Energy Weekly Report 2024 06 03

Amid economic uncertainties, OPEC+ maintains production cuts until 2025

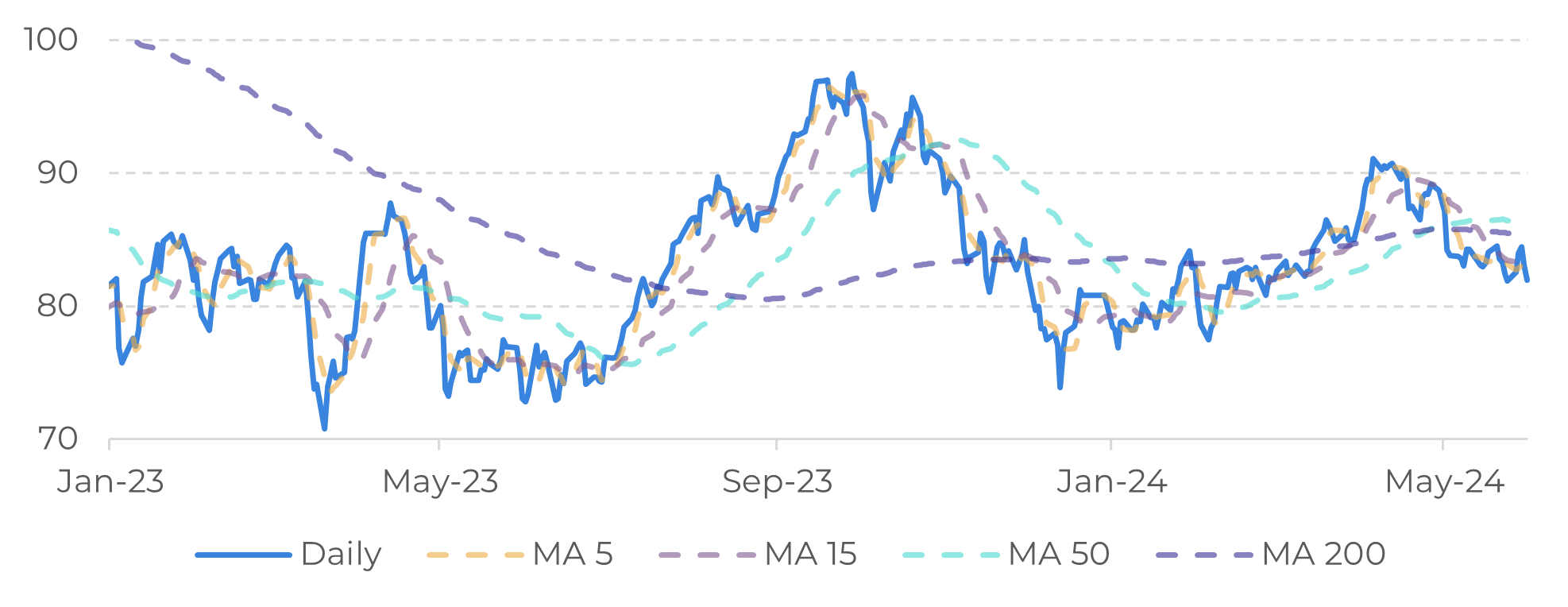

- Faced with a still uncertain economic scenario, OPEC+ decided to maintain the restriction on oil production at around 5.86 million bpd. Thus, supply-side fundamentals continue to be the main bullish driver for the main oil benchmarks, which have accumulated a rise of approximately 5% in 2024.

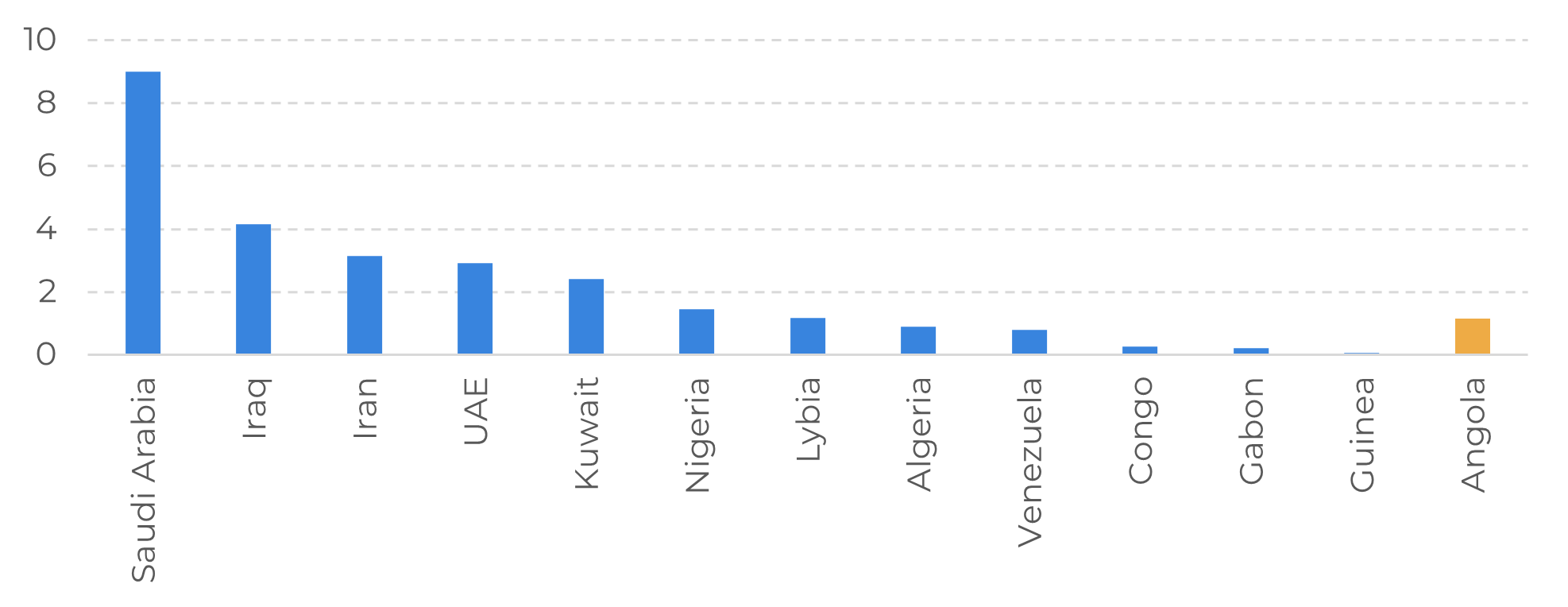

- It was also decided at the last meeting that quotas will remain unchanged for all members except the United Arab Emirates (UAE), which received an additional 300,000 bpd.

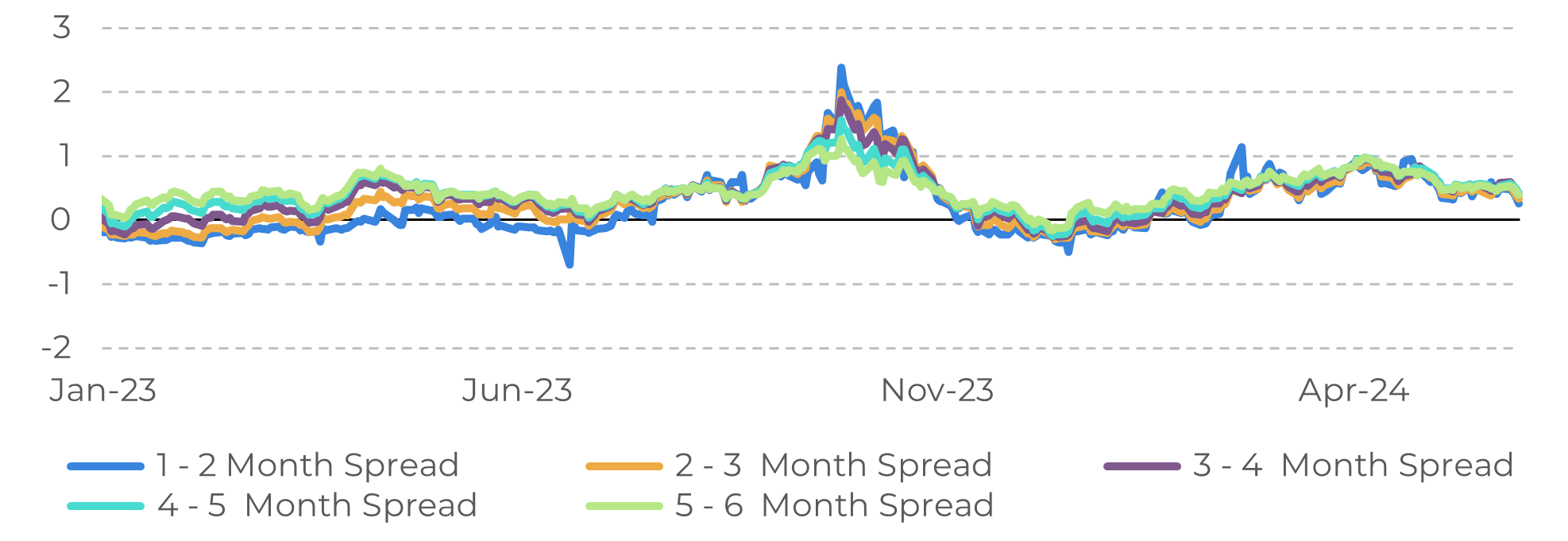

- With the continued restriction of oil supply, the market is expected to remain in backwardation during the second half of 2024, at least until September, when the extension of the 2.2 million bpd voluntary cuts expires.

- In the coming weeks, US economic data should become more relevant for the energy market. Monetary policy in the country has a direct impact on the consumption of energy commodities.

Introduction

Last Sunday (2nd June), OPEC+ decided to maintain its policy of cutting oil production. The decision includes the renewal of the 3.66 million barrels per day (bpd) cuts that were due to expire at the end of the year, extending them until the end of 2025. In addition, the voluntary cuts of 2.2 million bpd by eight members of the group, which were originally due to expire in June, have been extended until September this year.

Restricted supply in the oil market has been the main driver of the rise amid an increasingly risk-averse economic scenario. The US has not yet begun to ease its restrictive monetary policy, keeping interest rates high for longer, which has affected the value of the dollar, as well as demand for commodities.

Given the wide-ranging impact on energy commodity prices, this report will take a closer look at how the actions of OPEC+ are likely to affect the oil market in the coming months.

Image 1: Oil Price by OPEC Reference Basket (US$/bbl)

Source: Refinitiv

Image 2: Daily Oil Production OPEC Members (M bpd)

Source: Refinitiv

Modest demand reinforces the need to maintain oil production cuts

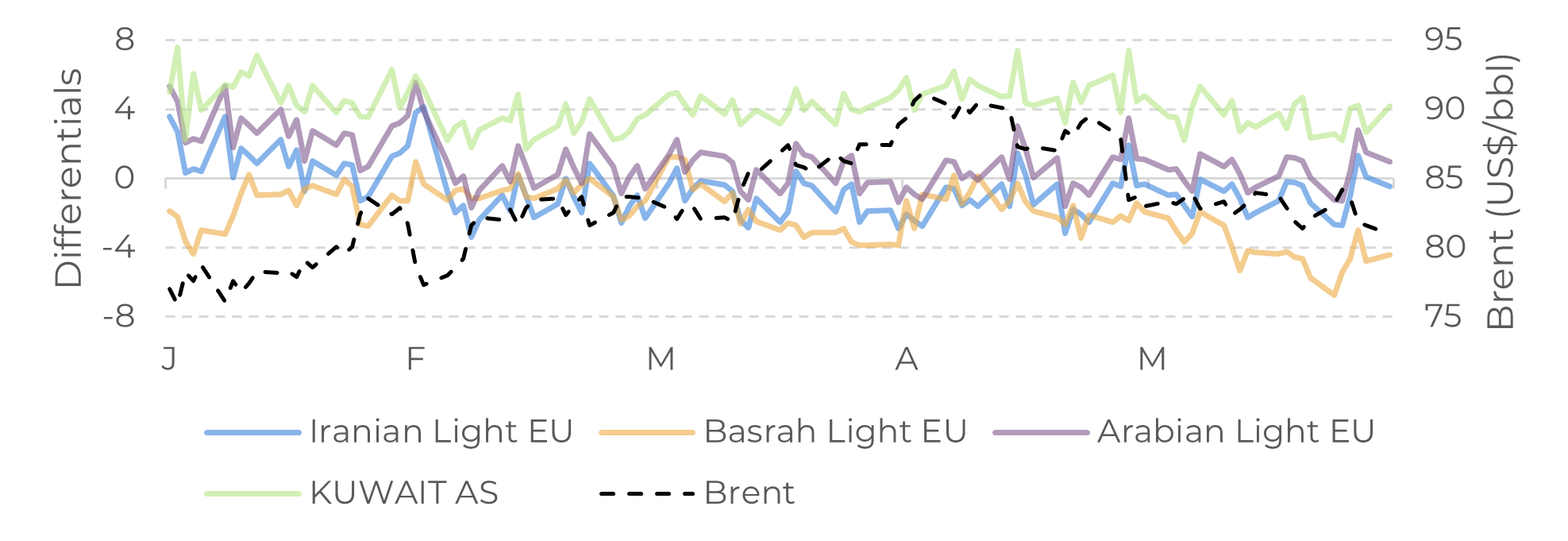

In recent months, two major forces have clashed in the global energy market. On the one hand, macroeconomic data with a bearish bias, mainly related to US monetary policy, while on the other, bullish fundamentals stemming from lower oil supply and pressure on world inventories.

This was the scenario in which OPEC+ opted to extend its production cuts to a total of 5.86 million barrels per day (bpd), equivalent to approximately 6% of world demand. This measure proved important, as the main support for the market came from the supply side, with demand remaining relatively moderate. If the policy of production cuts had not been maintained, the market would have run the risk of deepening losses, which in May totaled US$ -4.94 (-6%) for WTI and -6.24 (-7.10%) for Brent.

In the coming months, it will be crucial to observe the commitment of OPEC+ members to the established production quotas. Iraq and Kazakhstan presented a compensation plan for exceeding the established limit (almost 1 million bpd) in the first quarter, while Russia recently acknowledged having exceeded its quota in April. To a large extent, these countries depend on the revenues obtained from the sale of oil, but their lesser cooperation reduces the effectiveness of the strategy to restrict production.

Image 3: OPEC Crude Oil Grades vs. Brent (US$/Difference)

Source: Bloomberg

Fundamentals support oil backwardation

At the moment, the fundamentals indicate that the oil balance will remain tight, albeit less so. The market went into contango at the end of 2023, but has since remained firmly in backwardation given the low temperatures in the US, which paralyzed several oil exploration activities at the beginning of the year, have removed part of the production forecast for 2024, while OPEC+ actions also contributed to restricting supply.

Asia is also showing a robust economic recovery, resulting in an increase in demand for energy. Despite China showing signs of weakness in oil consumption, India surprised positively, contributing to the growth in global demand, reaching 27.81 million bpd in May, according to data from LSEG Oil Research.

There are two paths that could unfold ahead. The first is an improvement in the macroeconomic environment, due to the weakening of inflation in the US, opening up space for interest rate cuts. This scenario could open up space to see oil above US$ 90.00 by the end of the year. Another possibility is a still very risk-averse environment, resulting in a slow and gradual recovery in world demand, especially in the manufacturing sector. For the time being, OPEC+ actions are supporting the market, but without growth in consumption, the market could fall below US$ 70.00 per barrel next year.

Image 4: WTI (US$/bbl Spread)

Source: Refinitiv

In Summary

However, if the inflationary scenario persists, 2025 could be a challenging year for energy commodities, which will have to navigate an environment marked by uncertainties over interest rates, the possibility of a recession and a slowdown in consumption.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com