Argentina: a rising producer in crude oil supply

Argentina: a rising producer in crude oil supply

- Most of Argentina’s crude oil producing regions recorded declines in year-over-year comparisons, except for the Neuquén basin, which holds the Vaca Muerta shale reserves. This basin is enabling the country to increase its crude exports and generate revenue amid the financial crisis.

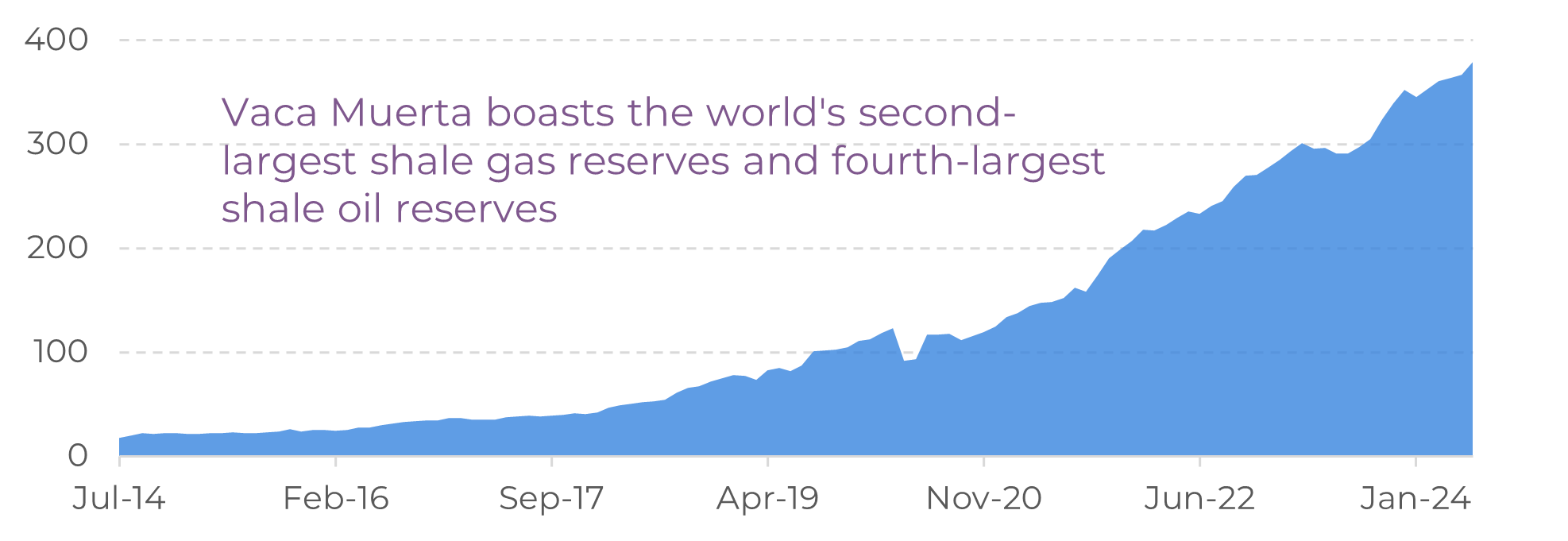

- Vaca Muerta holds the world's second-largest shale gas reserves and fourth-largest shale oil reserves, making it crucial to Argentina's aspirations to become a major energy exporter.

- More investment is needed in the region to unlock the full potential of crude oil and natural gas production. Signs are emerging that Argentina's credit and equity markets are opening up with new policies.

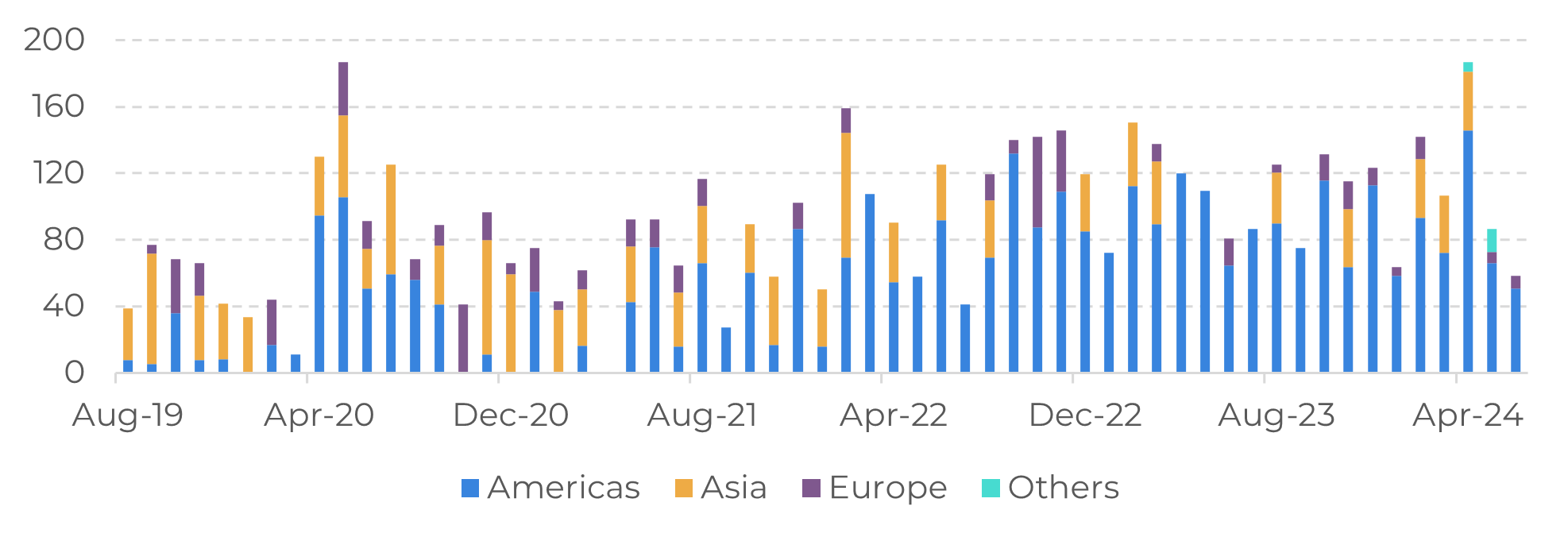

- Infrastructure projects will be crucial for Argentina to significantly expand its export volume in the coming decade. The Trans-Andean Pipeline, for instance, has facilitated daily shipments of 52,000 barrels of crude oil, marking a 30% surge in Vaca Muerta oil exports to Chile.

Introduction

Argentina’s last years increase in oil production has boosted its crude oil exports, offering some relief from the financial crises that have affected the country in recent years. There are a few reasons behind the increase in oil and natural gas production, but the primary driver is Vaca Muerta, one of the world's largest shale formations, which has attracted massive investments.

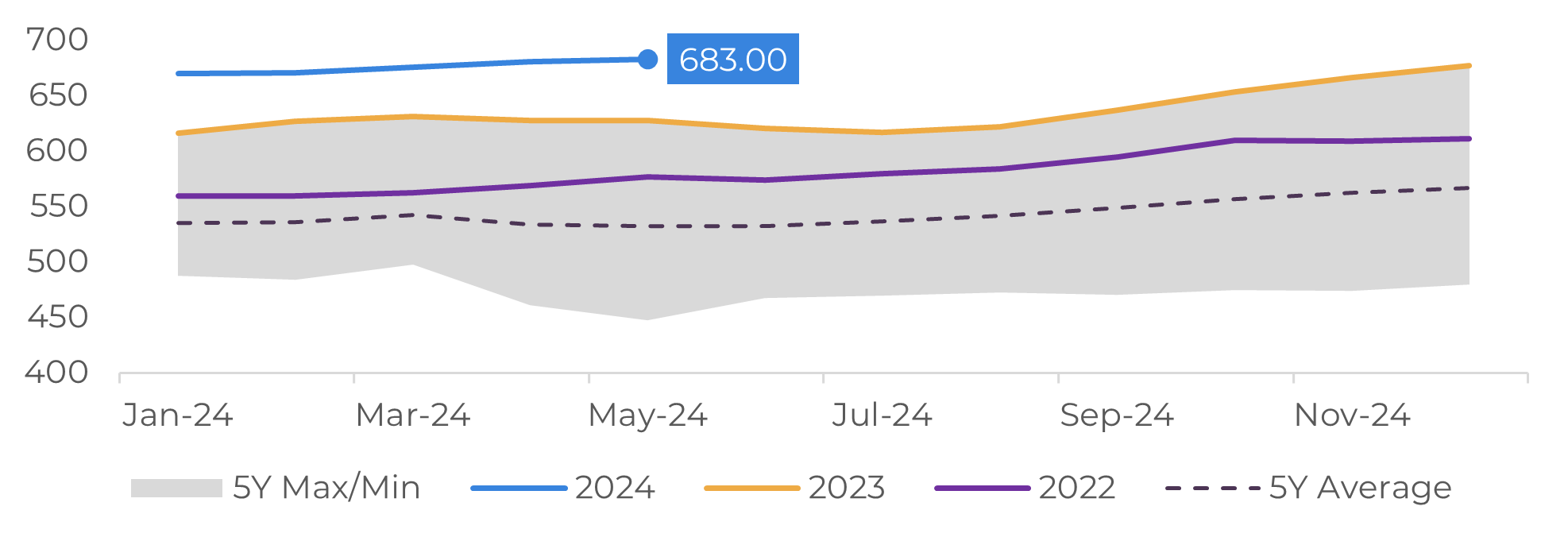

According to officials' data, crude oil production increased by 0.4% month-over-month (m/m) and 8.8% year-over-year (y/y), while natural gas production rose by 10.2% m/m and 11.2% y/y. These developments are making Argentina a major energy producer in South America. Furthermore, about 67% of total crude oil producing comes from Neuquén region, home to the Vaca Muerta formation (‘dead cow’).

South America's energy landscape is shifting. Countries like Argentina, Brazil, and Guyana are increasing crude oil production, helping to mitigate the supply deficit caused by OPEC+ nations in recent months. Let's examine Argentina’s energy scenario and its implications for the global energy market.

Image 1: Monthly Crude Oil Production (Thousand Barrels per Day)

Source: EIA

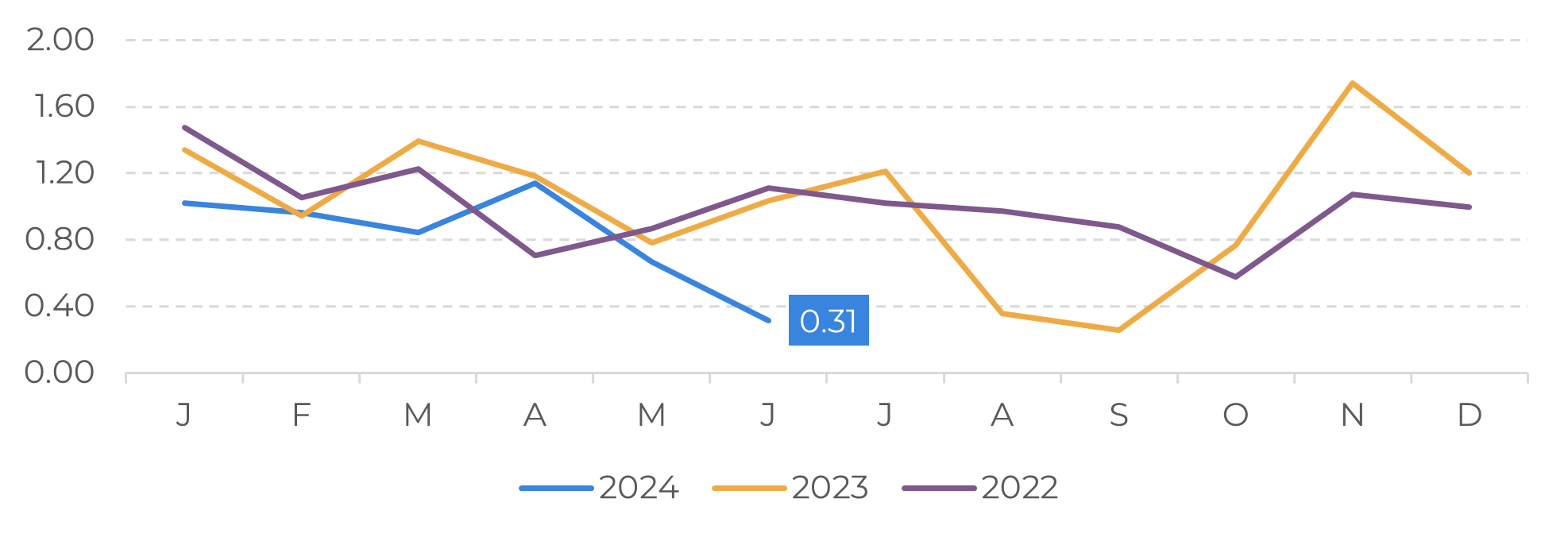

Image 2: Gasoline/Naphta Imports (Millions Barrels)

Source: EIA

Vaca Muerta is the main driver in Argentina’s oil market

In May, most of Argentina's crude oil producing regions recorded declines in their production compared to the same period last year. This includes Austral (-3.3%), Cuyana (-6.0%), and Golfo San Jorge (-2.6%). However, the Neuquén basin saw a significant increase of 15.9% year-over-year. This region is allowing the country to increase its crude exports, helping the country obtain revenue amid a financial crisis that has significantly reduced its international reserves.

One way to observe the region's growing importance is the increase in fracture stages, recently reaching 1,703, most of which are from the national oil company YPF. On this trajectory, Vaca Muerta is projected to exceed 1 million barrels per day (bpd) of crude oil production by 2030, positioning the region alongside U.S. shale oil regions like Bakken and Eagle Ford.

However, unlocking the region's full energy generation potential hinges on further investment and infrastructure development. Signs are emerging that Argentina's credit and equity markets may be opening up, as the newly elected president implements policies aimed at loosening the country's tightly controlled economy.

Image 3: Vaca Muerta is the main driver in Argentina’s oil market

Source: Bloomberg

More investments are needed for the energy sector

Argentina's new government is taking important steps by transitioning energy prices towards market levels. This move away from subsidies aims to attract investment across the energy sector, not just for crude oil production but also for natural gas. Increased investment in natural gas is crucial to achieve economies of scale, making it more competitive and potentially opening doors to attractive export markets, particularly in Europe which seeks to diversify suppliers following the Russia-Ukraine conflict.

In May YPF started the first stage of an oil pipeline that will help to boost the output from the Vaca Muerta formation, allowing the country to export more than 135 million barrels of oil per year. The first stage will require a US$ 190 million.

Infrastructure projects will play a pivotal role in enabling Argentina to expand its export volume in the coming years. Since its inauguration last year, the Trans-Andean pipeline has facilitated daily shipments of 52,000 barrels per day (bpd), marking a 30% increase in Vaca Muerta oil exports to Chile.

Image 4: ARG – Monthly Crude Exports (Thousand Barrels per Day)

Source: Kpler

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

livea.coda@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.