Energy Weekly Report - 2024 03 04

Russia implements a new ban on gasoline exports

- Normally, gasoline consumption in the country increases during the spring months, peaking in the summer. Due to Western sanctions against the country, domestic tourism has been more active, which puts pressure on gasoline demand.

- Due to higher gasoline prices, the country's authorities seek to prioritize the domestic market. In this regard, less than a year after the last intervention, the Kremlin has acted once again to stabilize domestic prices by enforcing a ban on gasoline exports.

- The impact of this measure on the energy complex should be limited, as the country does not export large volumes of gasoline, and despite being established for 6 months, it may last much less.

- However, this measure appears to be associated with recent attacks on the country's energy infrastructure, which increases uncertainty about whether similar measures will be taken for diesel, a product of greater relevance in the international market when it comes to Russia's exports.

Introduction

When it comes to Russia, there's no need for an introduction to highlight its significance in the world's energy supply. The country stands as the second-largest exporter of oil globally, trailing only behind Saudi Arabia. Additionally, Russia maintains its position as the largest holder of proven gas reserves and remains the second-largest gross gas exporter globally, following the US.

Nevertheless, the country faces its challenges regarding the energy complex. Starting from March 1st, Russia will implement a six-month ban on gasoline exports in an attempt to reduce prices for motorists and farmers, before the presidential election (15-17 March).

Less than a year after the last intervention, the Kremlin has once again acted to stabilize domestic prices. In 2023, Russia enforced a ban on exports of refined products like gasoline and diesel from September to November. Despite ongoing market discussions on the consequences of this move, the impact this time may be considerably more constrained. Let's explore the reasons behind this.

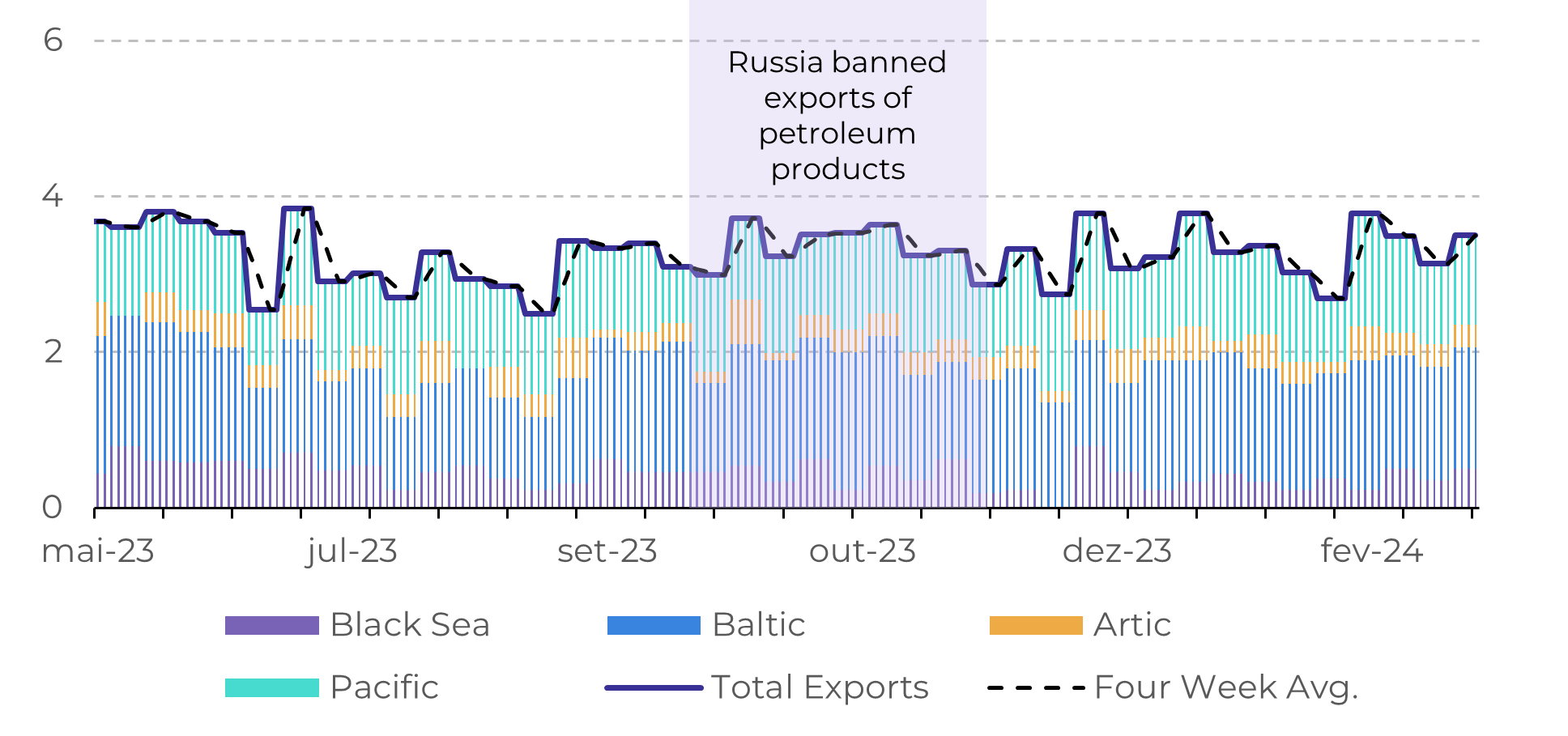

Image 1: Russia Seaborne Crude Oil Exports (Million bpd)

Source: Bloomberg

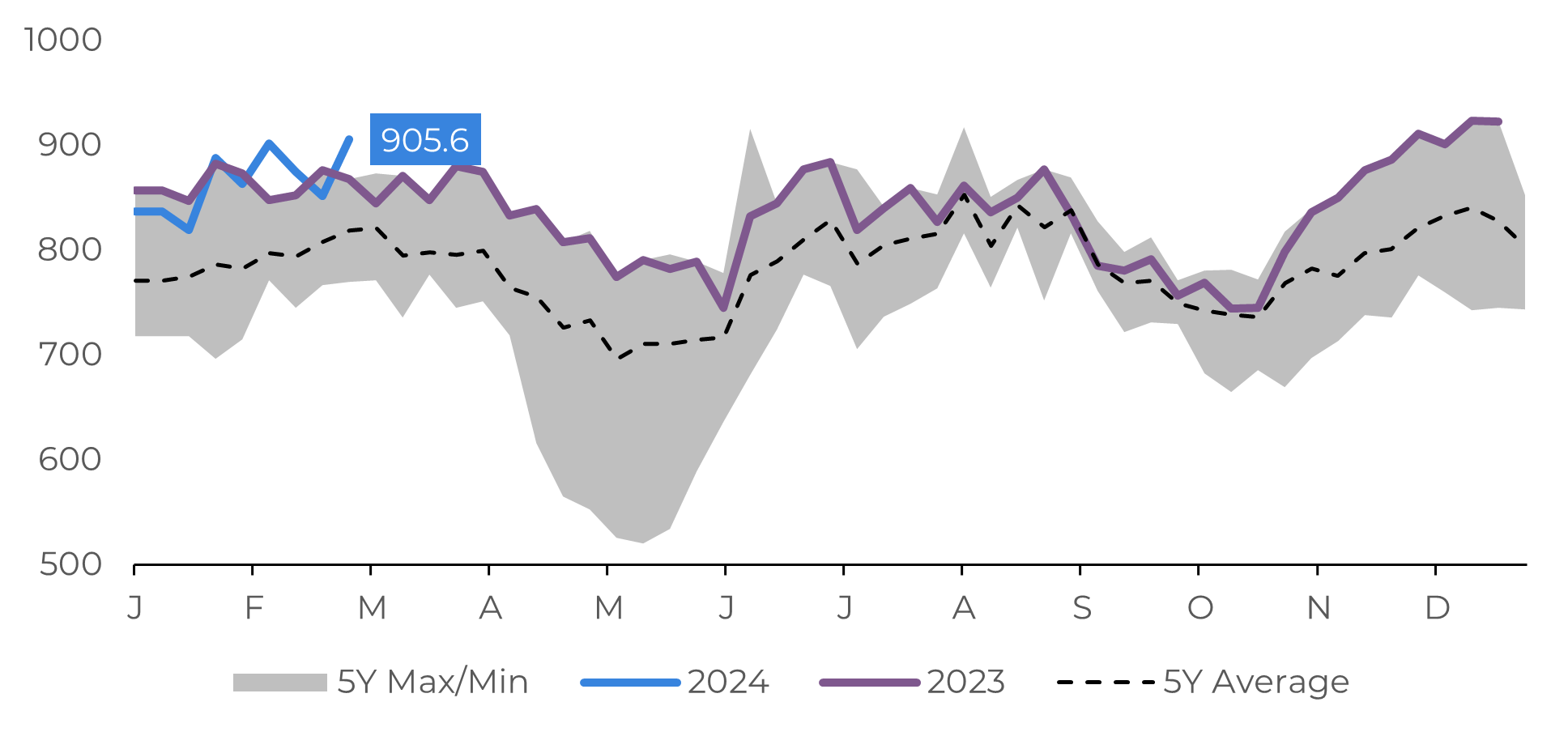

Image 2: Russia’s Gasoline Production (Thousand Tons)

Source: Bloomberg

Russian gasoline exports hold less weight in the supply balance compared to diesel

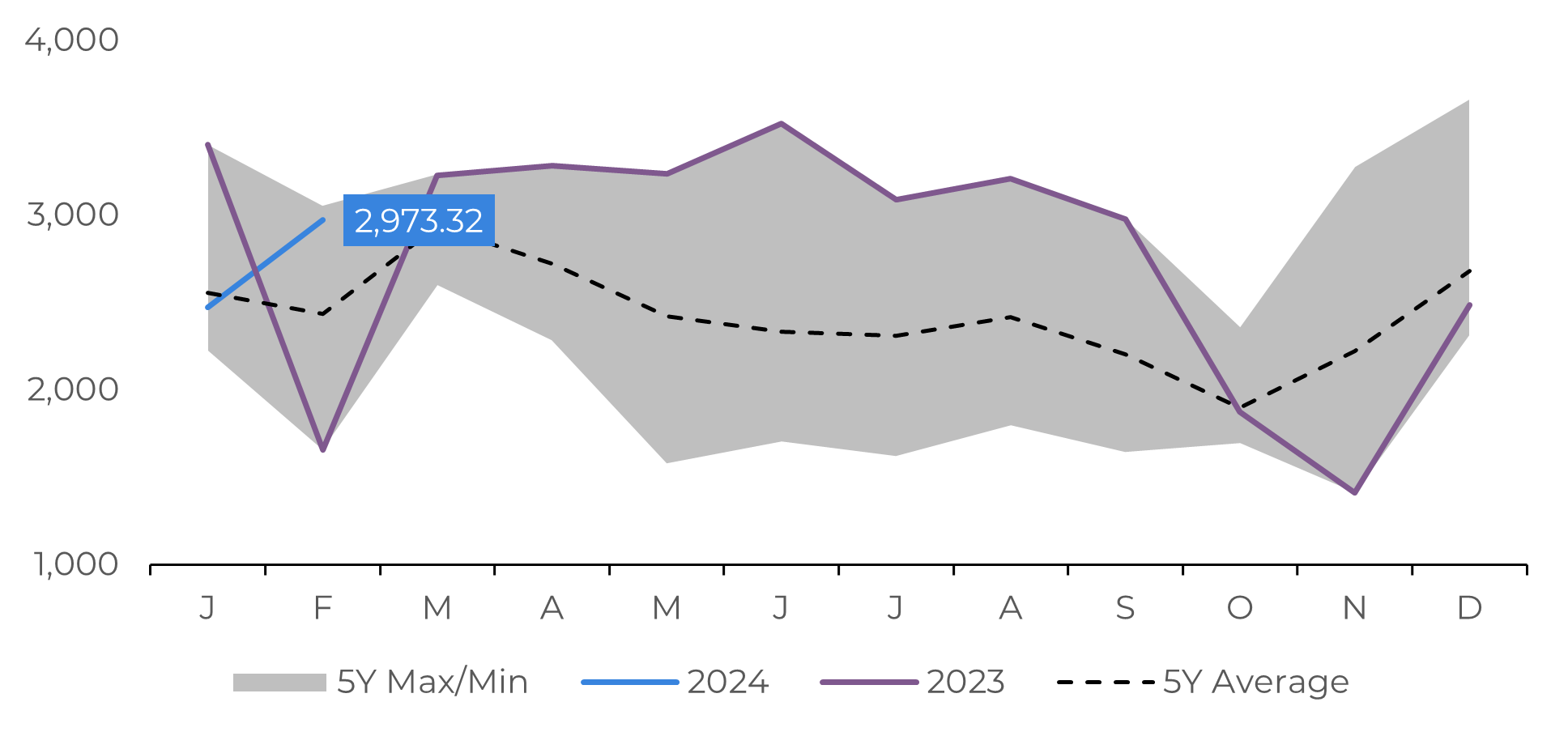

The fluctuations in the oil market and its derivatives inevitably lead to volatility, especially when they affect global supply. In this regard, Russia holds an important position in diesel exports, but the same cannot be said for gasoline, which constitutes only a minor portion of the country's refined export products. An illustration of this is that in 2023 the country exported more than 35 million metric tons of diesel, which nearly three-quarters transported via pipelines, whereas gasoline accounted for a mere 5.5 million metric tons.

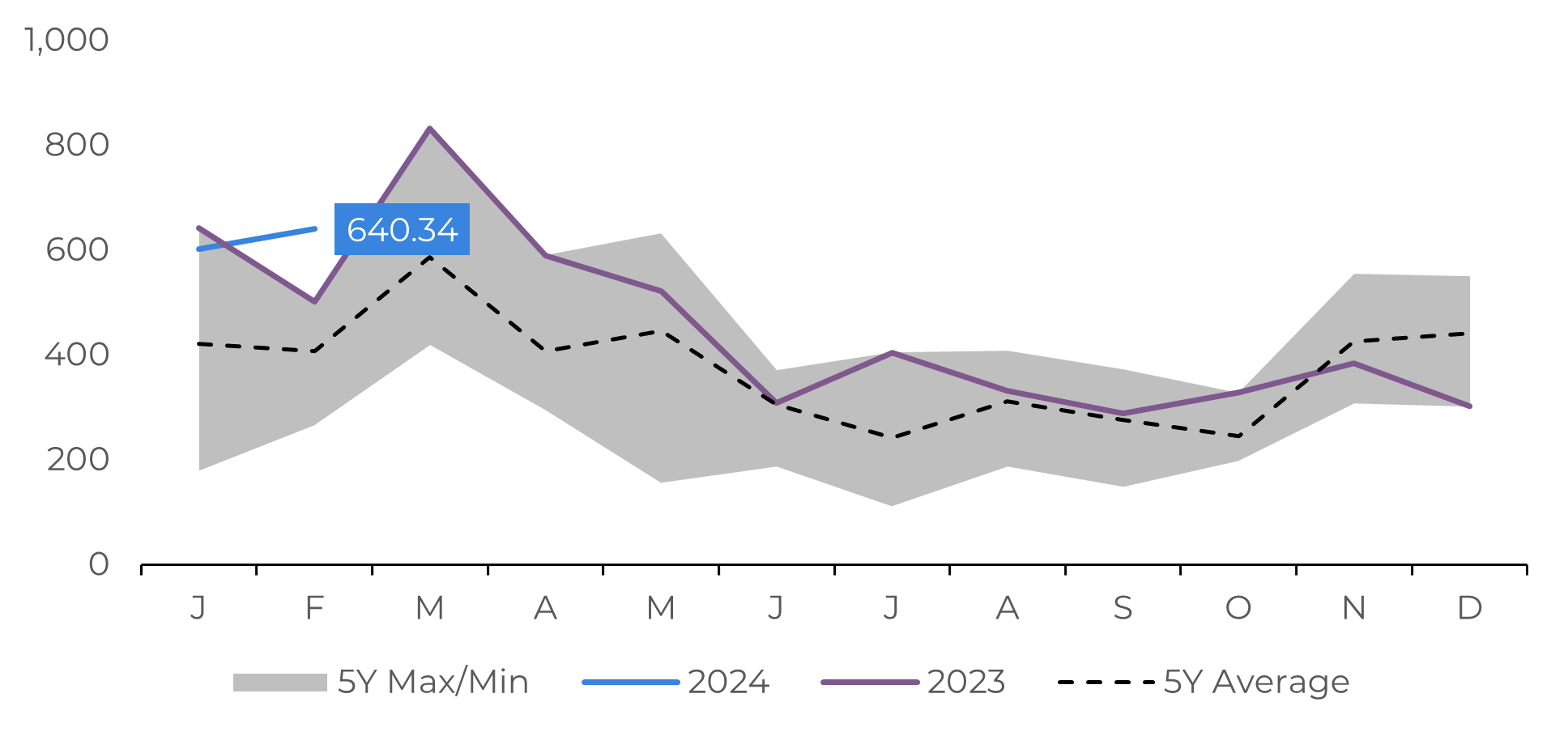

Currently, the country has been producing around 905,000 metric tons, an increase of +4.38% compared to the same period last year and over +10% compared to the average of the last five years. Most of the production is destined for exports; in February, the country recorded 640,000 tons, about 71% of the total available in the country. If production has increased in Russia, why are authorities concerned about ensuring local supply? It turns out that the country's energy structure has been under attack, a result of the conflict between the country and Ukraine.

Image 3: Russia's Exports of Gasoline (Thousand Metric Tons)

The country's energy infrastructure is under pressure

Ukrainian drones carried out a series of attacks on Russian refineries, aiming to pressure the country's capacity to meet domestic demand and reduce revenue generated from exports of refined products, especially diesel. Recently, a fire, supposedly resulting from a drone attack, forced Novatek to suspend operations at the Ust-Luga fuel terminal in the Baltic Sea. This is expected to result in a reduction of about 125,000 barrels per day in the export of naphtha, approximately one-third of the total exported by the country. If that wasn't enough, an incident led to the suspension of a processing unit at the Norsi refinery, the fourth largest in the country, near Nijini Novgorod. Estimates suggest it will take 4 to 6 weeks to address the technical issue.

Why are the damages to the country's capacity to produce and export liquid fuels concerning? Russia, along with OPEC, has been making efforts to restrict the supply of oil, with the country committing to reduce seaborne exports of crude oil and liquid fuels by 500,000 barrels per day (bpd). If the country exports fewer liquid fuels, this could result in higher oil exports, as the Kremlin may try to offset the loss of revenue from refined products with oil exports. However, in the case of gasoline, a product of lesser relevance in the country's export energy matrix, there should not be significant changes in the volumes of oil exported. However, if the ban extends to diesel, there would be deeper impacts on the market.

Image 4: Russia's Exports of Diesel (Thousand Tons)

Source: Refinitiv; These

figures are sourced from the Refinitiv Ship Tracking App. They are purely

indicative and may not accurately represent the figures that will be

subsequently published by authorities.

In Summary

New markets are opening up for Russian products due to their high discounts compared to other exporting countries. An example of this is Brazil, which imported 6.1 million tons in 2023, the second-largest importer behind Turkey.

An important lesson from the energy complex is not to underestimate the impacts caused by supply disruptions. In the case of the ban on Russian gasoline exports, although it poses low risks, it is a symptom of its energy infrastructure being under pressure.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com