Fuel prices could remain under pressure in the second half of the year in Brazil

Fuel prices could remain under pressure in the second half of the year in Brazil

- Oil production in Brazil has grown considerably in recent years, making the country one of the main non-OPEC+ suppliers on the world oil market.

- However, the country still depends on imports to supply its refineries, which were not designed to process domestic oil. In addition, a considerable part of the diesel consumed in Brazil comes from other countries.

- In this context, both international energy prices and the value of the BRL affect the price of oil derivatives in the country, resulting in an increase in the price of gasoline in July.

- The scenario ahead looks challenging, as the price of oil is likely to remain high and, even with the prospect of an interest rate cut in the US, the real has not appreciated in the face of the country's fiscal risks.

Introduction

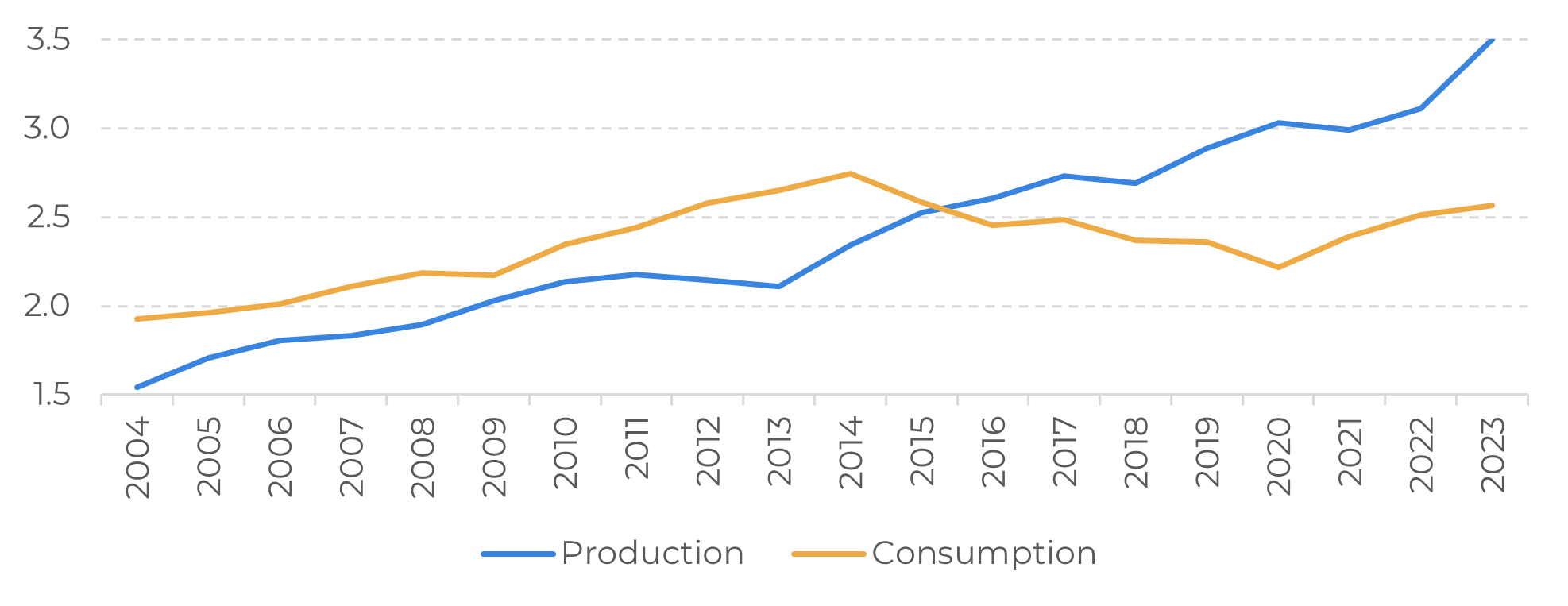

Brazil has excelled in oil production in recent years, achieving self-sufficiency, i.e. the ability to produce enough to meet the demand of its domestic market. In addition, the surplus from its production has contributed to boosting Brazil's trade balance, with around 25% of the surplus recorded in 2023 coming from the sale of oil and oil products.

However, it is important to note that Brazilian refineries were not designed to process the type of oil extracted in the country, requiring imports to blend and achieve the ideal yield in the production of oil products. Furthermore, a significant part of the diesel consumed in the country is also imported, maintaining the country's relative dependence on international prices.

Therefore, the dollar is a fundamental component in Brazil's energy costs. When the country's currency devalues, the cost of purchasing imported oil and refined products increases. In this context, our focus today will be to discuss the impacts of the devaluation of the BRL and how this will affect fuel prices in the country.

Image 1: Brazil - Average Annual Production and Consumption (M bpd)

Source: ANP

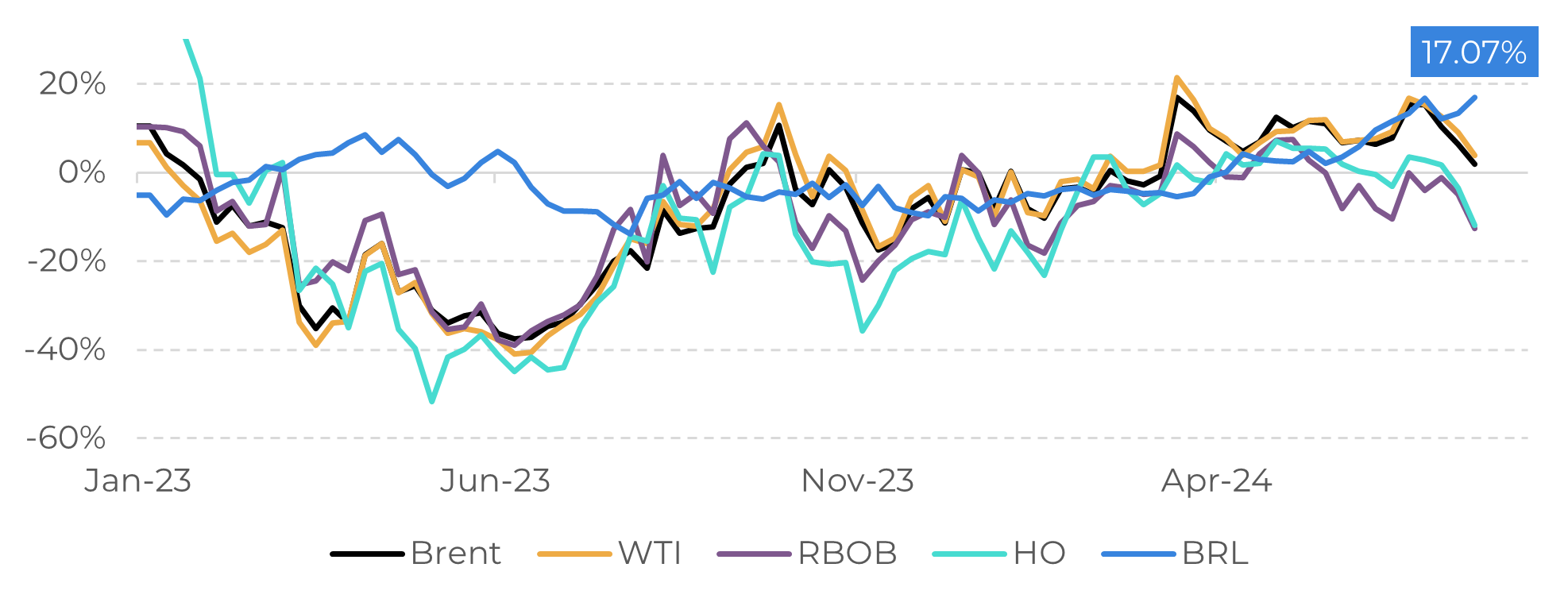

Image 2: Change in Energy Futures and BRL YoY (%)

Source: Refinitiv

The rise in the BRL contributed to increase domestic prices

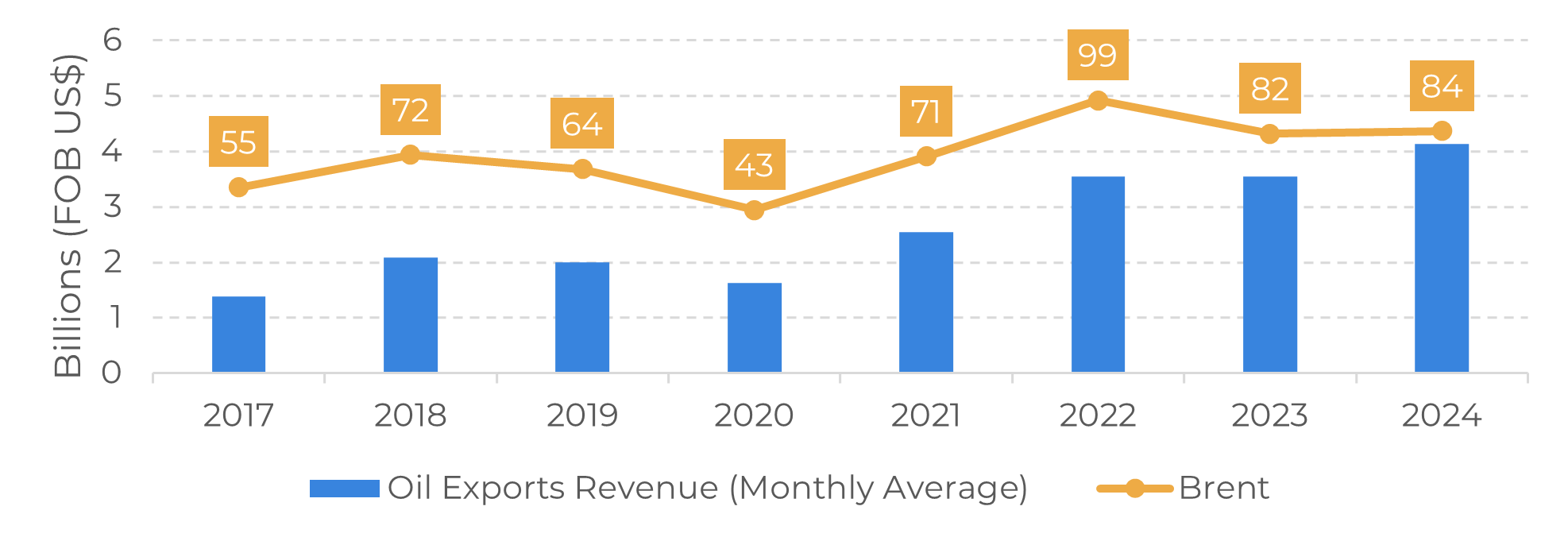

According to data from the IBP (Brazilian Oil and Gas Institute) and the ANP (National Petroleum Agency), since 2013 there has been a 165% increase in oil exports and a 59% drop in oil imports. This trend has benefited the Brazilian economy, where the increase in oil production has resulted in a boost to the country's trade balance. In 2023, for example, the country recorded a surplus of US$ 99 billion, with US$ 25 billion coming from the sale of oil and oil products.

However, the country is still dependent on imports, and international prices influence national energy costs. While some energy commodities have not seen a significant increase year-on-year, such as oil, which is around 3% more expensive, others, such as diesel and gasoline, have fallen by more than 11%. However, the BRL has risen by more than 17% in the same period, being the main factor behind the increase in the country's import costs seen in recent weeks.

Increasingly pressured by the domestic and international scenario, Petrobras had to raise the price of gasoline for the first time since August 16, 2023 (an increase of R$ 0.20 per liter), to an average of R$ 3.01.

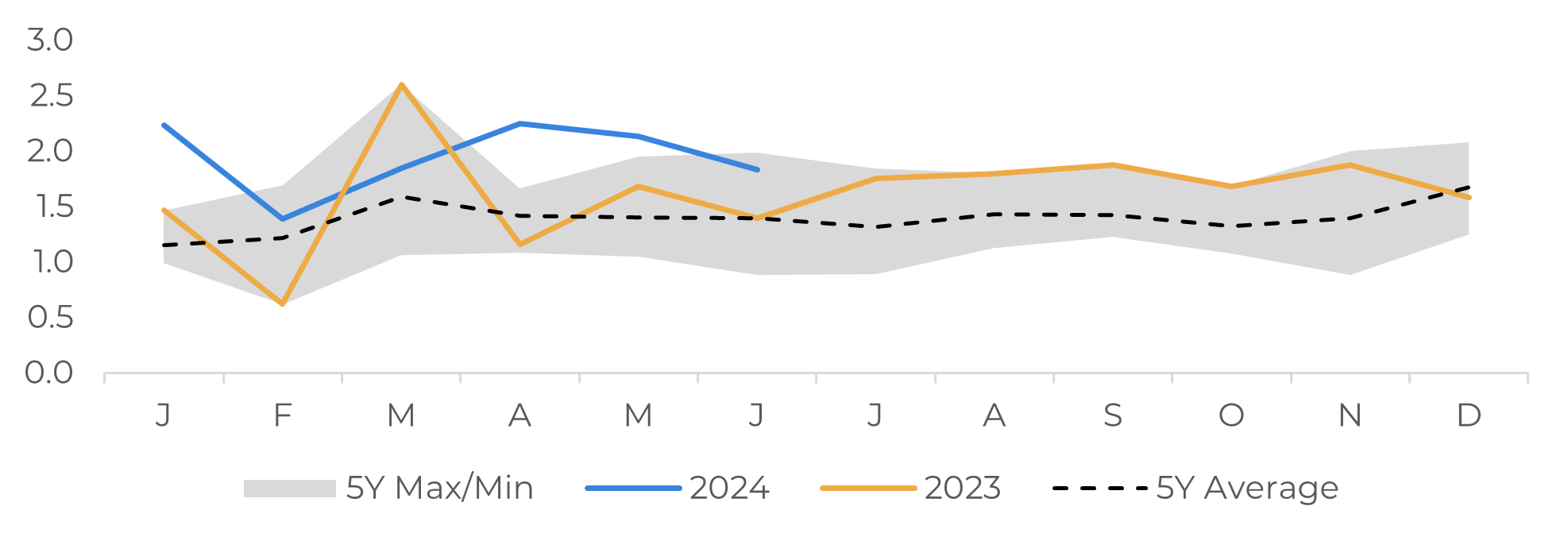

Image 3: Brazil - Monthly Oil Exports (M bpd)

Source: Bloomberg

Brazil - Average Monthly Export Revenue (US$ FOB) and Brent (US$/bbl)

According to data from the IBP (Brazilian Oil and Gas Institute) and the ANP (National Petroleum Agency), since 2013 there has been a 165% increase in oil exports and a 59% drop in oil imports. This trend has benefited the Brazilian economy, where the increase in oil production has resulted in a boost to the country's trade balance. In 2023, for example, the country recorded a surplus of US$ 99 billion, with US$ 25 billion coming from the sale of oil and oil products.

However, the country is still dependent on imports, and international prices influence national energy costs. While some energy commodities have not seen a significant increase year-on-year, such as oil, which is around 3% more expensive, others, such as diesel and gasoline, have fallen by more than 11%. However, the BRL has risen by more than 17% in the same period, being the main factor behind the increase in the country's import costs seen in recent weeks.

Increasingly pressured by the domestic and international scenario, Petrobras had to raise the price of gasoline for the first time since August 16, 2023 (an increase of R$ 0.20 per liter), to an average of R$ 3.01.

Image 4: Brazil - Average Monthly Export Revenue (US$ FOB) and Brent (US$/bbl)

Source: ANP, Refinitiv

Summary

Even if Petrobras avoids passing on the volatility of international prices to the domestic market, the increase in these costs should make further adjustments inevitable in the coming months.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.