Energy Weekly Report 2024 05 28

Refineries are still good business in the world

- Despite the growth of renewable alternatives in the fuel market, the oil refining market is still a very profitable activity. Since 2022, the sector has enjoyed a period of good margins due to a market that is still expanding, but with a lot of uncertainty regarding supply.

- One of the biggest limitations to a more bullish environment has been modest demand, the result of restrictive monetary policies in the world's main economies and modest consumption in the northern hemisphere.

- However, the approach of the driving season in the US as well as the hurricane season should bring upward biases for the main refined products, such as gasoline and middle distillates, while stocks in the world's largest economy are below the five-year average.

- In Brazil, on the other hand, uncertainties about the return on potential investments in the refining sector have increased following CADE's decision to release the country's oil giant, Petrobras, from privatizing five refineries under its control. This will make the scenario even more challenging for private refineries operating in the country.

Introduction

An oil refinery is an important industrial unit responsible for generating fuels. Its ability to transform crude oil into a diverse range of essential products, such as gasoline, diesel, aviation kerosene, asphalt, and many others, makes it a fundamental pillar for the functioning of the world as we know it.

Building refineries is not an easy task, it requires a lot of investment and depends on a long-term return to make it profitable. With the energy transition underway, there was doubt as to whether the refining market would cease to be profitable.

It's true that fossil fuels are losing ground to greener alternatives, but this hasn't yet had an impact on the sector's profitability, which remains at historically high levels.

In today's report, we'll look at the outlook for the sector at the moment and what the scenario is for crack spreads (refining margins) in the coming months.

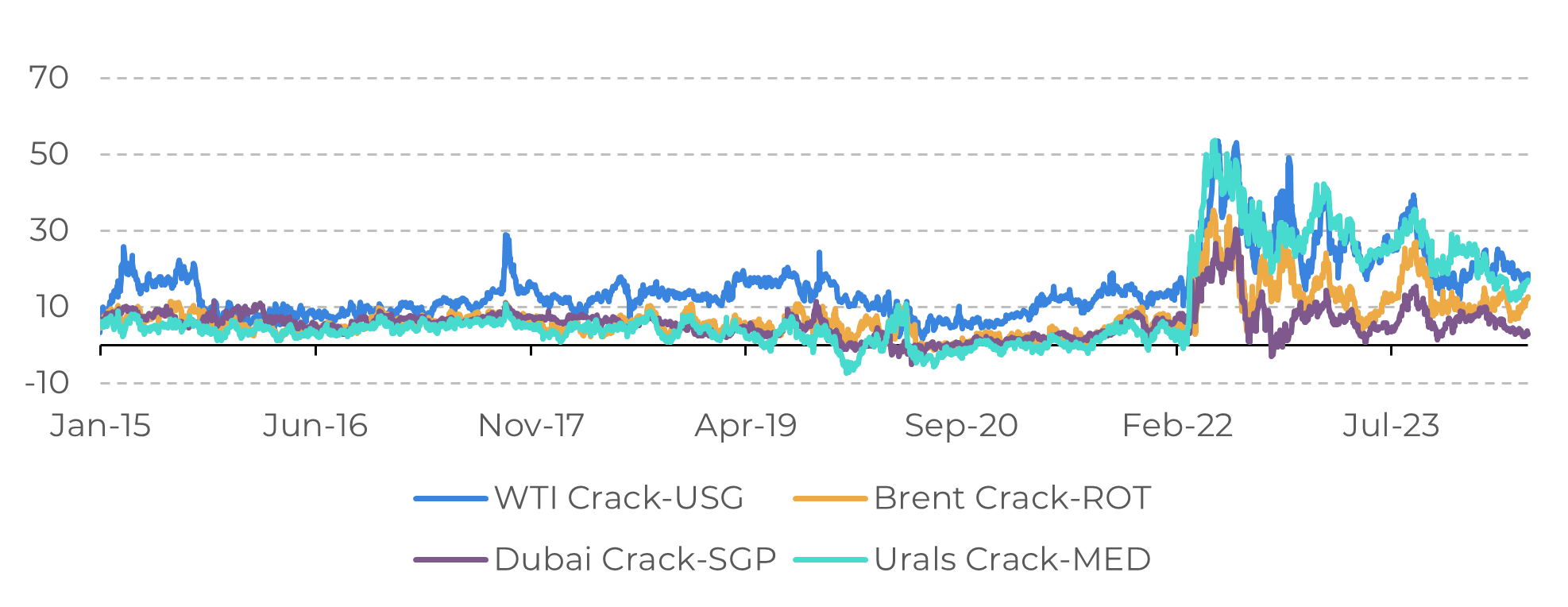

Image 1: Crude Oil Refining Profit by Region (US$/bbl)

Source: Refinitiv

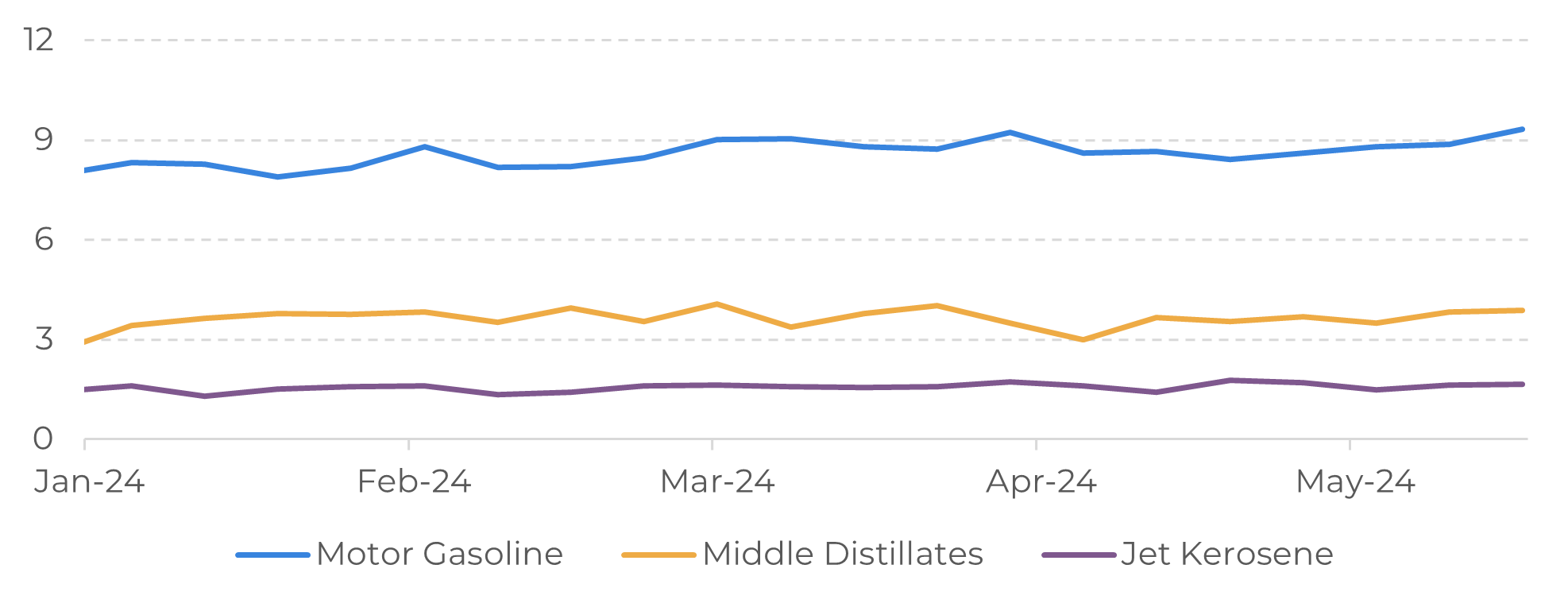

Image 2: USA - Implied Demand for Refined Products (Million Barrels)

Source: Refinitiv

Limited supply is the main reason for the rise in the sector

One of the main advantages for the refining sector is that the energy market continues to grow at a very reasonable pace. The IEA forecasts an increase of 1.1 million barrels per day (bpd) in demand by 2024, while OPEC is even more optimistic, projecting growth of 2.25 million bpd. Even though in relative terms fossil fuels are playing a lesser role in energy consumption, giving way to greener alternatives, in absolute terms it is still an expanding market.

However, the main bullish foundation for the sector lies in its limited supply growth, which has been badly affected by the pandemic. The US, for example, only returned to increasing its refining capacity in 2023, reaching a total of 18.1 million bpd, after two years of falling production capacity.

In addition, Russia's invasion of Ukraine, together with Western sanctions against Moscow, developed a very profitable scenario for the refineries in operation, which had one of their most profitable years in 2022. Gradually, this bullish scenario has been reversed, especially with some important oil processing projects around the world, such as Mexican state oil company Pemex's Dos Bocas refinery and the Dangote refinery in Nigeria. However, the increase in supply will occur gradually, which maintains an important bullish bias for the sector.

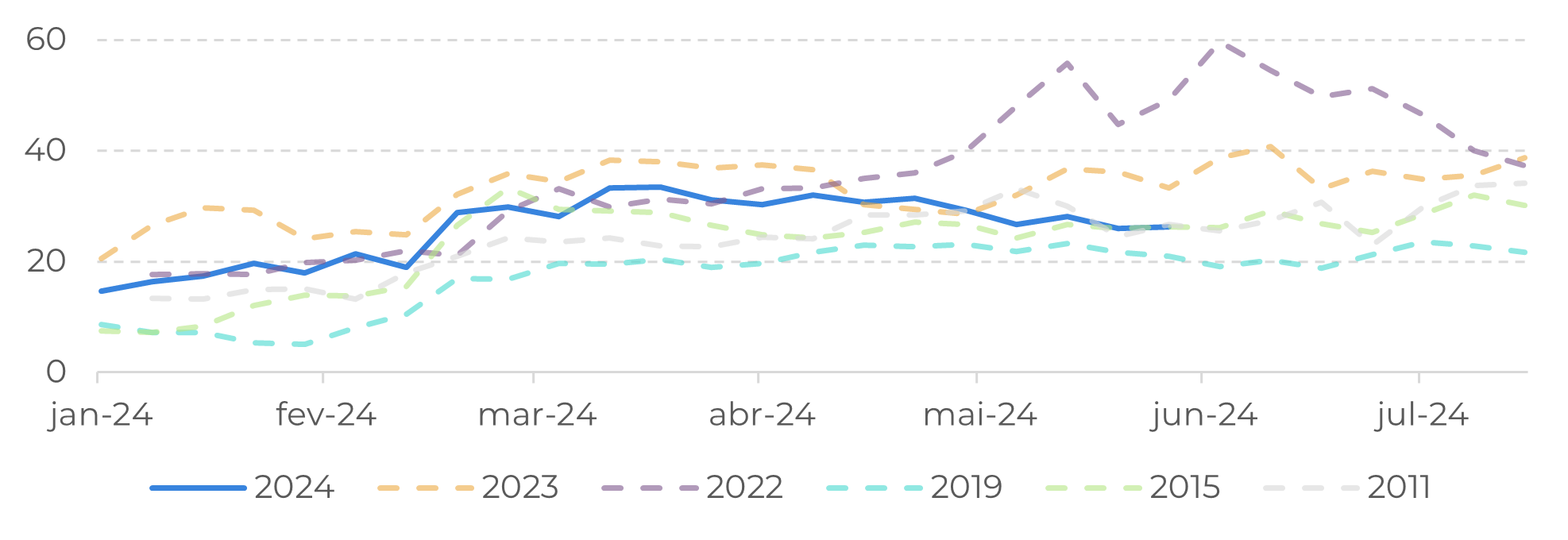

Image 3: Crack Spread by RBOB Future (US$/bbl)

Source: Bloomberg

Modest demand is the biggest obstacle at the moment

In mid-February, a very favorable environment was projected for refining margins due to the reversal of high inventories in the US of refined products such as gasoline and middle distillates. In addition, a resilient labor market, with industrial recovery underway and the prospect of interest rate cuts reinforced the view of increased consumption in the world's largest economy.

However, the opposite happened. Inflation still above target, with a very resilient services core, has eliminated the space for an interest rate cut in the first half of 2024. Gasoline consumption came in below initial projections, showing that Americans have adapted to the scenario of higher prices. Although the manufacturing PMI showed a slight recovery in March (above the 50 mark which indicates expansion), it registered 49.2 in April.

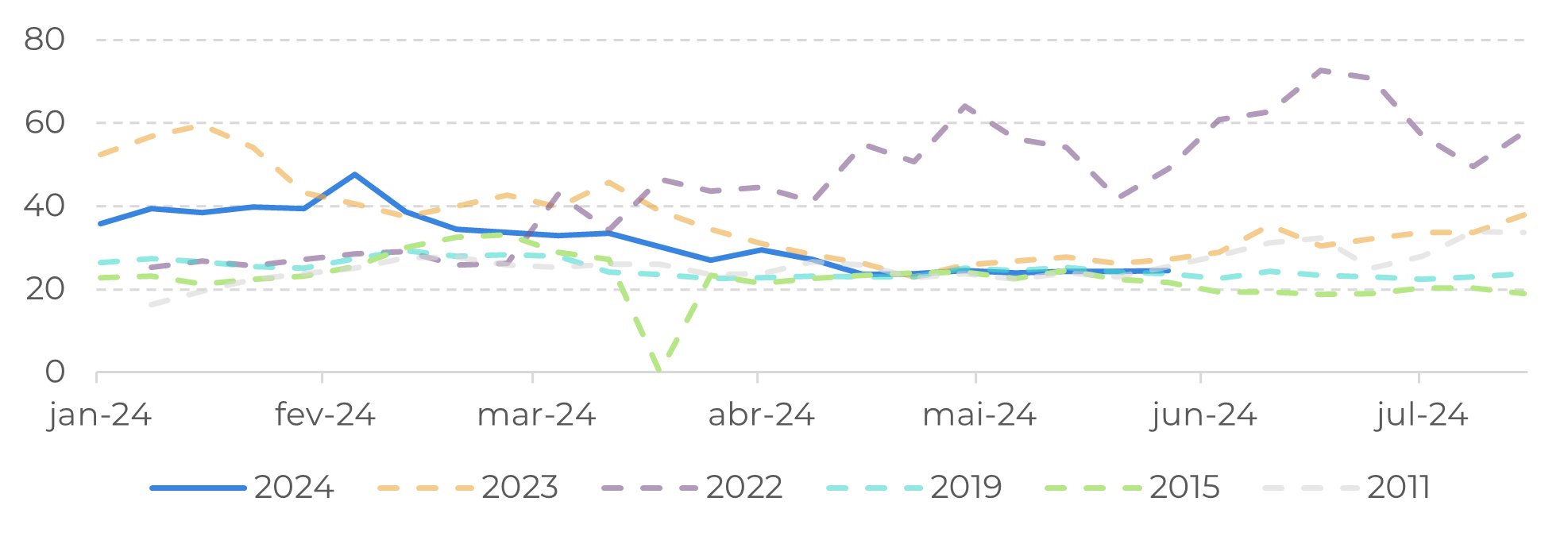

This could soon change with the start of the driving season, which could unlock a more bullish scenario for gasoline refining margins, while the price of middle distillates could suffer an upward bias with the risks of lower production due to the hurricane season in the northern hemisphere. The current levels of the RBOB crack spread (US$ 26.21 per barrel) and heating oil (US$ 24.65 per barrel) have shown important support, with the upside risks ahead being greater than the downside risks.

Image 4: Crack Spread for Heating Oil Futures (US$/bbl)

Source: Refinitiv

In Brazil, there are many uncertainties for the refining sector

This should bring an even more adverse scenario for private companies in the sector in the country. Refining margins (crack spreads) vary between companies due to product specificities and local laws. However, it is possible to run a simulation using the price of a barrel of WTI as a reference and the selling prices of gasoline and diesel in Brazil. The result shows that, on average, in May, the crack spread of a private refinery in the country was US$ 5.79 lower than that of a refinery in the US Gulf.

The revenue earned by private refineries in Brazil depends on the price charged by Petrobras, the largest supplier in the domestic market. However, the main cost, i.e. the barrel of oil, is subject to the forces of global supply and demand. Keeping gasoline and diesel prices low benefits consumers and helps control inflation in the country, but this distortion harms investment in the sector in the long term.

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.