Oil price impacts biofuel costs in the US

Oil price impacts biofuel costs in the US

- As soybean oil becomes a more prominent biodiesel feedstock, its price is likely to be more responsive to fluctuations in the energy complex.

- While the fundamentals of vegetable oil commodities are closely associated with production and consumption trends, petroleum prices significantly shape these markets due to their impact on fuel production costs.

- There has been a significant decline in the prices of major oil benchmarks, with WTI experiencing a correction of 21% and soybean oil dropping 30% over the past year.

- Despite low global inventories, the improvement in fuel inventories has contributed to a bearish sentiment in the market, with Brent and WTI non-commercial net positions at their lowest levels in the past two years.

Introduction

In recent years, the increasing use of renewable fuels, such as ethanol and biodiesel, has led to significant changes in the energy landscape. The expanding biodiesel and renewable diesel sector has generated a growing demand for feedstocks. To meet this demand, imports of animal fats and vegetable oils have risen, while soybean crushing in the U.S. has increased to capitalize on the opportunities presented by this industry.

Consequently, fluctuations in petroleum prices directly impact futures contracts for commodities such as soybean oil. One way to understand this dynamic is by examining the BO-HO margin, which represents the economic viability of converting soybean oil into biodiesel.

The latest developments in the U.S. energy sector could impose even greater downward pressure on D4 credits, posing additional challenges for U.S. biofuel refineries.

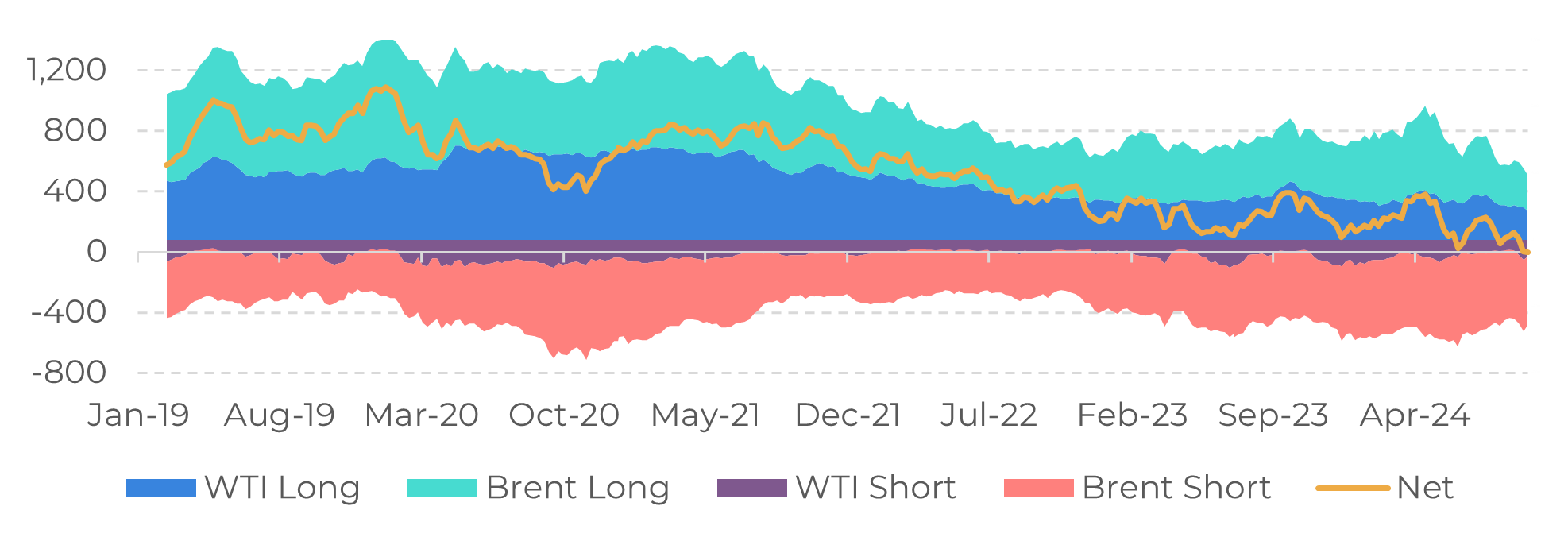

Image 1: Non-Commercial Positions in Crude Oil (1,000 Contracts)

Source: CFTC, ICE

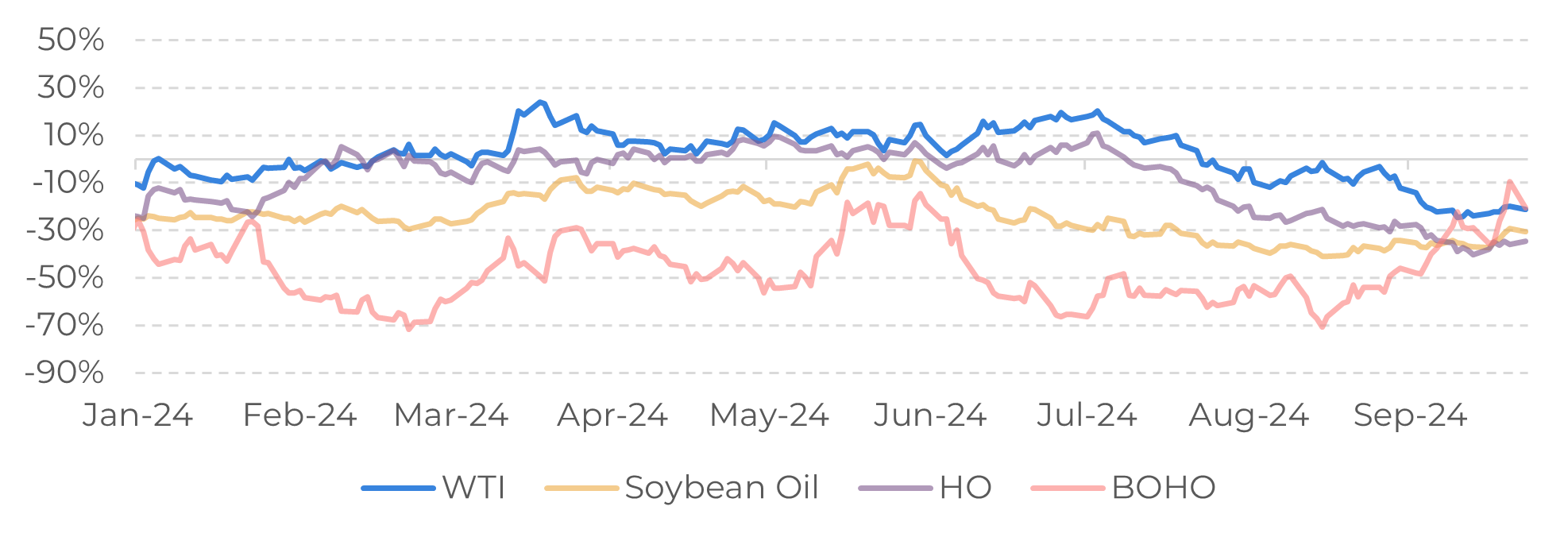

Image 2: WTI,

Soybean Oil, Heating Oil, and BOHO Spread (YoY, %)

Source: Refinitiv

Soybean oil prices are under pressure from multiple fronts

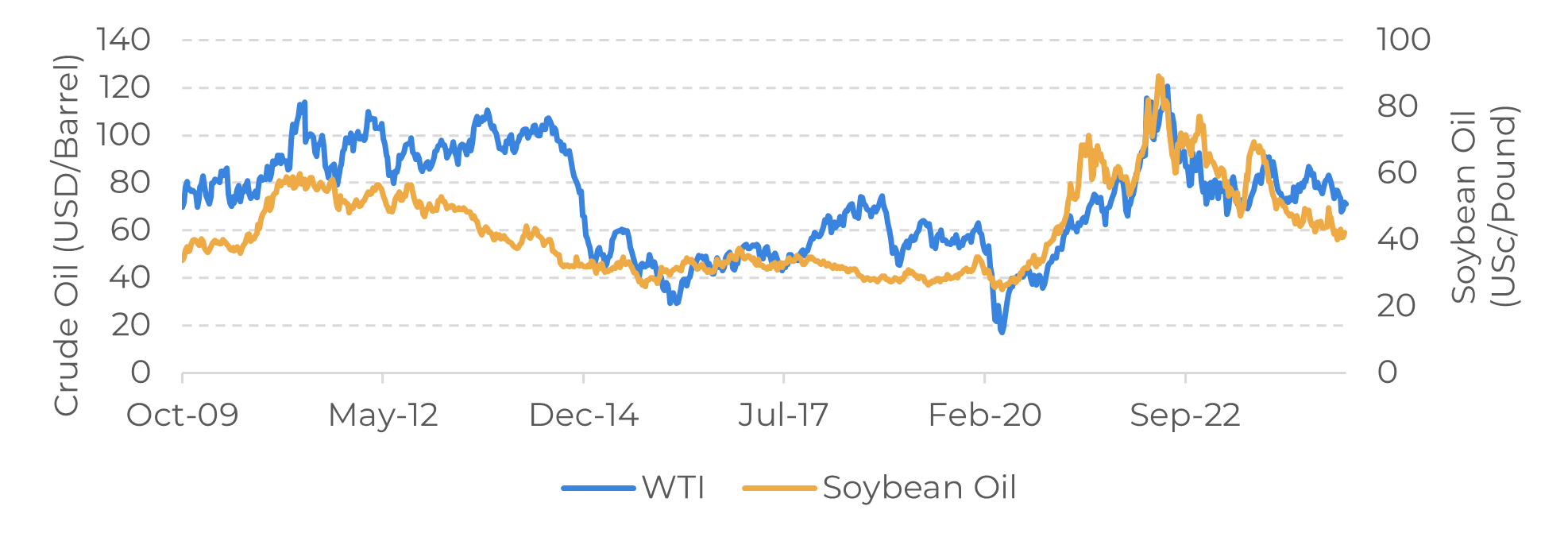

While the fundamentals of vegetable oil commodities are closely associated with production and consumption trends, petroleum prices play a crucial role in shaping these markets, particularly due to their impact on fuel production costs. As soybean oil becomes a more prominent biodiesel feedstock, its price is likely to become more responsive to fluctuations in the energy complex.

In this context, there has been a significant decline in the prices of major oil benchmarks. While WTI has seen a correction of 21% over the past year, soybean oil has dropped 30% during the same period. Not only are energy prices declining, but the increased supply of soybean oil – driven by a good crop and favorable weather conditions – has also put downward pressure on prices.

Despite low crude oil global inventories, including those in the U.S.—which are at their lowest levels in approximately five years at around 417 million barrels—the improvement in fuel inventories has contributed to a bearish sentiment in the market. Currently, Brent and WTI non-commercial net positions are at their lowest levels in the past two years, with short positions exceeding long positions.

Image 3: Crude Oil (USD/Barrel) Vs. Soybean Oil (USc/Pound)

Source: Refinitiv

The BO-HO spread is likely to narrow in the coming months

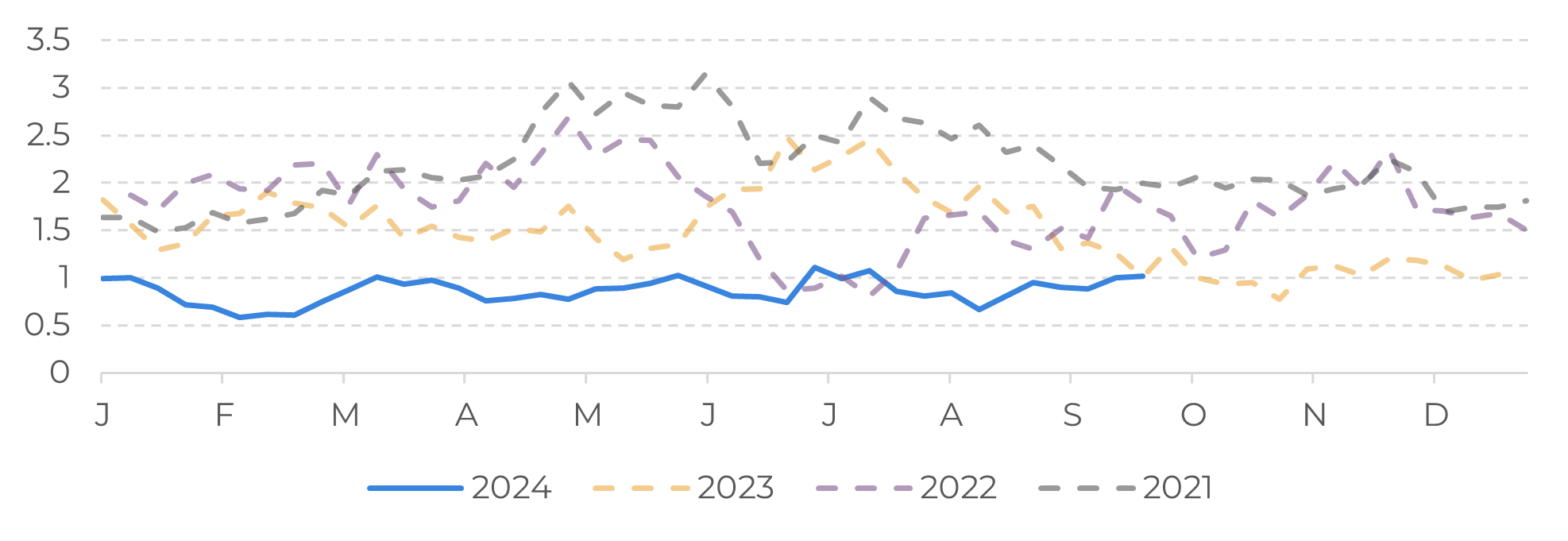

Lower oil prices have led to reduced prices for refined products such as middle distillates and gasoline. Heating oil, a benchmark for diesel, has fallen by more than 30% compared to 2023. The recent easing of U.S. monetary policy, which surprised part of the market with a 50 basis point cut, could gradually provide some support to the manufacturing sector, which depends on fuel to meet logistical demands.

Considering the absence of factors driving soybean oil prices and the support for heating oil prices, the BO-HO spread could narrow in the coming months. As U.S. refineries enter maintenance season and heating demand rises, middle distillate prices are likely to find support in the near-term, contributing to the narrowing of the spread.

The decline in vegetable oil costs and the narrowing of the BO-HO margin are likely to keep D4 RIN credits below $0.60 per gallon, could slow the expansion projects of renewable diesel refineries due to smaller margins for biofuels. As if market difficulties weren't enough, the possibility of a change in government in the U.S. next year could impose even greater challenges for biofuels in the coming years.

Image 4: BOHO Spread (USD/Gal)

Source: Bloomberg, Refinitiv

Summary

However, the BO-HO spread is likely to narrow due to lower soybean oil prices and support for heating oil prices in the coming months.

The decline in vegetable oil costs and the narrowing spread are expected to keep D4 RIN credits low, potentially slowing down the expansion of renewable diesel refineries.

Weekly Report — Energy

victor.arduin@hedgepointglobal.com

thais.italiani@hedgepointglobal.com

Disclaimer

Contact us

Check our general terms and important notices.

We have updated our Terms & Conditions to reflect improvements to our platform, data handling practices, and the overall experience we provide to our clients.