Energy Weekly Report - 2024 04 08

Geopolitical risk amplifies bullish factors for oil

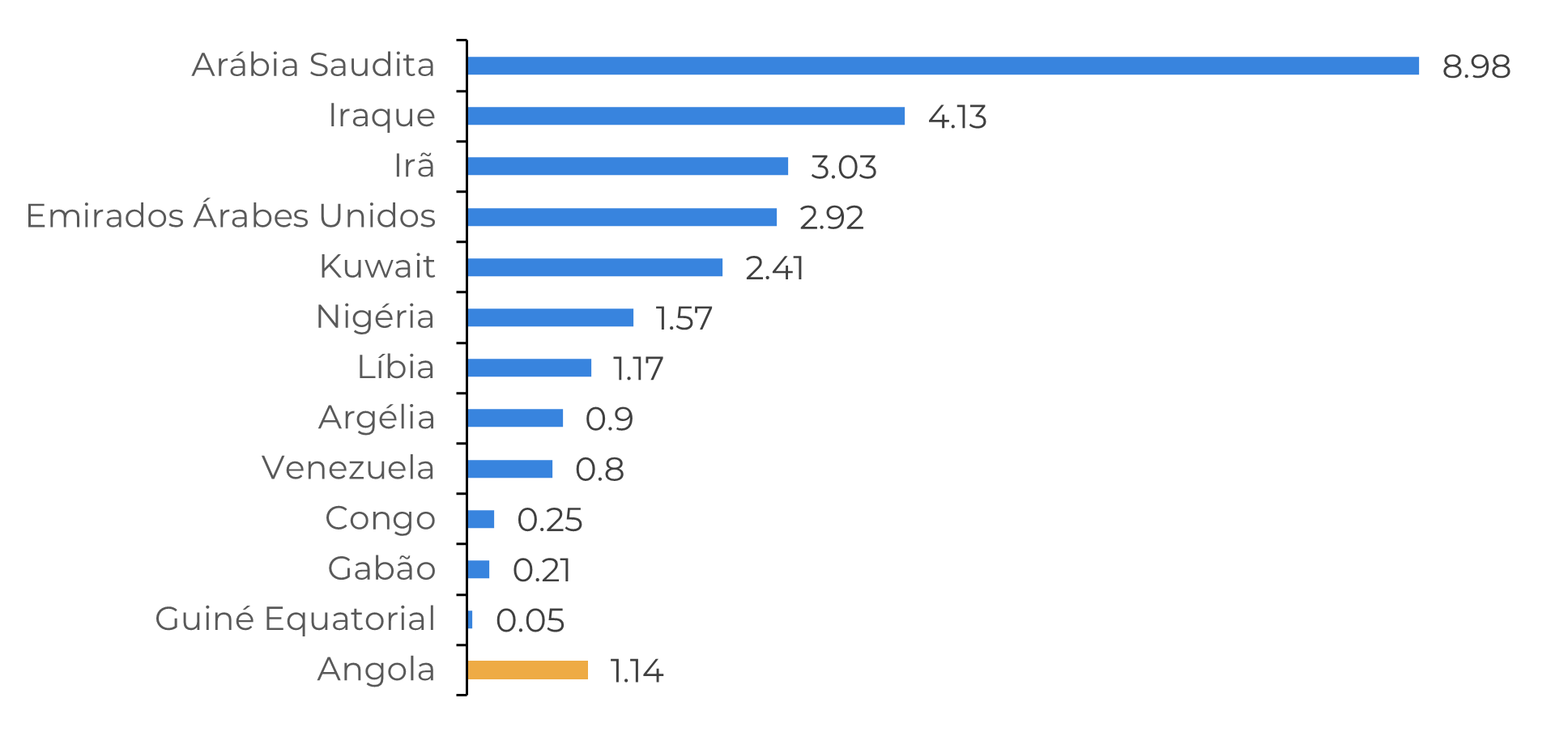

- In another meeting, OPEC+ decided to maintain its additional voluntary production cut of 2.2 million barrels daily. However, compliance was a highlight of the last meeting, as some countries were found producing above their quotas.

- In another week of gains for the major oil benchmarks, it is impossible not to recognize the success of the strategy adopted by oil-exporting countries.

- Also, geopolitical tensions are adding further premiums to the energy complex. Both Europe and the Middle East conflicts experienced escalations recently, which will also add to oil appreciation.

- However, some bearish risks may impact the market in the coming weeks. Current prices of crude oil will exert pressure on inflation in the US and Europe, potentially eliciting a response from central banks.

Introduction

The current state of energy complex assets, especially oil and its derivatives, is significantly different from the beginning of the year. While bullish revisions to the global GDP and tighter oil market are driving bullish sentiment, recent geopolitical tensions are adding an extra premium to its oil price. Still on the heels of bullish fundamentals, the recent OPEC+ meeting extended the additional voluntary production cut of 2.2 million barrels per day by member countries, at least until June 1st when a new meeting will be held.

However, some bearish risks to the market could materialize in the coming weeks. One bearish factor could arise if China reduces its oil imports pace in favor of its reserves, thus avoiding the current high prices. Another risk is that central banks may keep interest rates high for longer to control prices, which are strongly pressured by the elevated costs of fuels.

Therefore, let's discuss the bullish and bearish risks likely to shape the price of oil and its derivatives in the coming weeks.

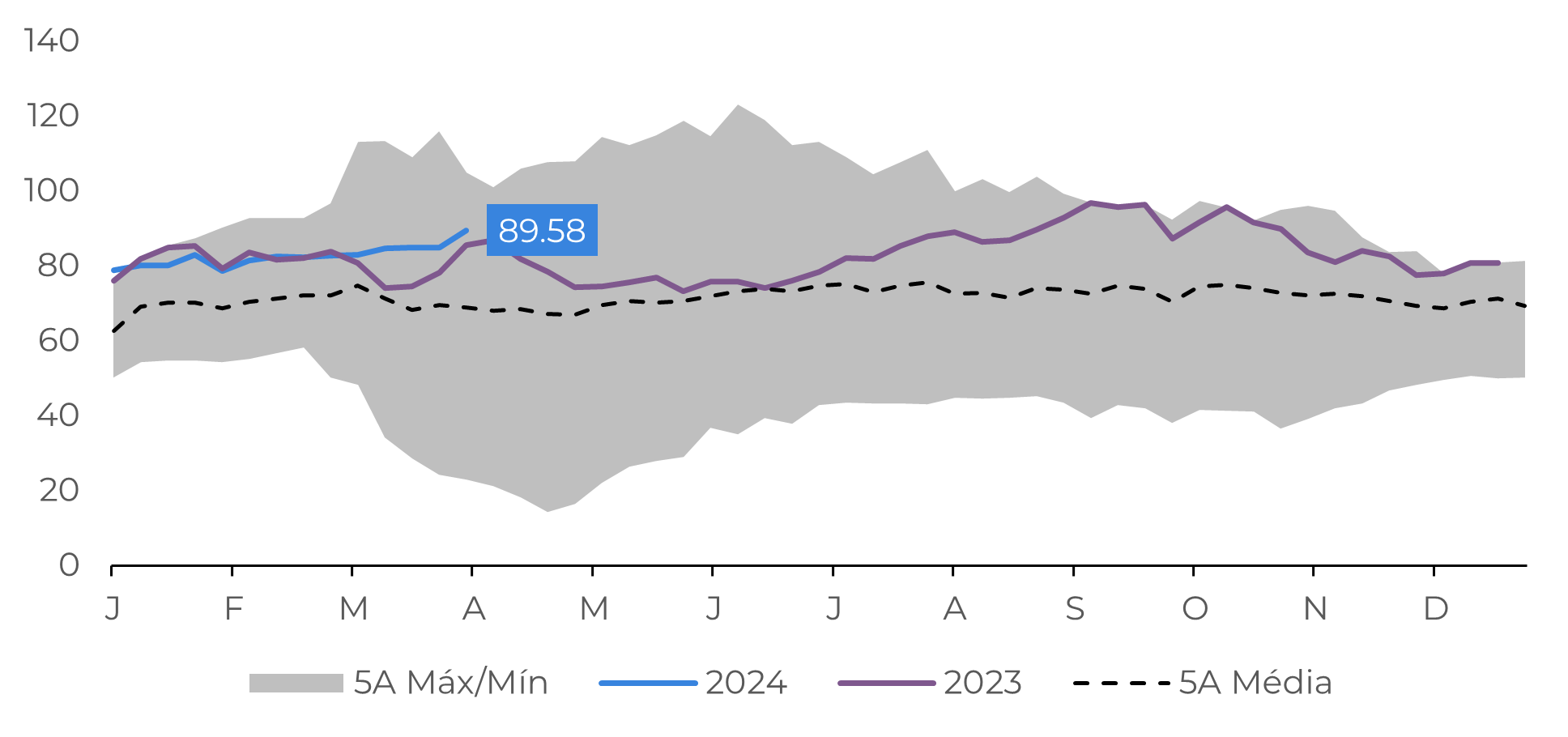

Image 1: OPEC Crude Oil World Daily Basket (US$/bbl)

Source: Refinitiv

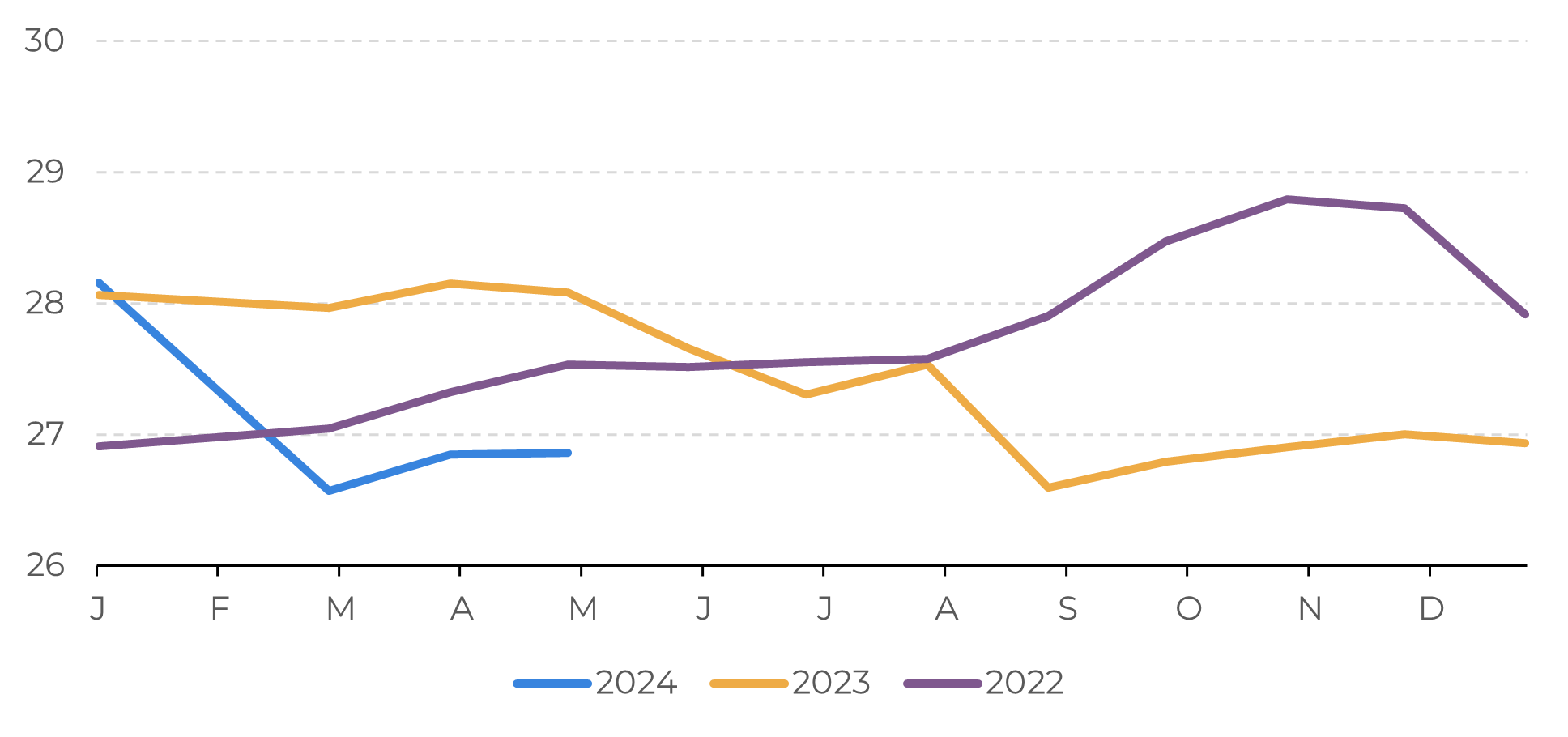

Image 2: OPEC Crude Oil Production (Million Barrels)

Source: Refinitiv

Note: Angola's production was excluded for the

years 2023 and 2022

Nothing changes in the OPEC+ crude oil game

After the major oil benchmarks closed the week at new highs, with Brent at $91.17 (+4.22%) and WTI at $86.91 (+4.5%), what room is there for further oil appreciation? Several risks could unlock a more bullish or bearish scenario for the energy complex.

Looking at the more bearish scenario, some reasonable risks are associated with OPEC+. According to data from Platts, the organization's production averaged around 34.5 million barrels per day, 170,000 above the group's quotas. Countries such as Iraq, UAE, Kuwait, and Kazakhstan were the main contributors to this production exceeding the quotas. A compensation plan is being discussed for the coming months, but with prices at current levels, it may be difficult for nations to dispense revenue from oil and gas exploration.

Furthermore, trade data from China and India, the world’s first and third-largest oil importers, could inject bearish volatility into the market. India has already expressed its discomfort with the recent price escalation through Oil Secretary Pankaj Jain, suggesting that companies may take an "appropriate decision“ to protect their economy. China, with its strategic oil reserves, might also slow its import pace to avoid the current high value of oil. Also, the rising fuel costs will push up inflation, potentially leading to higher interest rates for an extended period in the US. This combination would have a significant bearish impact on crude oil prices.

Image 3: OPEC 12 Members + Angola Crude Oil Production (Million bpd)

Source: Refinitiv

In the bullish scenario, the economic outlook has improved in the past two months. Upward revisions to GDP forecasts by the IMF to 3.2% (+0.2) and OPEC to 2.8% (+0.1%) suggest a more optimistic growth trajectory for this year. Also, Europe is avoiding a recession, which provides additional momentum for sustained industrial activity and increased energy demand. Moreover, geopolitical tensions in the Middle East and Eastern Europe have bolstered energy commodity premiums. These factors are significant contributors to the recent surge in oil prices

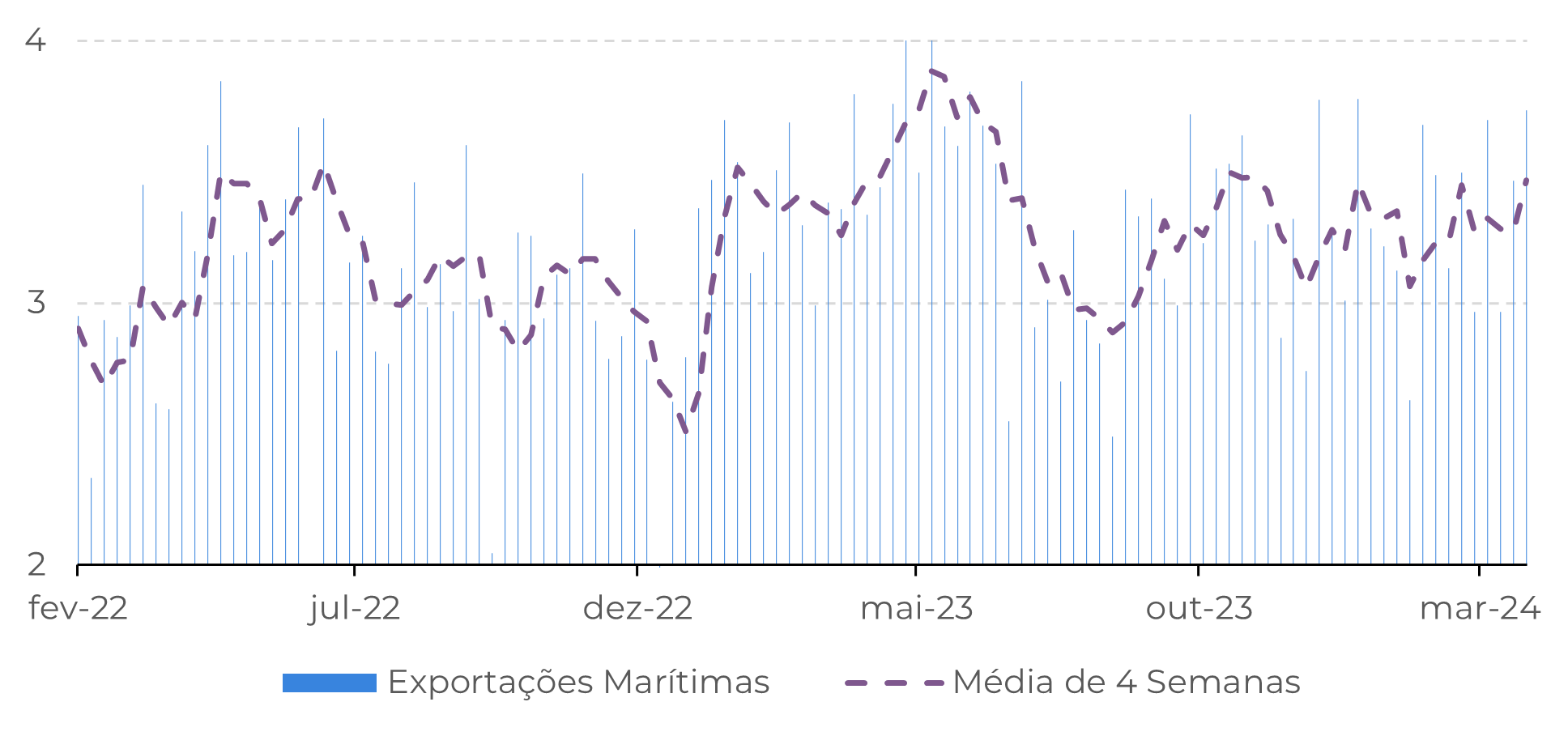

On the geopolitical conflicts, particularly the one on Middle East, the situation remains highly volatile after Israeli attacks on an Iranian consulate in Damascus escalated the conflict. Meanwhile, in Europe, the Kremlin announced that Russia and NATO are in direct confrontation in Ukraine. Ukrainian drone attacks on Russian energy infrastructure affected about 14% of the country's refining capacity. Apart from impacting the prices of refined products, especially diesel, Russian oil exports are expected to increase. However, the country has reiterated that it will maintain its production within the quotas established by OPEC+.

Therefore, geopolitical risks will provide some room for further appreciation of the major oil benchmarks. However, this could change at the next Fed meeting at the end of the month, given that oil prices are having a significant impact on inflation.

Image 4: Russia – Crude Oil Seaborne Exports (Million bpd)

Source: Refinitiv

In Summary

However, central banks in the US and Europe are still battling against inflation. High oil prices could force them to keep interest rates higher for a longer period, potentially leading to bearish volatility in energy markets.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.