The silente effect of interest rates on oil

The silente effect of interest rates on oil

- Oil prices have faced significant pressure recently due to bearish fundamentals such as weak demand from China, macroeconomic concerns, and diminishing risk premiums, including those related to the Israel-Hamas conflict.

- The Fed's potential easing of restrictive monetary policy, which weakens the dollar and reduces borrowing costs, could contribute to a shift from backwardation to contango in the oil market.

- Other fundamentals also influence the structure of oil futures, and the gradual return of OPEC+ production to the market between the end of this year and 2025 may also contribute to this shift in the market.

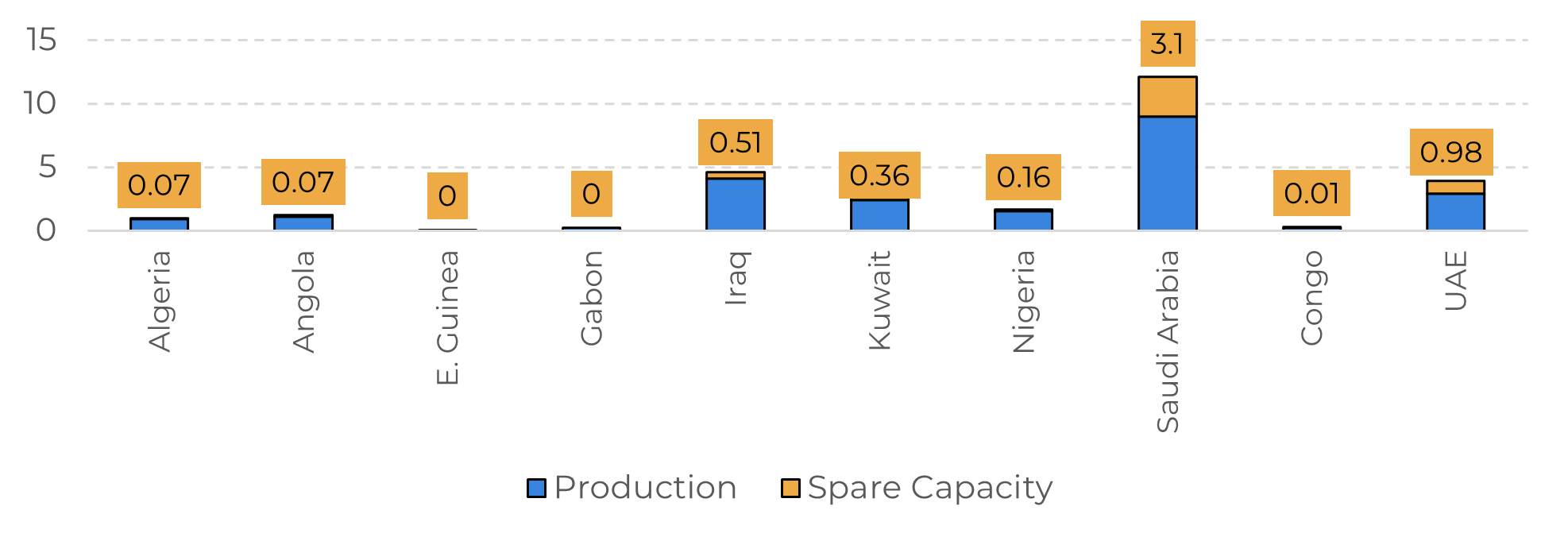

- OPEC+ actions, including oil supply cuts, have supported the market over the past year by reducing global inventories, but their spare capacity of over 6 million barrels per day has led to a loss of market share to non-member countries like the U.S., Canada, Guyana, and Brazil.

Introduction

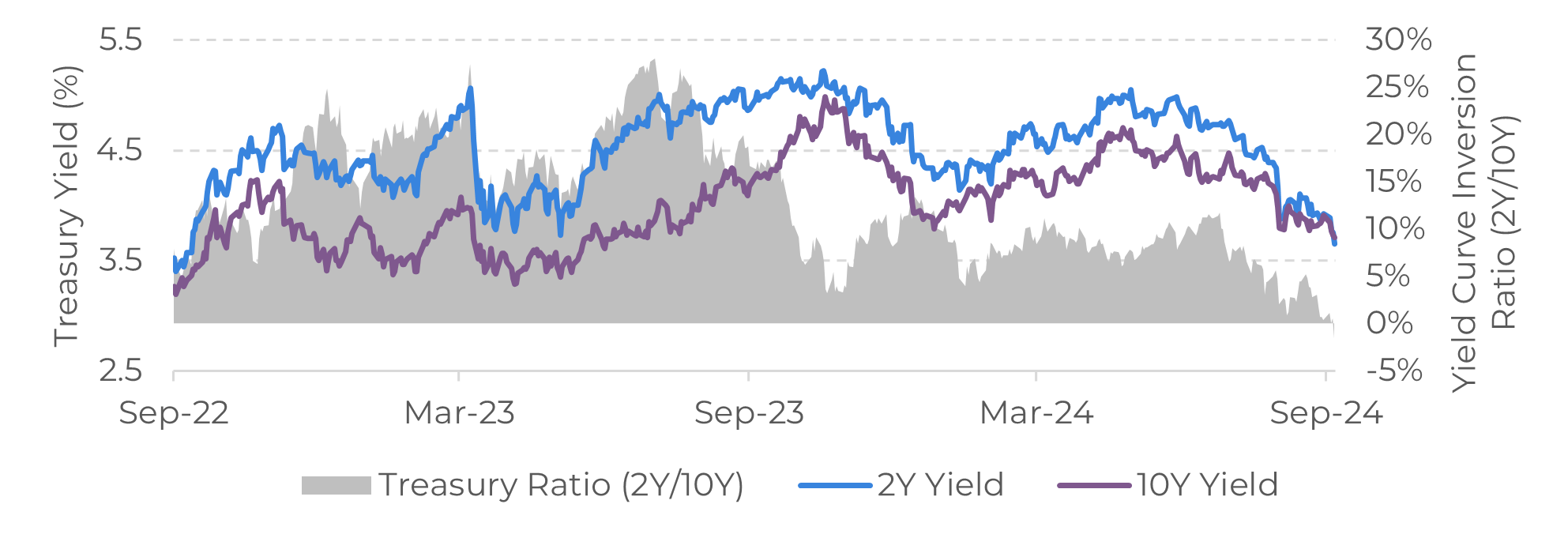

The recent de-inversion of the U.S. Treasury yield curve, with short-term yields falling below long-term yields for the first time in over two years, is bringing optimism to the market. This reduces the risks of a recession, even though it remains plausible, and aligns the market with more benign fundamentals for growth, favoring short-term investments.

However, there are other important points to consider. The likely interest rate cut in the U.S. by the Fed this month could have a broader impact on the oil market. Not only does the weakening of the dollar favor the trade of energy commodities and boost consumption and investment, leading to higher energy demand, but it also lowers the costs of insurance, storage, and carry.

Today, our report will discuss the subtle effects of interest rates on the oil market, which could gradually contribute to a shift in future prices from backwardation to contango.

Image 1: US – Treasury Yield (%)

Source: Refinitiv

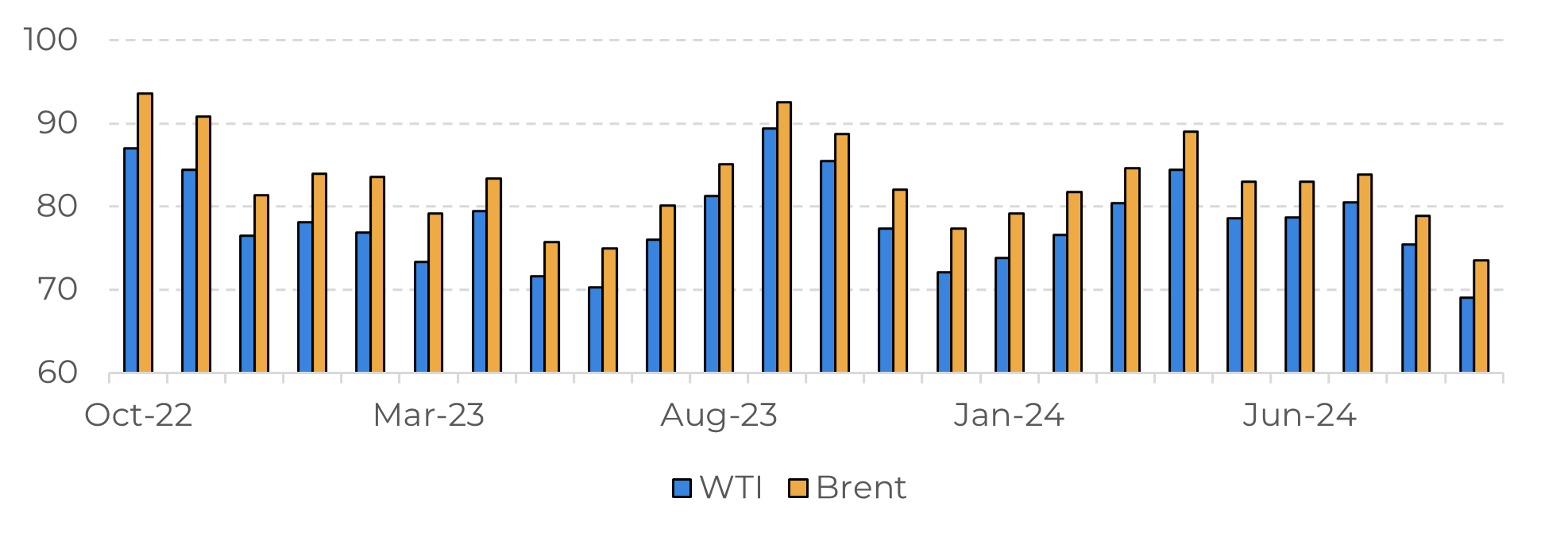

Image 2: Monthly Average Price of Major Crude Oil Benchmarks (US$ per Barrel)

Source: Refinitiv

Once again, the oil market is approaching a contango structure

In recent weeks, oil benchmarks have been under significant pressure due to bearish fundamentals in the energy market, which is finding less and less support from weak demand from China and some macroeconomic concerns. Additionally, risk premiums in the market have gradually diminished, such as those related to the Middle East conflict between Israel and Hamas, contributing to lower oil prices.

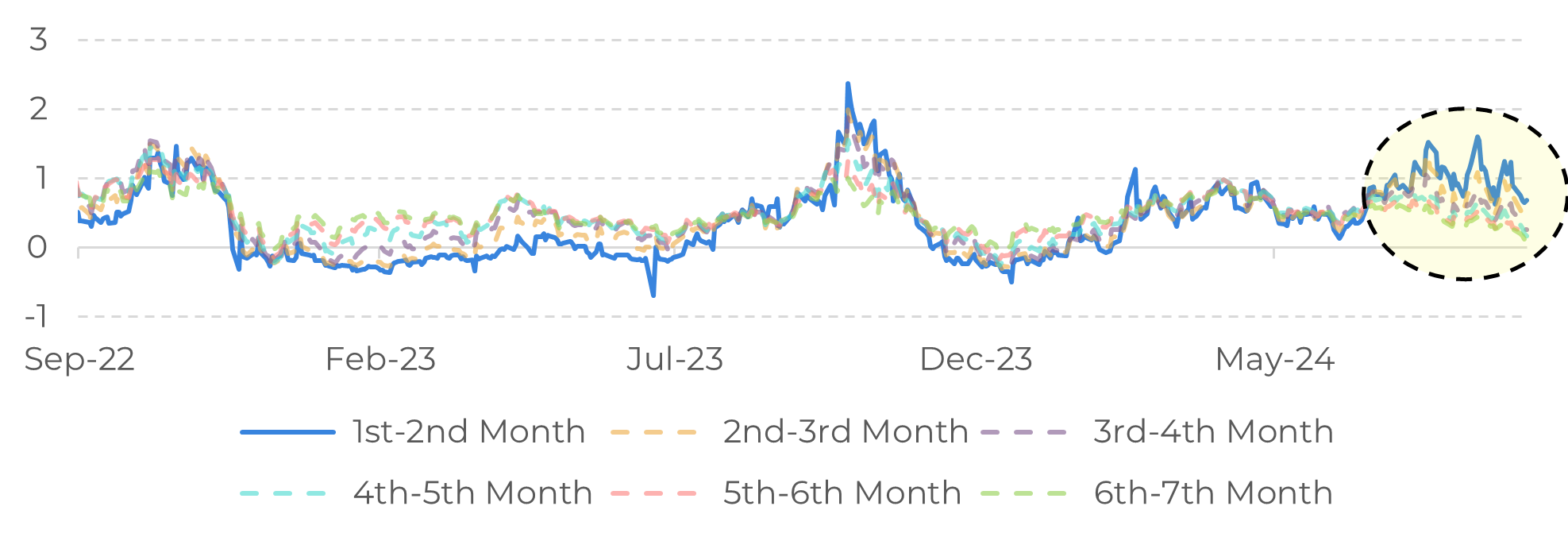

This is occurring just as the Fed is poised to ease its restrictive monetary policy, which theoretically favors commodities like oil and its derivatives as they are denominated in dollars and lower interest rates in the U.S. imply dollar weakness. While bearish energy market fundamentals are outweighing the benefits of lower interest rates, the reduced borrowing costs are contributing to a shift from backwardation to contango in the market.

Because interest rates play a significant role in insurance, storage, cost of carry, and others. In this context, there is significant production capacity in OPEC+ countries that may return to the market sooner or later. The increase in oil supply in the future could also contribute to shifting the structure of the futures price curve into contango.

Image 3: WTI Futures Spread (US$)

Source: Refinitiv

OPEC+ fundamentals the main bullish factor, but for how long?

In a move to support the market, OPEC+ announced last week that it would delay the planned return of production from the 2.2 million barrel per day voluntary cuts, initially scheduled for October. As a result, the group now anticipates a production increase of 180,000 barrels per day in December. The increase in production could result in an oversupply in the future, contributing to a contango market structure in the oil market.

The group actions have been the primary support for the oil market over the past year. Oil supply cuts have put pressure on global inventories, including U.S. stockpiles, which fell to a one-year low last week. Currently, the group’s spare capacity exceeds 6 million barrels per day. While this capacity allows OPEC+ to defend higher oil prices, it also leads to a loss of market share to non-member countries such as the United States, Canada, Guyana, and Brazil.

Nevertheless, this strategy will become increasingly less effective in boosting prices. Without a parallel rise in demand, it is doubtful that prices can be maintained above $75. Moreover, it will become progressively harder for countries to sacrifice essential revenue, especially for those with budgets that heavily depend on oil sales, such as OPEC+ members.

Image 4: Select OPEC Production and Spare Production Capacity (Barrels per Day)

Source: Bloomberg, Refinitiv

Summary

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

ignacio.espinola@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.