Energy Weekly Report - 2024 04 02

What can we expect from diesel in the coming months?

- Heating oil futures ended March slightly down, reflecting the slow recovery in diesel consumption and the end of winter in the northern hemisphere.

- Some events could soften this bearish scenario, such as the recovery of manufacturing activity in the main regions of the world and a less restrictive monetary policy, with the possibility of an interest rate cut by the Fed in June.

- However, it cannot be ignored that Ukrainian drone attacks on Russian refineries are increasing the risks to some disruption to supplies from the Black Sea and the Baltic ports.

Introduction

Middle distillates are petroleum products and have one of the highest correlations with countries' industrial performance. When manufacturing activity is booming, diesel consumption tends to increase. For this reason, we have seen one of the most challenging periods in recent months, the benchmark futures contract for middle distillates, which recorded modest gains of 2.76% in 2024 (+US$ 0.07) per gallon.

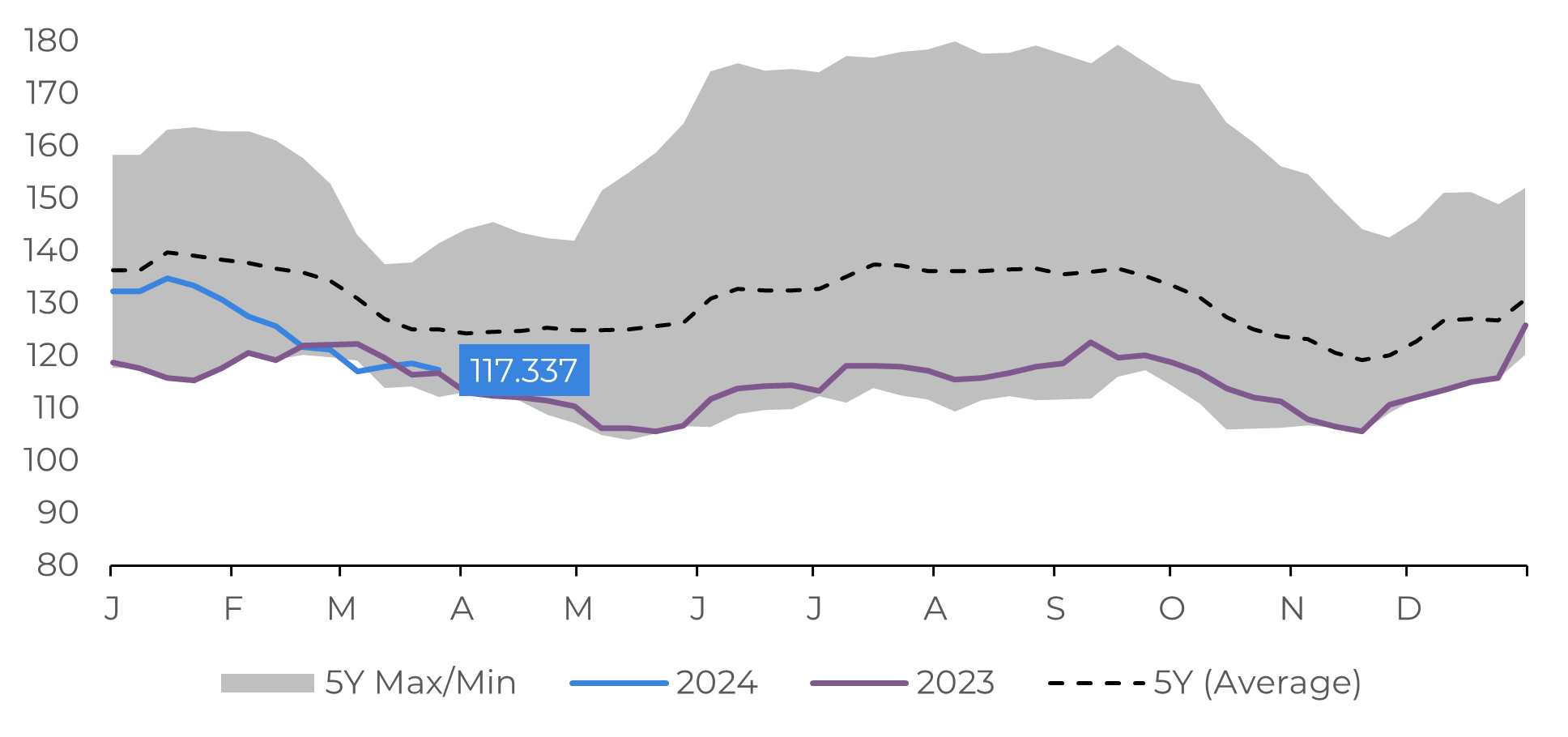

Despite the very significant risks on the supply side, especially the historically low US inventories, totaling 117 million barrels according to the EIA report last week, the lack of demand has kept downward pressure on heating oil futures. The end of winter is yet another factor contributing to a less optimistic outlook for the future gains of this commodity. However, recent events are bringing a less bearish scenario, and our report will focus on this data.

Image 1: US - Middle Distillate Stocks (Million Barrels)

Source: EIA

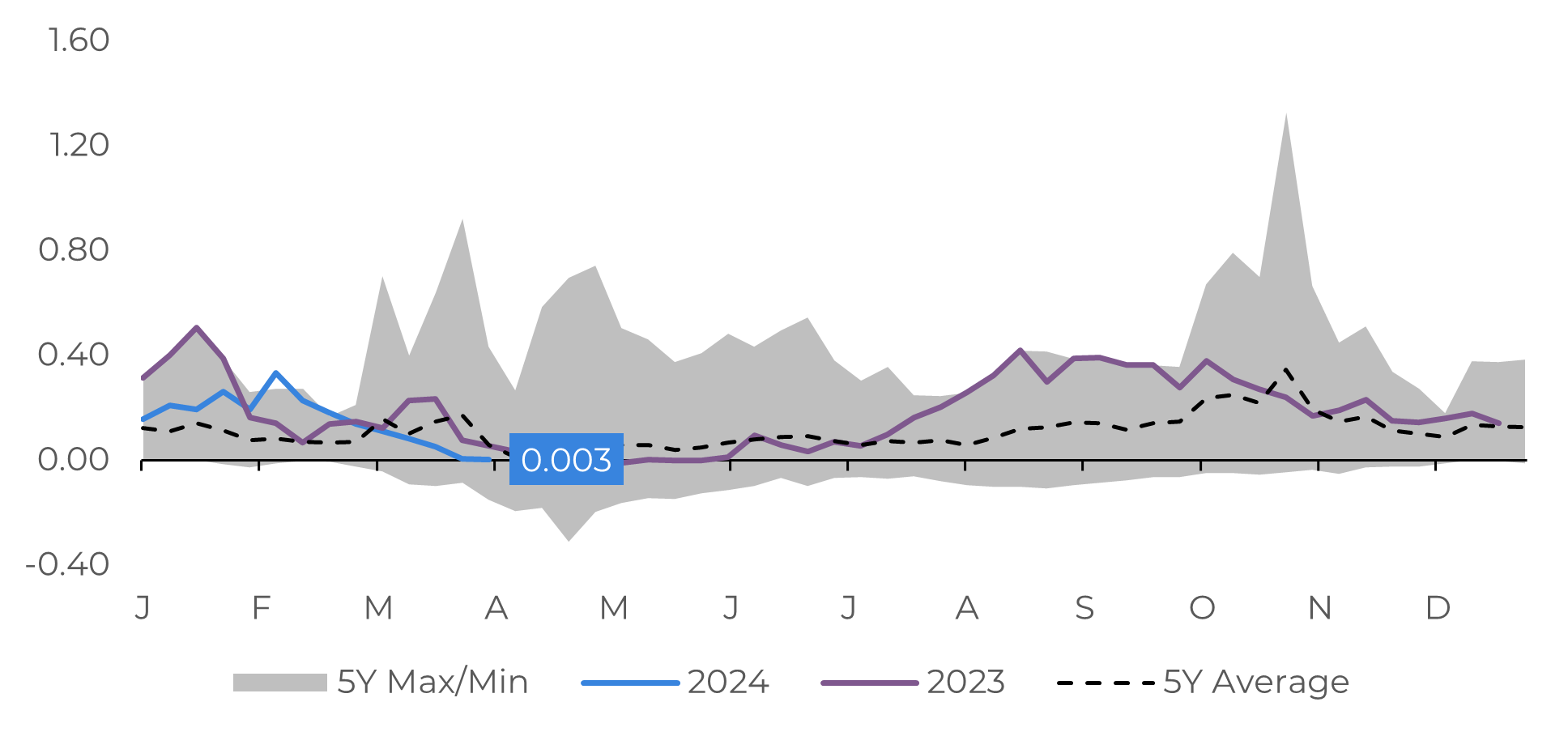

Image 2: Six-Month Heating Oil Spread (US$/gal)

Source: Refinitiv

Signs of a recovery in diesel consumption are beginning to emerge

Heating oil futures have found little room for appreciation in recent weeks, ending March with losses of -2.54% (US$ -0.068/gal) amid the end of winter and a slow, gradual recovery in global diesel demand. The difference between the May and October futures contracts is very close to zero, indicating that the market is not very optimistic about the growth in consumption of diesel and other middle distillates in the future. In fact, consumption seems to be the key factor in unlocking a more bullish scenario for heating oil, as stocks of middle distillates remain low in the US remain low, approximately 6% below the 5-year average.

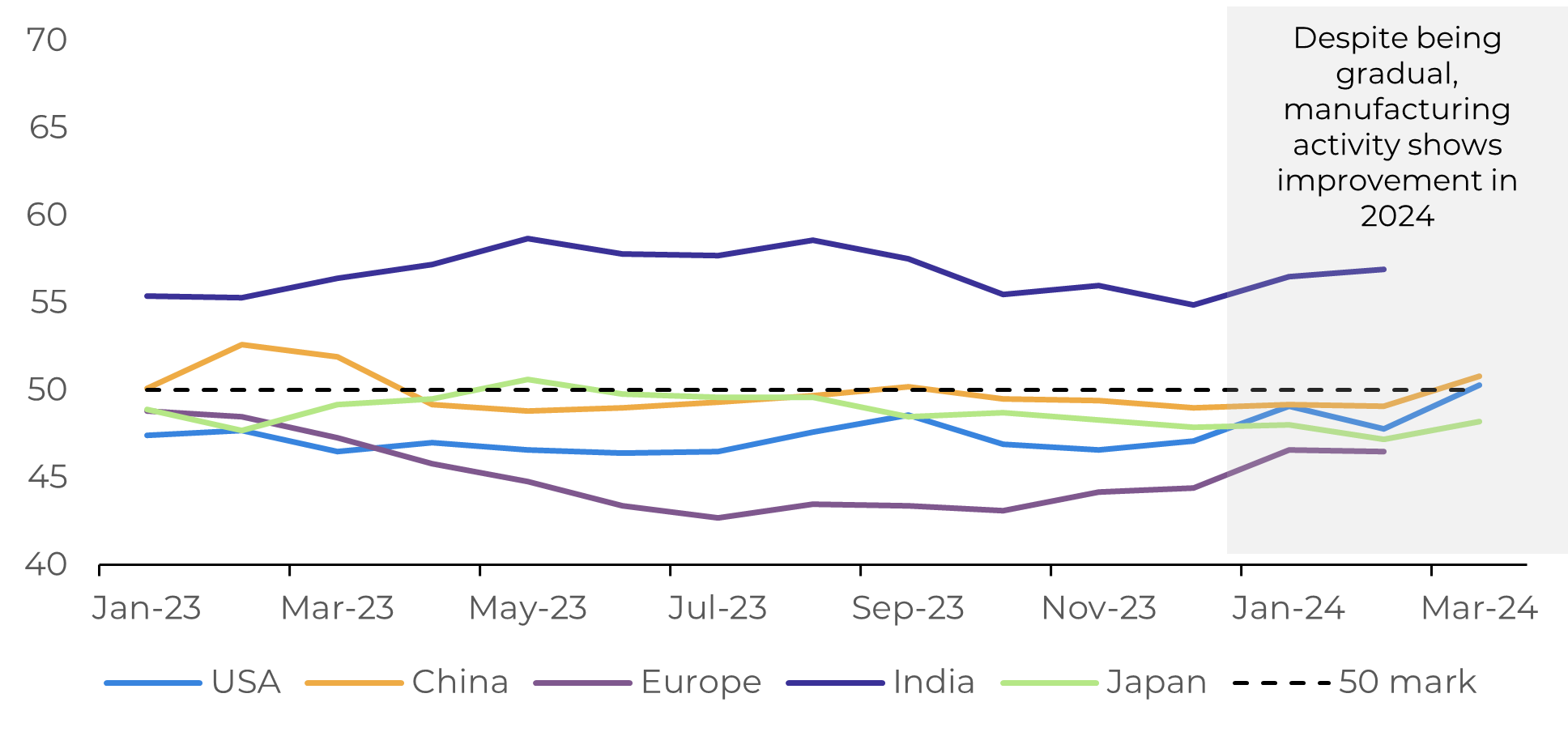

It's difficult to predict when consumption of middle distillates will increase significantly, but some signs are beginning to emerge, and paving the way for an appreciation in heating oil. The US and Chinese manufacturing PMIs have started to recover. According to ISM data, the index has surpassed the 50 mark, which indicates expansion in the sector. In addition, a less restrictive monetary policy by the Fed, due to interest rate cuts this year, should boost industrial activty, which is very intensive in the consumption of diesel and other oil derivatives.

Image 3: Manufacturing PMIs in Selected Countries

Source: Refinitiv

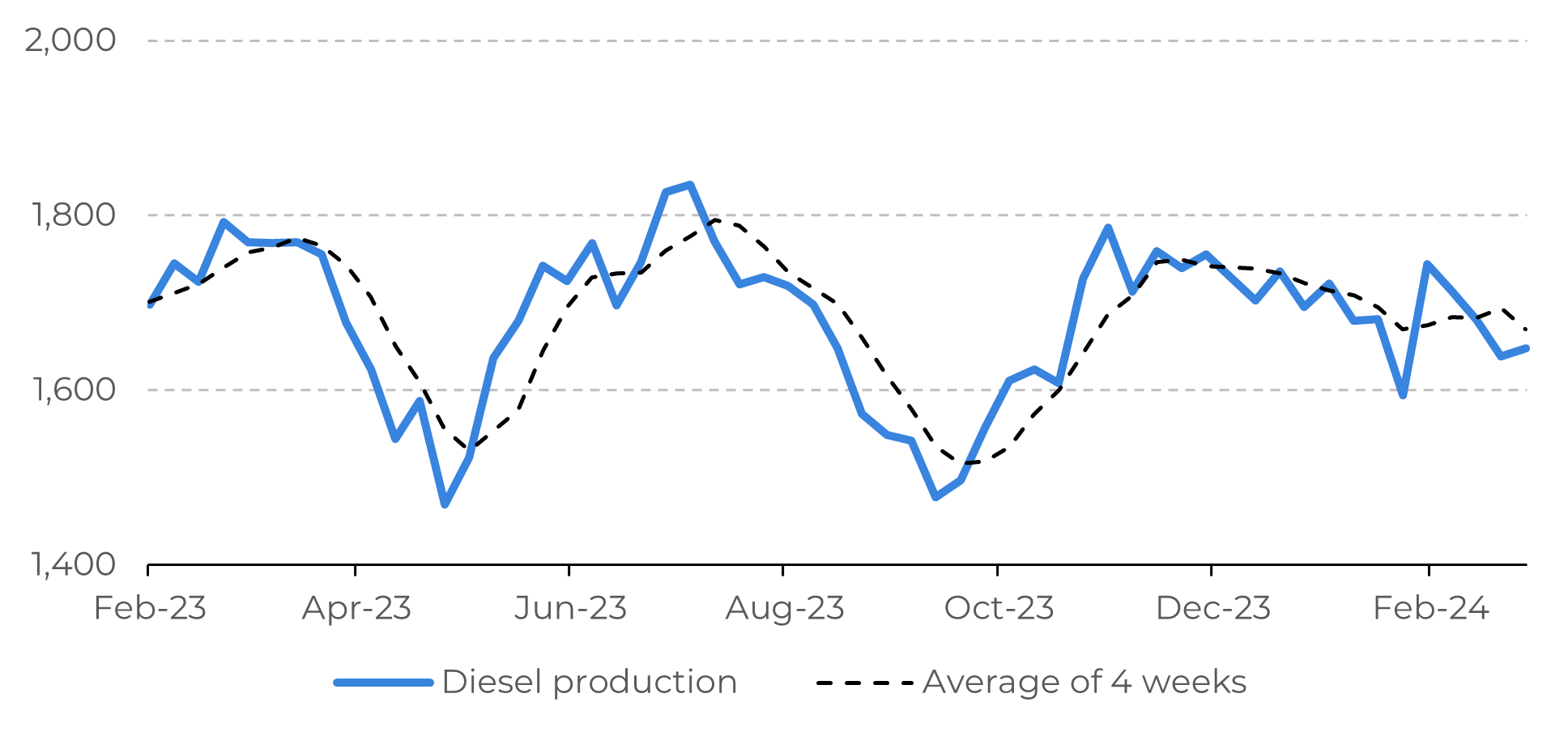

Russian diesel production is at risk

Meanwhile, other risks are accumulating around heating oil, and perhaps one of the most significant is in Russia. Reuters estimates that approximately 14%, or around 900,000 barrels per day, has been affected due to Ukrainian drone attacks on the country's refineries. The Kremlin authorities deny that there will be a ban on diesel exports from the country. However, data shows a reduction in the flow of cargo leaving the Baltic and Black Sea ports of more than 500,000 barrels per day, one of the lowest levels in the last 5 months.

Given this context, we can outline two possible scenarios for heating oil in the coming months. A neutral scenario, in which the recovery in middle distillates consumption will be slow and gradual, but with prices supported by low US stocks and a barrel of WTI above US$ 80.00. Another possibility is a tighter-than-expected market, with supply challenges coming from Russia amid an electoral process in the world's largest economy, which brings uncertainty as to whether the US will be able to fill the gap left by Moscow in world supply. For the time being, the market has reacted to the first scenario, which is the most likely, but the growing risks from the damage to Russian refineries should not be ignored and could reflect on prices in the future.

Image 4: Russia - Diesel Production (Thousands of Tons)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

laleska.moda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.