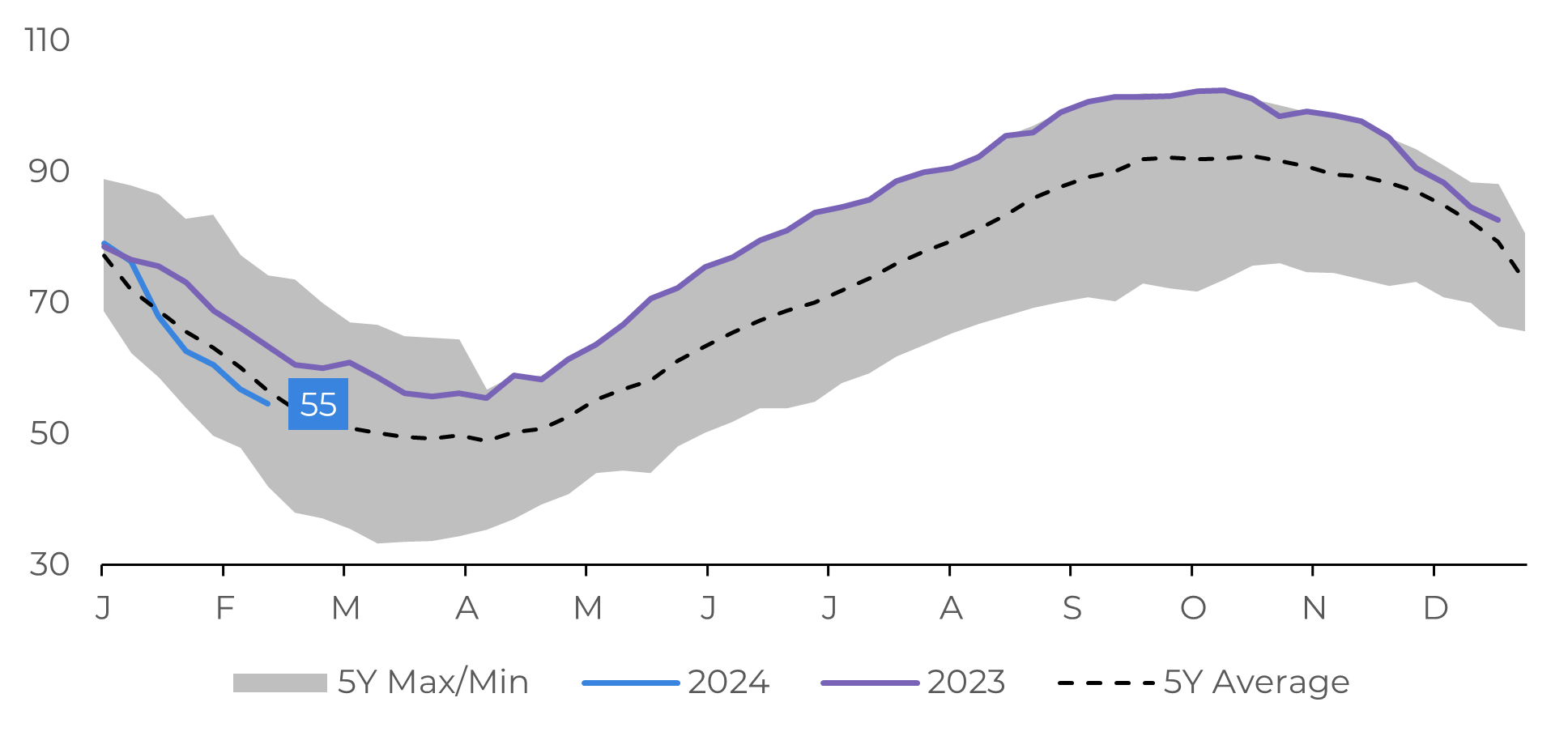

Image 2:

USA - Propane/Propylene Stocks (Million Barrels)

Source: Refinitiv

The demand for propane is expected to grow in various regions in 2024

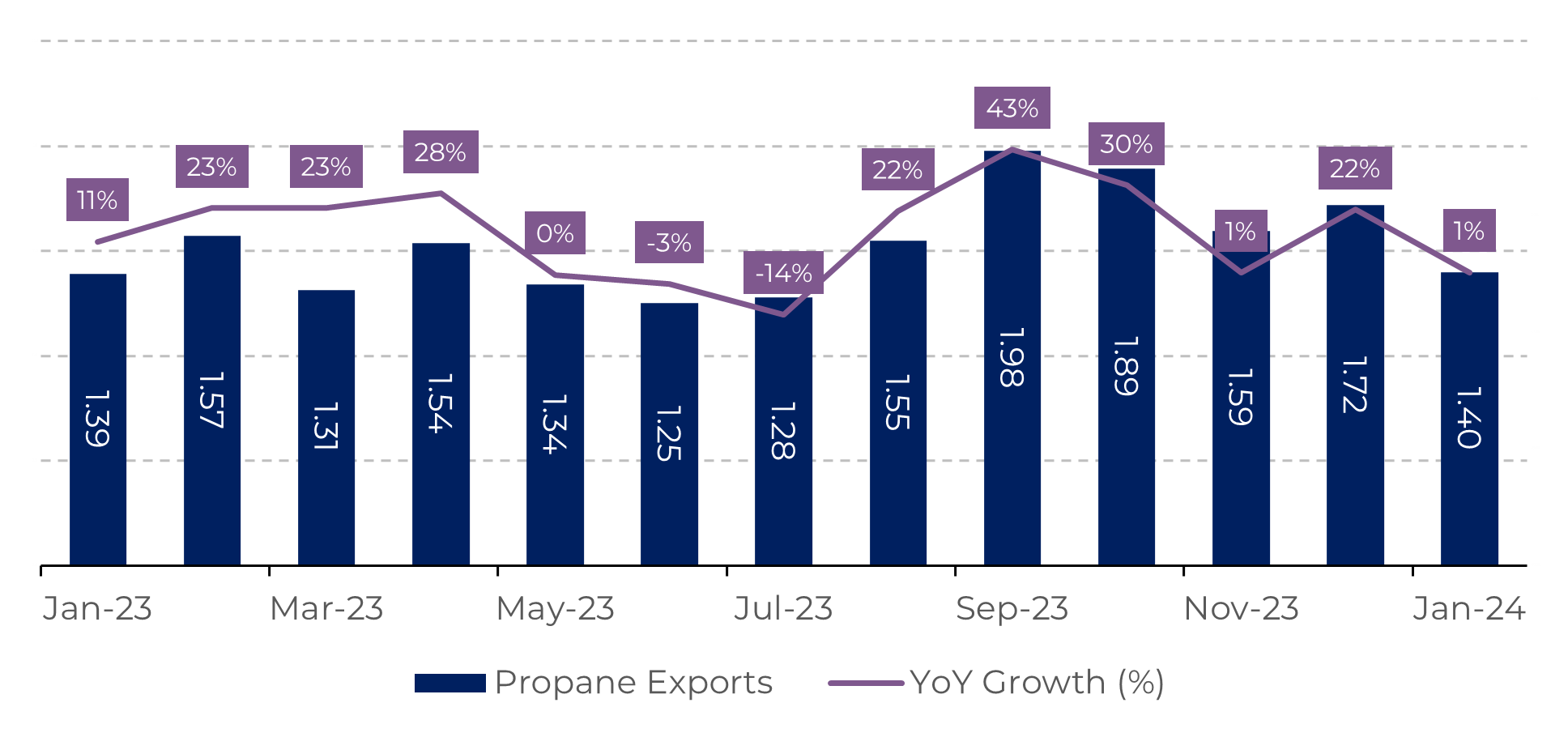

There's much talk about the impacts on the oil market when OPEC+ supply restriction actions are carried out. However, behind these movements, there's a profound impact on the refined products market, with propane production being a prime example. With less oil being supplied by OPEC+ countries, whose extraction process also results in propane production, American companies have had an opportunity to increase their exports, growing on average by 14%, which is about 1,6 million bpd, over 2023.

On the one hand, there has been an opportunity opening up on the supply side; on the other, the demand outlook is quite promising. Manufacturing activity, closely associated with propane demand, is picking up, as evidenced by the latest PMI data for the United States at 49.1 (+2) and Europe at 46.6 (+2.2). Moreover, Asia, the primary destination for US propane exports due to its petrochemical complexes, is expected to benefit from a less restrictive monetary environment in 2024. For now, propane exports since the beginning of this year have shown modest growth (+1%) compared to last year, but this is due to transportation challenges imposed by the lower water volume in Lake Gatun, significantly reducing trade in the region, an important route for American LPG production to Asia.

Image 3: USA – Propane/Propylene Exports (Million Barrels)

Source: EIA

The cold weather put pressure on propane stocks in the US

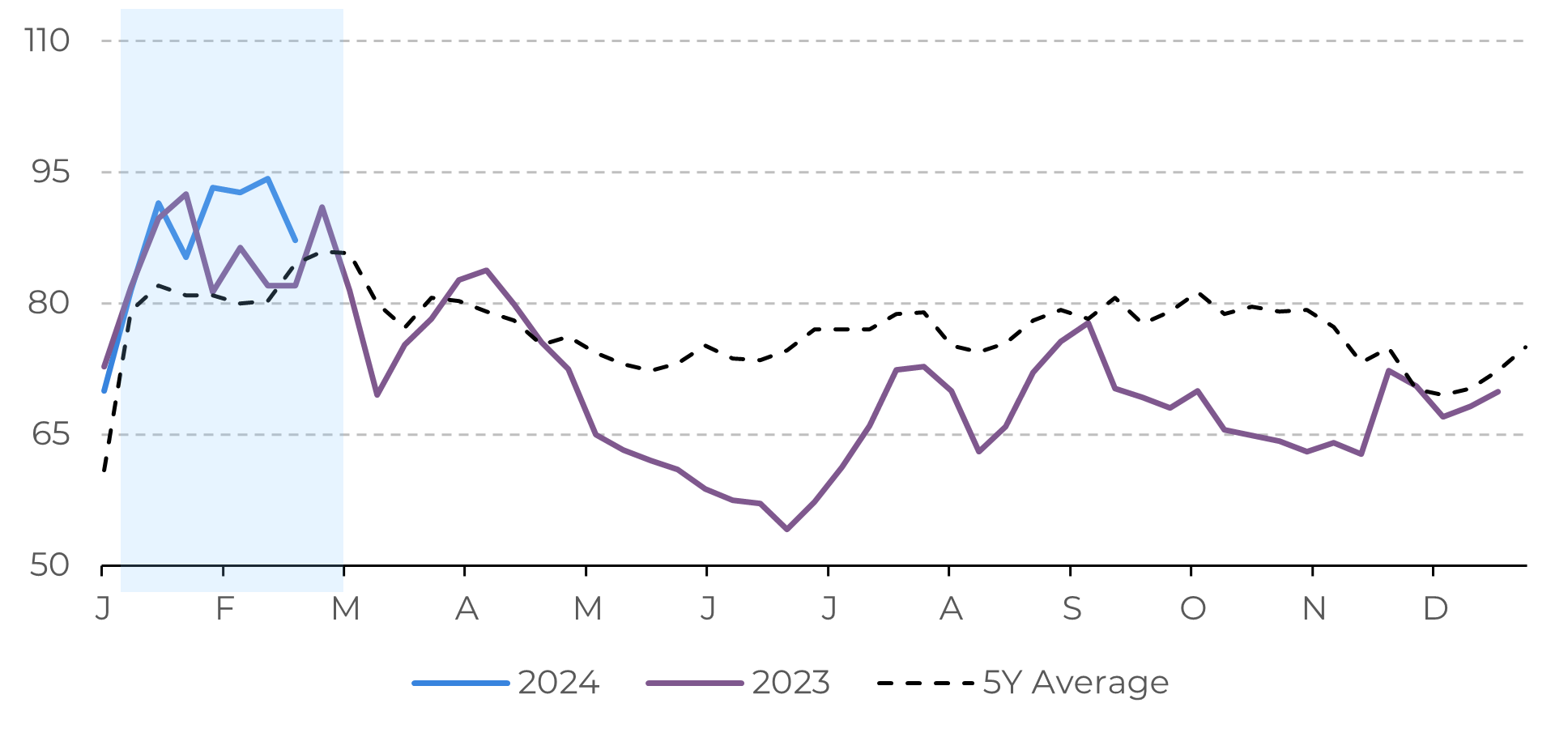

While propane inventories remained at record levels for much of 2023, a result of the strong increase in production, the weather reminds us how volatile the energy complex can be and how quickly its fundamentals can change. Due to the severe cold in the United States in January, there was a significant increase in heating demand. Furthermore, the low temperatures that affected the country halted oil and natural gas production in many regions, causing the country's stocks to plummet rapidly, dropping from approximately 81 million barrels of propane/propylene at the beginning of the winter to approximately 55 million barrels (-35%) by February 16th.

Of course, these changes have impacted spot propane prices in Mont Belvieu, where prices are on average 4.15% higher (an 11% increase compared to the 5-year average) than those compared to 2023. In this sense, the primary fundamental for propane – the weather – takes a bearish direction as we approach the end of winter, reducing the need for heating. However, there are other important fundamentals that can impact the price of propane, as we mentioned before. OPEC+ may have a significant influence in the coming months.

Image 4: Propane Spot Price at Mont Belvieu (USc/gal)

Source: Refinitiv

OPEC+'s ability to influence oil prices will be crucial for a bullish environment for propane

Despite a promising outlook for propane demand, oil and natural gas production in the United States has been experiencing a significant increase, leading to a greater supply of gases as LPG products. Therefore, it will be important to observe the performance of oil throughout 2024. If it manages to reach higher levels, this will result in higher costs for its refined products, which include propane.

However, there are significant challenges in the medium term. Although the Fed has not yet begun the process of easing its contractionary monetary policy, high interest rates in the American economy are supporting a strong dollar, which makes energy commodities more expensive for holders of other currencies, something bearish for the energy complex. Additionally, the trend is for the OPEC+ supply cut to remain in effect, but it is expected to be gradually reversed between the third and fourth quarters of this year. Therefore, in the medium term, propane prices are expected to converge to lower levels than current ones.

Image 5: Crude Oil (USD/bbl) and Major Propane FOB Prices (USc/gal)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.