Energy Weekly Report 2024 05 20

Decisive OPEC+ meeting ahead

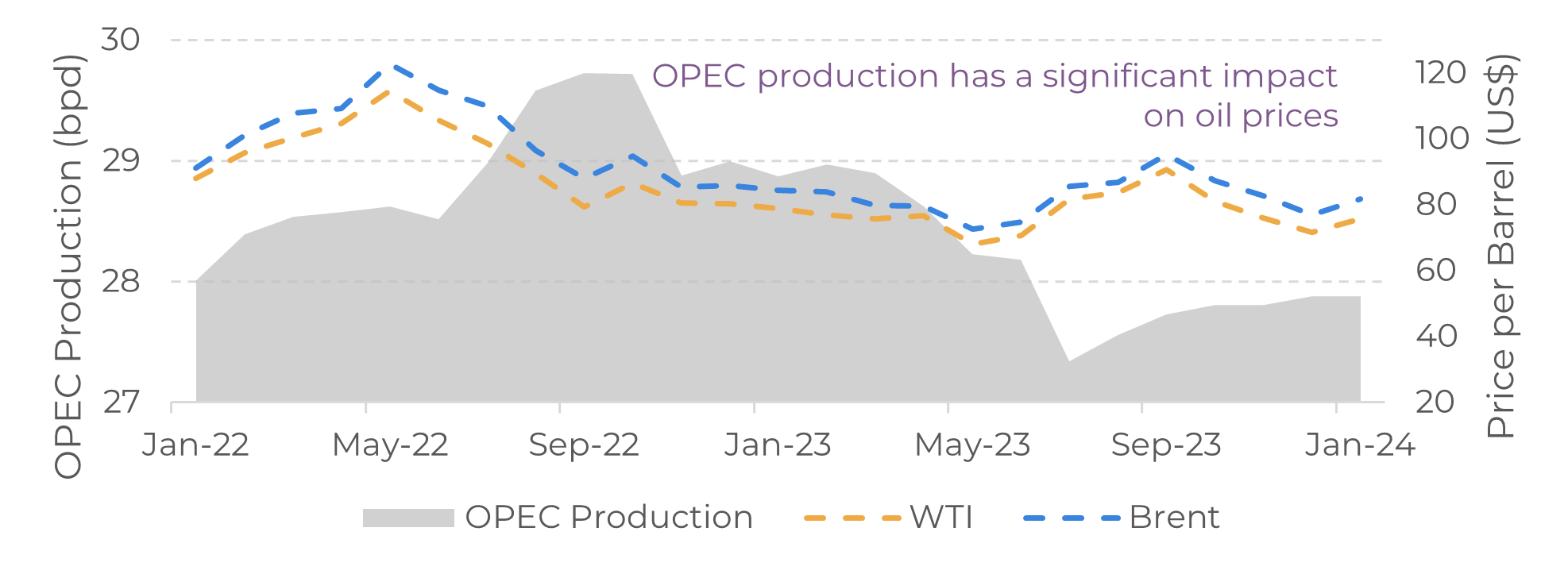

- After a period of falling prices due to the macroeconomic scenario, the market is closely watching the next steps of OPEC+, which should impact the energy complex.

- Against a backdrop of weak demand and the IEA's recent downward revision, supply is the main fator driving oil prices, especially from the alliance of exporting countries.

- What is at stake is the voluntary oil cuts' extension, which totals 2.2 million barrels per day (bpd), 1 million bpd from Saudi Arabia. Maintaining, even partially, these cuts would signal the group's effort to raise oil prices.

- However, persisting with the supply restriction leads to a loss of market share, which causes disagreement among some members and makes its lack of cooperation explicit.

Introduction

After a period of downward pressure on the main oil benchmarks, there has been an improvement in the risk perception involving the US macroeconomic environment. Recent indicators show a slowdown in economic activity and a 0,3% rise in the CPI (lower than the market estimate of 0.4%), raising expectations of an interest rate cut in the coming months.

Attention now turns to the OPEC+ meeting on June 1, where the maintenance of the voluntary cuts of 2.2 million barrels per day (bpd) of oil will be discussed. At the moment, the restriction on production by the world's largest producers and exporters is around 5.86 million bpd (estimated to be 6% of world demand).

Although it implies a loss of market share, this strategy has achieved its main objective of raising the price of a barrel of oil. Given this, it is highly likely that OPEC+ countries will extend production cuts, and in this report, we will analyze their impact on the market.

Image 1: OPEC Production Vs. Oil Major Benchmarks (US$)

Source: Refinitiv

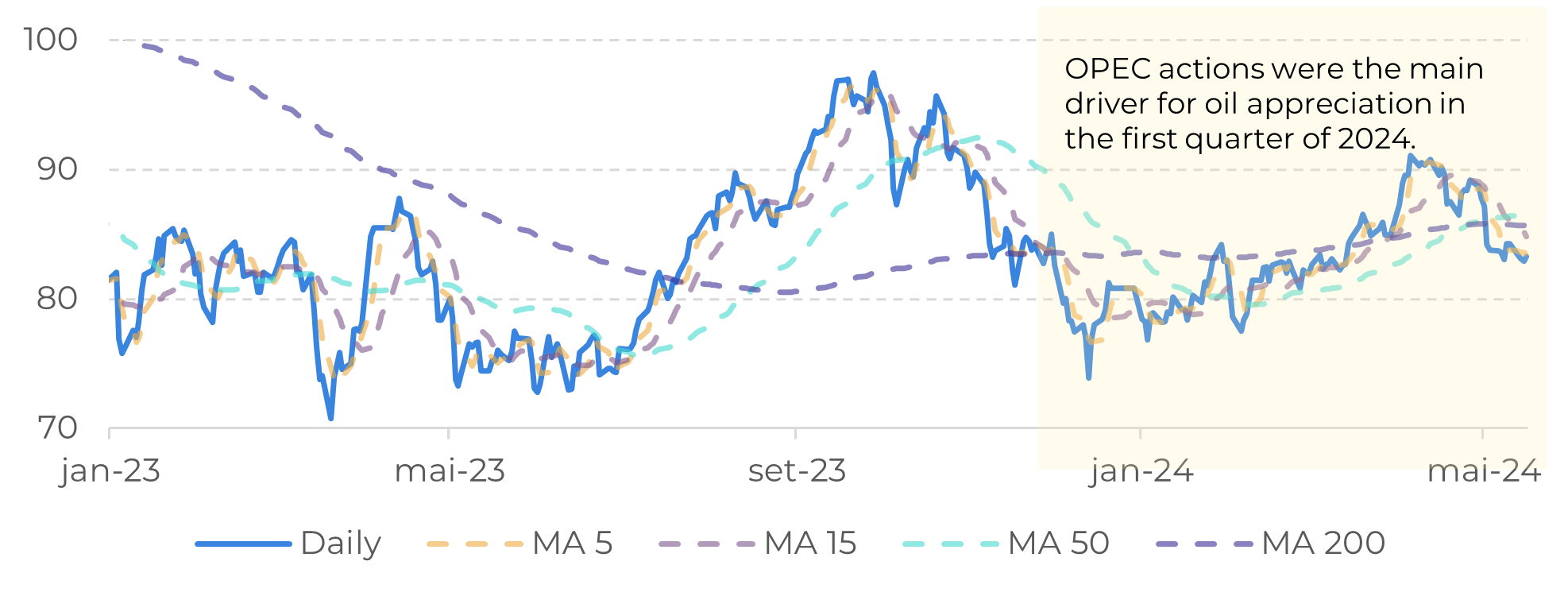

Image 2: OPEC Reference Basket (US$/bbl)

Source: Refinitiv

Floating stocks fall, but demand remains modest

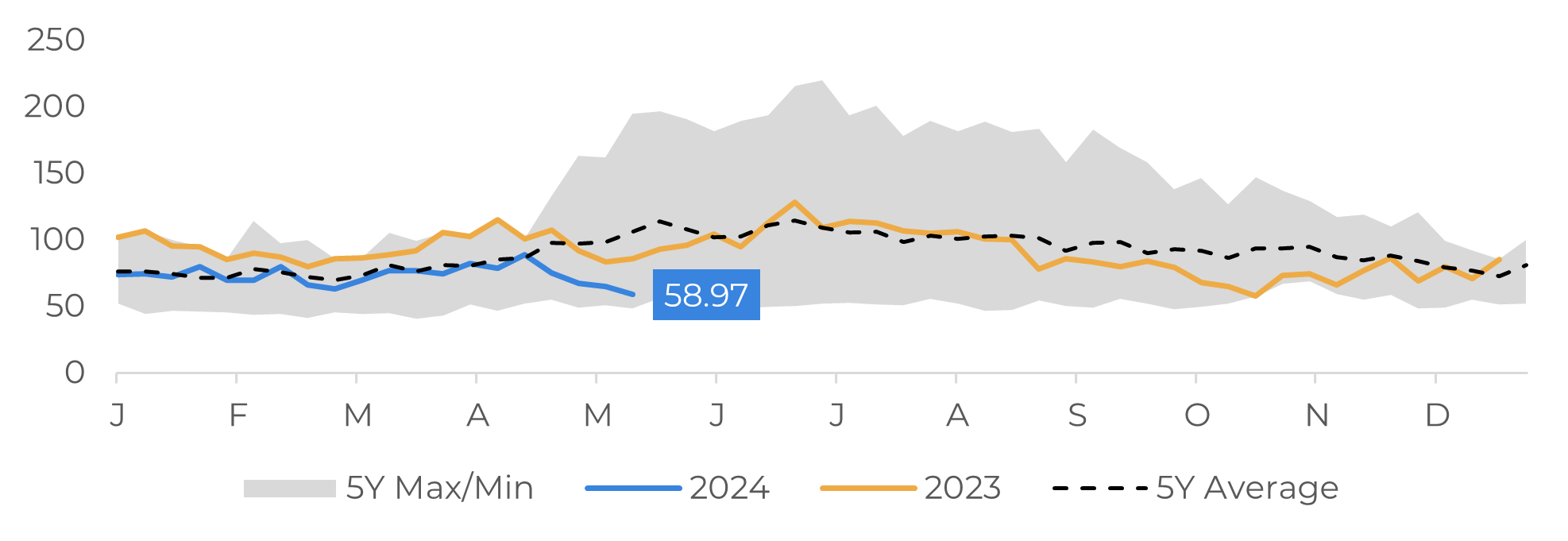

The OPEC+ oil production cut policy resulted in a significant drop in global oil stocks, especially in the first half of 2024. This become evident with the reduction in floating storage to the lowest level since 2020, around 55 million barrels. Although these facts are bullish fundamentals for the energy market, prices have retreated in recent weeks and investment funds' long positions have decreased.

Support for the energy market is based mainly on supply-side factors, while demand remains weak in 2024. Last week, the International Energy Agency (IEA) reduced their estimates for demand growth for this year,, now at 1.1 million bpd (a reduction of 140,000 bpd). Weak demand for gasoline in the US, still below 9 million bpd, and for middle distillates such as diesel, amid difficulties in the manufacturing sector, also contribute to tempering more optimistic expectations.

Although OPEC projects an optimistic growth in demand of 2.2 million bpd (attributing a large part of this expansion to China), this scenario is not reflected in current reality. If this forecast comes true, even partially, there would be no reason to fully extend the group's voluntary cuts. In this sense, OPEC+'s decision in June will speak more about its vision of the oil market than its projections.

Image 3: Global Floating Storage (Millions of Barrels)

Source: Bloomberg

Stability of the alliance remains a challenge

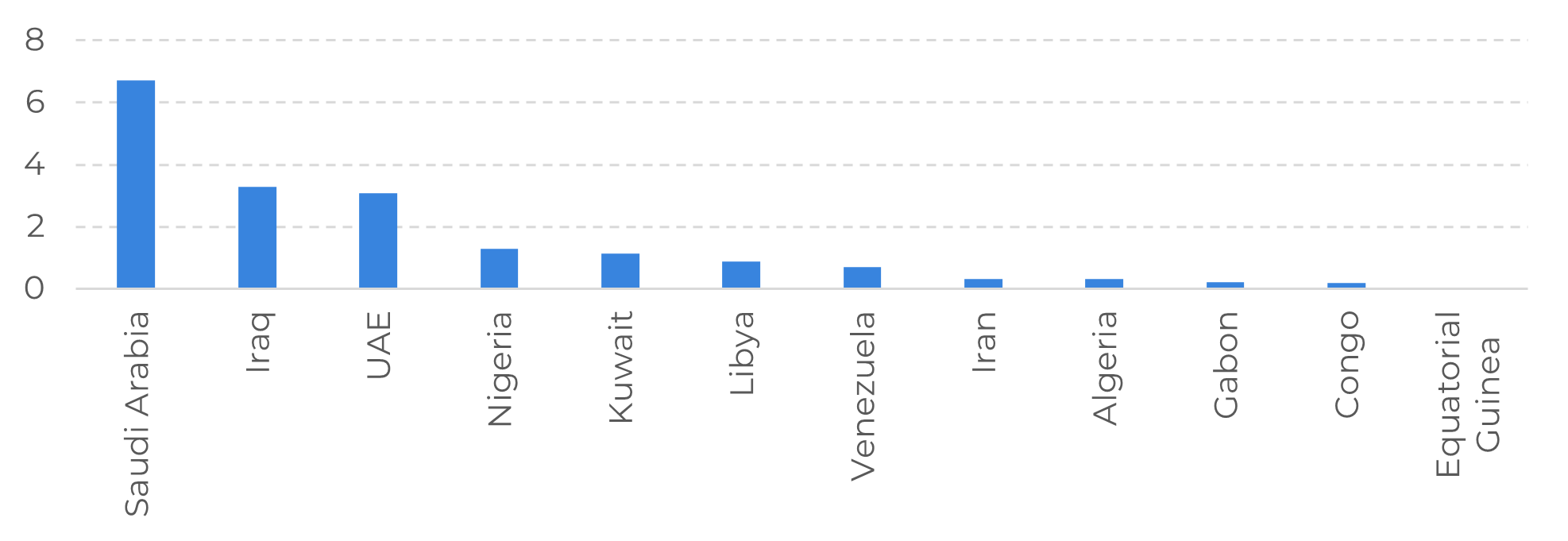

Defending prices by cutting production in 2024 is not as easy as it once was, as it implies a high cost of Market share. Non-OPEC+ countries such as Brazil, Canada, Guyana, and, above all, the US, have been increasing their oil production in recent years, limiting the effects of the restrictive production policies of the largest producers.

In this sense, some members are increasingly dissatisfied with the production quotas and are calling for revisions that would inevitably bring more oil to the market. Angola has already left the group after disagreeing with the stipulated levels, while the United Arab Emirates (UAE) is looking to increase its production capacity. Also, in this scenario of difficult cooperation, Iraq and Kazakhstan exceeded their quotas in the first quarter of 2024 by 602,000 bpd and 389,000 bpd, respectively.

In general, all oil exporters benefit from higher prices. However, Saudi Arabia and Russia seem to be the most interested in supply tightening. The Saudis, being the largest exporters in the world, increase their gains in absolute terms with better prices, while the Russians sell their oil above the price ceiling imposed by Western sanctions as a result of the invasion of Ukraine.

Image 4: US – OPEC Monthly Exports in April (Million Barrels)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com