Energy Weekly Report - 2024 03 25

After strong gains, oil will encounter resistance

- Oil has benefited from various bullish news in the energy complex, such as revisions to the global GDP, stimuli in China, and geopolitical premiums from the Middle East and Europe.

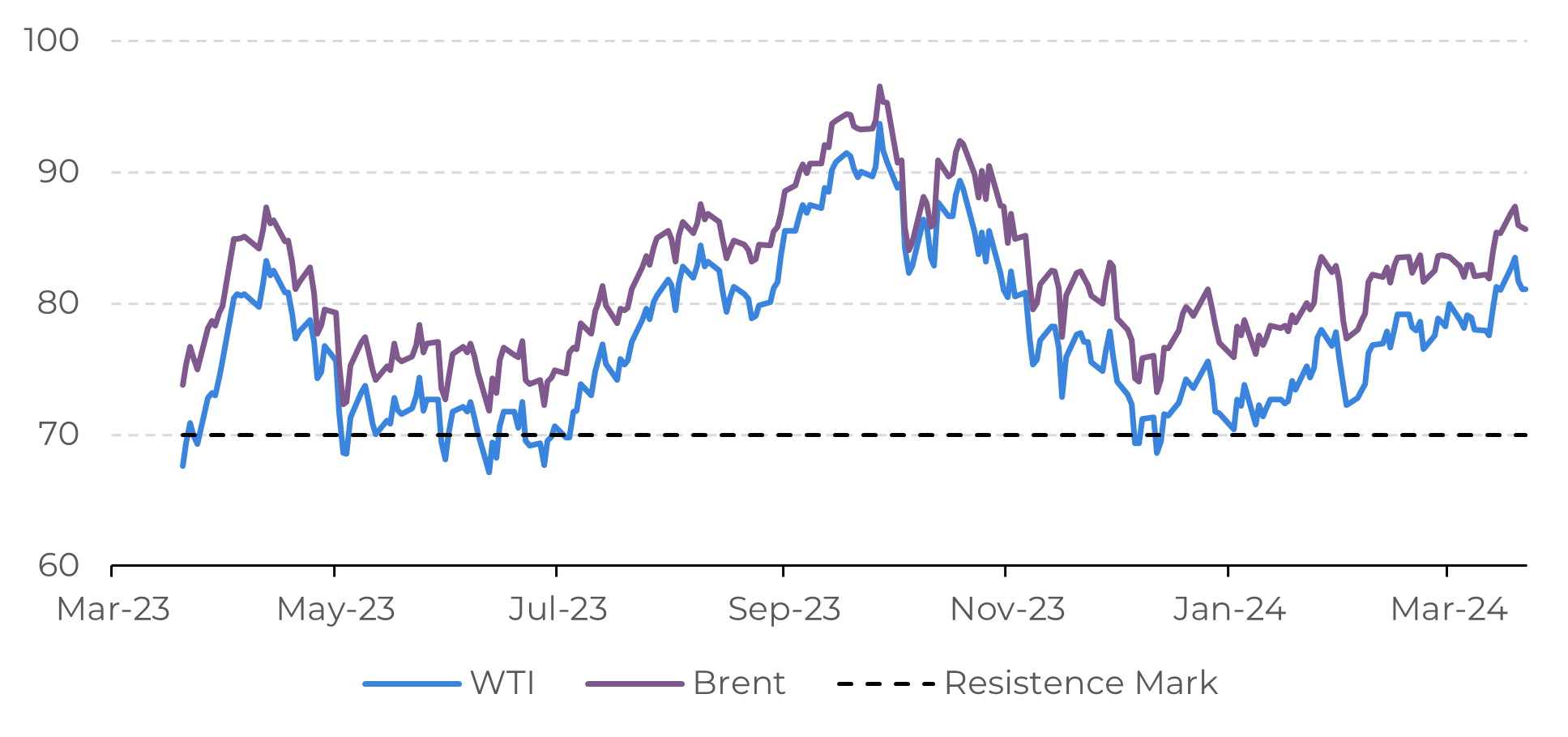

- Once current levels are reached, WTI and Brent will face more resistance to appreciation. One of the reasons is that the dollar remains quite strong, even in the face of the possibility of interest rate cuts in the US, which makes it difficult for holders of other currencies to trade the commodity.

- Another factor is that higher prices also incentivize increased production, both among OPEC members and non-members alike. Despite the organization's joint efforts to restrict oil supply, many countries are operating below their quotas.

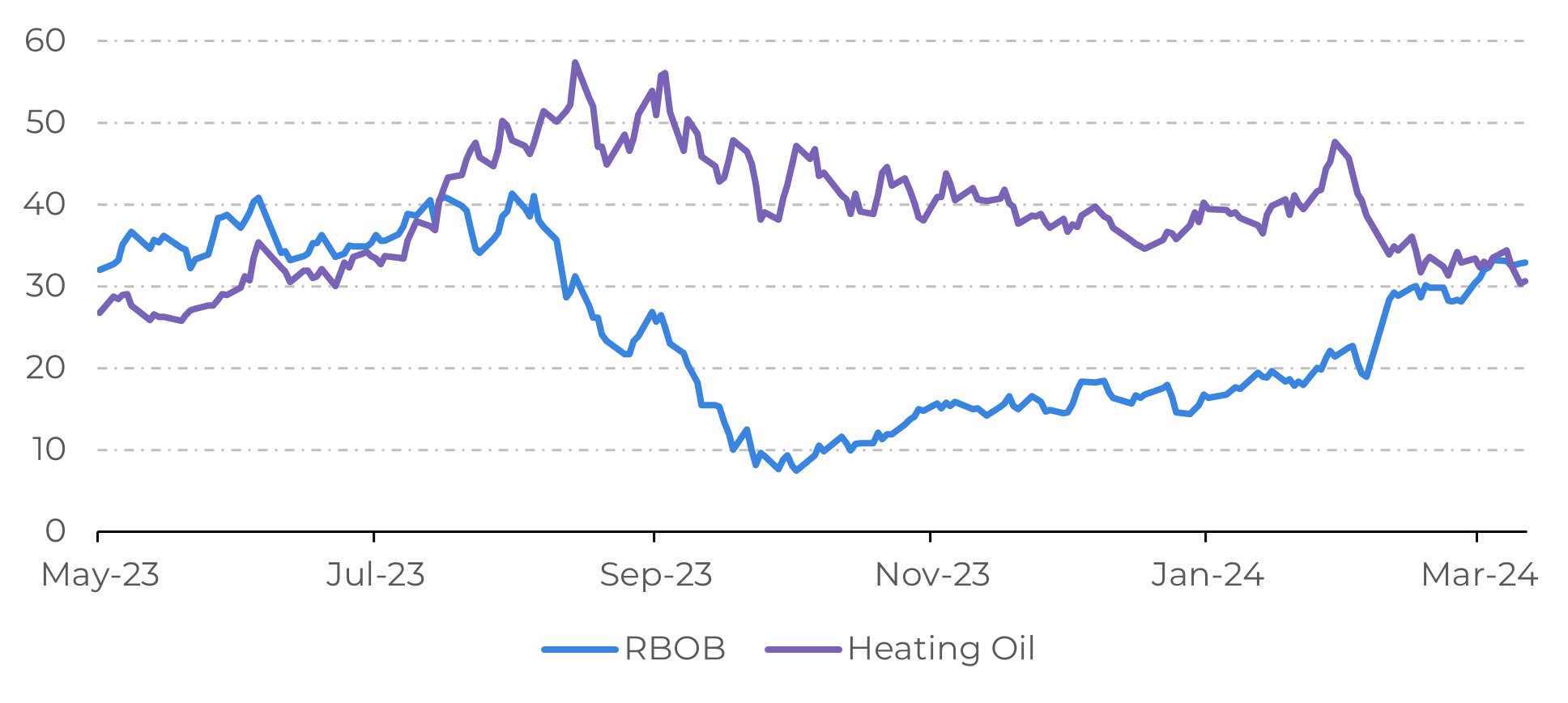

- The possibility of a reversal in oil prices in the coming weeks presents an opportunity for gasoline cracks, a derivative of oil, as it benefits from seasonal factors of increased mobility in the US.

Introduction

Once again, we observe how assets in the energy sector are volatile, swiftly changing their price dynamics in response to new developments that alter traders' and investors' sentiments. If earlier in 2024, WTI hovered around $70.00 per barrel, driven by worries over diminished demand and surplus in the oil market, that scenario now appears distant. The American oil benchmark has surged past the $80.00 threshold since last week and has sustained this level for seven consecutive trading sessions.

The bullish revisions to global GDP forecasts from the IMF (3.2%) and OPEC (2.8%), coupled with fiscal and monetary stimuli from China, are bolstering the expectation of heightened energy consumption for 2024, indicating a rise in demand for oil. However, Brent and WTI may encounter resistance to surpass their current levels. This will be the focus of our report: to present the key fundamentals that have influenced the main oil benchmarks and to highlight the challenges for further appreciation.

Image 1: Major Crude Oil Benchmarks (US$/bbl)

Source: Bloomberg

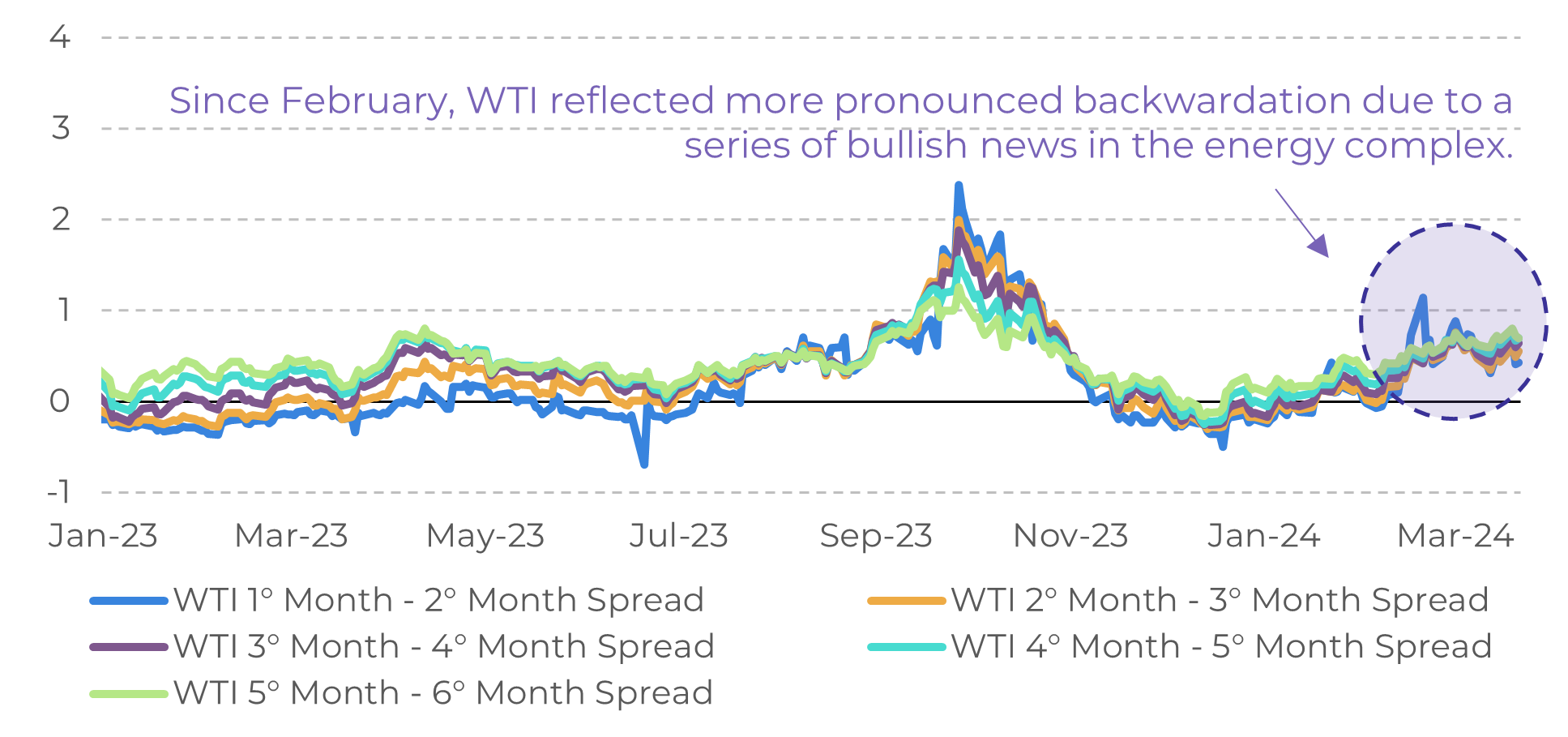

Image 2: WTI Contracts (US$/Spread)

Source: OPEC

Demand revisions strengthen the bullish sentiment for oil

The first months of the year have shown more bullish news for oil. The International Energy Agency has raised its demand estimates for 1Q2024 to 1.7 million bpd (+270,000), OPEC has extended its production cuts until mid-year, and China has shown signs of being more willing to use fiscal and monetary stimuli to support its economy. This is without mentioning the low temperatures in January and February that have caused some disruption to oil and gas production in the United States. The combination of demand surpassing projections and lower-than-expected supply has resulted in more bullish sentiment for oil. As a result, the main oil benchmarks showed a significant increase in 2024, with WTI at $10.93 (+15.5%) and Brent at $10.11 (+13.32%). Since mid-February, WTI has fallen into backwardation, indicating greater immediate demand for the market.

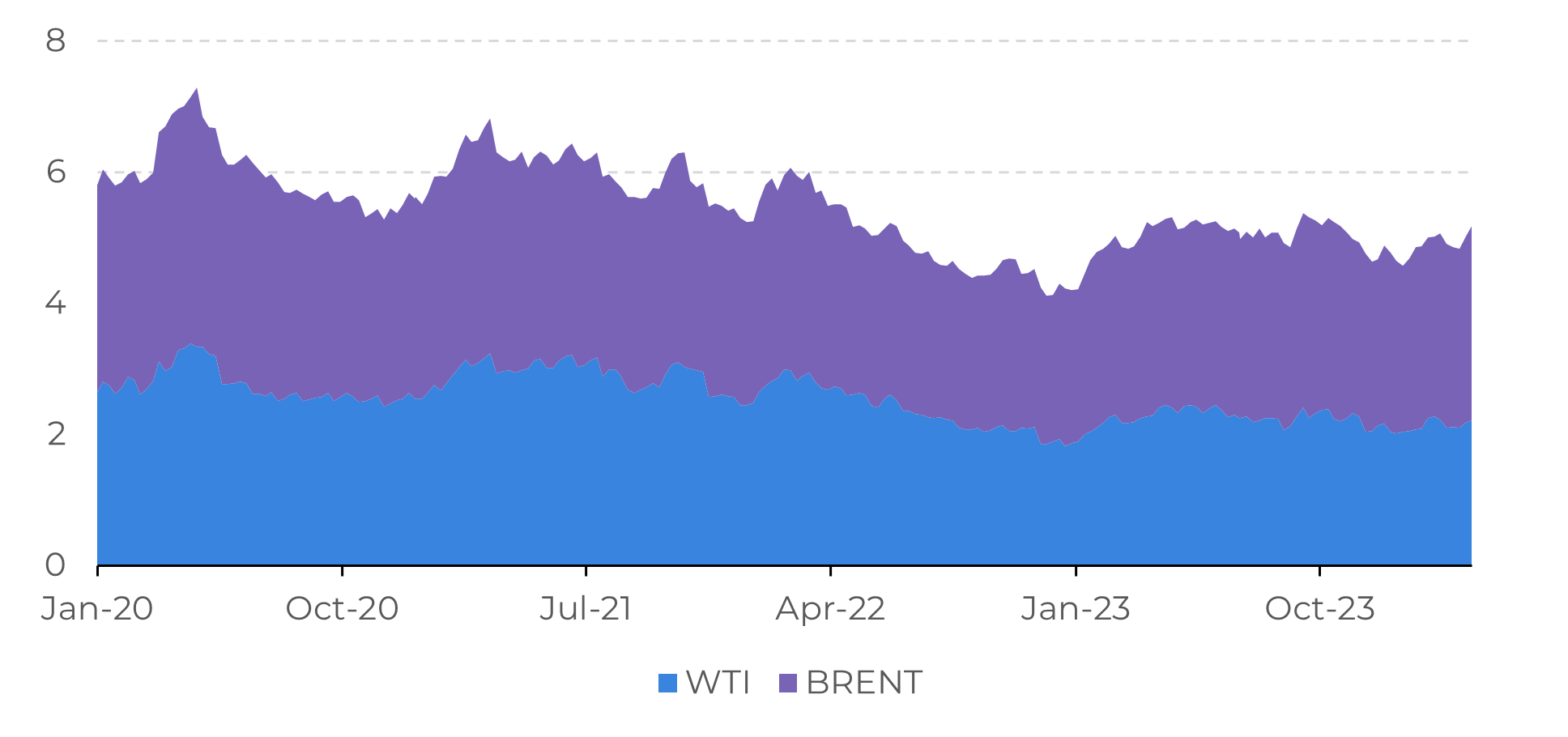

The market has certainly taken note of these developments. While the increase in open interest (the sum of long and short positions) for WTI has been moderate, just above 3% for this year, Brent has seen a substantial increase (+11%), reaching its highest level since November 2021. However, it will be difficult for oil to surpass current price levels. It's important to consider that higher oil prices encourage increased production. Despite joint efforts by OPEC to restrict production, there are members, such as Nigeria, operating below their quotas. Therefore, following the example of February 2024, when OPEC production increased by 203,000 bpd to 26.57 million bpd, we may expect to see more supply from the organization in the coming months.

Image 3: WTI and Brent Open Interest (Contracts of 1000 Barrels)

Source: EIA

The dollar is a fundamental of resistance to oil demand

Although risk assets are benefiting from the prospects of interest rate cuts in the United States in June this year, commodities, in general, are still not capturing this environment of reduced risk aversion. The Bloomberg Commodities Index fell by more than -12% in 2023, and, this year, it improved by 0.4%. So far, oil has benefited from geopolitical premiums, such as the conflict between Russia and Ukraine and developments in the war between Israel and Hamas in the Middle East. However, the historically high dollar levels hinder a greater demand for energy assets. Holders of other currencies tend to purchase fewer assets traded in the American currency, and as most energy commodities are priced in dollars, this exerts additional downward pressure on oil prices.

If there's less room for appreciation in oil at this moment, the same cannot be said for refined products, especially gasoline. Seasonal factors are benefiting the appreciation of RBOB, the benchmark contract for gasoline. The crack spread, which is the difference between the value of the refined product and the cost of oil, a proxy for refinery margins, has already risen by more than $16.00 per barrel since the beginning of the year. If oil prices decline in the coming weeks, this would represent an opportunity for gasoline cracks and refinery margins.

Image 4: RBOB and Heating Oil Cracks (US$/bbl)

Source: EIA

In Summary

The current moment presents opportunities for the energy complex. While middle distillates have lost support due to reduced heating needs and a gradual recovery in diesel demand, RBOB cracks show potential for gains in the coming weeks with increased demand for gasoline and a correction in WTI.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.