Energy Weekly Report - 2024 04 22

After tensions, where does oil go?

- In April, several economic data points brought about increased risk aversion in the commodities market. Resilient inflation in the US, appreciation of the dollar, and consequently, expectations of higher interest rates for a prolonged period were among the factors contributing to this sentiment.

- However, the main oil benchmarks are proving to be resilient. Actions by OPEC+ have shifted the market into a deficit, while geopolitical risks have maintained uncertainty about global supply.

- In this environment, where support for prices is related to supply factors, a growth in demand would be disruptive for the market, and we may observe this during the summer in the Northern Hemisphere.

Introduction

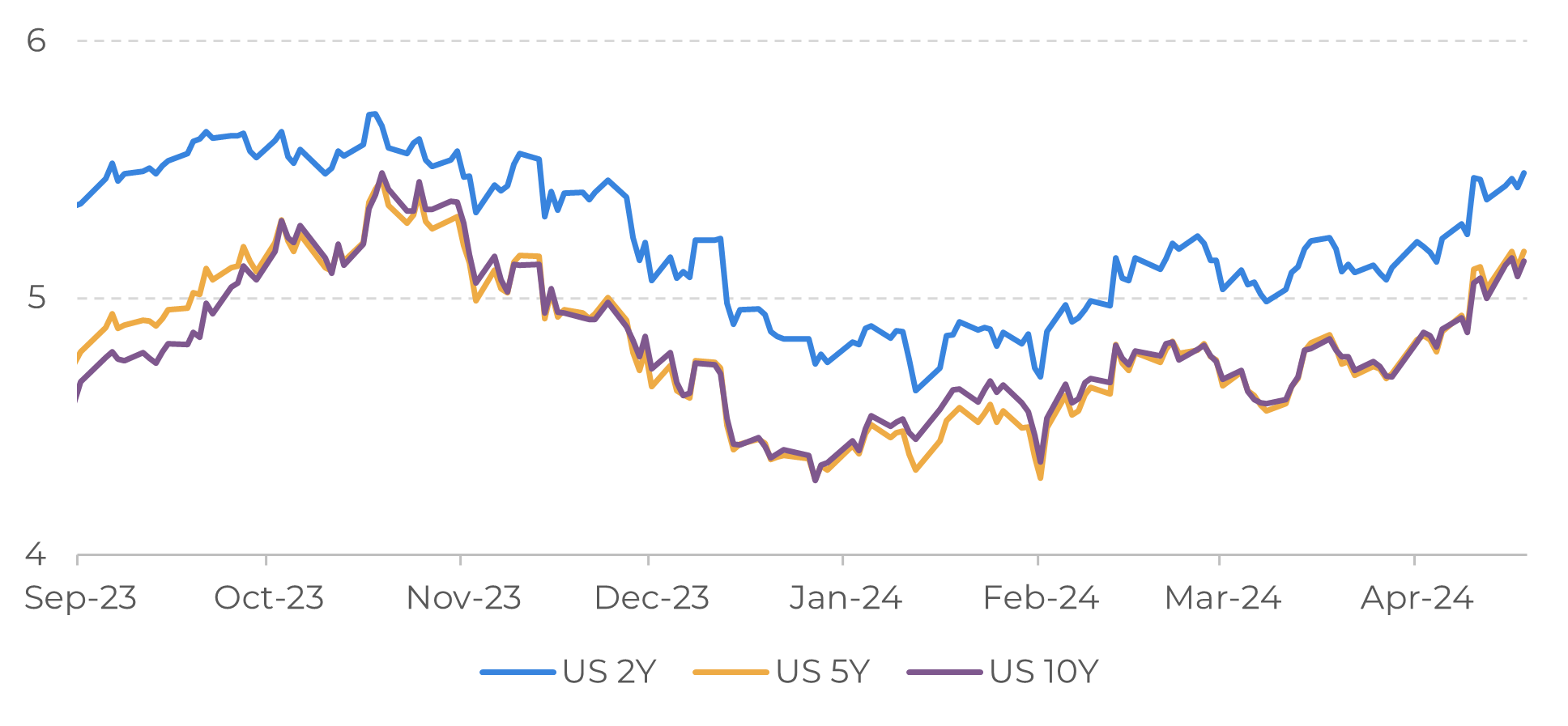

Traders and investors have long been grappling with the challenge of navigating inflationary risks in the world's major economies alongside geopolitical tensions in the Middle East and Europe. Just a few weeks ago, there were expectations that interest rate cuts in the United States could occur in June of this year, but the latest CPI at 3.5% YoY has dashed those prospects.

Treasury yields surged more than 7% in April, strengthening the dollar and pushing up commodity prices for holders of other currencies, especially energy-related ones. This usually would lead to a downward trend in crude prices, but that has not been the case.

The tight oil market, resulting from oil production cuts by OPEC+, is the main bullish driver of prices at the moment, and geopolitical risks have amplified this outcome. Even in the face of bearish events, the main oil benchmarks are showing resilience, and we will explore more about it in this report.

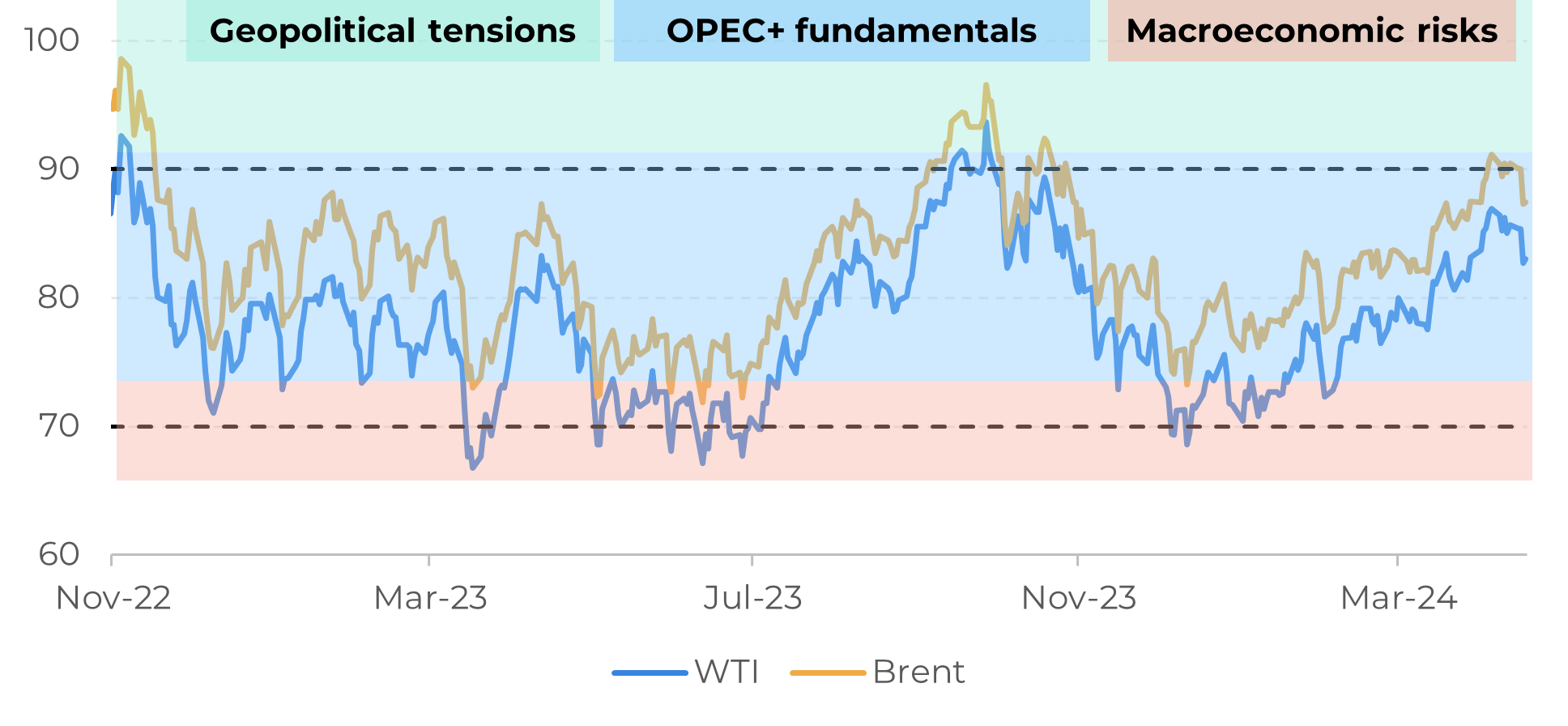

Image 1: Major Crude Oil Benchmarks (US$/bbl)

Source: Refinitiv

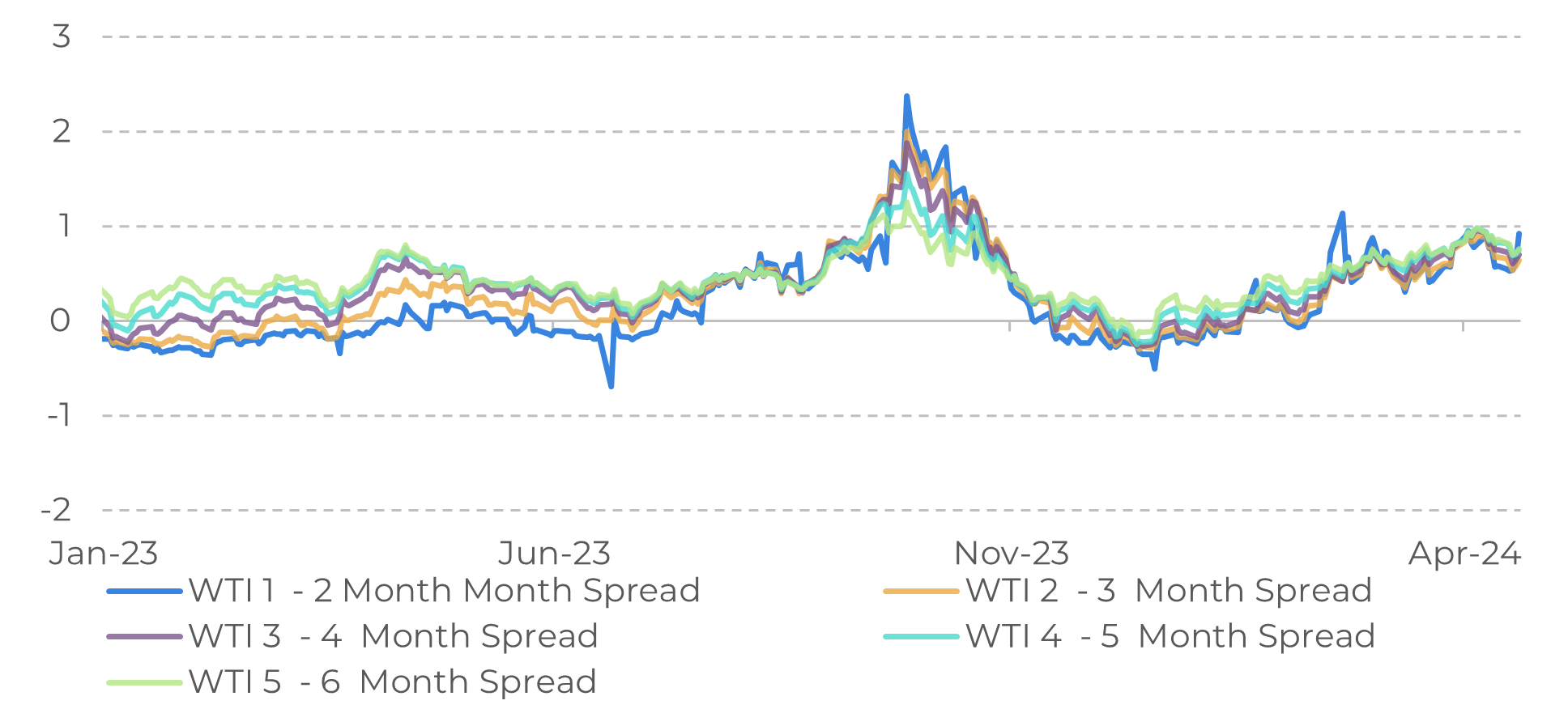

Image 2: WTI Futures (US$/Spread)

Source: Refinitiv

The market aims to navigate between inflationary risks and geopolitical tensions

The data releases earlier this month reinforced a bearish sentiment in the oil market. The EIA data revealed an increase in US oil inventories by 8.5 million barrels in April, about 1% below the five-year average. Additionally, inflation data in the US showed a scenario of high uncertainty, likely keeping interest rates at the current level of 5.25-5.50% for longer than initially expected.

The increase in risk aversion has led to an appreciation in the US treasury yields. Expectations by the end of last year were for a Fed interest rate cut in the first semester of 2024, but the odds have changed significantly with the latest economic data from the country. As a result, commodities, including energy assets, will be more expensive for holders of other currencies for longer.

The major crude oil benchmarks are undergoing corrections, with WTI dropping by 2.94% to US$ 83.14 and Brent declining by 3.49% to US$ 87.29 last week. However, the overall scenario remained bullish. OPEC+ measures are pressuring crude oil inventories worldwide, while the Strategic Petroleum Reserves (SPR) in the US are at historically low levels. Conflicts in the Middle East and Europe (Ukraine and Russia) continue to elevate uncertainty about supply logistics.

Image 3: US – Treasury Yields T-Notes (%)

Source: Refinitiv

Higher demand in US is a missing element in the market

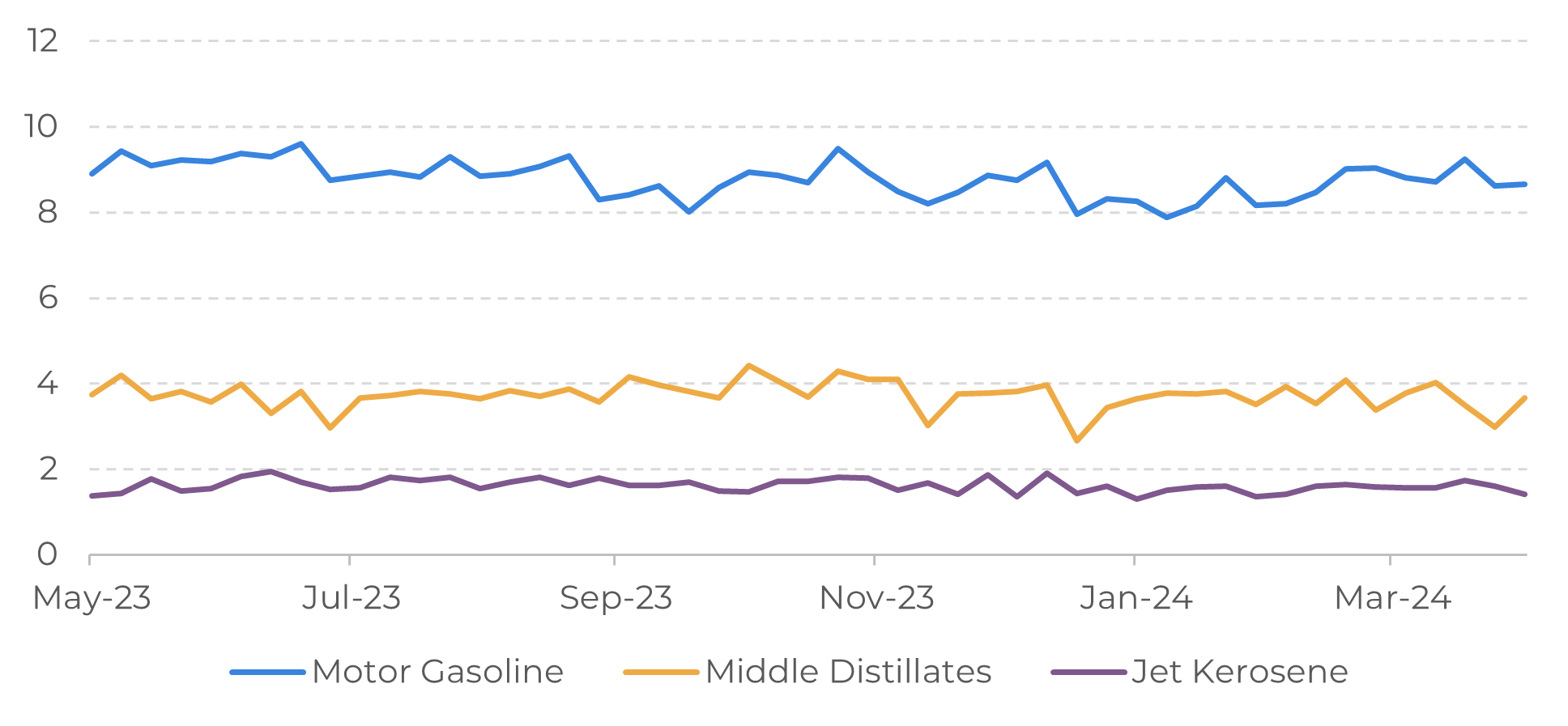

A resilient job market in the US, with an increase of 303,000 jobs in non-farm payrolls in March, suggests that the demand for gasoline will remain strong this summer. Additionally, the improvement in manufacturing PMIs and industrial growth in major economies indicates a recovery in the consumption of middle distillates. The main challenge lies in determining the pace of consumption growth in the coming months.

In general, what is needed for the market to unlock a consistent price action beyond the resistance at $90.00 is an acceleration of demand. One way to observe it is through the refinery output, a measure that serves as a proxy for fuel demand. When considering the main liquid petroleum products - motor gasoline, middle distillates, and jet kerosene - consumption has been modest compared to 2023. Gasoline implied demand remained below 9 million barrels, while the four-week average for distillate consumption is 8% lower compared to the same period last year.

If supply measures are the fundamentals that have kept oil appreciated in 2024, with a valuation of over 15%, the removal of this factor will have a highly bearish effect on the market. And sooner or later, OPEC+ will return its offline production back to the market.

Image 4: US - Implied Demand for Select Refined Products (Million Barrels)

Source: Refinitiv

In Summary

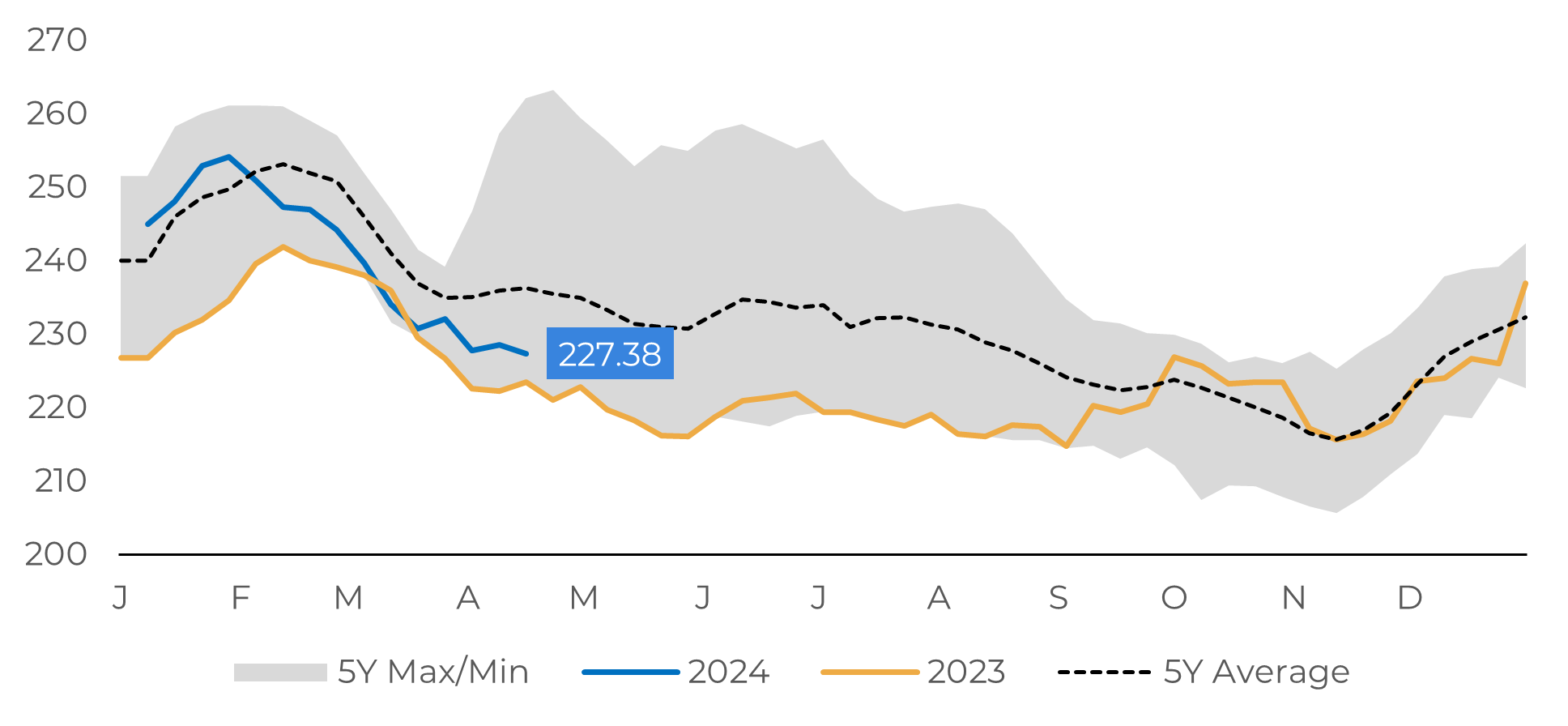

Image 5: US – Motor Gasoline Stocks (Million Barrels)

Source: EIA

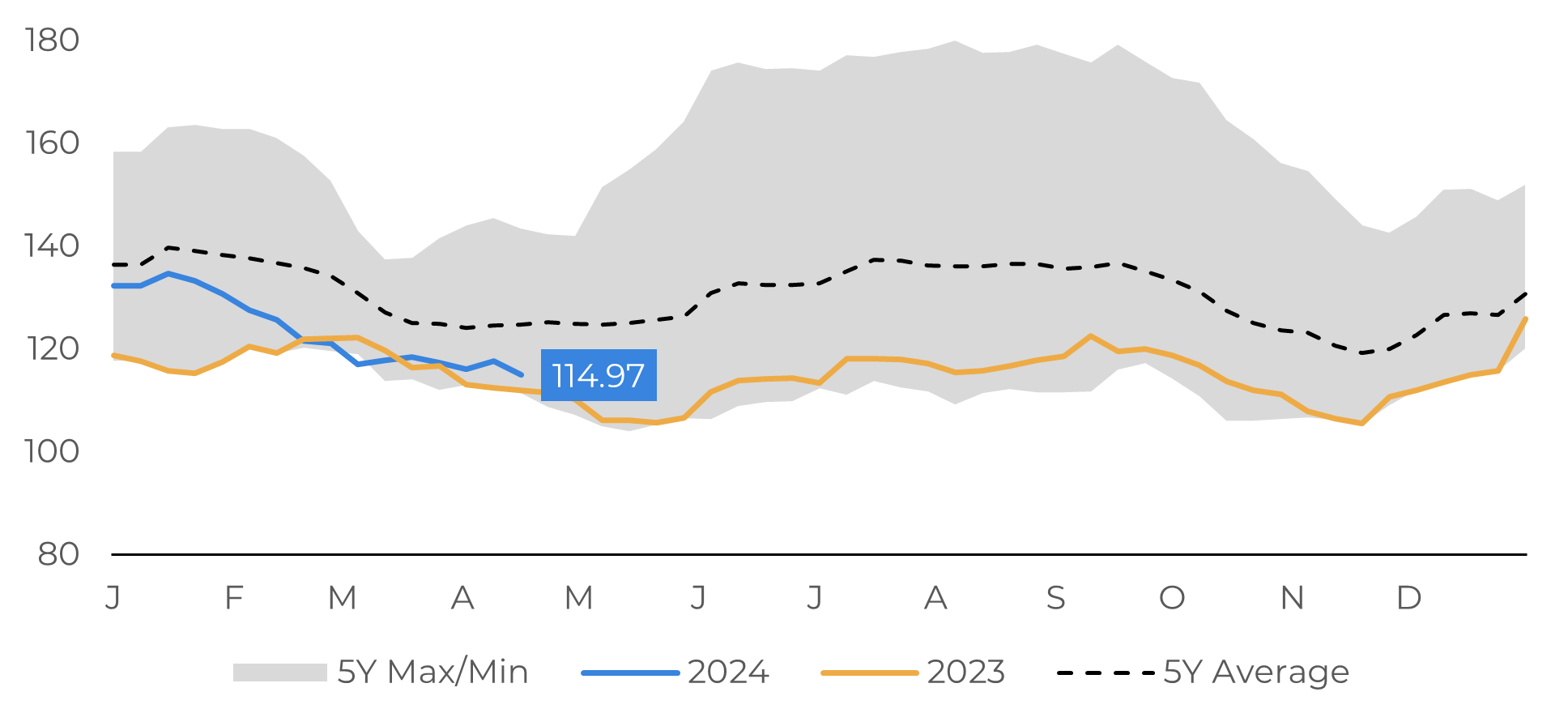

Image 6: US – Middle Distillates Stocks (Million Barrels)

Source: EIA

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.