Energy Weekly Report - 2024 03 19

Will oil consumption in China surprise in 2024?

- Still as the primary driver of oil demand, significant signals have emerged in China that prompt reflection on what its oil consumption will be like in 2024.

- A less restrictive monetary environment can boost global trade, greatly supporting the Chinese economy, which could be a fundamental driver for increase in crude oil consumption crude oil consumption.

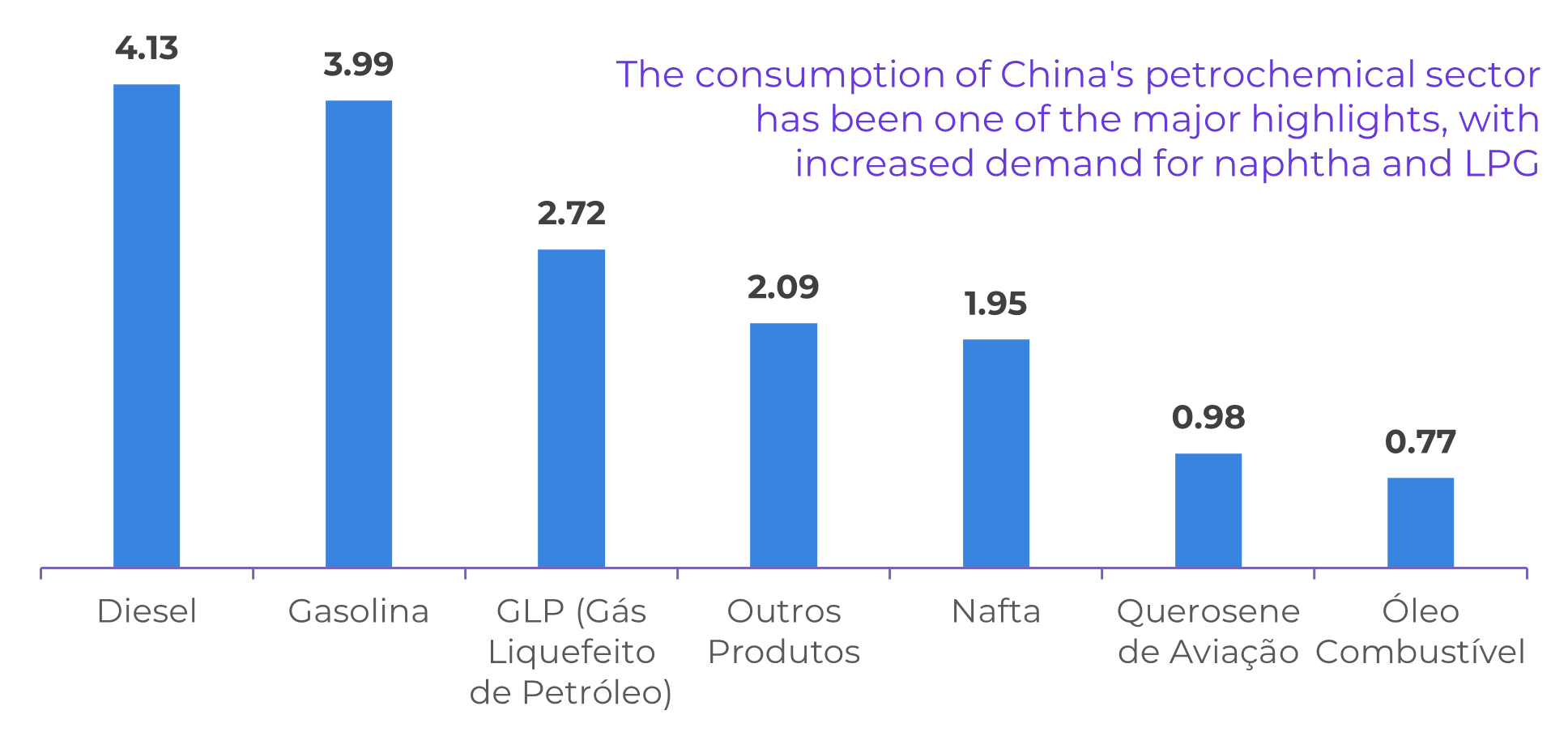

- While services, supported by gasoline and aviation kerosene, were the main drivers of the expansion in oil consumption in 2023, in 2024, improvement in the country's industrial sector is expected to boost diesel.

Introduction

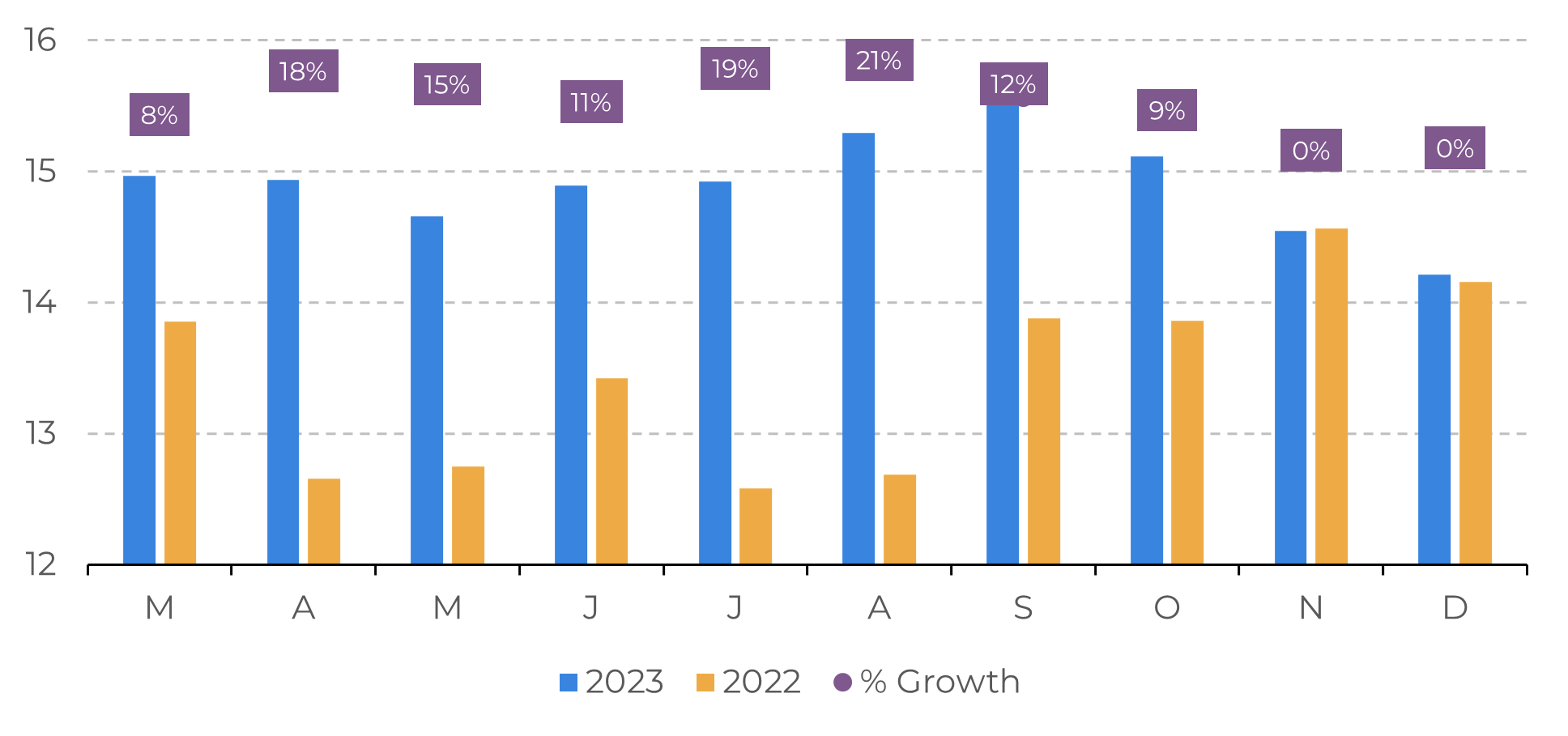

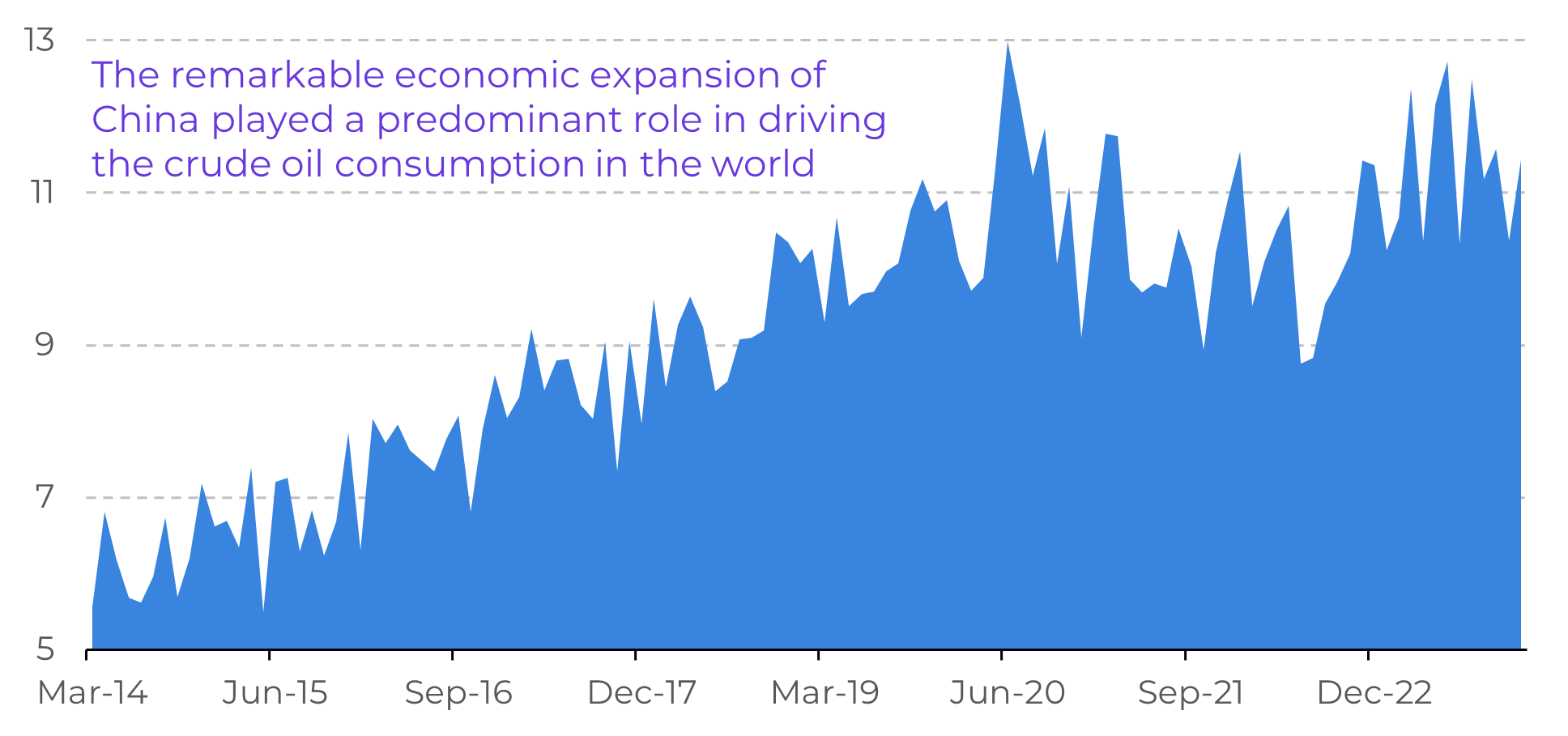

In recent years, China has been one of the most significant countries in the expansion of oil consumption worldwide. The increase in income, resulting from the strong growth of its economy, coupled with its enormous population, has brought about significant fuel demand, making the country the world's largest importer of oil since 2017.

It is expected that the country will expand its demand for oil by 620,000 bpd in 2024, significantly below the 1.7 million bpd in 2023. However, Beijing has shown signs of being willing to inject more stimulus into the economy, which could surprise energy sector analysts this year. Therefore, we are going to delve into a few important insights regarding China's crude oil consumption and its consequences for the market.

Image 1: China’s Crude Throughput (Million bpd)

Source: Bloomberg

Image 2: China’s Oil Demand Per Product in Jan 24 (Million bpd)

Source: OPEC

Oil imports in China grew by 11% in 2023

The second-largest economy in the world has reduced its influence on the oil market over the past few years, with many projections indicating that India will become the main driver of the market in the near future. There is validity in this view, but China still holds significant importance, and its absolute weight in terms of oil consumption will take a long time to be replaced by India. According to OPEC data, oil demand in China exceeded 16 million bpd, while in India, it stood at 5.34 million bpd. Despite India's rapid economic expansion, the country’s oil consumption is approximately one-third of China's economy.

When we examine the country's economy, significant changes are impacting its oil demand. Until 2020, the country showed positive growth rates, the highest in the world. However, with the implementation of the COVID-zero policy, the country has reduced its oil imports from over 10.8 million bpd in 2020 to approximately 10.2 million bpd in 2022, marking a 6% reduction (-660,000 bpd). In 2023, with the reopening of its economy, oil imports resumed growth, reaching 11.28 million bpd (+11% YoY). While this may have partially disappointed some projections that expected a larger increase, it's also undeniable that there was a significant rise in the country's oil consumption.

Image 3: China’s Crude Oil Imports (Million bpd)

Source: EIA

Beijing's stimuli are expected to favor oil consumption

The external sector is expected to improve for the country as interest rates fall in the United States, resulting in a weakening dollar. With global trade having more room to expand, this will aid China. Furthermore, Beijing this year is showing more willingness to implement fiscal and monetary stimuli to support the country's growth above 5%, which is a positive sign since oil consumption is strongly linked to a country's economic expansion.

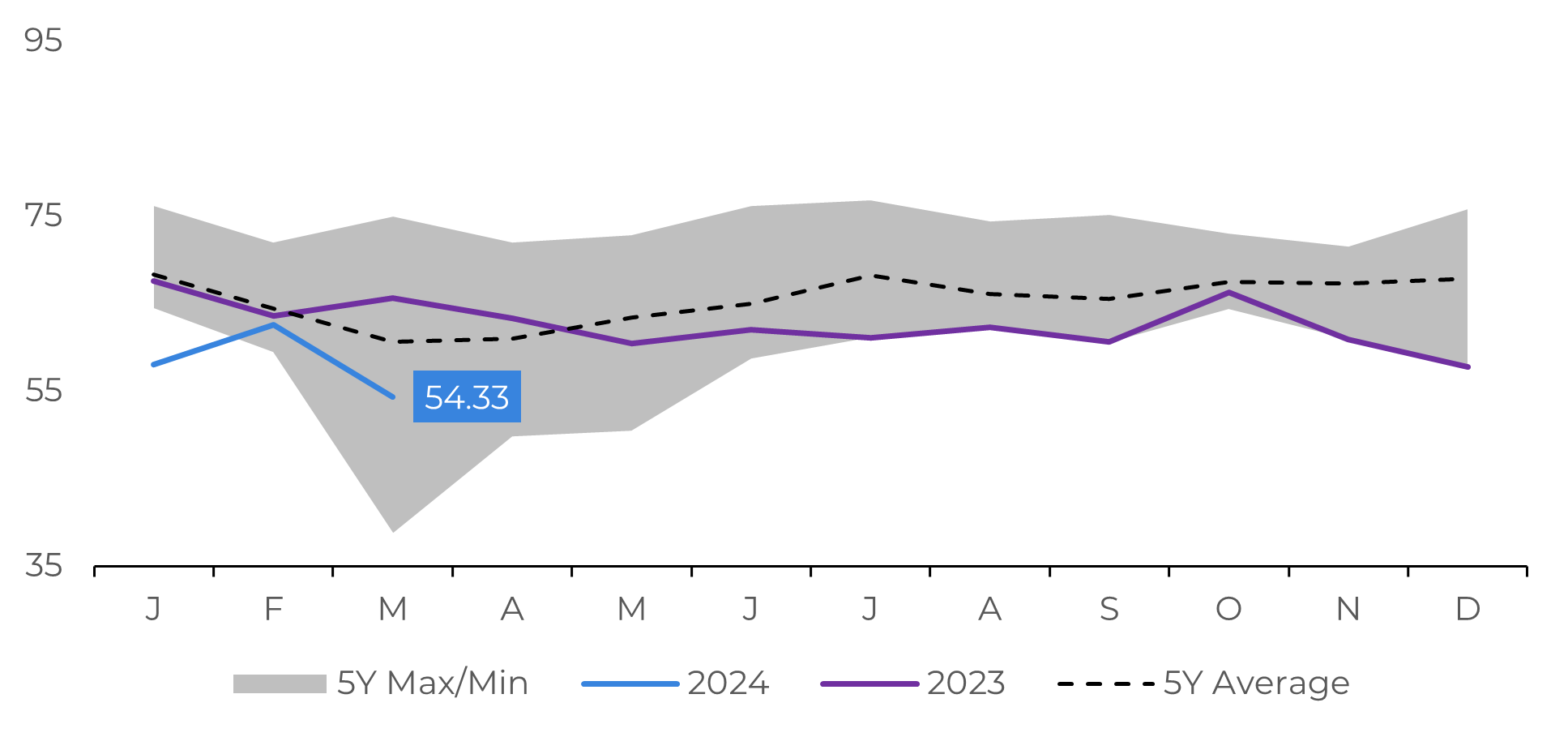

There are still significant challenges that deserve attention. The construction sector, which is highly diesel-dependent, has been experiencing a crisis in recent years, thwarting expectations for for an increase in petroleum and derivatives consumption. Diesel is the main product of 'teapots', small private refineries in China, which production have fallen to their lowest levels in the last 2 years. Since September 2023, the manufacturing PMI has been below 50 indicating contraction in this sector. So far, the service sector has been the main driver of the increase in oil consumption in the country, primarily due to the demand for gasoline, LPG, and aviation kerosene. If the country manages to implement support programs for its industry, particularly the real estate market, we may be surprised in 2024 with a higher-than-expected increase in China's energy consumption.

Image 4: Shandong Independent Refineries Utilization Rate (%)

Source: EIA

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

laleska.moda@hedgepointglobal.com