Energy Weekly Report 2024 06 18

Oil imports continue to slow down in China

- In the first quarter of 2024, the Chinese economy showed positive signs, with growth of 5.3% compared to the same period last year. Given this scenario, one would expect an increase in energy consumption in the country.

- In the first five months of the year, there was a -1.03% drop in oil imports. Part of this recent drop is due to the refinery maintenance period, but another part is related to the modest demand seen in the country.

- Weaker demand is reflected in challenges such as falling refining margins this year. Also, with the recent rise in the price of oil, refineries will probably prioritize the use of the country's commercial stocks rather than buying oil on the physical market, which could lead to downward volatility in the market.

- OPEC+ actions will continue to provide support to the main market benchmarks, but without a more significant increase in demand, the oil market is likely to see a significant correction in prices towards the end of the year.

Introduction

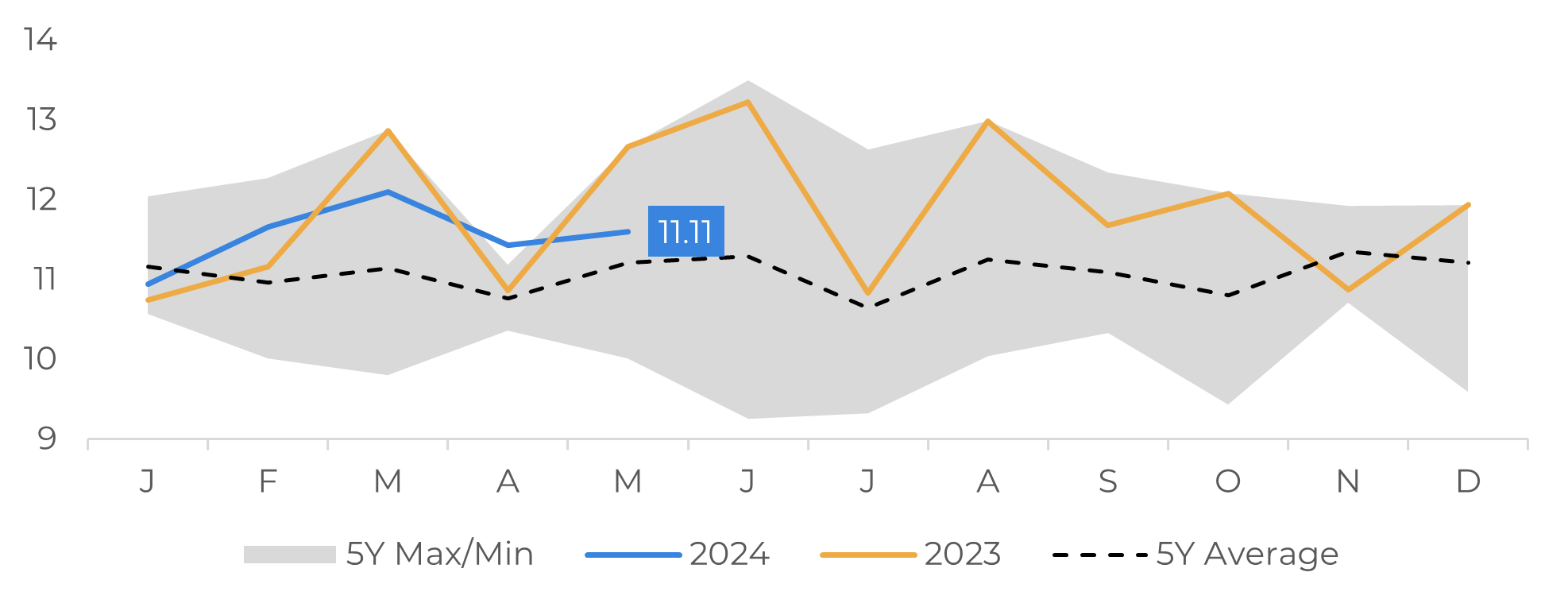

In the oil market, one of the main drivers of consumption is China, which currently stands out as the world's largest importer, with an average of more than 11 million barrels per day over the last 12 months. OPEC, which projects a growth in demand of 2.25 million barrels by 2024, has allocated 680,000 bpd to the Asian giant, which highlights its importance for the development of a bullish market.

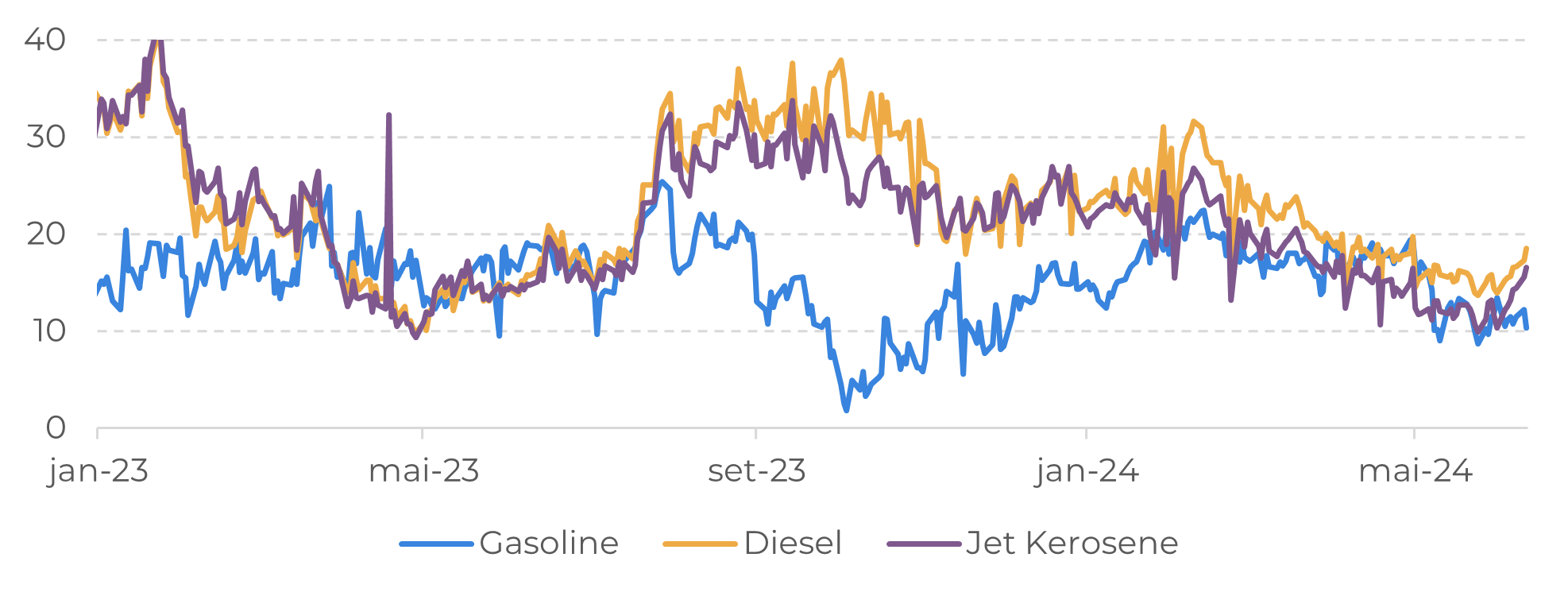

However, the data is raising doubts as to whether China will achieve such a significant expansion in oil consumption. In May, the country's refineries reduced their processing, a sign that domestic consumption may be slowing down as a result of the economic challenges the country is facing, especially in the real estate sector. Another worrying sign is the persistent weakening of refining margins in Asia.

As we reach the halfway point of the year, we think it's important to discuss oil consumption in China and anticipate possible impacts on the energy market in the coming months.

Image 1: China -Crude Oil Imports (Millions of barrels per day)

Source: Bloomberg

Image 2: China - Refined Products Margins (US$/bbl)

Source: Bloomberg

China's oil imports raise concerns

The first quarter of 2024 brought positive signs for the Chinese economy, with growth of 5.3% compared to the same period last year. This represents a significant milestone for the country, which is aiming for annual growth of at least 5%. Despite the crisis in the real estate sector, which has been slowing down the economy, industrial activity has been surprising, as has the recovery in exports, which are proving to be very competitive amid the weakening of the Yuan.

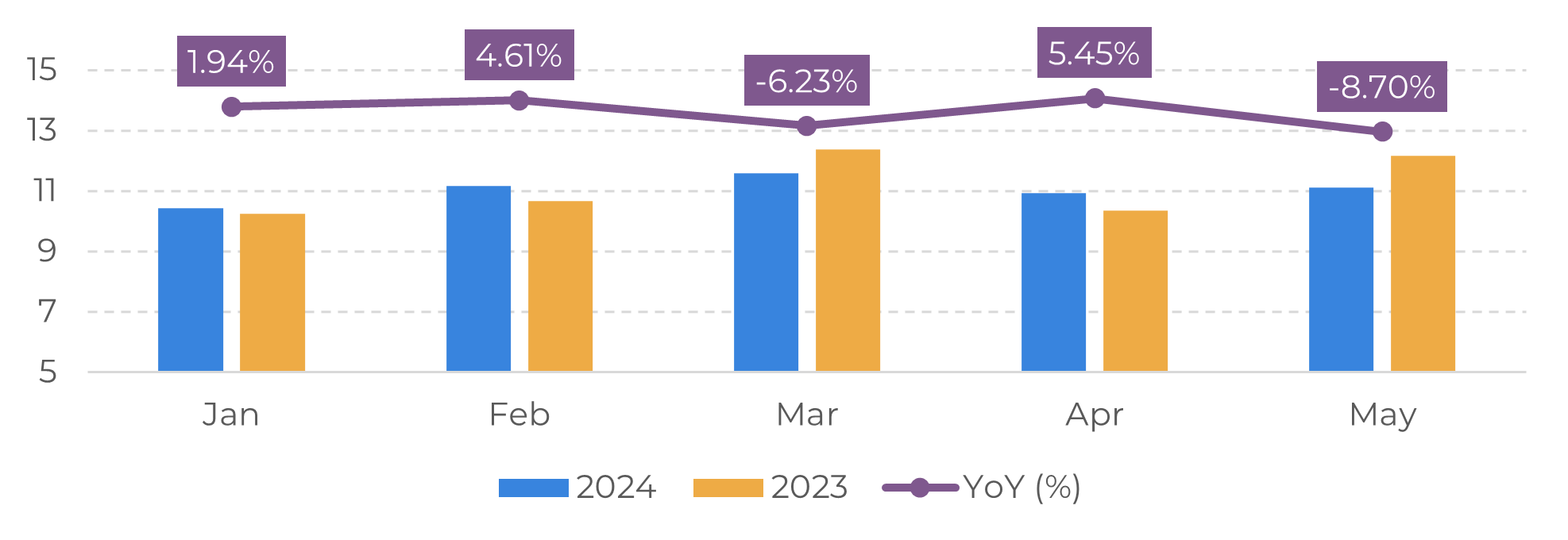

Energy consumption is correlated with a country's economic activity. In this context, it would be expected that the results of the Chinese economy would translate into an increase in oil imports. However, the scenario observed in the first five months of the year diverges from this expectation: China's total oil imports in the period are 1.03% lower than in the same period in 2023. This drop in oil demand is a warning sign for those who predicted a more bullish scenario for the energy market.

The International Energy Agency (IEA) projects an increase of 1.1 million barrels per day (bpd) in global oil demand in 2024, while the Organization of the Petroleum Exporting Countries (OPEC) is more optimistic, forecasting growth of 2.25 million bpd. However, these projections could be revised over the coming months, especially if China does not show an improvement in fuel consumption.

Image 3: China - Oil imports in 2024 (Millions of barrels per day)

Source: Bloomberg

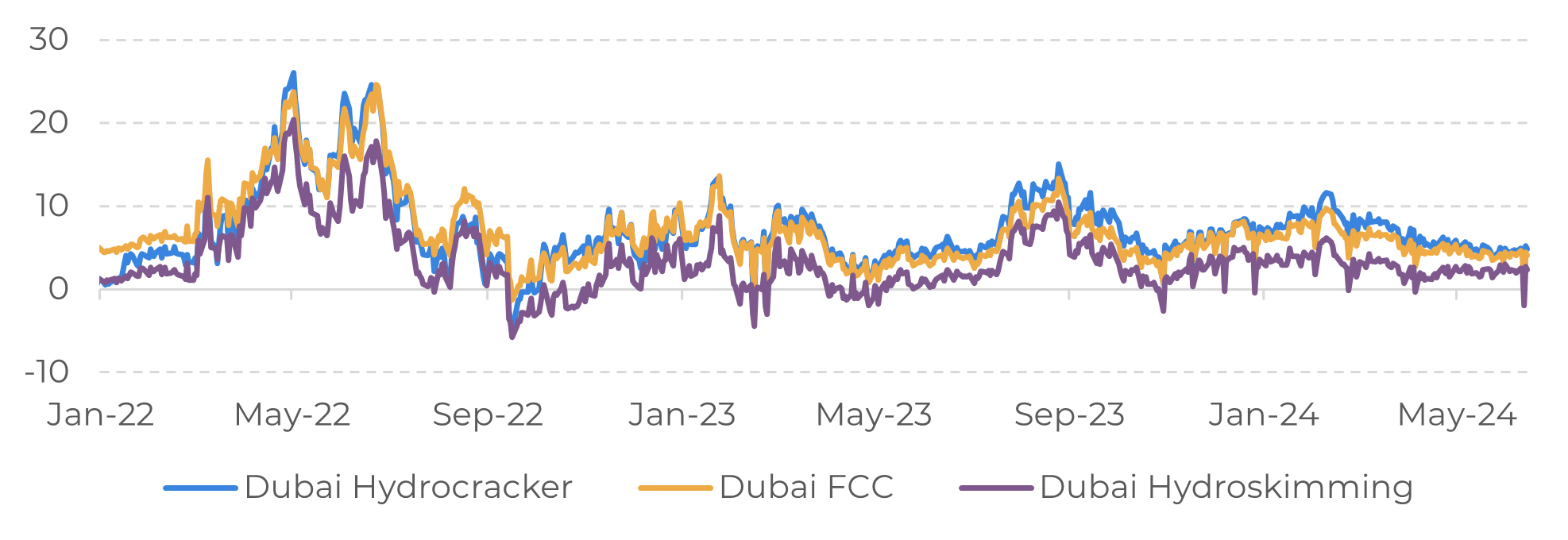

Margins at Asian refineries continue to fall

Asian refineries are seeing their margins come under increasing pressure. On the supply side, the fundamentals stemming from OPEC+ actions have provided price support for market benchmarks, keeping the Brent benchmark at around US$ 80.00 per barrel. On the other hand, modest demand for derivative products puts pressure on the revenue obtained from converting a barrel of oil into products such as gasoline or diesel.

Oil processing in China is at an all-time low, but the country should gradually recover its refining level after a period of maintenance. The main question for the market is whether refineries will choose to increase oil purchases, increasing imports, or use commercial stocks.

In this sense, the country is likely to contribute to the downward volatility in oil prices, since the current market conditions do not offer great advantages for the country's refining complex to make purchases on the physical market. In another sign of uncertainty, in June Saudi Aramco had to reduce its sales prices to the Asian market, the first reduction since February amid weakened demand.

Image 4: Asia - Refining Margins (US$/bbl)

Source: Refinitiv

In Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.