Energy Weekly Report - 2024 05 14

US set to achieve record oil output in 2024

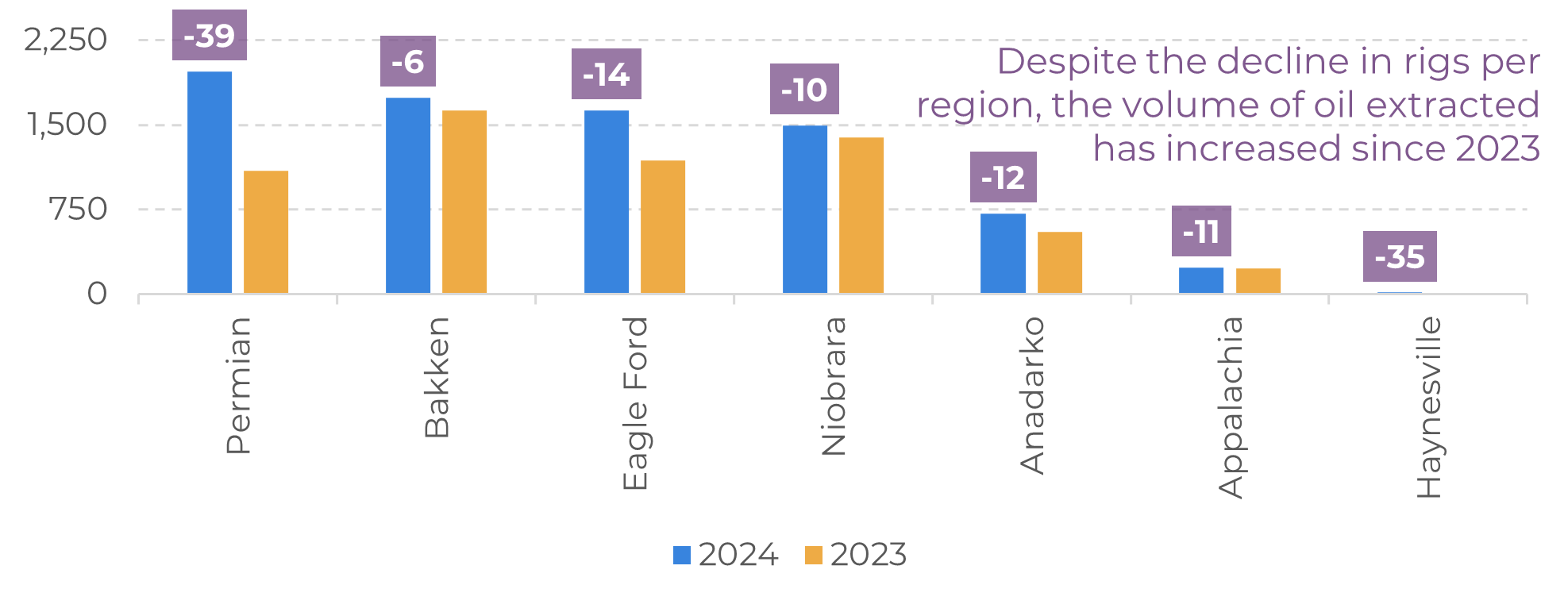

- The number of oil rigs is a key indicator for the energy market, reflecting investment levels and drilling capacity. However, despite a significant decline since last year, oil production has not declined.

- Thanks to technological advances, well productivity has allowed US producers to extract more crude oil. As a result, the country is on track to achieve its highest monthly output ever at some point this year.

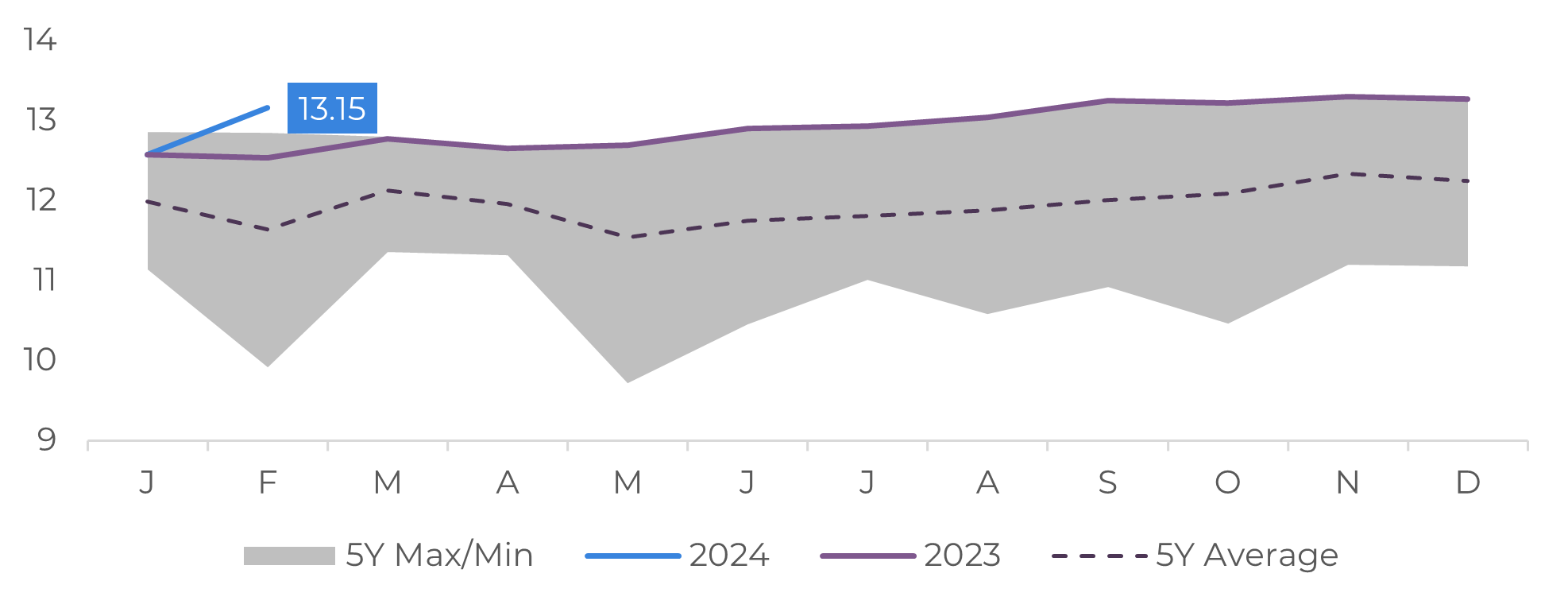

- The favorable price environment compared to last year is expected to incentivize increased production in the United States. As a non-OPEC+ producer, the country’s oil output may play a role in mitigating the projected supply deficit in 2024.

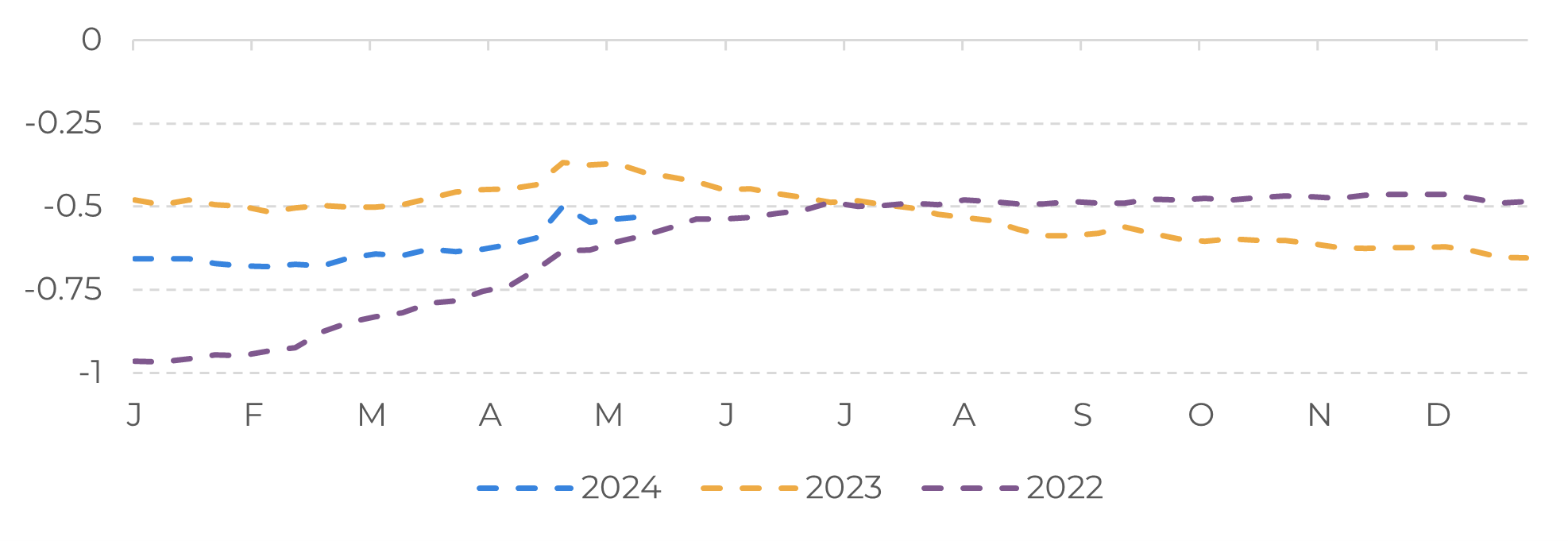

- As of 2024, WTI futures contracts have accumulated an increase of over 9% (+10.43% year-on-year). In light of this scenario, the decline in drilling activity is expected to stabilize soon.

Introduction

The energy commodities, such as oil and natural gas, are among the most volatile in the world, directly influencing the global economy. Price fluctuations in oil, for example, significantly impact drilling activities, rig operations, and oil well productivity.

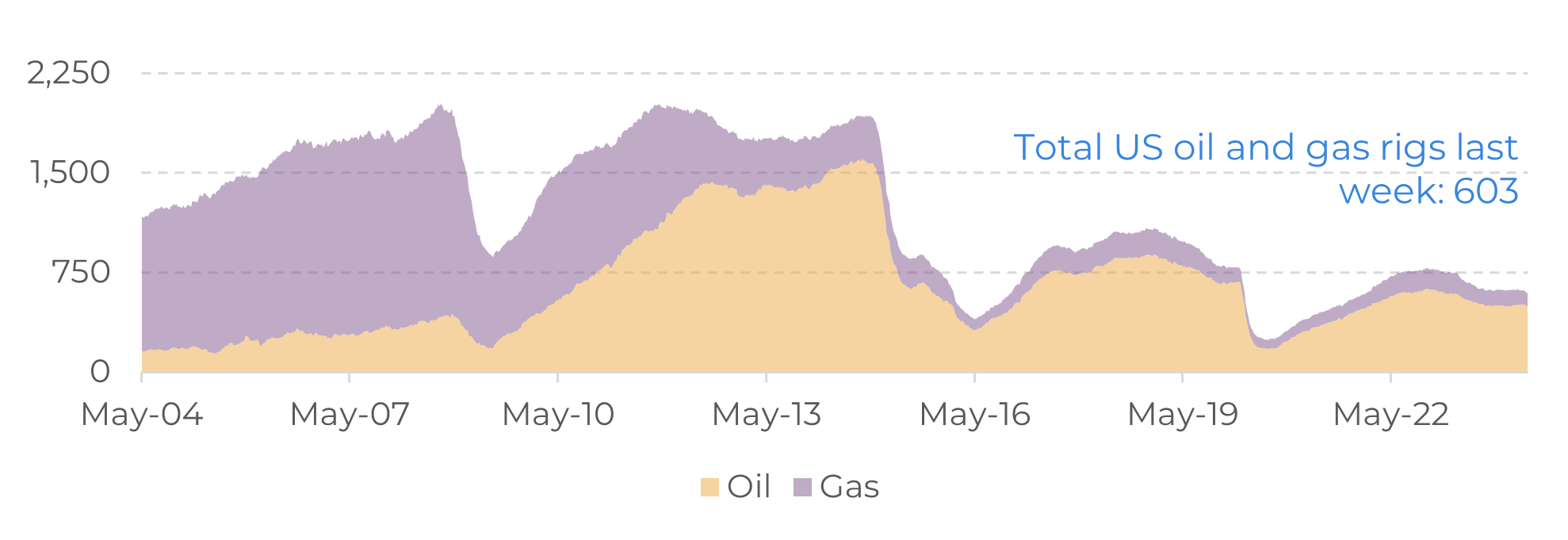

Last Friday, energy companies in the US cut the number of oil and gas rigs in operation for the third week in a row. The total active rigs reached 603, representing a down of 17.51% compared to the same period last year. This is an important indicator for the oil and gas market as it provides insights into the potential production of fossil fuels in the future.

Contrary to expectations, however, US oil production has continued, oil production in the US continued to grow and is expected to reach the highest monthly output in its entire history in 2024. In addition to the symbolic result, the increased availability of oil helps to reduce the impact of actions by OPEC+ that have restricted their production by more than 5 million barrels per day.

Image 1: US - Weekly Rotary Rig Count

Source: Baker Hughes

Image 2: Z-Score Weekly Rotary Rig Count (Standard Deviation from the 10-Year Average)

Source: Hedgepoint, Baker Hughes

Productivity enables U.S. producers to extract more crude

A rig is a machine that rotates the drilling column from the surface to drill a new well (or divert an existing one) to explore, develop, and produce oil. The number of active oil rigs is a crucial indicator for the energy market, as it represents, to some extent, the level of investment in the sector, and because more active rigs can drill more new wells. Following Russia's invasion of Ukraine in 2022, oil and gas drilling activity increased significantly until mid-2023.

This increase was driven by rising oil prices on the global market, due to sanctions imposed on Russia and supply disruptions. The number of active oil rigs has fallen significantly after that, and currently stands at 496, a 15,36% decrease year-over-year (YoY) according to Baker Hughes. Similarly, gas rigs have also declined by 26,95% YoY, sitting at 103.

However, oil production has continued to grow even with this decrease in drilling activity. This is thanks to advances in technology that are increasing well productivity, enabling U.S. producers to extract more crude oil from new wells drilled while maintaining production from legacy wells.

Image 3: US - Drilling Oil Production per Region (Thousands of barrels per day)

Source: EIA

The fundamentals favor an increase in production

A surge in oil production, coupled with lower exports, has led to rising US inventories in recent weeks, alleviating concerns about market tightness and exerting downward pressure on prices. This inventory buildup was particularly evident in late April, contributing to a significant price decline on WTI.

Despite moderate demand expectations, supportive measures from OPEC+ and favorable price conditions compared to the last year are expected to encourage increased production in the United States. As the leading non-OPEC+ producer, the US has an role to play in offsetting the expected supply deficit in 2024.

Currently, US oil production stands at 13.1 million barrels per day, approximately 200,000 barrels below the all-time high of 13.3 million. The U.S. Energy Information Administration (EIA) predicted that for 2024 oil production will grow 260,000 barrels per day in 2024. This suggests that the US could break the monthly record in the coming months.

Image 4: US – Total Crude Oil Production (Millions of barrels per day)

Source: EIA

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.