Energy Weekly Report 2024 07 03

Renewable diesel brings changes to the American energy market

- The 2024 outlook for middle distillates, products associated with the economic cycle, presents significant challenges. he US continues to navigate an uncertain inflationary environment, characterized by high interest rates that affect diesel demand. However, the macro outlook is not the only factor influencing its recently reduced demand.

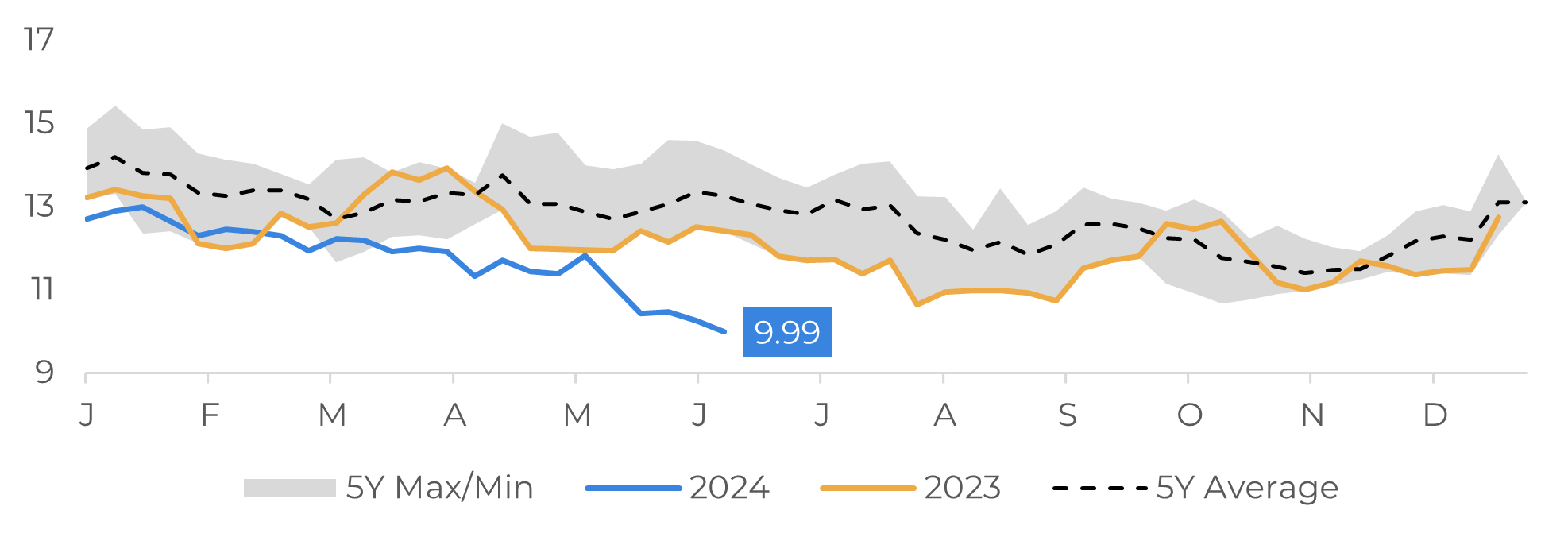

- Renewable diesel is gaining more and more ground in US energy consumption. This growing demand is reflected in the reconfiguration of national stocks, with PADD 5 (West Coast) registering the lowest levels of middle distillates in the last five years.

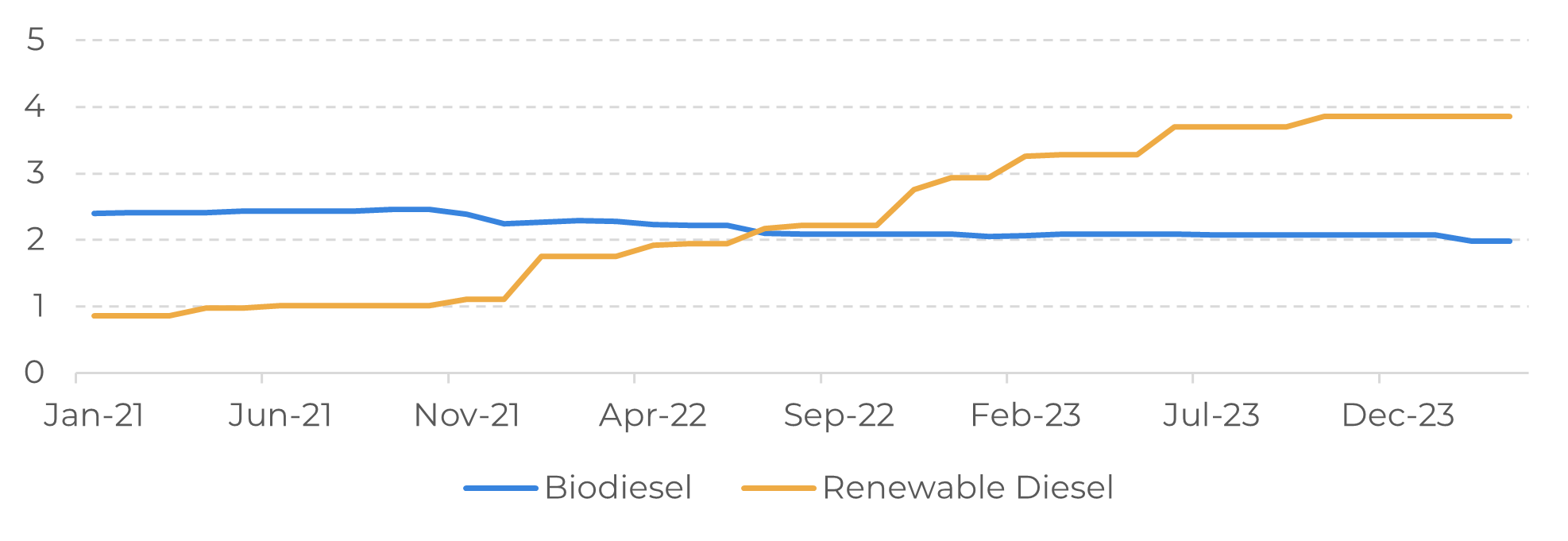

- Renewable diesel competes with biodiesel for the same market, posing a challenge to its industry. Since the renewable diesel has more similarities to the fossil alternative, especially in terms of fueling power, its growth has resulted in biodiesel market share lost.

- In addition, the excess carbon credits generated by the production of biodiesel and renewable diesel have created an oversupply in the market that has put pressure on the sector's profitability.

Introduction

Renewable diesel has gained ground in the US in recent years, driving a transformation in the country's energy landscape. Although it costs more than petroleum-based diesel, federal and state decarbonization policies tend to make it more competitive. These measures include minimum volume mandates and the granting of tax credits, which reduce the final price of renewable diesel for consumers.

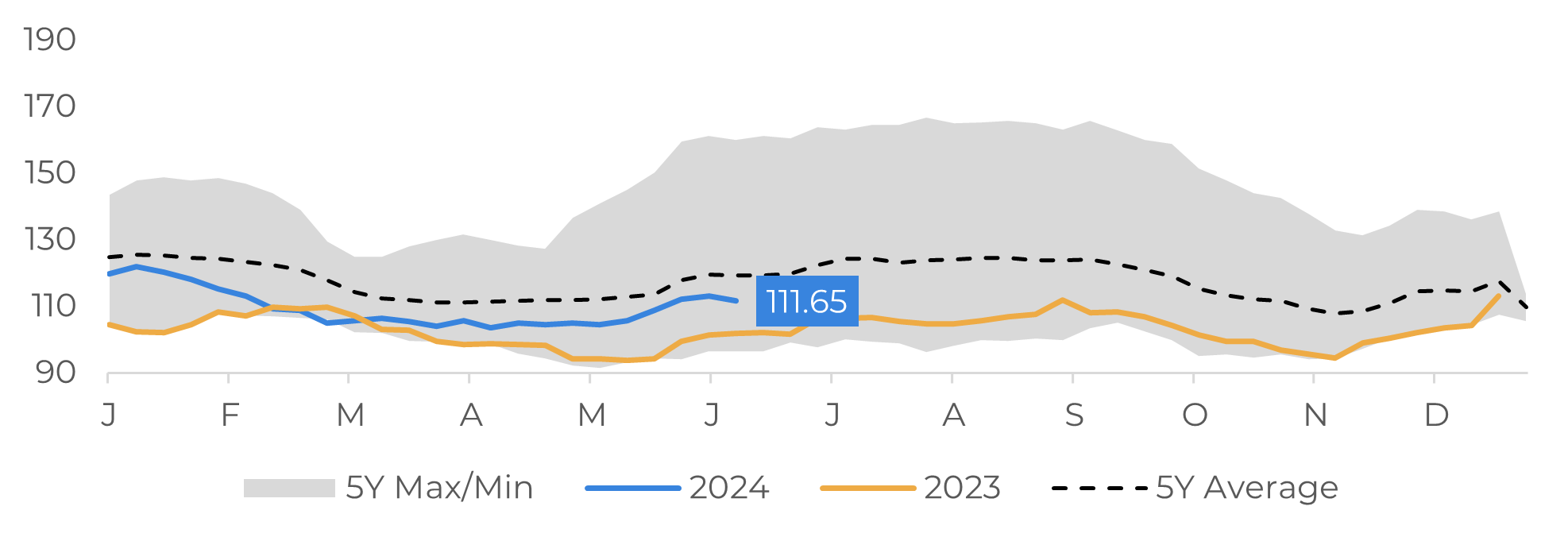

As a result, the US middle distillate market is undergoing changes, with the pattern of stocks on the West Coast (PADD 5) differing significantly from other regions. This trend is mainly driven by the high consumption of renewable diesel in California, which has become the main consumer of the fuel in the country.

In this report, we will analyze the main impacts of renewable diesel on the American market and its consequences on the oil market.

Image 1: US PADD 5 - Middle Distillate Stocks (Million Barrels)

Source: EIA

Image 2: US PADD 1 to 4 - Middle Distillate Stocks (Million Barrels)

Source: EIA

Renewable diesel gains market share in the US

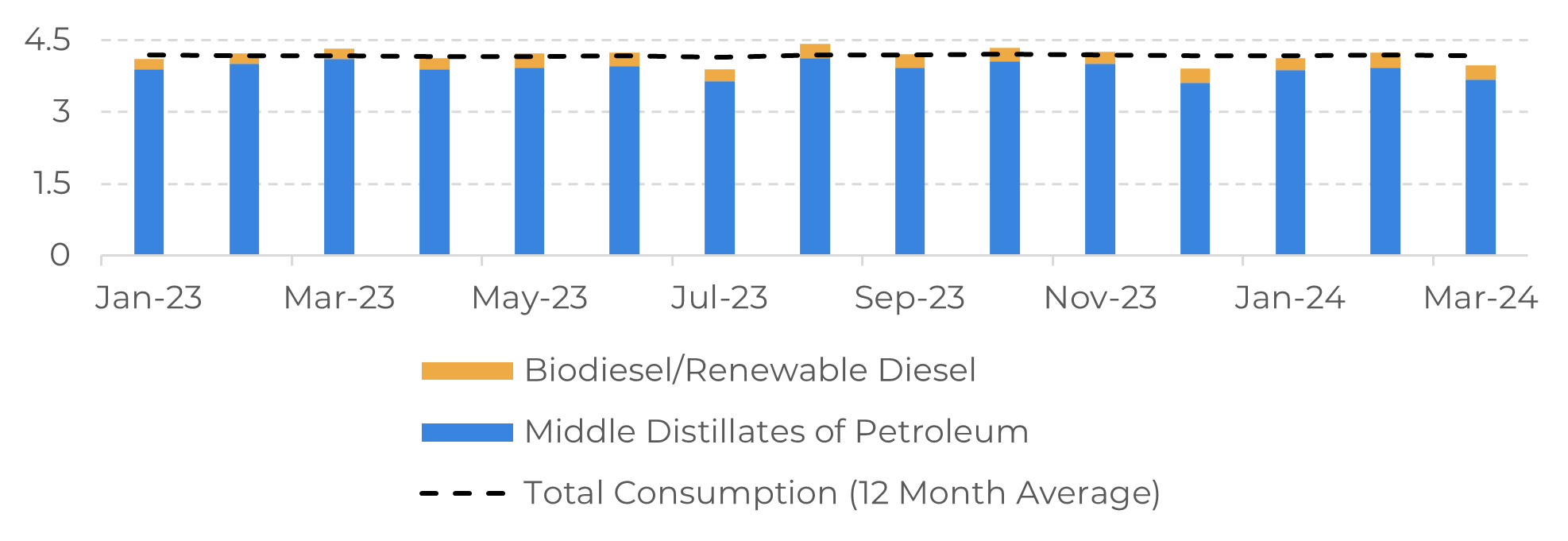

Traditional diesel, derived from petroleum, is increasingly losing ground to options such as renewable diesel and biodiesel. These fuels are widely used in freight transportation, manufacturing, and construction are strongly correlated with the country's economic cycle.

According to data from the Energy Information Administration (EIA), the consumption of middle distillates fell by 4.66% in the first three months of the year, equivalent to 186,000 barrels per day (bpd). On the other hand, biodiesel and renewable diesel saw an increase of 37.62%, corresponding to 79,000 bpd.

While part of the reduction in consumption can be attributed to the inflationary scenario in the United States, driving higher interest rates and weaker demand, the other part is explained by the by renewable fuel growth.

Image 3: US - Monthly Consumption of Mid. Distillates (Million Barrels per Day)

Source: EIA

California boosts renewable diesel in the US

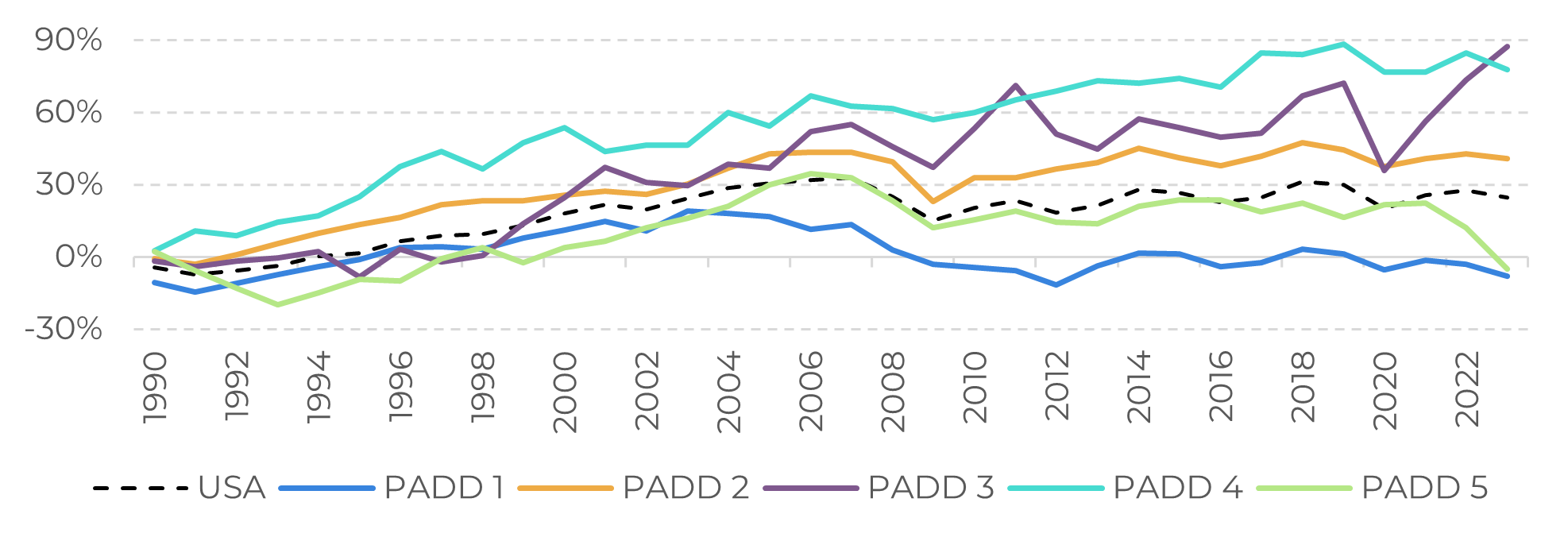

In recent years, the consumption of middle distillates, mainly diesel, on the US West Coast (PADD 5) has fallen significantly. Consumption is currently around 5% lower than in 1989, a marked contrast to the 34.59% growth recorded in 2006 (572,000 barrels per day).

The drop in consumption of petroleum-based diesel comes after the implementation of the Low Carbon Fuel Standard (LCFS) in 2011, a regulation that requires transportation fuels used in the state to be blended with biofuels to reduce their carbon intensity. In addition,

California is the only state that offers a refund to customers who buy renewable diesel specifically, which boosts the use of this type of fuel in the state.

However, the growing supply of renewable diesel puts pressure on biodiesel profit margins, which could lead to the closure of production plants. Both fuels compete directly for the same market.

Image 4: USA - Demand for Middle Distillates (% compared to 1989, base 100)

Source: EIA

Oversupply creates challenges for the renewables market

Image 5: USA - Production (Millions of Gallons)

Source: EIA

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.