Energy Weekly Report - 2024 04 30

LNG exports key to raise natural gas prices

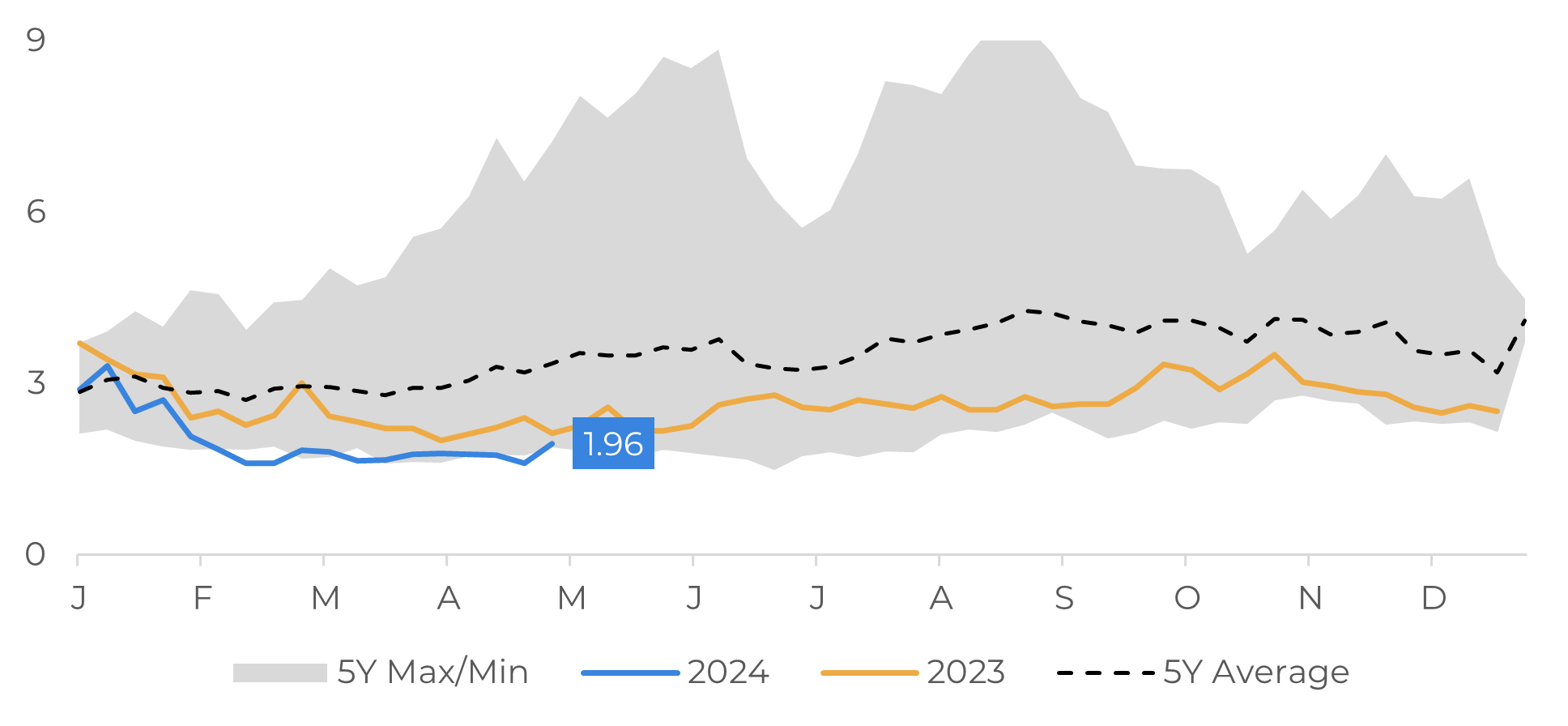

- Natural gas futures Henry Hub futures fell last week, reflecting continued bearish pressure on the market. Milder temperatures and strong domestic supply in the US are key factors driving this decline.

- Adding to the bearish sentiment, a key US LNG export facility, Freeport LNG in Texas, has been operating below 80% capacity in recent weeks due to technical problems.

- Warmer months might offer some support as demand for natural gas for cooling rises, but this is likely to be countered by the current high storage levels.

- So, a more bullish environment for natural gas will depend on its LNG exports. Although partly benefited by the normalization of its liquefaction terminals, these exports are limited by lower external demand.

Introduction

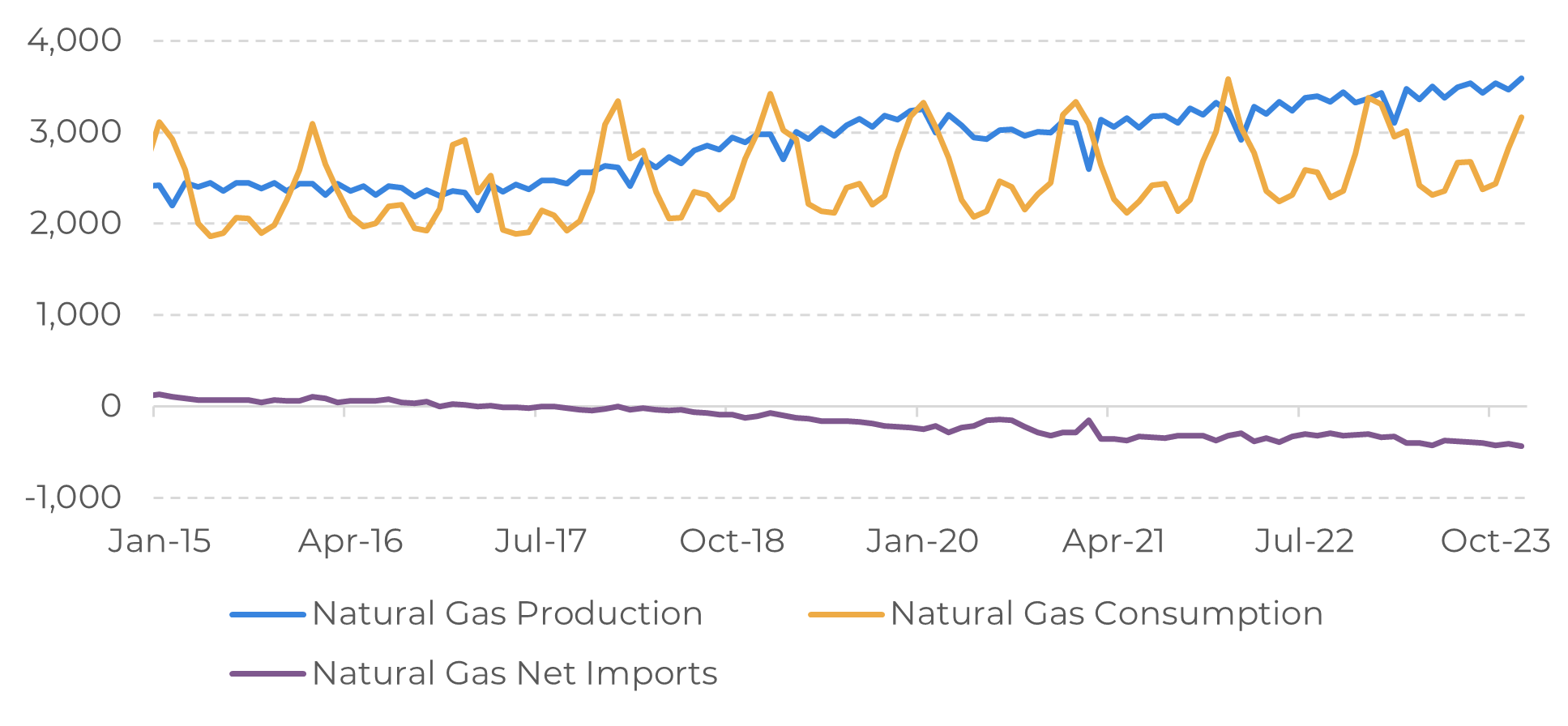

Since 2023, the outlook for natural gas futures has remained bearish. This trend is primarily attributed to the rapid increase in U.S. production, which has outpaced domestic demand, resulting in a buildup of underground storage levels.

Exporting natural gas presents a natural solution to this surplus, with exports growing by over 10% last year, totaling 20.9 billion cubic feet. US LNG exports constituted more than half of all US natural gas exports, while the remainder was accounted for by natural gas exports via pipeline to Canada and Mexico.

However, technical issues at liquefied natural gas (LNG) plants have hampered product loading, while warmer temperatures have reduced demand for heating. In this report, we will explore into the potential trajectory of natural gas prices over the coming months.

Image 1: US - Natural Gas Overview (Bcf)

Source: EIA

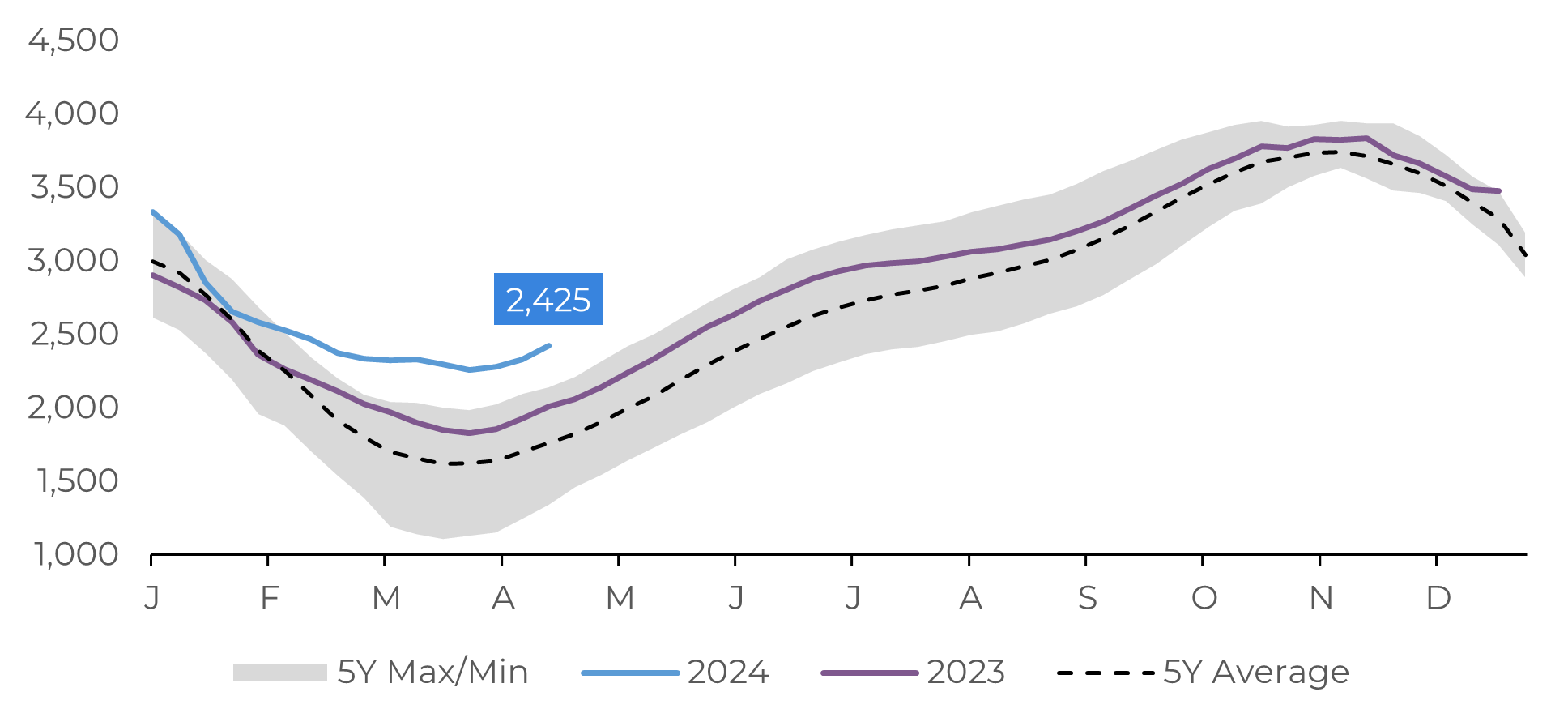

Image 2: Weekly Natural Gas Storage (Bcf)

Source: EIA

Despite the increase in cooling demand, the outlook remains bearish

Last week, Henry Hub natural gas futures fell ahead of the expiration of the May contract, closing at US$1.61 MMBtu (-7.88%) on a weekly basis. One of the key bearish factors for the market has been the operation below 80% capacity in recent weeks at one of the country's main LNG export facilities, Freeport, Texas, which has been hampered by technical problems. This situation has limited commodity exports, influencing prices. With less volume for export, there is more storage in the US Gas Storage, which puts pressure on prices.

Despite the expectation that export terminals will return to normal in Texas in the coming weeks, the outlook remains bearish. The approach of the warmer months could bring some support as cooling demand increases, but high storage levels are expected to offset this factor. Furthermore, premiums stemming from the escalation in the Middle East have been dissipating as the market does not anticipate an increase in tensions between Israel and Iran.

Image 3: Henry Hub Natural Gas (US$/MMBtu)

Source: Refinitiv

LNG Exports are also expected to face restrictions

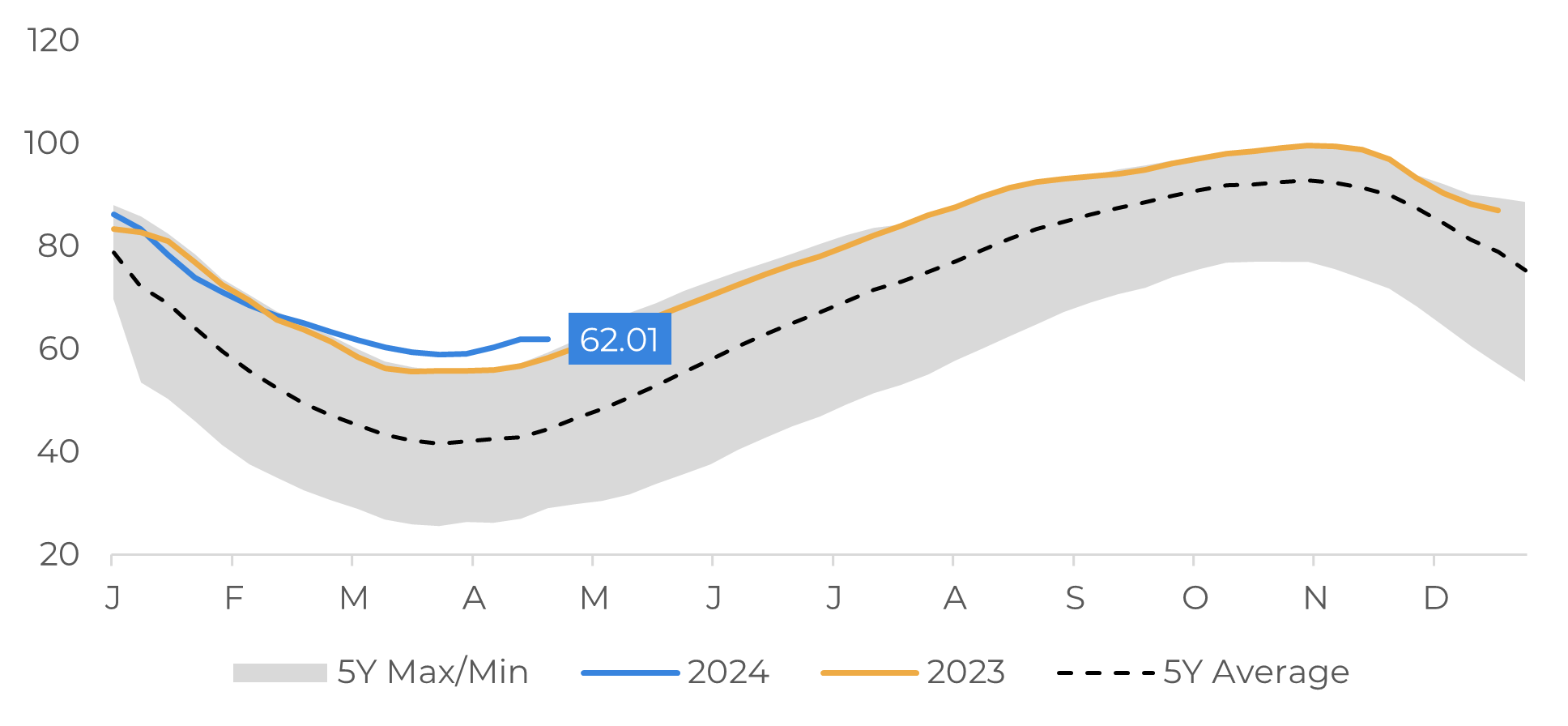

The current European landscape in stark contrast to what unfolded in 2022 following Russia's invasion of Ukraine. Over the past year, natural gas prices have plummeted by over 45% amidst diminished supply disruptions and a milder winter, which reduced the heating demand of European households. Furthermore, the economic downturn has led to decreased energy consumption. As a result, storage levels have reached their highest point in recent years, standing at 62.01%.

Asian LNG prices have recently declined due to expectations of lower demand. However, some counterbalancing factors exist. The delay in restarting a 1.1 gigawatt (GW) nuclear power plant in Japan will necessitate increased LNG consumption there, potentially offering some market support. Conversely, rising LNG shipping costs pose a challenge for other major players like China and India, leading them to cut back on new purchases.

Image 4: Europe - Gas Storage Capacity Full (%)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.