Energy Weekly Report - 2024 03 11

As March arrives, what facts should you know about gasoline?

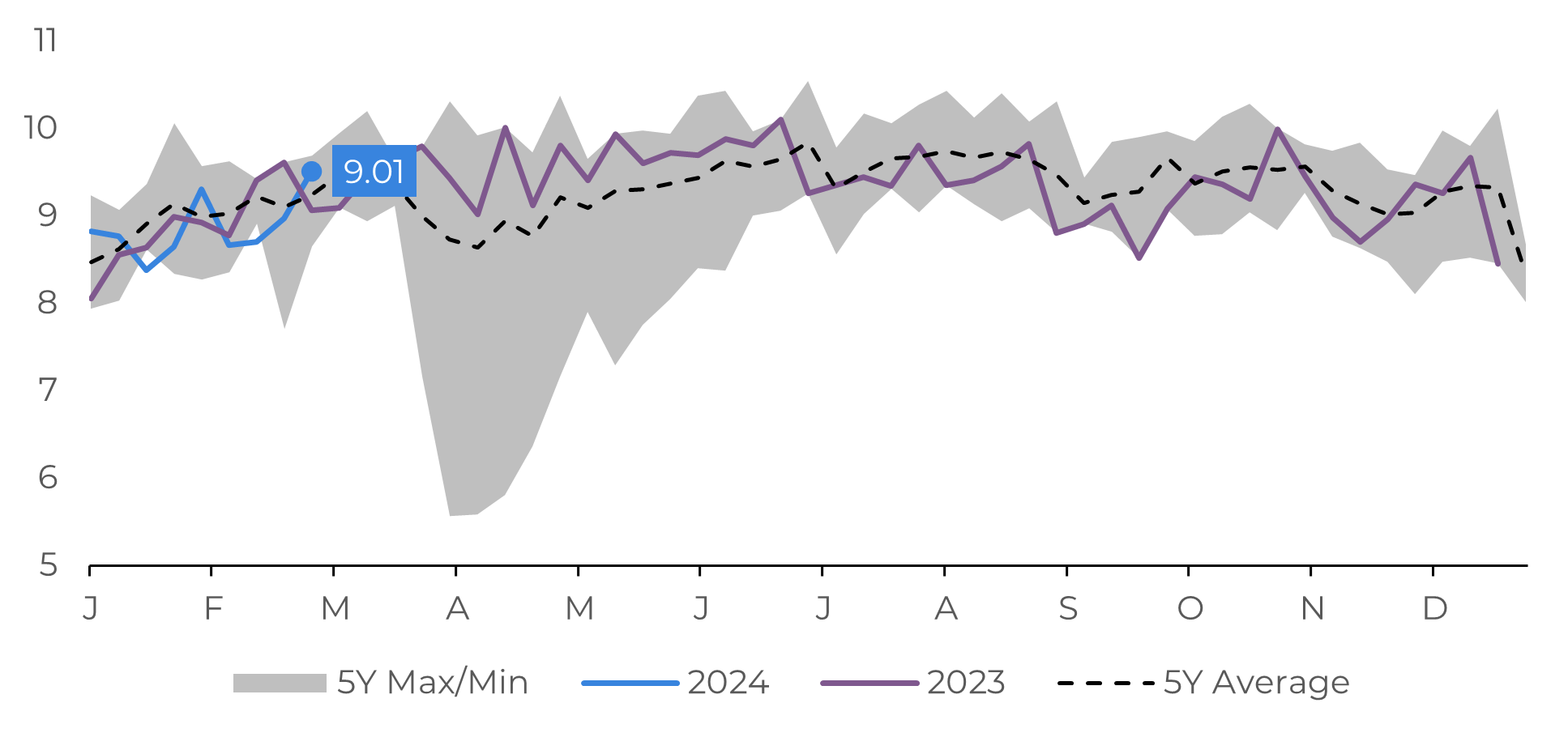

- The outlook for gasoline is rapidly improving in the United States as we approach the end of winter and the beginning of the Driving Season. Last week, gasoline demand surpassed 9 million bpd for the first time in 2024, marking a weekly increase of +546 thousand bpd.

- Not only are bullish signals emerging from demand, but bearish fundamentals on the supply side are also gradually being removed from the market as stocks have been aggressively depleted over the last few weeks.

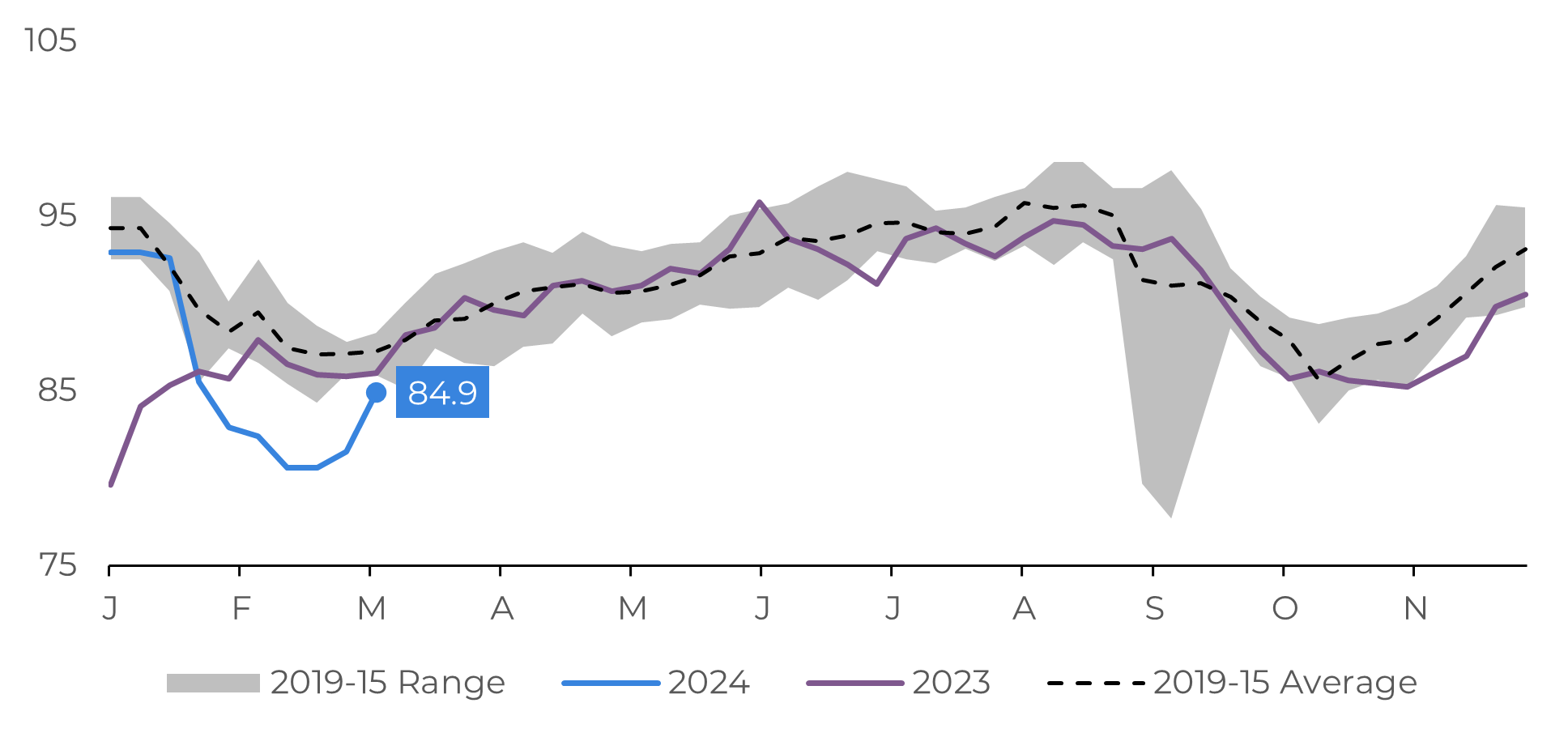

- Refining activity in the United States has faced challenges throughout this winter, resulting in lower utilization and consequently reduced production of petroleum derivatives.

- Despite this, there are risks to be considered, such as the current level of monetary policy, which remains quite restrictive, and the potential postponement of interest rate cuts in the world's largest economy.

Introduction

Availability has become tighter in recent months, especially for gasoline and middle distillates, as several refineries experienced unplanned outages in the USA. Consequently, refined products are expected to gain more prominence in the energy complex, which should lead to more bullish positions.

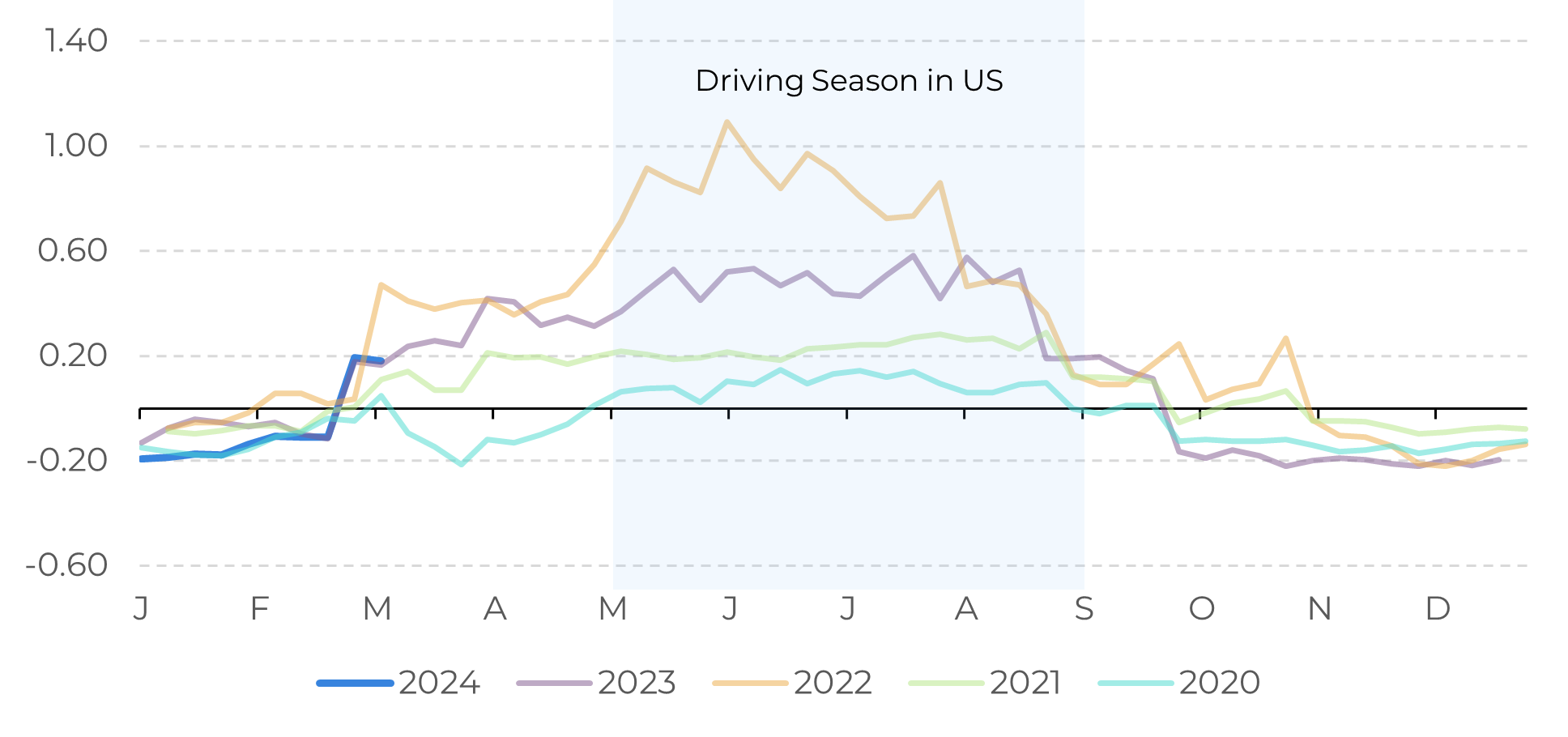

Middle distillates have an uncertain future with the end of winter, which reduces demand for heating oil (bearish), but also has expectations of higher demand for diesel due to the manufacturing activity recovery and interest rate cuts on the horizon (bullish). Meanwhile, the gasoline has plenty of room for significant appreciation this year.

Some noteworthy risks need to be considered, such as resilient inflation in the United States, which is casting doubts on the market about when there will be interest rate cuts in the country. However, data support a bullish view for gasoline, and that will be the focus of this report.

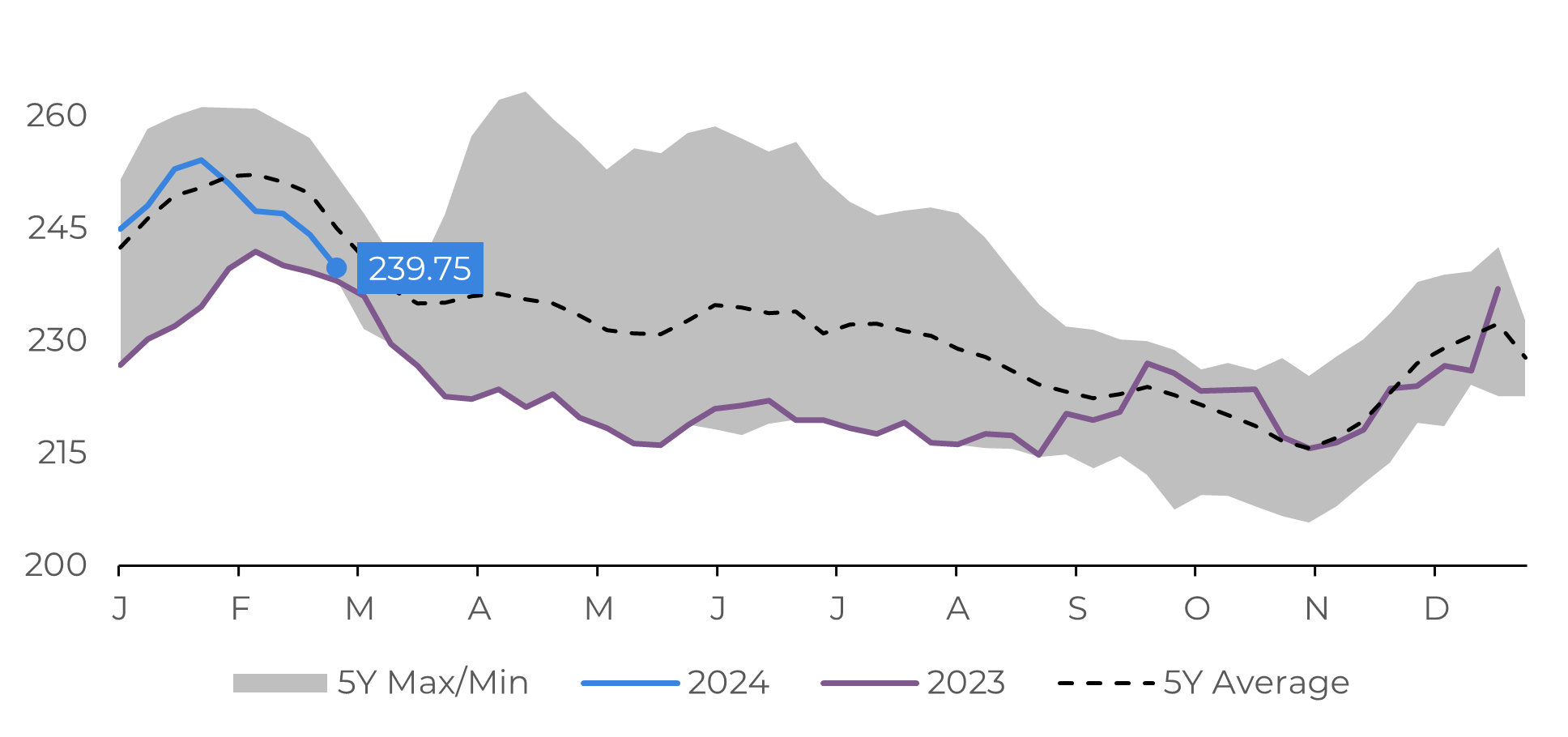

Image 1: US - Gasoline Stocks (M bbl)

Source: Bloomberg

Image 2: RBOB Front-Month Spread (US$/gal)

Source: Bloomberg

Gasoline demand exceeds 9 million bpd for the first time in 2024

It's virtually impossible to overlook data concerning gasoline in the United States without at least considering a potentially bullish outlook for this energy commodity in the coming months. Despite the low temperatures reducing mobility, impacting gasoline consumption at the beginning of 2024, EIA data shows an increase of 546 thousand barrels per day (+6.45%) in gasoline demand in the week ended 03/01, the highest value recorded for this time of year since 2021. This is partly explained by the strong performance of the American economy, which grew by 2.1% in 2023, supporting the resilience of the country's job market, which in February recorded a non-farm payroll of +275,000 job openings.

If, on the demand side, data show a bullish scenario, on the supply side, some bearish fundamentals have begun to dissipate. Large inventories were the primary obstacle to higher prices for RBOB. As of today, gasoline stocks have increased by just over 1% in 2024, one of the smallest accumulations in recent years, and in February, over 14 million barrels were removed from the stocks. Gasoline consumption naturally increases as we approach the driving season in the United States, but losses in production due to unplanned refinery shutdowns are impacting the market.

Image 3: US - Weekly Gasoline Demand (M bpd)

Source: EIA

The refining activity in the United States is facing challenges

The current low level of refinery utilization has exerted upward pressure on refined products, dropping below 81% in some weeks of February, below the average of the last 5 years. In this scenario, one of the most concerning areas is the Gulf Coast region (PADD 3), where most of the country's refining infrastructure is located. Refineries here have less protection against extreme cold, and the lack of winterization contributes to power outages or damage to refinery structures, resulting in temporary shutdowns. Refinery utilization levels in the region dropped by more than 14%, but have since recovered in recent weeks, reaching 85.3% in the last EIA report.

With lower production of petroleum derivatives coming into the market, inventories have been consumed over the past few weeks. Stocks of middle distillates are at historic lows, 10% below the average of the last 5 years, but upward pressure on prices is expected to be restrained as we approach the end of winter, reducing demand for heating oil. As for gasoline, where inventories are 2% below the average of the last 5 years, there is room for significant appreciation. In 2024, RBOB, the benchmark futures contract for gasoline, has risen by +20% ($0.43 per gallon).

Image 4: US – Refinery Utilization (%)

Source: EIA

In Summary

It will be important to observe how intense the pressure on the country's gasoline stocks will be in the coming weeks. If they continue to be consumed at the current pace, one of the few bearish fundamentals of the market will be dissipated.

Nevertheless, there remains a considerable risk of the United States delaying an interest rate cut. A shift in the favorable economic winds could dramatically impact gasoline consumption this year. Although not the most likely scenario, this is a risk present in the energy complex.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

natalia.gandolphi@hedgepointglobal.com