China adds uncertainty to 2024 oil consumption

China adds uncertainty to 2024 oil consumption

- The possibility of an interest rate cut in the U.S. in September has fueled more bullish expectations for energy commodities like oil. However, the drop in Chinese imports raises a warning signal.

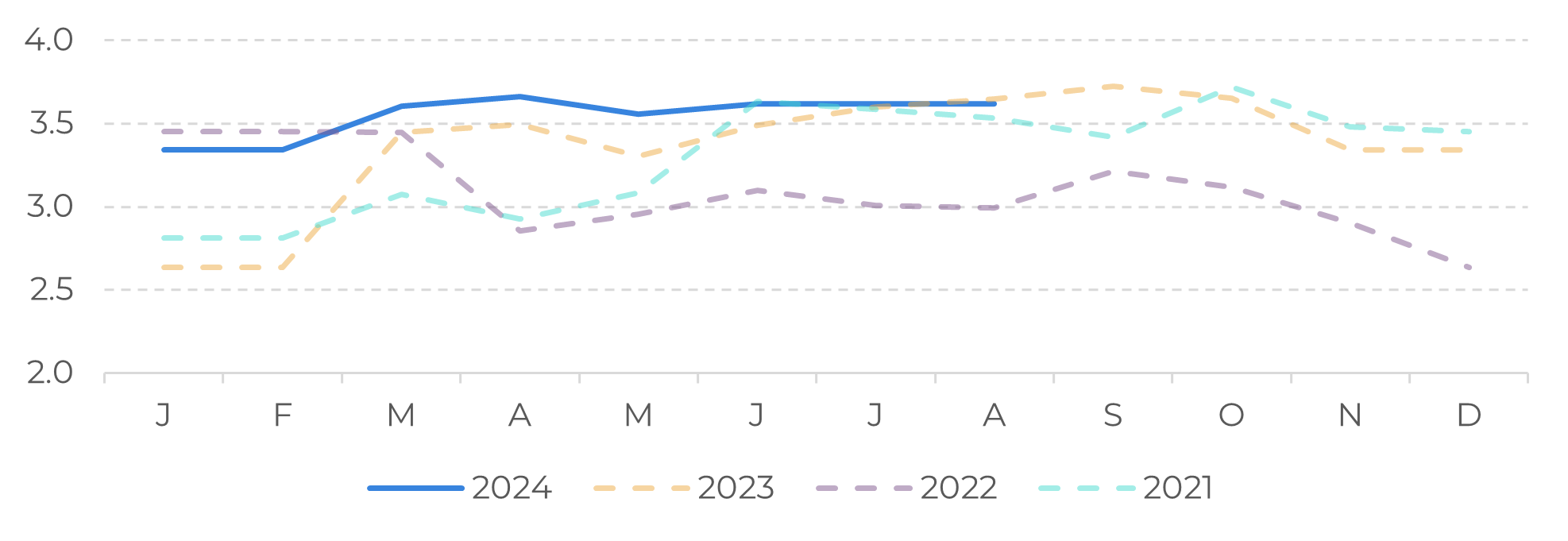

- Economic challenges, combined with the energy transition, have led to stagnant gasoline demand in 2024, with consumption holding steady at just over 3.5 million barrels per day (bpd), unchanged from the previous year.

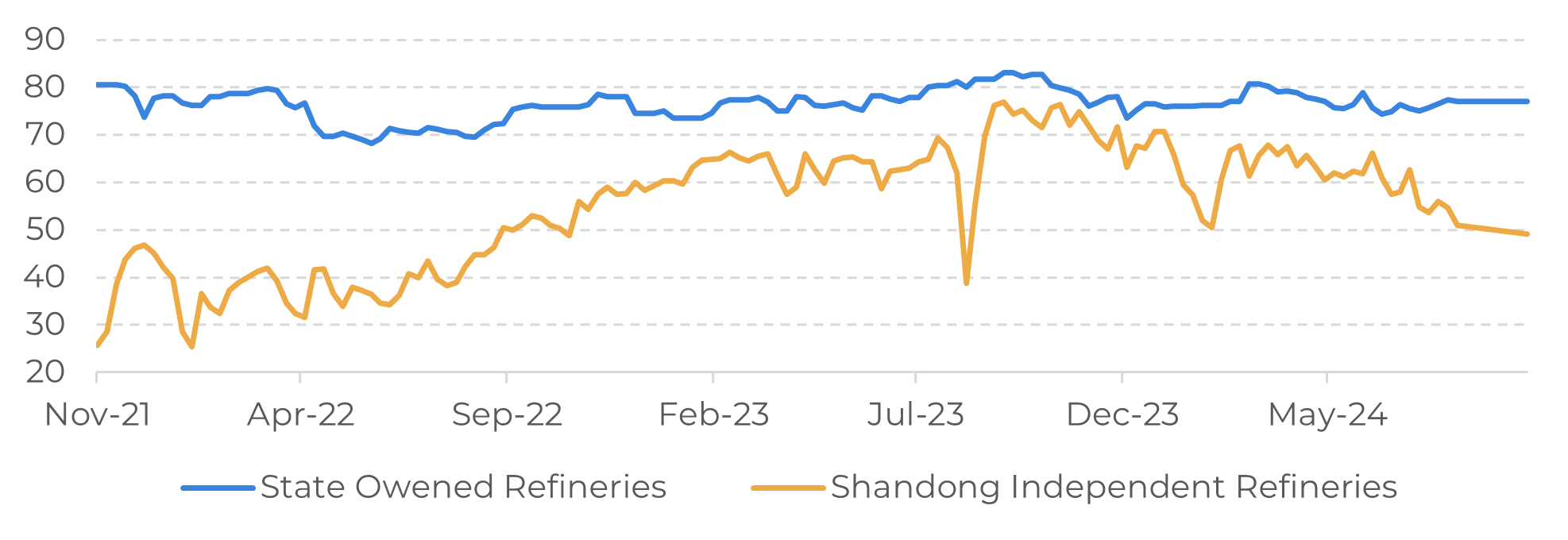

- Typically, refineries enter autumn maintenance after peak summer demand and before the heating season begins, but weak demand may trigger an earlier start for independent refineries in China.

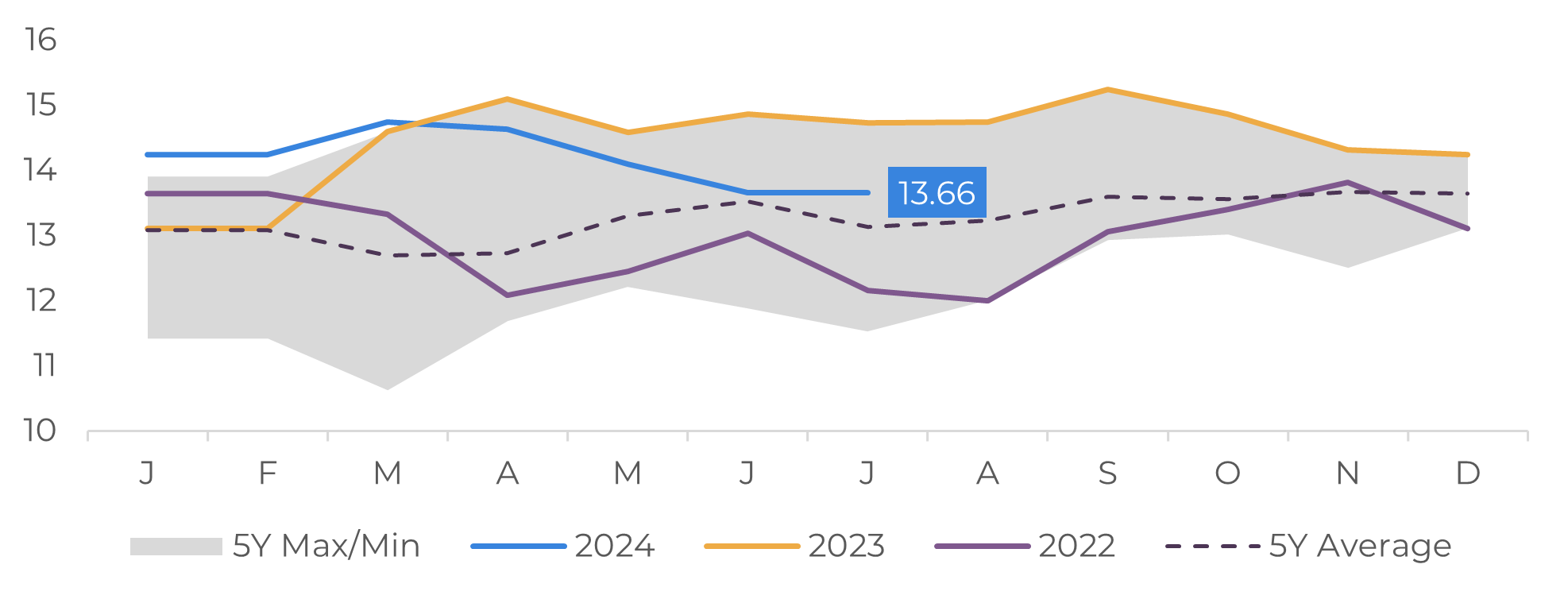

- China's recent crude oil imports and domestic demand suggest that actual global oil demand growth may be lower than the current market projections.

Introduction

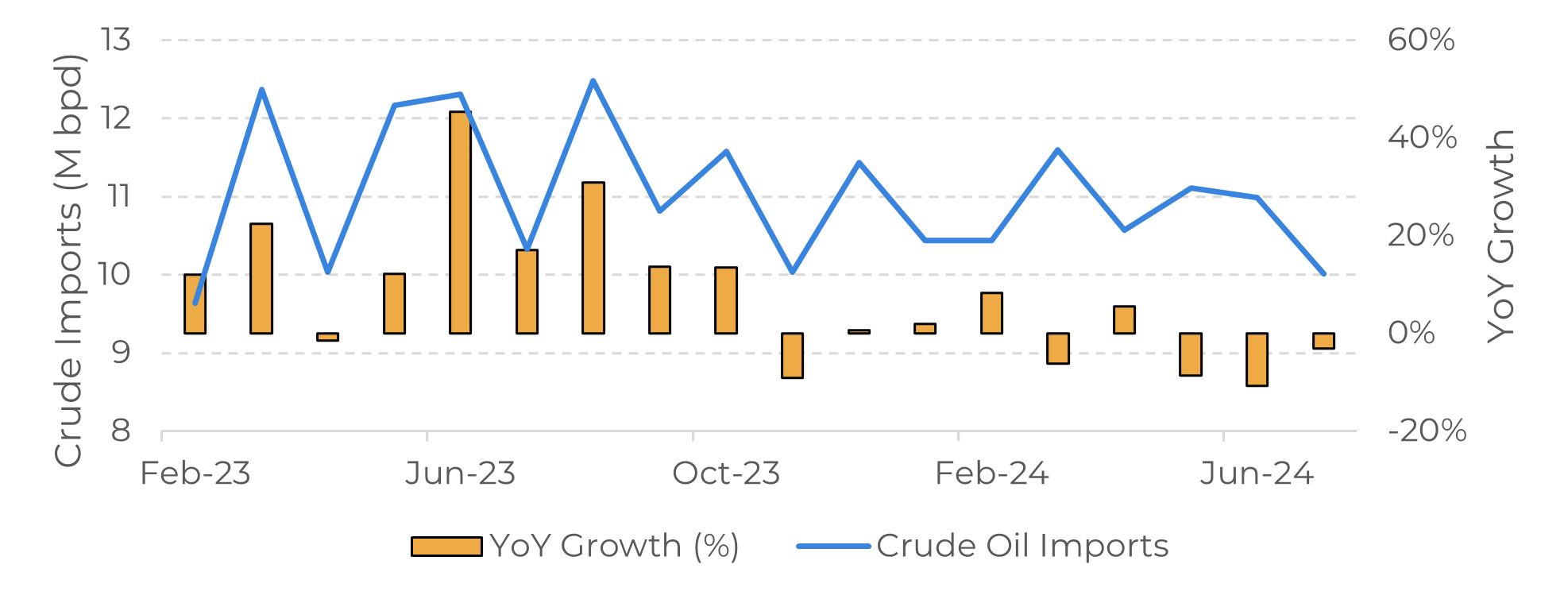

As China is heavily reliant on crude oil imports, it is a major driving force in the global oil market. Increased imports from China indicate expanding global oil consumption. Following the reopening of the economy last year, China set monthly records for crude oil imports. Russia, with its sanctioned oil offered at significant discounts, was particularly sought after by Chinese refineries.

A recovery in crude oil imports was anticipated for 2024, primarily driven by expected US interest rate cuts that could stimulate global commodities demand. However, the reality has been markedly different, with imports approximately 2.5% lower than the previous year. It's not just oil imports that are declining; the ongoing energy transition, coupled with the country's real estate crisis, has led to a significant reduction in demand for petroleum products in the world's second-largest economy.

In this context, we will address the situation of petroleum-derived products in the country and their impact on global energy prices.

Image 1: China – Crude Oil Imports (M bpd)

Source: Bloomberg

Image 2: China – Total Apparent Oil Demand (M bpd)

Source: Bloomberg

Tepid demand for oil products affects refinery margins in Asia

One of China's most pressing challenges is sluggish domestic demand, which has contributed to persistently low inflation in the world's second-largest economy. While fiscal and monetary stimulus measures have been implemented, they have yet to significantly bolster consumer confidence and spending. Economic challenges coupled with the ongoing energy transition have led to stagnant gasoline demand in 2024, with consumption levels remaining virtually unchanged from the previous year, at slightly above than 3.5 million barrels per day (bpd).

Asian refineries are facing sluggish margins as demand for refined products has been pressured by oversupply in China, impacting regional refining margins (cracks). South Korea, a highly export-oriented country, could be deeply affected in case of an oversupply of Chinese oil products in the second half of 2024. The possibility of the Chinese government releasing 15 million metric tons (over 100 million barrels) of oil product export quotas is further exacerbating bearish sentiment for regional refining margins.

Typically, South Korean and Chinese refineries compete for market share in Asia-Pacific countries such as the Philippines, Indonesia, and Australia. The current economic conditions in China reinforce the expectation that a larger portion of its refined products will be directed towards exports rather than domestic consumption.

Image 3: China – Gasoline Apparent Demand (M bpd)

Source: Bloomberg

Teapot refinery run rates are below 50%

Independent oil refineries in Shandong, commonly known as 'teapots', paint a clear picture of the current crisis in China's oil consumption. These refineries typically produce heavier products such as middle distillates and asphalt, but the property sector's downturn has negatively impacted demand for these products.

As a result, their refinery utilization has dropped below 50% for the first time since 2022. Typically, refineries enter their autumn maintenance period after the peak summer demand and before the heating season begins, but sluggish demand suggests this period may start earlier than usual. On the other hand, state-owned refineries remain at levels similar to those observed in recent months, as they have advantages such as producing higher-margin products and operating with significant economies of scale.

Crude oil demand is becoming more uncertain. The IEA has cut its 2024 oil demand growth projection to below 1 million barrels per day amid concerns about a global economic slowdown. Meanwhile, OPEC continues to withhold 2.25 million barrels per day for 2024. Given the significant gap, the recent imports of crude oil into China, combined with domestic demand, suggest that the final number is likely closer to 1 million than to 2 million.

Image 4: China – Refinery Runs (%)

Source: Bloomberg

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.