Energy Weekly Report - 2024 04 15

Geopolitical conflicts bring uncertainty to the market

- Iran, one of the world's leading oil producers, launched an attack on Israel last weekend. This was Iran's first direct attack on Israel and marks a new phase in the Middle East conflict.

- The oil market benefited from geopolitical risks and maintained modest corrections last week, despite negative data such as rising inventories and resilient inflation in the US.

- However, as the biggest risks fail to materialize, energy market assets should have a week of corrections, but still BE supported by the deficit in the oil balance.

Introduction

Last week was marked by market turbulence, with bearish economic data exerting a strong influence on commodity prices. The consumer price index (CPI) in the US, which rose to 3.5% per year in March, went against expectations and signaled that inflation remains resilient.

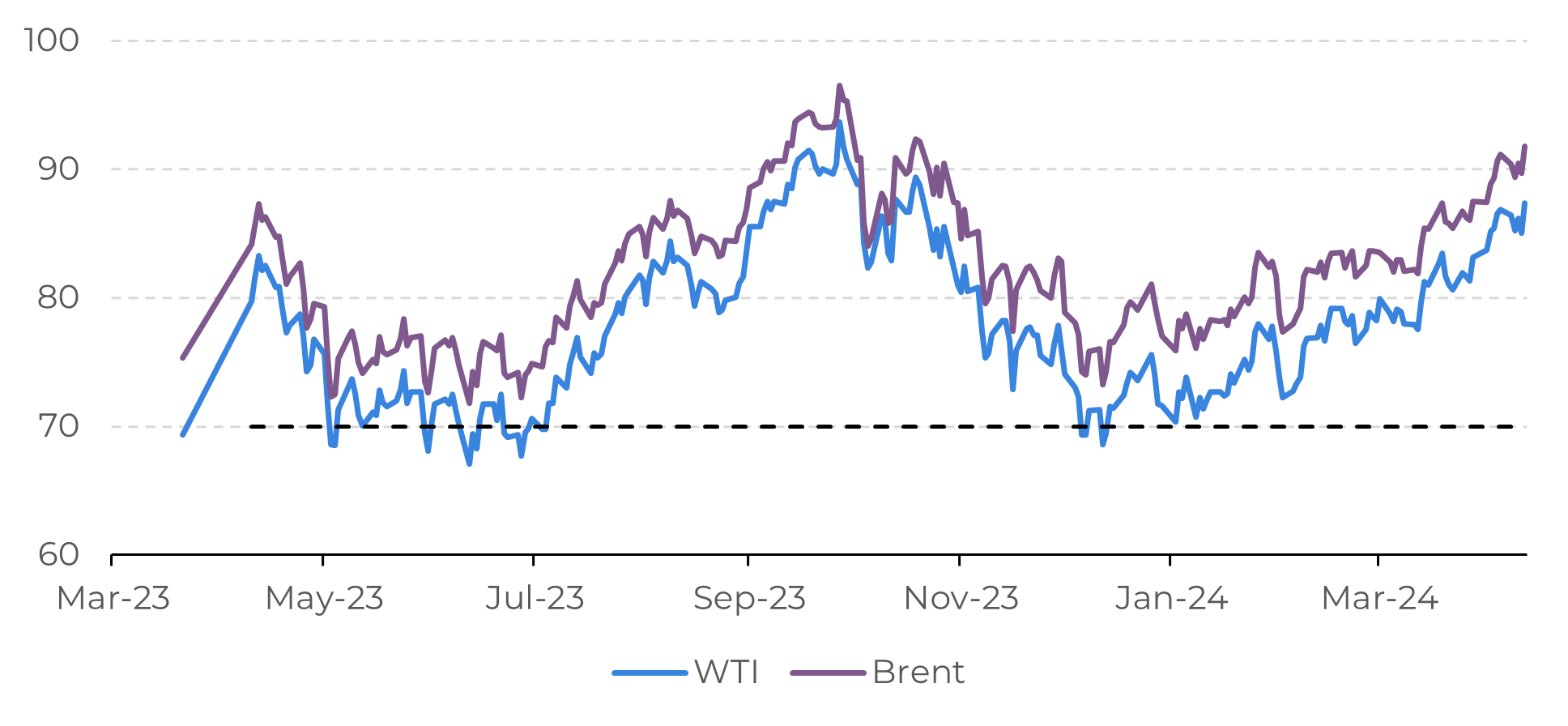

In contrast to the fall in commodities in general, the energy market proved resilient last week, with WTI and Brent recording small losses of -1.44% and -0.79%, quoted at US$ 85.66 and US$ 90.45 respectively. Geopolitical tensions, especially the escalating conflict between Iran and Israel in the Middle East, continue to influence the oil market. The perception of risks to global supply drives demand for the commodity, pushing up prices.

Currently, the conflict is expected to be limited to the last few days' developments, but uncertainty will continue to hang over the market. In the meantime, the main fundamental will continue to be the balance sheet deficit due to the OPEC+ actions.

Image 1: Major Crude Oil Benchmarks (US$/bbl)

Source: Refinitiv

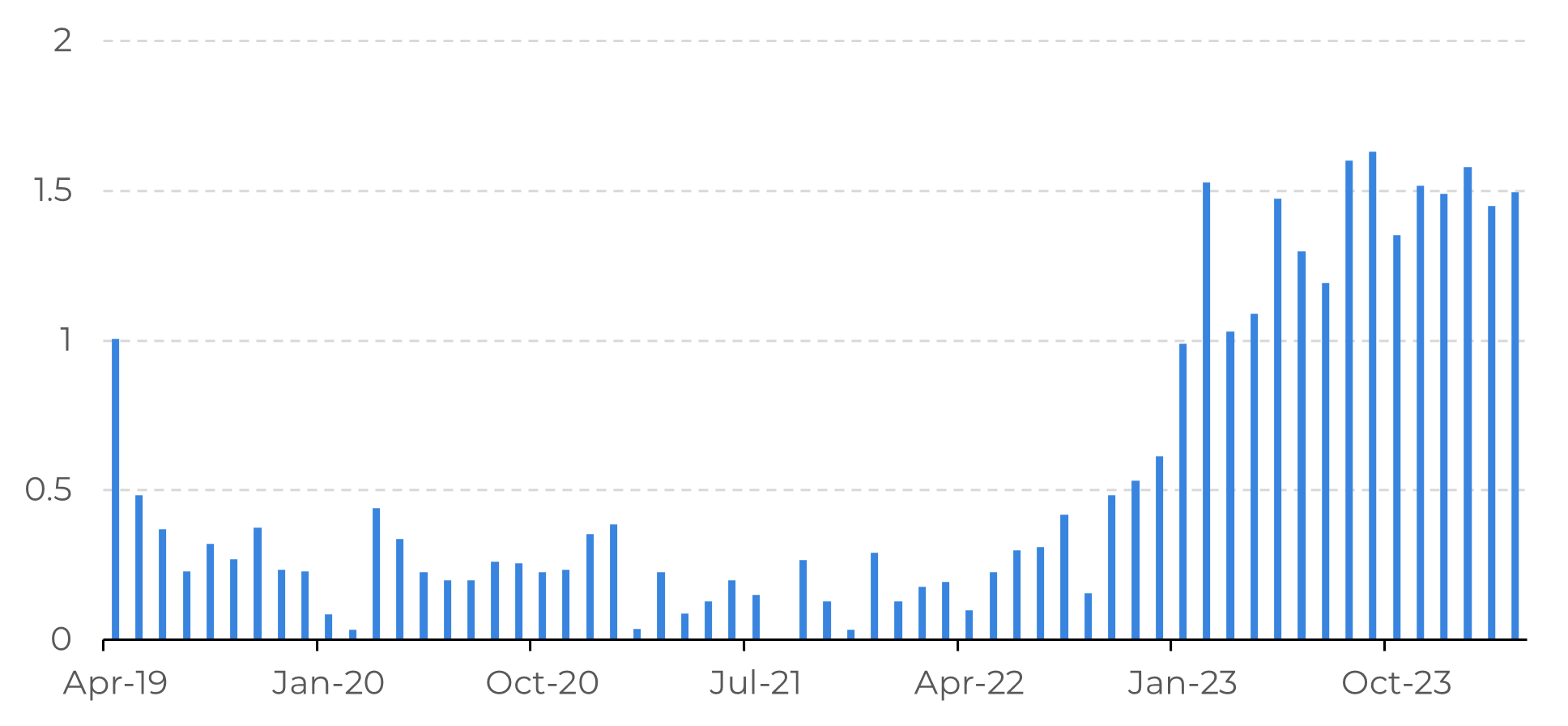

Image 2: Iran – Total Crude Oil Exports (Million Barrels)

Source: Bloomberg

Escalation in the Middle East provides support for oil

Last weekend, Iran launched a series of drone and missile attacks against Israel, in retaliation for the Israeli attack on its consulate in Syria on April 1st. This was Iran's first direct attack on Israel and marks a new phase in the Israel-Hamas conflict.

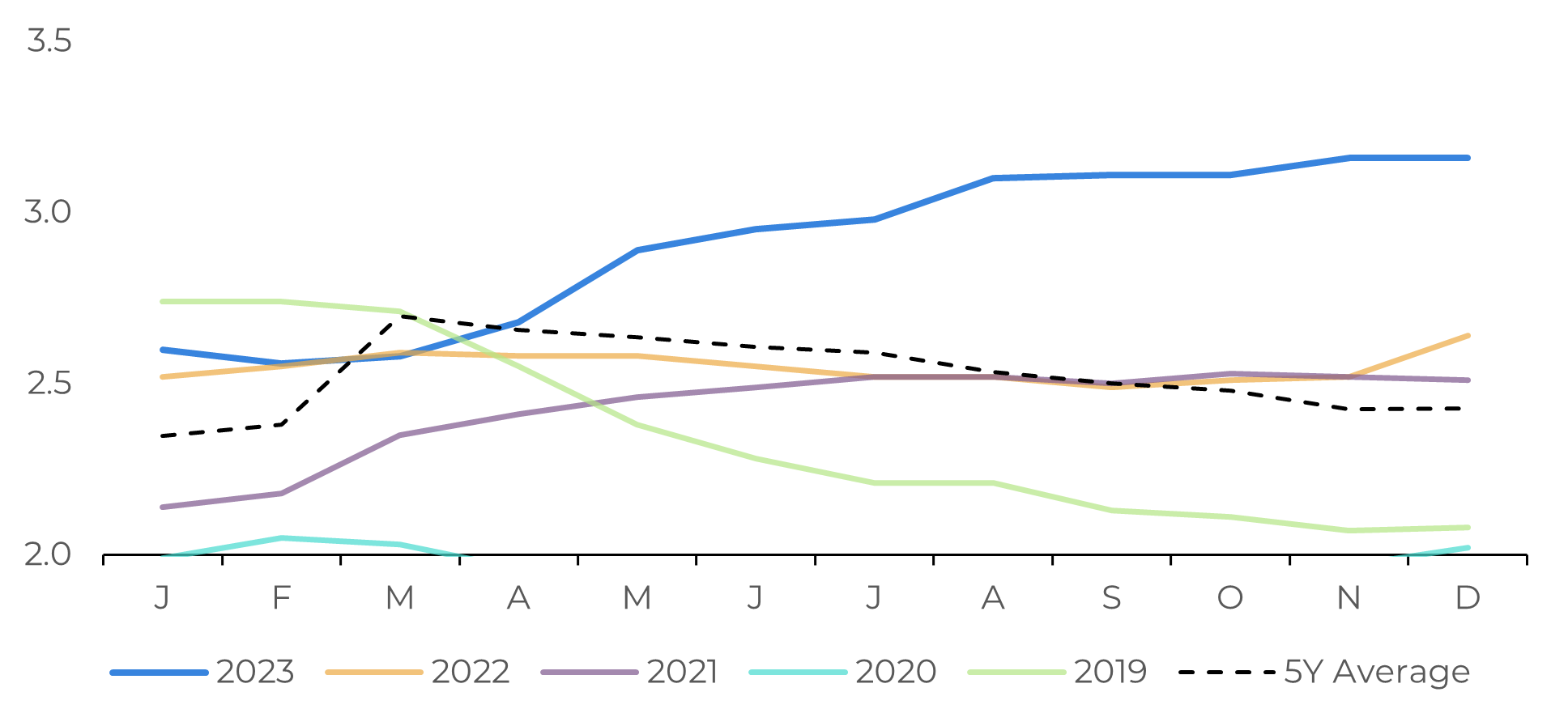

Iran stands out as a major oil producer in the Middle East, with current production exceeding 3 million barrels per day (bpd). As one of the world's largest exporters, any wider conflict affecting its energy infrastructure poses a risk to world supply. In addition, the country frequently threatens to close the Suez Canal, an important maritime route for oil trade. When tensions rise in the region, so do the risks of oil supply disruption. Whether through sanctions or direct attacks on infrastructure, this induces higher premiums on the market.

However, if the events mentioned above do not materialize, we will likely see a price correction. A wider escalation would result in major economic damage for Israel and Iran, as well as causing gasoline prices to rise in the US.

Image 3: Iran – Total Crude Oil Production (Million Barrels)

Source: OPEC

Agencies forecast a deficit in the oil market for 2024

Last week's macroeconomic outlook brought bearish data for commodities. Inflation in the United States remains high, reducing the chances of an interest rate cut in June this year. As a result, the 2-year US Treasury yield closed at 4.88% (+3.17%), reaching a level not seen since November last year. A stronger dollar is detrimental to commodities in general making them more expensive for holders of other currencies.

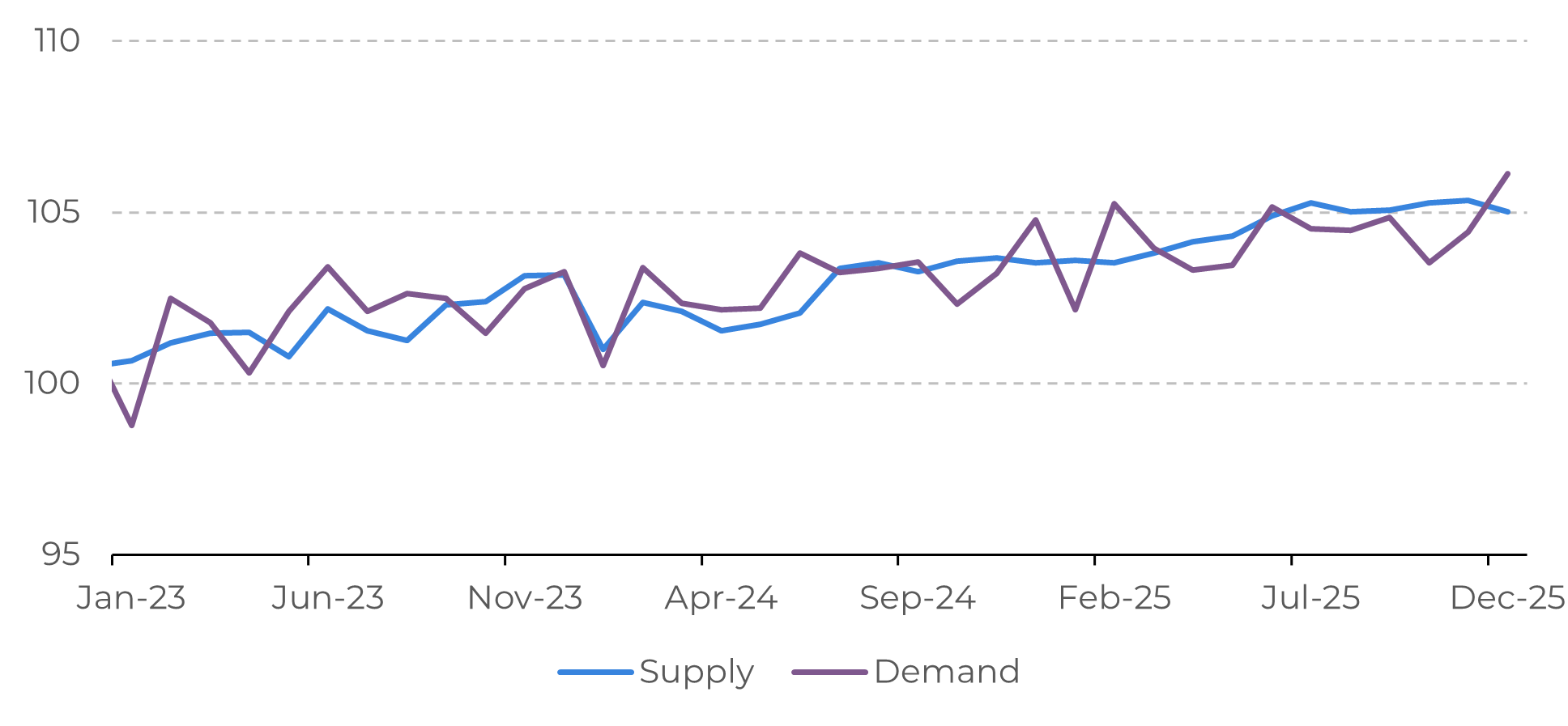

However, OPEC+ actions, a group of the main oil-exporting countries, have proven effective in reducing supply on the market, resulting in a supply deficit expected to persist throughout the second quarter of this year. This strategy aims to balance the market and sustain barrel prices. The group has implemented a voluntary production cut of 2.2 million bpd, with Saudi Arabia being the largest contributor, with 1 million bpd. This measure has contributed to the rise in prices, which have increased by more than 17% up to April.

The main agencies that conduct studies on the sector predict deficits for 2024, with OPEC estimating a deficit of -1.64 million bpd, the IEA -0.30 million bpd, and the EIA -0.26 million bpd

Image 4: World Crude Oil & Liquid Fuels Balance (Million Barrels)

Source: Bloomberg

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.