Energy Weekly Report 2024 06 10

Oil: sanctions on Venezuela have a moderate effect

- Washington has reimposed sanctions on Caracas after it failed to comply with agreements regarding the country's elections. As a major oil producer, Venezuela's political fate could have an impact on the energy complex.

- Despite the restrictions, the United States will still allow specific companies to operate in Venezuela, limiting the economic impact of the sanctions on the country. In the midst of the production cuts promoted by OPEC+, Venezuelan oil contributes to the global energy balance.

- The direct impacts of the decrease in Venezuelan oil exports on the global market will be relatively low due to its limited participation in international supply, but the indirect effects could be more significant and complex.

- Some American refineries in the Gulf of Mexico can obtain better yield margins with high-density, high-sulphur oil, specifications found in Venezuelan oil.

Introduction

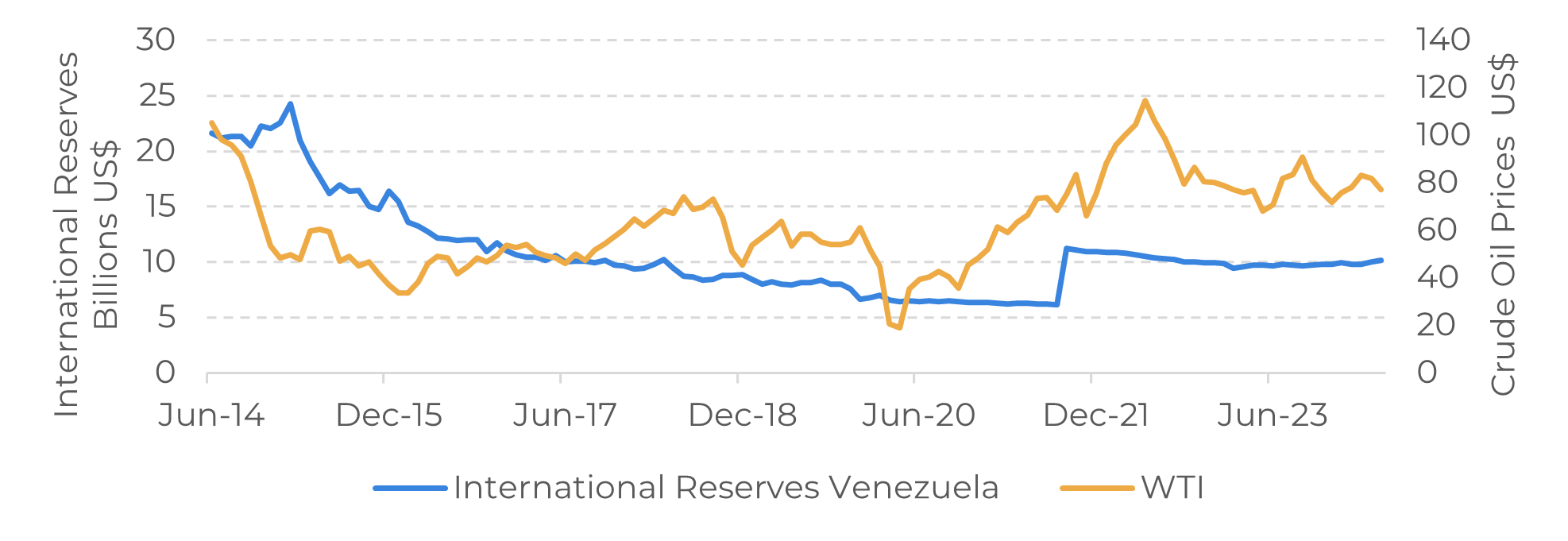

On July 28, Venezuela will elect a new president, or at least that's what the Maduro regime wants the world to believe. With the largest oil reserves in the world (303.22 billion barrels) and once one of the world's largest producers, Venezuela's political fate has profound implications for the oil market.

In January 2019, the United States imposed a package of sanctions on Venezuela, aimed at making it more difficult for the country to obtain revenues from the exploitation of the oil and gas sector. In November 2022, the United States granted an easing of sanctions, allowing companies such as Chevron Corporation (NYSE: CVX) to operate in Venezuela's oil sector. Measures like this have resulted in an increase in the country's oil exports.

However, in the midst of non-compliance with the agreements signed with Washington regarding the country's elections, new sanctions have been reimposed against Venezuela. In today's report, we will analyze the current situation in the South American nation and its potential impact on the oil market.

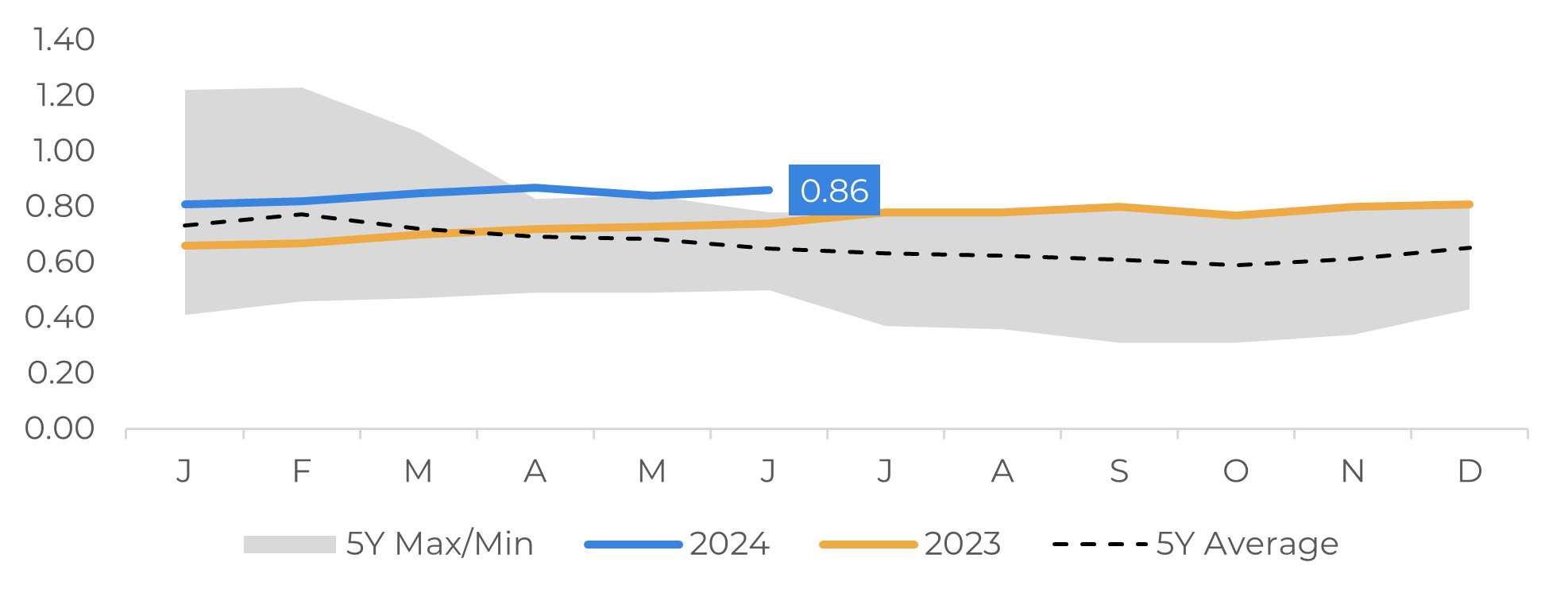

Image 1: Venezuela - Oil Production (Millions b/d)

Source: Refinitiv

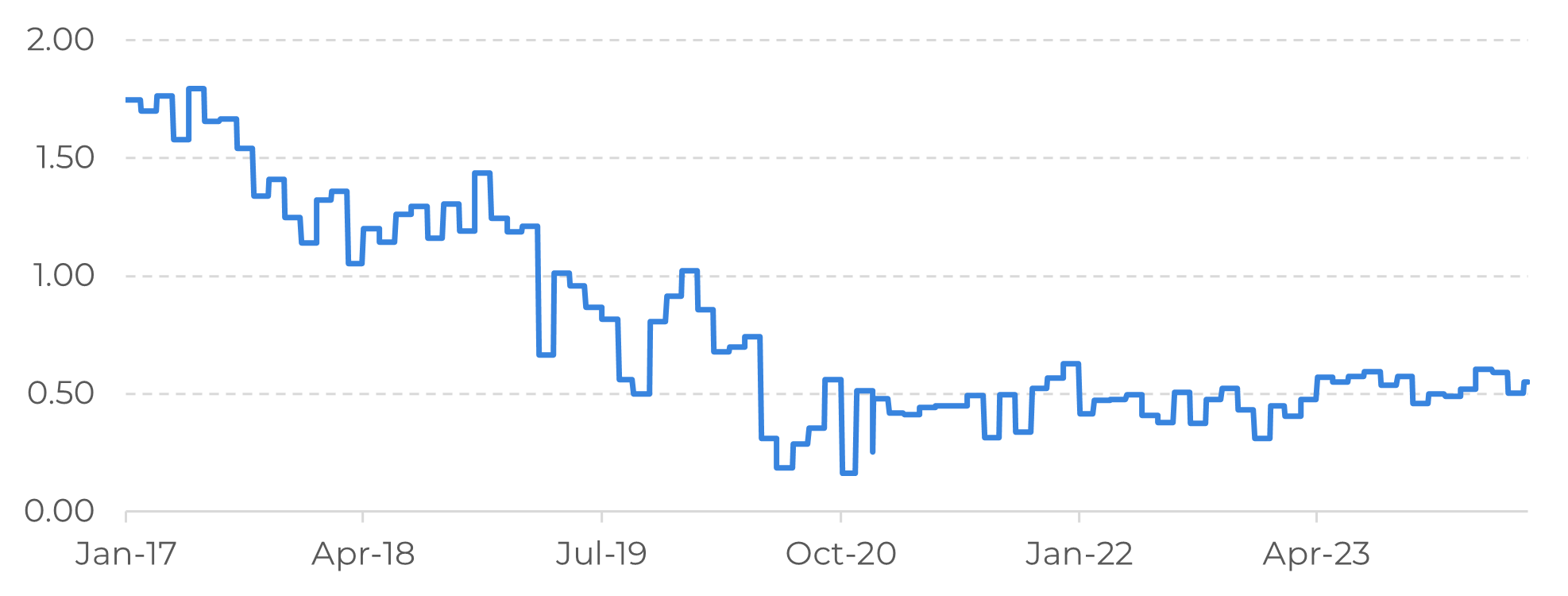

Image 2: Venezuela - Oil Exports (Millions b/d)

Source: Refinitiv

Sanctions may have limited impact on energy market

Oil production in Venezuela stands at around 860,000 bpd, which is a significant reduction on the 3.2 million bpd recorded in the 2000s. Still, in terms of global market share, Venezuelan production represents just over 0.5% of world demand. However, the country has the largest reserves in the world and its political fate has an impact on the energy market. If the country had free elections, we could see a reorganization of its energy sector, but that doesn't seem to be the case, culminating in the return of sanctions.

On May 31, the general authorization allowing companies to operate in Venezuela expired. This US measure aims to increase pressure on the Venezuelan government in response to its failure to honour agreements regarding the country's elections. However, the impact will be limited, as some special licenses will remain in force, such as the permission given to Chevron since 2022 to sell oil in the US and to some European companies as well.

Oil prices fell by more than 6% in May amid an uncertain macroeconomic scenario and fears of weakened demand. However, the complete removal of Venezuelan oil from the market could impact energy costs in the United States and Europe, especially when OPEC+ actions have increasingly restricted global supply.

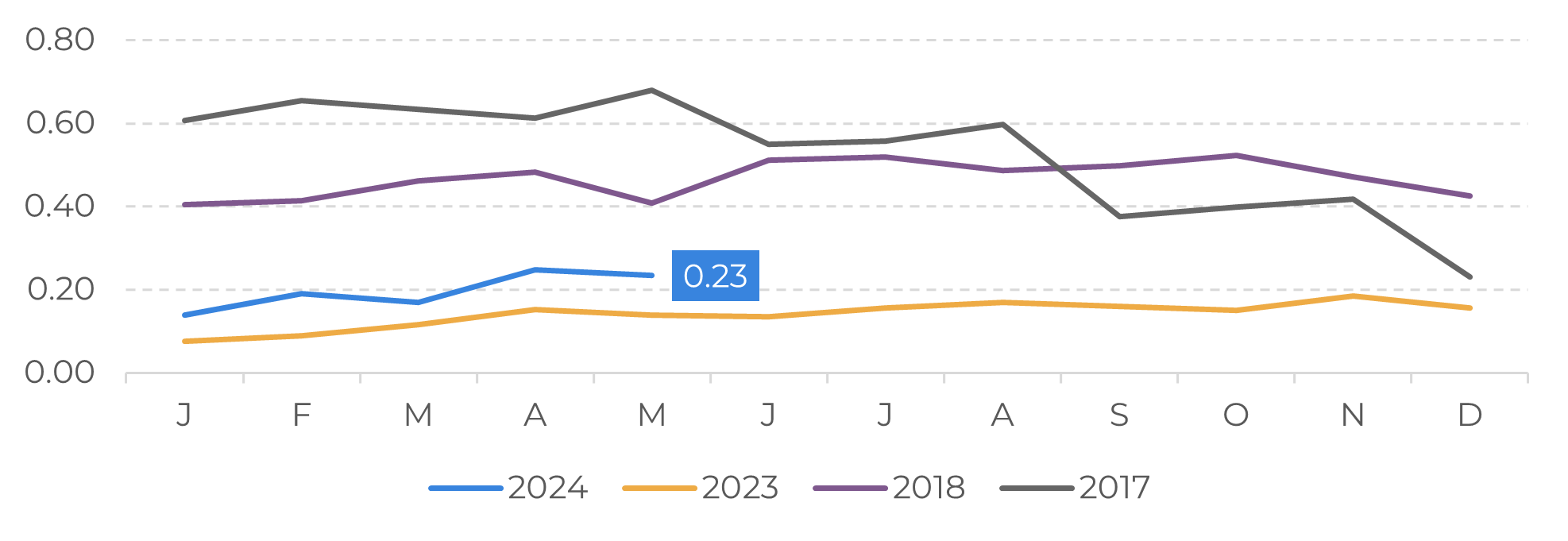

Image 3: Venezuela - Oil Exports to the USA (Millions b/d)

Source: Bloomberg

Some US refineries were designed to process Venezuelan oil

American refineries in the Gulf of Mexico are designed to process heavy oil, obtaining better margins with high-density and high-sulphur crudes, while other refineries can blend with lighter crudes to achieve the desired specifications.

For now, weak demand data in the US and the gradual recovery of the manufacturing sector have kept demandfor medium and heavy products lower. However, considering the low stocks of middle distillates in the country and the fact that refineries are starting to focus on gasoline production due to the driving season, the total absence of Venezuelan oil would impact energy costs as well as inflation in the coming months.

The reimposition of sanctions will make it more difficult for the regime in the South American country to increase its revenues, but it is far from eliminating the profits the country makes from oil sales. In recent years, Venezuela has expanded its trade relations with other nations, especially China. This has brought advantage to Chinese refineries that have benefited from Venezuela's cheap oil to obtain higher profit margins.

Image 4: Venezuela's International Reserves Vs. Oil Price (US$)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.